Monthly Archives: October 2022

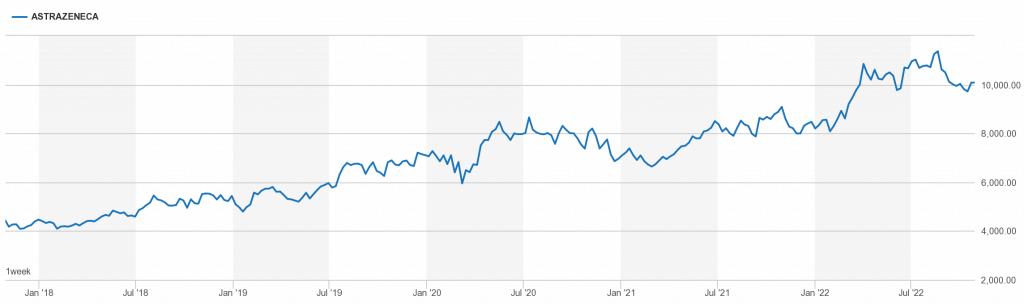

The 5-year ascent of Astra Zeneca

The UK pharma giant Astra Zeneca, famous for many things, and more recently for the mass manufacturing of pioneering University of Oxford Covid-19 vaccine. Its heritage has its roots from ICI (Imperial Chemical Industries).

AstraZeneca – Research-Based BioPharmaceutical Company

Imperial Chemical Industries – Wikipedia

The graph speaks volumes

William Shatner Quote: Investment in reality

Investment in Kate Bush

Aviva PLC September Dividend

A few weeks ago, the UK insurance giant, Aviva PLC paid out its September dividend to shareholders

The dividend was 10.3p a share.

the total number of voting rights in Aviva plc was 2,802,902,021.

https://www.londonstockexchange.com/news-article/AV./total-voting-rights/15607769

Thus:-

2,802,902,021 x £0.103 = 288,698,908.163

That is £288.698 Million paid to shareholders

https://www.londonstockexchange.com/stock/AV./aviva-plc/company-page

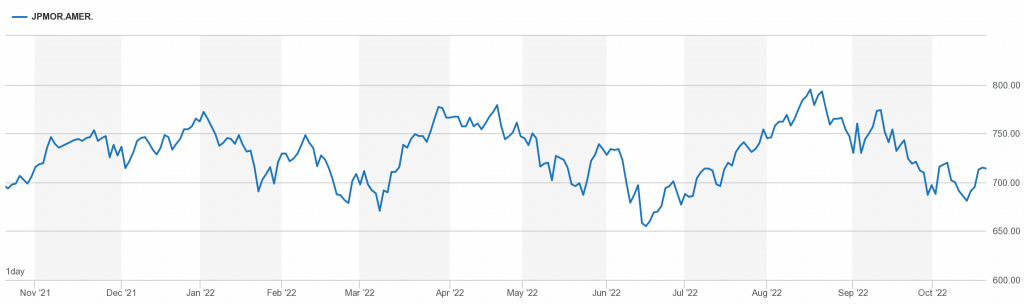

JPMorgan American Investment Trust plc

The JPMorgan American Investment Trust plc is a London listed investment trust.

It aims to generate attractive long-term returns from the world’s largest stock market by focusing on high quality companies that are also reasonably priced. It aims to achieve capital growth from North American investments by outperformance of the S&P 500 index. The trust predominantly invests in quoted companies including, when

appropriate, exposure to smaller capitalisation companies, and emphasise capital growth rather than income. The Company has the ability to use borrowing to gear the portfolio within the range of 5% net cash to 20% geared in normal market conditions.

Holdings

Microsoft Information Technology 5.6% of the fund

Apple Information Technology 5.3% of the fund

Tesla Consumer Discretionary 4.2% of the fund

Bank of America Financials 4.1% of the fund

Amazon Consumer Discretionary 3.9% of the fund

United Health Group Health Care 3.8% of the fund

Alphabet Communication Services 3.5% of the fund

Martin Marietta Materials 3.2% of the fund

Loews Financials 3.2% of the fund

Berkshire Financials 3.2% of the fund

https://www.londonstockexchange.com/stock/JAM/jpmorgan-american-investment-trust-plc/company-page

Abrdn PLC September Dividend.

