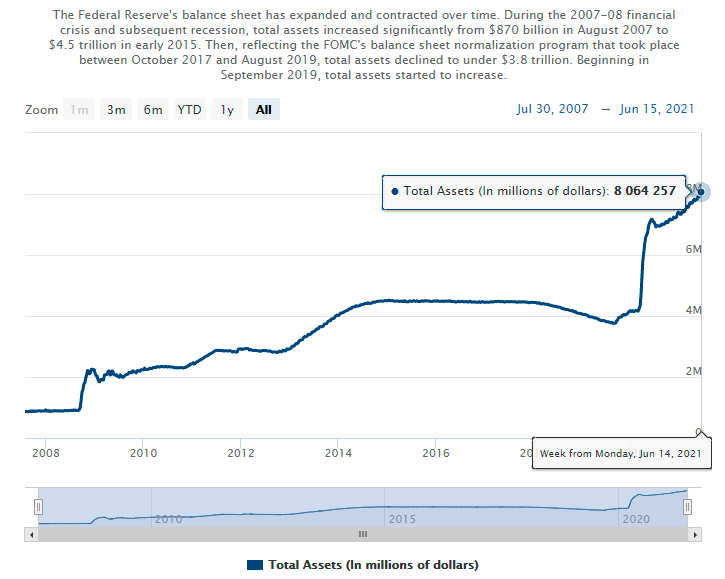

The Central Bank of the USA, The US Federal Reserve has grown its balance sheet since the start of the pandemic from $4 Trillion to $8 Trillion.

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

The Central Bank of the USA, The US Federal Reserve has grown its balance sheet since the start of the pandemic from $4 Trillion to $8 Trillion.

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

On Friday 25th June, John Laing Environmental Assets Group (JLEN) paid out its quarterly dividend

1.69p a share.

https://www.londonstockexchange.com/news-article/JLEN/total-voting-rights/14982129

the total voting rights in JLEN is 601,392,027

Thus:-

601,392,027 x £0.0169 = £10,163,525.2563

That is £10million

https://www.londonstockexchange.com/stock/JLEN/jlen-environmental-assets-group-limited/company-page

There is huge demand for wood. (Lumber). This video shows that inflation is here.

The reason for price rises in wood is that people changed their homes due to the pandemic. As people moved out of cities, and that has resulted in a new construction boom. Also has restaurants and cafes are building out door areas for eating, this needs new construction. All a result of Covid19.

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a Covid 19 world. UK’s HM Government needs to fund many new demands. [www.dmo.gov.uk]

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In April 2021 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 7 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

19-May-2021 0 5/8% Treasury Gilt 2035 £3,093.7490 Million

18-May-2021 0 1/8% Treasury Gilt 2024 £4,062.4950 Million

18-May-2021 1¼ % Treasury Gilt 2041 £2,812.4990 Million

11-May-2021 0 3/8% Treasury Gilt 2026 £3,283.7500 Million

11-May-2021 0½% Treasury Gilt 2061 £1,500.0000 Million

05-May-2021 0¼% Treasury Gilt 2031 £2,750.0000 Million

05-May-2021 0 7/8% Treasury Gilt 2046 £2,000.0000 Million

Thus:-

3,093.7490 Million + 4,062.4950 Million + 2,812.4990 Million + 3,283.7500 Million + 1,500.0000 Million + 2,750.0000 Million + 2,000.0000 Million = £19,502.493 Million

Another way of looking at it, is in the 31 days in May 2021, HM Government borrowed:£629.11267741935483870967741935484 Million each day for the 31 days. We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature from 2026 through to 2061. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together…“

Today, one of the world’s energy companies, pays out its quarterly dividend.

Shell PLC is a dual listed company, it has two share classes, Shell A and Shell B.

It is paying out $0.1735 or 12.26p per share on Shell A and Shell B shares.

https://www.londonstockexchange.com/news-article/RDSA/total-voting-rights/14997114

Royal Dutch Shell plc’s capital as at May 28, 2021, consists of 4,101,239,499 A shares and 3,706,183,836 B shares, each with equal voting rights. The total number of A shares and B shares in issue as at May 28, 2021 is 7,807,423,335

Thus:-

7,807,423,335 x £0.1226 = £957,190,100.871

That is £957million paid to shareholders.

https://www.londonstockexchange.com/stock/RDSA/royal-dutch-shell-plc/company-page

https://www.londonstockexchange.com/stock/RDSB/royal-dutch-shell-plc/company-page

Tomorrow BP PLC, one of the world’s largest energy companies, pays out its June quarterly dividend.

