Yesterday, with much media excitement, BP announced its Q2 results

The media were in a frenzy anout the size of the figures

https://news.sky.com/story/bp-reports-second-quarter-profit-of-8-45bn-highest-in-14-years-12663939

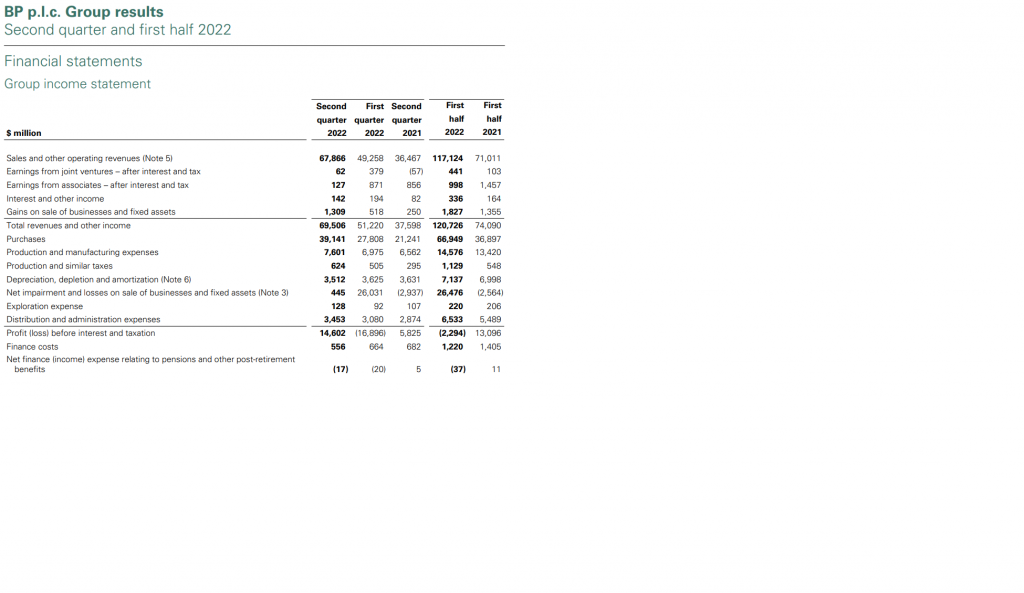

When one looks at the figures it is important to get past the “feeding frenzy” and look at the results in detail.

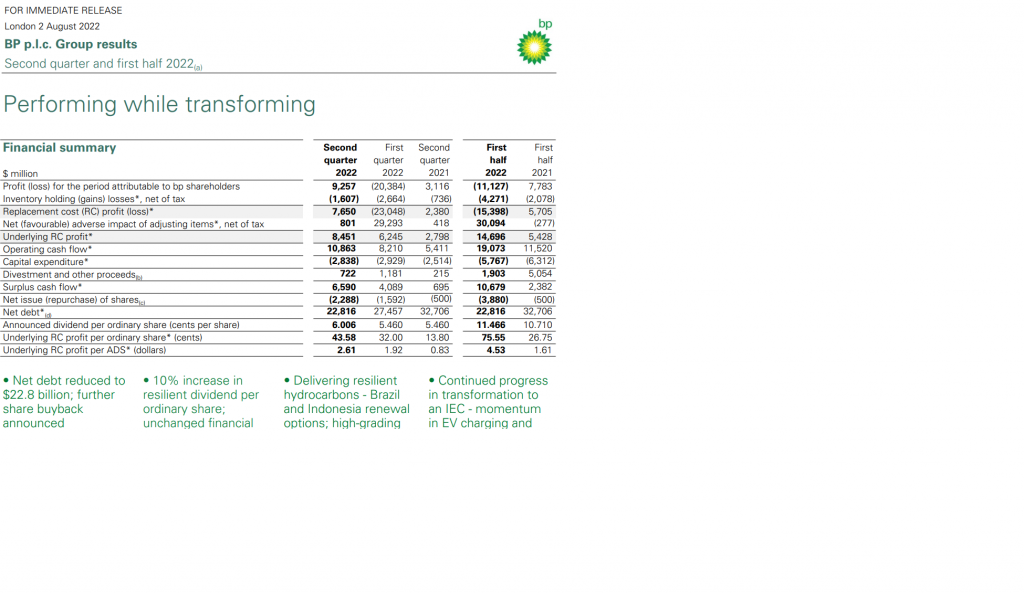

$9.2 Bn Profit = £7.52192 Bn

Current Debt of $22.8 Bn = £18.6413 Bn

Finance Costs, (interest payments) in the quarter = $556m = £454.586m

So by doing some simple forecasting, if total debt is £18.6413 Bn and BP is paying £454.586m a quarter, in a year, it is paying (£454.586m x 4 = £1,818.344 a year on its debt).

That means, (£18.6413 Bn / £1.818.344 bn) its rough annual interest rate on its debt is 10.25%.

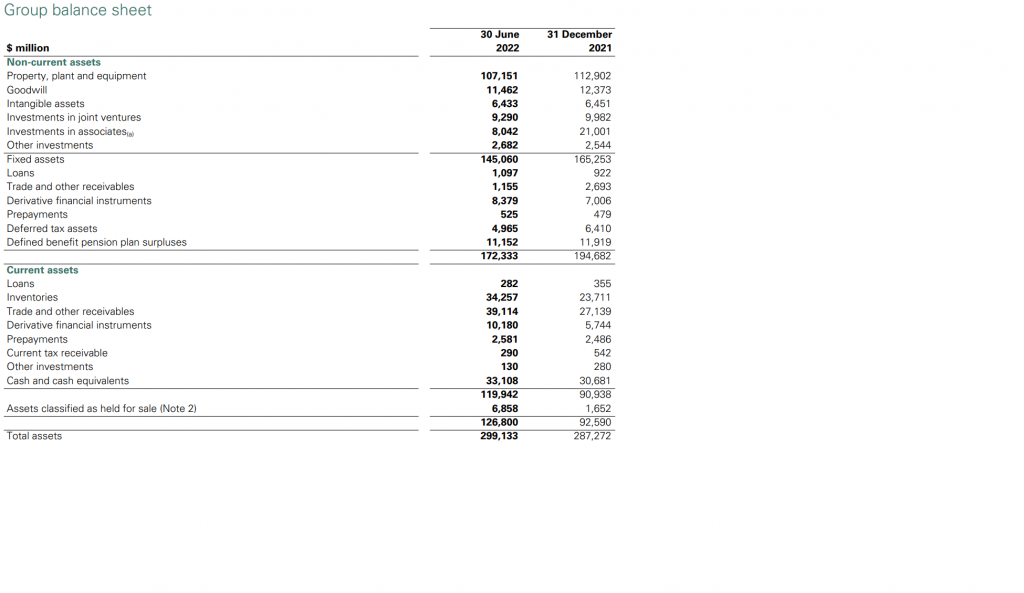

The balance sheet is large. $299bn

https://www.londonstockexchange.com/stock/BP./bp-plc/company-page