One week after the Brexit vote, we are seeing real facts that are worrying.

The Vote Leave campaign claimed that the UK would save £2bn on energy bills. Leave promised the UK could end VAT on household energy bills. While that is possible, it won’t save us any money in reality because we rely on imports for so much of our energy as we import gas from Norway, (the Troll field from Norway) gives the UK a lot of gas. However, as UK£ Sterling has fallen, the cost of imports rises, and thus energy prices will rise, so there will be no £2bn saving.

Also if the economy hits hard times, it is very unlikely that the VAT will be reduced, as this tax is an important revenue earner for the government.

There was huge talk about getting our sovereignty back. Talk about unelected officials in the EU making decisions and passing legislation on our lives. Now if Boris Johnson becomes PM, it will be down to the Conservative Party and the 1922 Committee internal election of the 330 Conservative MP’s deciding on the replacement to David Cameron. 330 officials deciding on the new PM. The UK electorate have no say in this decision. This is Sovereignty is action.

Vote leave promised £350m a week that would stop going to the EU and be diverted into the National Health Service. Our NHS. Now that figure is thoroughly avoided by the Vote Leave team, and are trying to distance themselves from this promise. incredible.

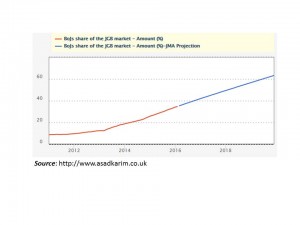

Most concerning is that during the recession of 2008 onwards, funding for our universities fell, that was offset by the huge rise in tuition fees for students. However lets us never forget the £7bn in science funding alone between 2007 – 2013 that came from the EU.

And what happens to our membership of key technical programmes like The European Space Agency or the world leading Physics laboratories of CERN.

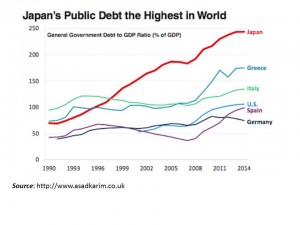

The UK could suffer from this decision.