$0.0525 a share = 3.7118p

https://www.londonstockexchange.com/news-article/BP./total-voting-rights/14997281

The total number of voting rights in BP p.l.c. is 20,242,824,246

Thus:-

20,242,824,246 x £0.037118 = £751,373,150.363028

That is £751 million

https://www.londonstockexchange.com/stock/BP./bp-plc/company-page

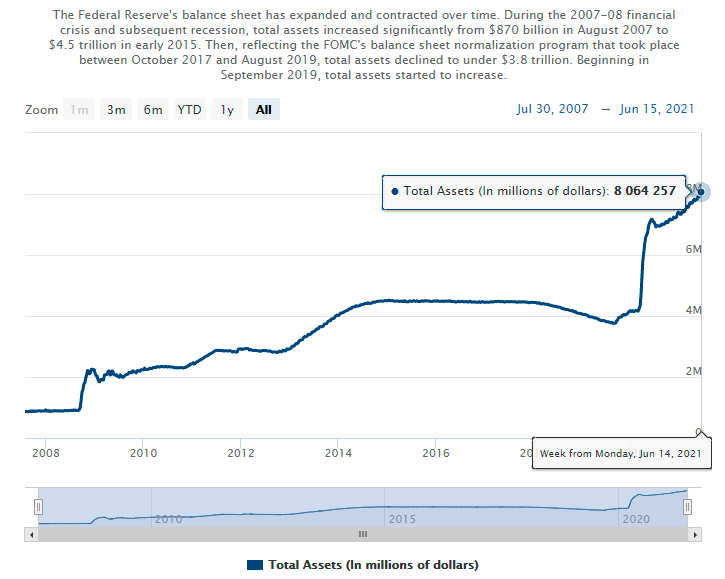

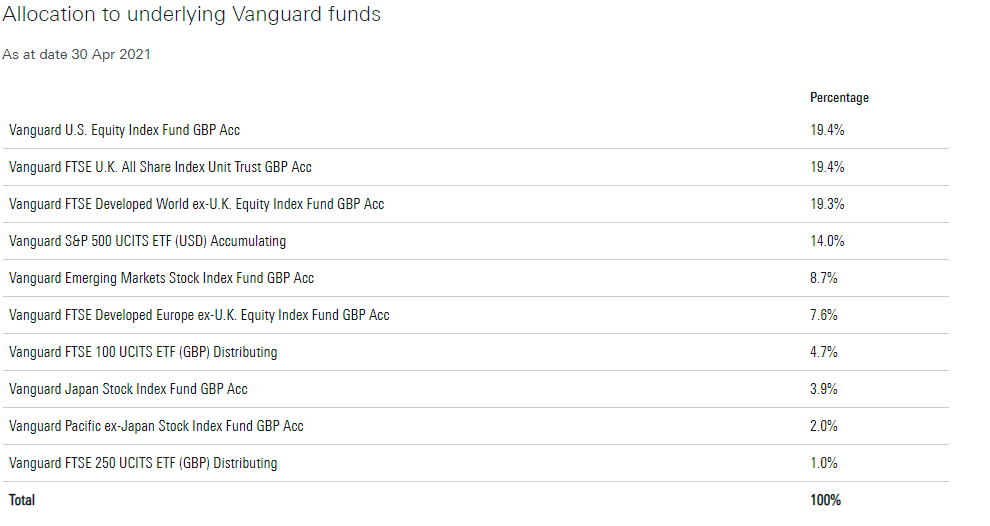

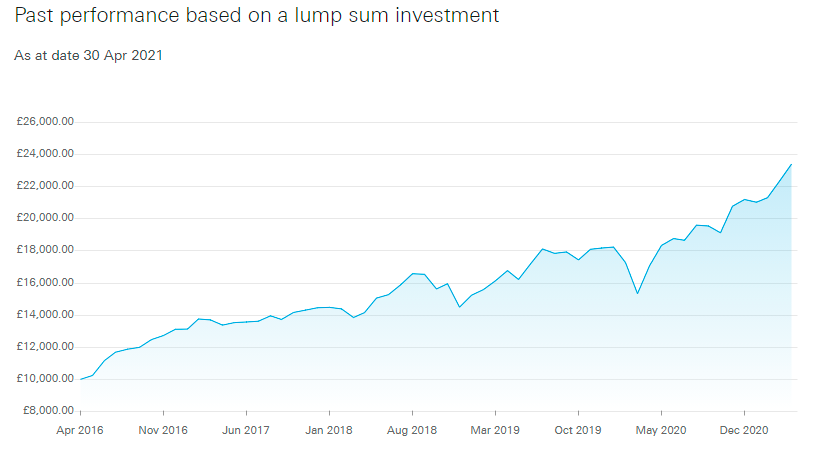

The Vanguard LifeStrategy® 100% Equity Fund is a fund of funds from Vanguard, on the largest money managers.