A few weeks ago Scotland’s largest asset manager, Abrdn PLC (formerly known as Standard Life plc) paid out its September dividend to shareholders.

7.3p a share.

https://investegate.co.uk/abrdn-plc–abdn-/rns/total-voting-rights/202208010955024204U/

The Company’s issued share capital consists of 2,167,475,819 ordinary shares

Thus:-

2,167,475,819 x £0.073 = £158,225,734.787

That is £158.225 Million, paid to shareholders.

https://www.londonstockexchange.com/stock/ABDN/abrdn-plc/company-page

Matt: HM Government

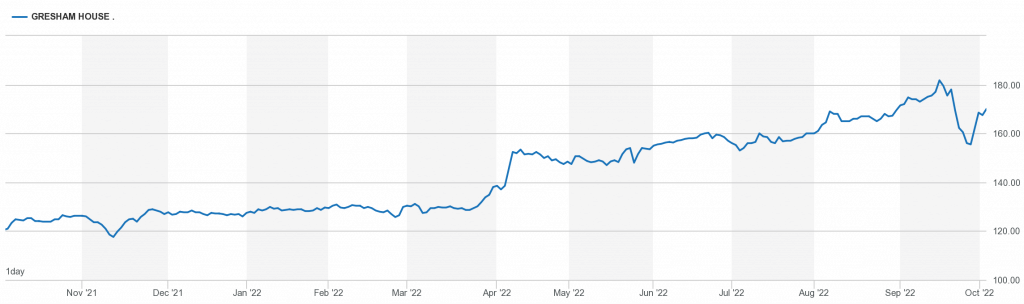

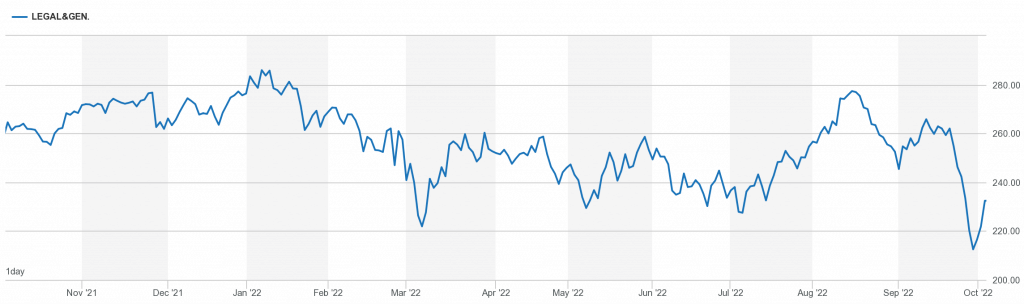

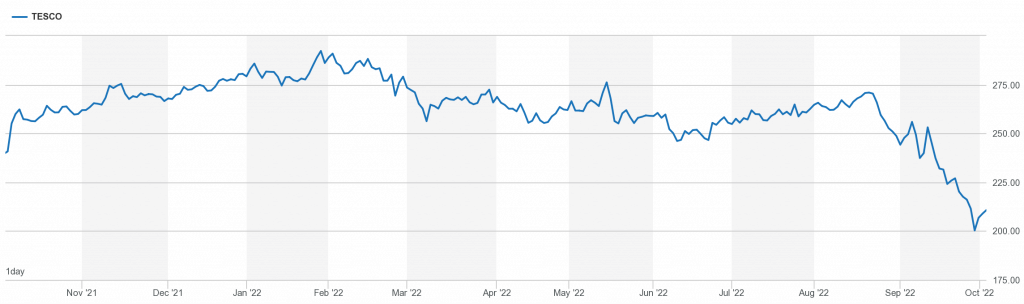

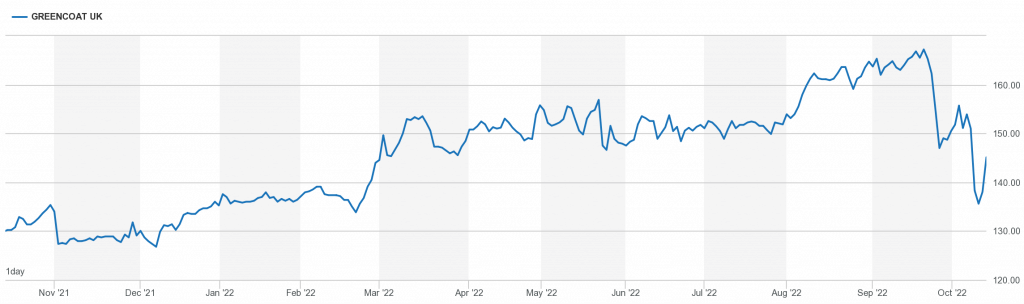

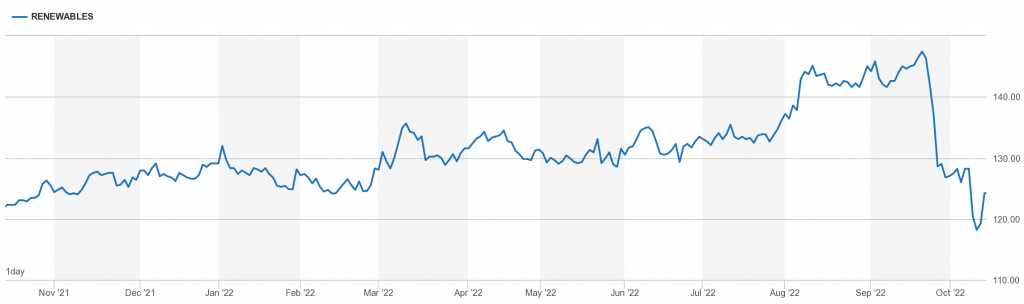

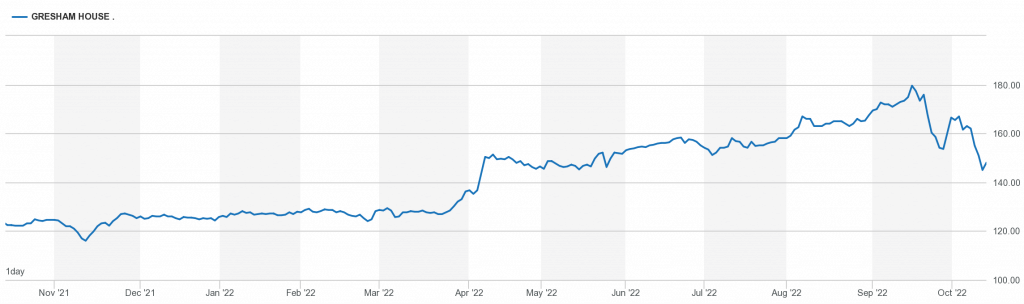

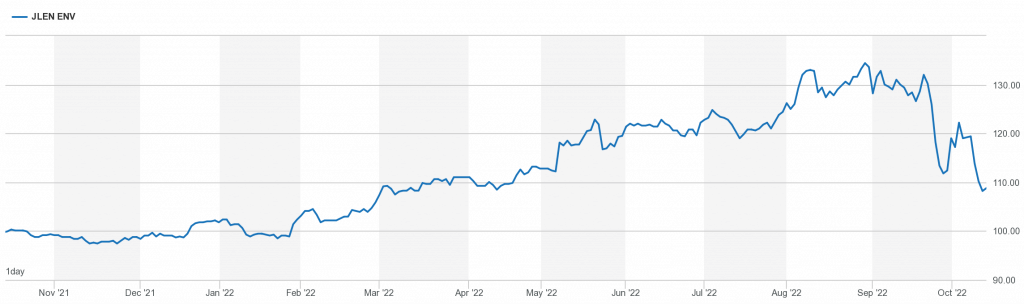

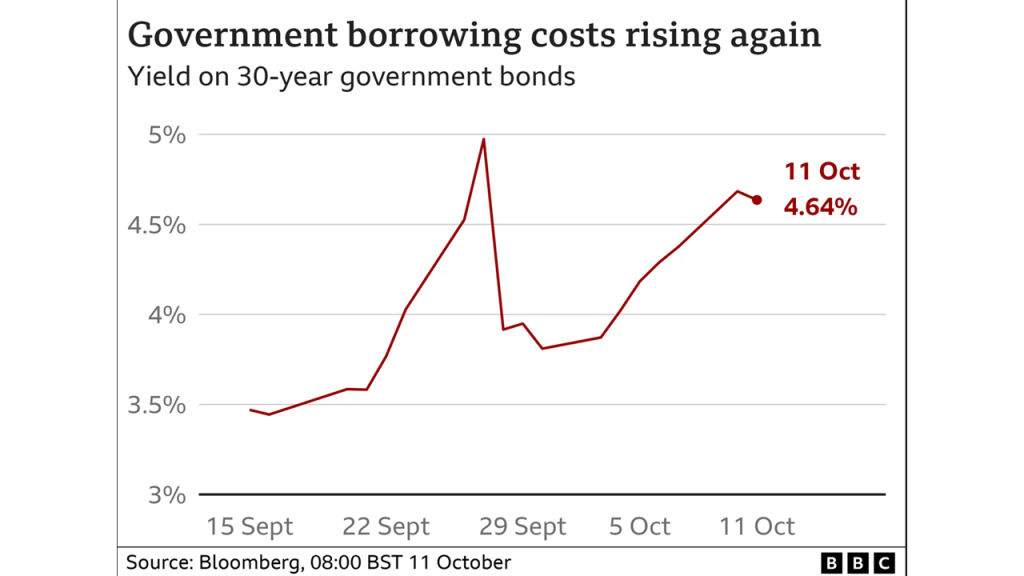

The effect of HM Government plans cap on revenues of renewable energy firms

https://news.sky.com/story/government-plans-cap-on-revenues-of-renewable-energy-firms-12718382

It is a windfall tax, punishing investment in Green Energy companies.

