“Investment is crucial. Because the truth is, you only get jobs and growth in the economy when people invest money, at their own risk, in setting up a business or expanding an existing business.”

Monthly Archives: December 2016

HICL December Dividend.

Tomorrow, HICL Infrastructure pays out £0.0191 on Dec 30th 2016.

https://otp.tools.investis.com/clients/uk/hicl/rns/regulatory-story.aspx?cid=1239&newsid=816302

HICL is now a member of the FTSE-250, it began life known as HSBC Infrastructure.

The Company’s issued share capital consists of 1,457,706,805 ordinary shares

https://otp.tools.investis.com/clients/uk/hicl/rns/regulatory-story.aspx?cid=1239&newsid=801023

That means the total cost of the dividend to HICL was:-

1,457,706,805 ordinary shares x £0.0191 = £27,842,199.98

That is £27.84 Million.

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=185903&action=

A yield of 4.5%

The Unaffordable Cost of Private Education

School fees for public schools in the UK have no connection to the salaries of the middle classes.

1. Eton College

http://www.etoncollege.com/currentfees.aspx

£12,354 per term = £37,062 per year

2. Harrow School (near South Ruislip)

http://www.harrowschool.org.uk/Fees-and-Deposits

£12,450 per term = £37,350 per year

3. Framlingham School (Suffolk)

http://www.framcollege.co.uk/Admissions-Fees

£6,211.50 per term = £18,634.50 per year (non boarding)

4. Ipswich School

http://www.ipswichhighschool.co.uk/Fees-and-scholarships

£4,458 per term = £13,374 per year (non boarding)

4 examples of the fees that parents may have to pay. It is now becoming unaffordable for the middle classes as those numbers are paid from bank accounts AFTER tax. So Harrow fees of £37,350 per year is actually a £60,000 annual salary in approximate terms !!

The Nasdaq Composite 20 Years on…..

FTSE-100 Index: 20 Years Performance

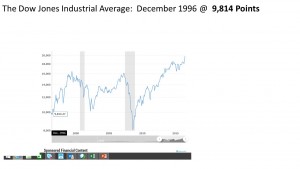

The Dow Jones: The Power of The Index

Imagine if one invested in a tracker fund that tracked the Dow Jones Industrial Index, 20 years ago:

The Dow 30 was at 9, 814. In December 1996

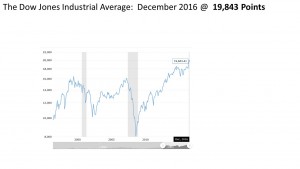

Now if one held that fund, today, 20 years on :-

The index is at 19, 843 in December 2016

The index has more than doubled in 20 years. With hindsight it was a one way bet. Your money has more than doubled, with dividends from these companies in the index. Praise to Jack Bogle.

The December 2016 BP Dividend

On Friday 16th December, BP PLC paid its shareholders its Q3 dividend. The cash amount was 7.9313p.

The total number of voting rights in BP PLC is 18,321,665,312.

http://otp.investis.com/clients/uk/bp_plc/rns/regulatory-story.aspx?cid=233&newsid=615531

The cash paid to shareholders is thus:-

18,321,665,312 shares x £0.079313 = £1,453,146,240.89

That is £1.453 billion.

Devaluation of Sterling on the Shell PLC dividend.

Yesterday, Friday 16th December, Royal Dutch Shell, paid it’s third quarter dividend.

The quarterly dividend in 2016, has remained stable at $0.47 a share.

In September the 2nd quarter dividend was the stable figure of $0.47 which equated at the UK Sterling exchange rate at the time of 35.27p per share.

Yesterday Shell paid out $0.47 per share, but the UK Sterling exchange rate was 37.16p per share.

What you can see is the real affect of the devaluation of Sterling.

Someone with 100 shares in September would have got: £35.27

That same person yesterday with the 100 shares would have got: £37.16

That is an increase of over 5% in 3 months for doing NOTHING

Fidelity Asian Values PLC

Fidelity Asian Values PLC is a London listed investment trust, worth £220m

Launched in 1996.

It’s top ten holdings are:-

POWER GRID CORP OF INDIA LTD

TISCO FINANCIAL GROUP PCL

COGNIZANT TECH SOLUTIONS

TAIWAN SEMICONDUCTR MFG CO

HOUSING DEV FINANCE CORP LTD

WPG HOLDING CO LTD

RHT HEALTH TRUST

ASCENDAS INDIA TRUST

LT GROUP INC

SK HYNIX INC

How the shares trade at 10% discount to the assets. Thus the share price is reflecting 90% of the real value of the assets.

