TheCT Global Managed Portfolio Trust is a ‘multi-manager’ or managed investment trust.

This means it invests in a range of investment companies. In turn, this can give an exposure to different investment providers and markets by using one investment trust.

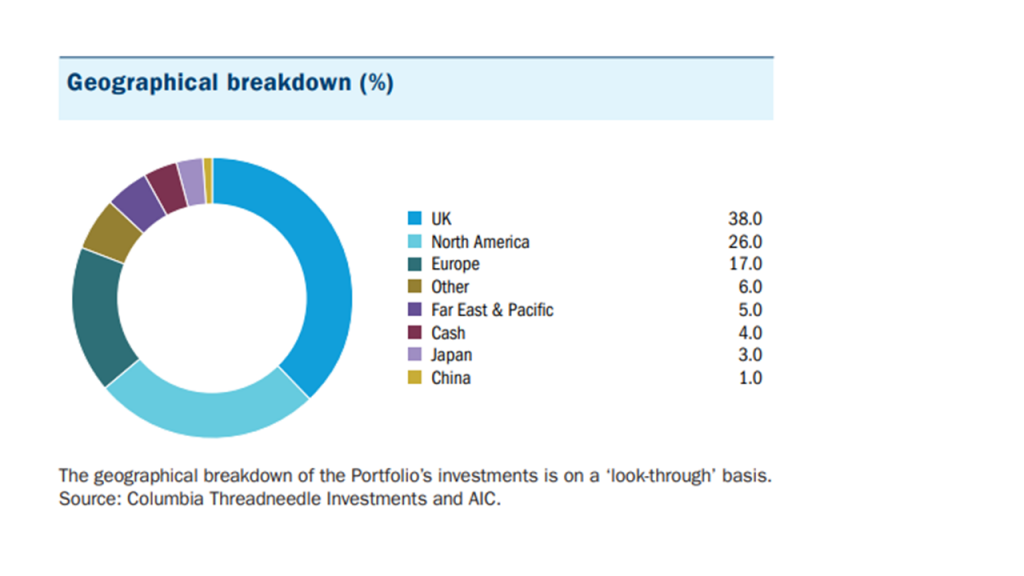

Trust aims: The objective for the Growth Portfolio is to provide growth shareholders with capital growth from a diversified portfolio of investment companies. The Growth Portfolio invests in a diversified portfolio of at least 25 investment companies that have underlying investment exposures across a range of geographic regions and sectors and the focus of which is to maximise total returns, principally through capital growth

https://www.columbiathreadneedle.co.uk/global-managed-portfolio-trust-plc/

Top 10 Holdings:-

HgCapital Trust 4.5% of the fund Private Equity

Polar Capital Technology Trust 3.7% of the fund Technology & Technology Innovation

Fidelity Special Values 3.7% of the fund UK All Companies

Finsbury Growth & Income Trust 3.6% of the fund UK Equity Income

Allianz Technology Trust 3.5% of the fund Technology & Technology Innovation

Law Debenture Corporation 3.4% of the fund UK Equity Income

JPMorgan American Investment Trust 3.2% of the fund North America

Worldwide Healthcare Trust 3.1% of the fund Biotechnology & Healthcare

Monks Investment Trust 3.1% of the fund Global

Aurora Investment Trust 3.0% of the fund UK All Companies

https://www.londonstockexchange.com/stock/CMPG/ct-global-managed-portfolio-trust-plc/company-page