One of the most significant changes from the HM Government, 2017 Spring Budget is the reduction in the tax-free dividend allowance from £5,000 to £2,000. It affects investors who are shareholders with portfolios – of about more than £50,000, and what this means more people may have to pay more tax on their dividend income on the shares they own.

The change is effective from April 2018, meaning investors have just over a year to organise their dividend income to shield it as much as possible from increased tax charges. Potential options to consider.

(1). Using the tax-free dividend allowance

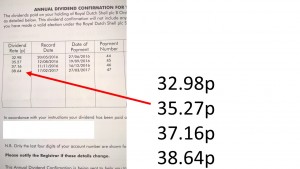

Investors will continue to have a £2,000 tax-free dividend allowance, which means they will be able to hold about £50,000 in stocks. Today, the FTSE-100 Index is yielding 3.8% (a rough approximation on dividend yield) before having to pay any tax on dividend income. Investors could decide on moving their highest-yielding stocks (BP, Vodafone, Shell etc etc ) into ISAs or Pensions, while keeping the lower-yielding stocks (growth stocks) outside the ISA wrapper.

(2). Using ISA’s

Investors could use ISA’s to shield their dividend income as they offer tax-free income and growth. By acting before the end of this tax year, investors can shield up to £55,240 in a stocks and shares Isa by the time the new allowance comes into force:

* £15,240 in 2016/17

* £20,000 in 2017/18

* £20,000 on first day of the tax year, 6 April 2018.

By using both of a couple’s allowances, this could mean investing up to £110,480 over three years.

If investors sell existing share holdings and reinvest the proceeds in an ISA using the ‘bed and ISA’ rules, this may give rise to a capital gains tax charge, although it could be partially or fully covered by the individual’s £11,100 (2016/17) capital gains tax exemption. Investors need to be aware that ISA’s, unlike direct share holdings, cannot be placed into trust for inheritance tax (IHT) planning. Instead, when the investor dies, the ISA will remain within the estate for the purposes of IHT. This is in sharp contrast with pension investments, which are usually deemed to be outside the estate.

(3). Switching investment objectives

For any shareholdings that cannot be shielded in ISA, investors could consider switching their investment profile – moving from an emphasis on generating income to one centred on capital appreciation. If investors decide to reduce their income-generating investments, they could also choose to regularly sell investments or gains to supplement their reduced dividend income.

While these actions may be helpful in reducing dividend income tax liability, they may store up future capital gains tax charges unless planning is undertaken to counter this.

Concluding comments from www.asadkarim.co.uk:

The tax rules for shareholders have been changing fast. The tax-free dividend allowance was only introduced a year ago, and now it is being more than halved.

These quick-fire changes send out a confused message to those trying to save for their futures, and makes it difficult to set a long-term plan. But it also flags up the need for shareholders to work with their advisers to make sure their investment portfolio is tax-efficient. Tax is not the only consideration when setting the right portfolio, but it is an important one.