Invesco

Formerly Amvescap PLC, the owner of the UK investment house, Invesco Perpetual, is one of the largest money managers in the world.

Renamed Invesco after moving from London.

The assets under management are vast:

http://www.invesco.com/corporate/dam/jcr:d97b217c-9b9a-4fcc-946c-698e359c0954/2016_11_09_aum.pdf

assets under management (AUM) of $807.5 billion

The UK Housing Market

The UK has a major issue regarding rampant house price inflation. The link between salaries and actual house prices is now gone.

For example in 1997,a graduate earning say £18,000 could afford to buy a house that was on the market for £55,000 in East Anglia.

The 3.5 times multiple of salary to house price meant one could buy that £55,000 house.

Today, the situation is that a new graduate earning £28,000 in East Anglia, could not afford a house, as that £55,000 in 1997 is now on the market for £200,000

Madness.

Why ?

The simple reality is not enough supply of new houses. A major cause and rarely mentioned by the politicians is that the our aging population live in incorrectly dimensioned homes.

A family house, say a 4 bedroom house, that once housed a full family, is now occupied by an elderly couple or just one person.

These homes are not coming onto the market for younger people, thus lack of supply of family homes.

All time highs of the S&P 500.

The Standard and Poors 500 Index (The USA’s largest 500 companies) has done exceptionally well.

S&P 500 rose is at about 2,240, an all time high.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities.

Within this index assets comprising approximately US$ 2.2 trillion of this total.

The index includes 500 leading companies and captures approximately 80% coverage of available market capitalisation

http://us.spindices.com/indices/equity/sp-500

The top ten companies in the S&P 500. are:

Apple

Microsoft

Exxon Mobile

Johnson & Johnson

Berkshire Hathaway B

Amazon.com

JP Morgan chase & Co

General Electric

Facebook

Wells Fargo

HSBC Dividend Dec 2016 Dividend

Yesterday, HSBC Holdings paid out its third interim dividend to shareholders.

It paid out US $0.10 = £0.080417

The total number of voting rights in HSBC Holdings plc is 19,805,075,710 shares.

So the dividend paid to shareholders:-

19,805,075,710 shares x £0.080417 =£1,592,664,773.37

That is £1.592 Billion cash paid out to shareholders.

Greencoat UK Wind PLC

Greencoat UK Wind PLC is a London listed Windfarm operator.

http://www.greencoat-ukwind.com/

Worth over £850 Million.

Offering a yield of over 5.4%

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=7013076

The Portfolio consists of interests in nineteen wind farms located in the UK, together having an aggregate net installed capacity of 420.1MW. All of these assets are onshore except for Rhyl Flats.

Greencoat carries total debt of £245m, a portfolio generating sufficient electricity to power 375,000 homes.

HM Government November Borrowings

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties. Another deficit month, thus to bridge the gap, needs to borrow on the bond market.

In November 2016, the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement.

There were “only” 4 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office (http://www.dmo.gov.uk/) to raise cash for HM Treasury:-

22-Nov-2016 1½% Treasury Gilt 2026 £2,874.9960 Million

17-Nov-2016 0 1/8% Index-linked Treasury Gilt 2026 £1,100.0000 Million

08-Nov-2016 1¾% Treasury Gilt 2037 £2,711.0900 Million

01-Nov-2016 0½% Treasury Gilt 2022 £2,750.0000 Million

When you add the cash raised:-

∑(£2,874.9960 Million + £1,100.0000 Million + £2,711.0900 Million + £2,750.0000 Million = 9,436.086 Million

£9,436.086 Million = £9.436086 Billion

On another way of looking at it, is in the 30 days in November, HM Government borrowed:-

£314 million each day for the 30 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature 2022, 2026, and 2043. All long term borrowings, we are mortgaging our futures, but at least “We are in it together…”

The Twenty Four Income Fund

The TwentyFour Income Fund is a closed-ended investment fund managed my Twenty Four Asset Management. TFIF is the ticker symbol

£428.2m of assets

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=6340436&action=

A yield of 6.5%

Top Ten Holdings are:-

CBFLU 1 BTL RMBS 3.32%

SCGC 2015-1 Consumer ABS 3.22%

LUSI 5 Prime RMBS 3.05%

AURUS 2016-1 Consumer ABS 2.67%

WARW 1 NC RMBS 2.63%

TPMF 2016-GR1 Prime RMBS 2.12%

MPS 3 NC RMBS 2.04%

AMF 2015-1 BTL RMBS 1.97%

SCGC 2016-1 Consumer ABS 1.95%

CELES 2015-1 BTL RMBS 1.95%

and pays our quarterly.