The Fund seeks to hold investments that will pay out money and increase in value through a portfolio comprising approximately 100% shares. The Fund gains exposure to shares by investing more than 90% of its assets in Vanguard passive funds that track an index

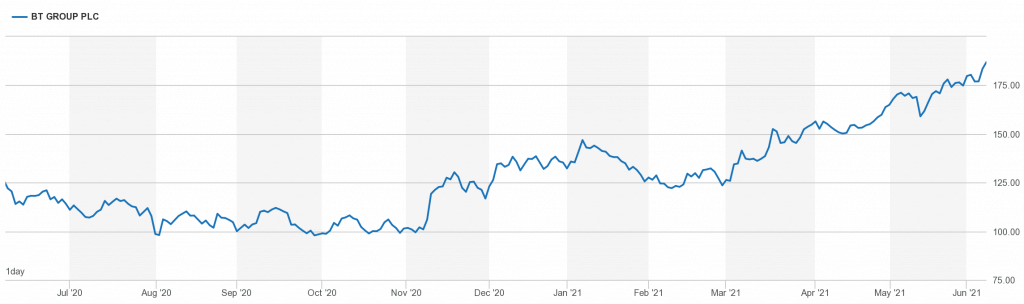

British Telecommunications PLC is the UK’s premier voice and data communications provider.

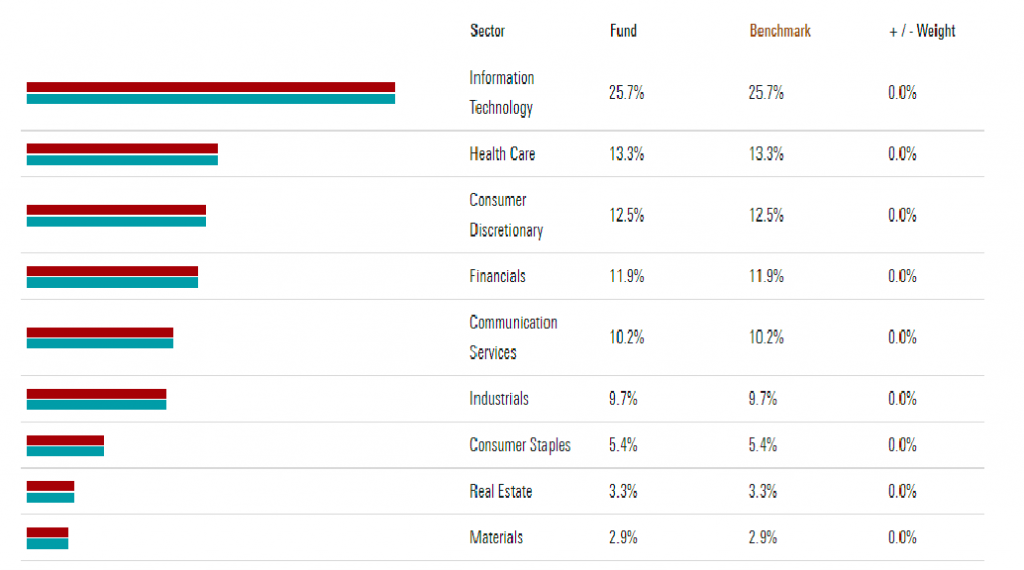

The Vanguard U.S. Equity Index Fund is a passive investment fund. The Fund seeks to track the performance of the Standard and Poor’s Total Market Index (the “Index”).

The Index is comprised of large, mid, small and micro-sized company shares in the US. It holds 3746 stocks in the fund.

The Gresham House Energy Storage Fund tomorrow pays out a dividend.

1.75p a share.

348,556,364 are the total voting rights.

Thus:

348,556,364 x £0.0175 = £6,099,736.37

That is £6 million.