There is a lot of media speculation about the future of the UK’s largest water company, Thames Water.

The media are reporting that HM Government may have to rescue the company due to its debt pile.

Thames Water in funding talks amid collapse fears – BBC News

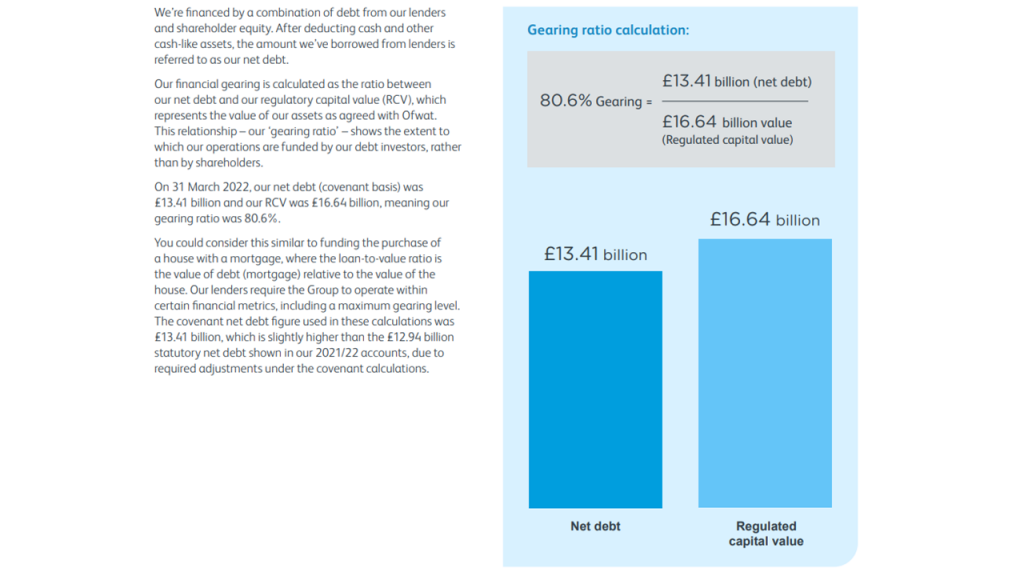

What is the debt position ?

The firm carries £13.41bn of debt.

“We maintain relatively long-dated debt maturities (currently with an average tenor of approximately 13 years) to minimise refinancing risks. The average interest

rate we incurred during 2021/22 was 6.63%, and we paid net interest of £273.6 million on our debt (of which £115.3 million was capitalised) “

They paid out £273.6 Million on interest payments alone for the year 2021/22.

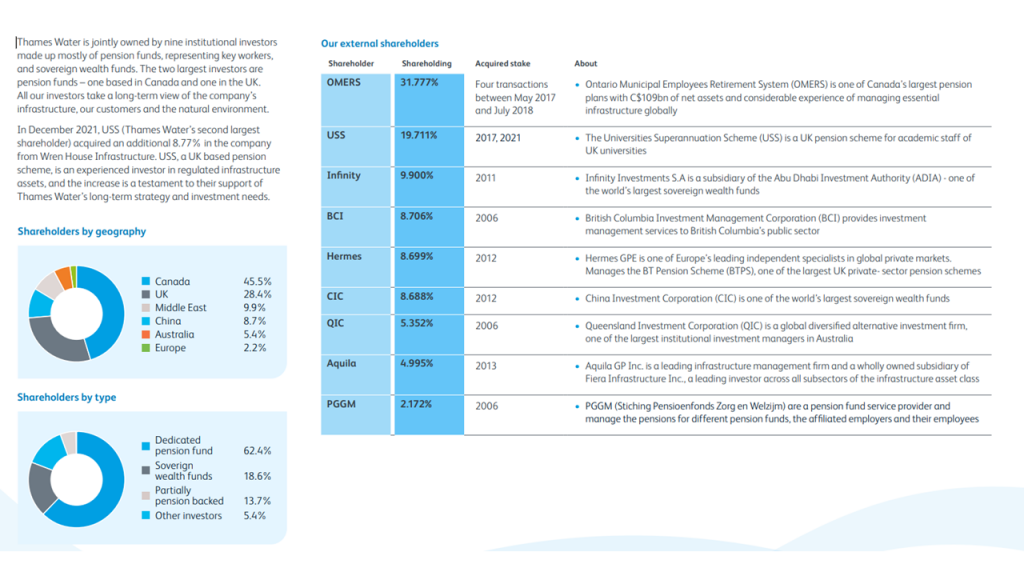

Who are the owners of the business ?

Note the 2 largest UK shareholders are The BT pension fund (Hermes) and The UK Universities Pension Fund (USS).