The effect on the UK Green Energy sector has been brutal and dramatic, as the graph’s below show:-

Beth Rigby…Sky News

HM Government U-Turn

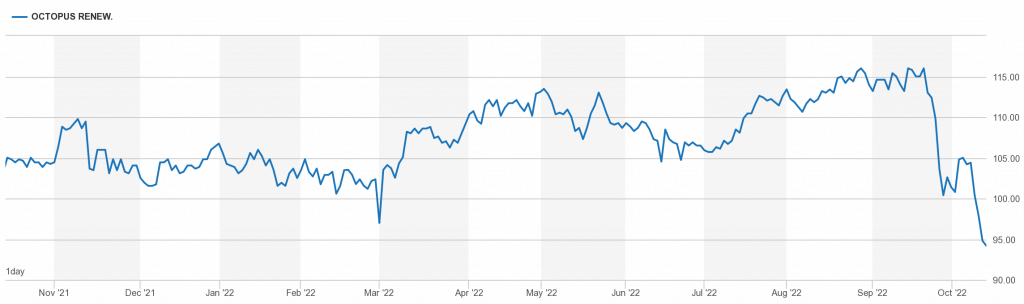

The Bank of England warning of a “material risk”

The Bank continues to monitor developments in financial markets very closely in light of the significant asset repricing of recent weeks. It has also been working with the UK authorities to address risks to the resilience of Liability Driven Investment (LDI) funds arising from volatility in the long-dated government bond (gilt) market

Bank of England widens gilt purchase operations to include index-linked gilts | Bank of England

The Bank said it would buy more government bonds to try to stabilise market conditions. Its emergency scheme started after September’s mini-budget, which spooked markets and drove up borrowing costs. Government borrowing costs rose again sharply on Monday after the Bank said the scheme would end this week.

HM Government Borrowings: September 2022

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a post Covid 19 world. UK’s HM Government needs to fund many new demands. [www.dmo.gov.uk]

https://www.dmo.gov.uk/data/pdfdatareport?reportCode=D2.1PROF7

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In September 2022, the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were only 4 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

27-Sep-2022 0 1/8% Index-linked Treasury Gilt 2031 3 months £1,200.0000 Million

07-Sep-2022 1% Treasury Gilt 2032 £3,437.5000 Million

06-Sep-2022 0¼% Treasury Gilt 2025 £4,183.1570 Million

01-Sep-2022 0 7/8% Treasury Gilt 2046 £2,499.9990 Million

£1,200.0000 Million + £3,437.5000 Million + £4,183.1570 Million + £2,499.9990 Million = £11,320.656 Million

£11,320.656 Million = £11.320656 Billion

On another way of looking at it, is in the 30 days in September 2022, HM Government borrowed:- £377.3552 Million each day for the 30 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond maturing from 2025 to 2046. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together……”

An Apology: “for pure incompetence”

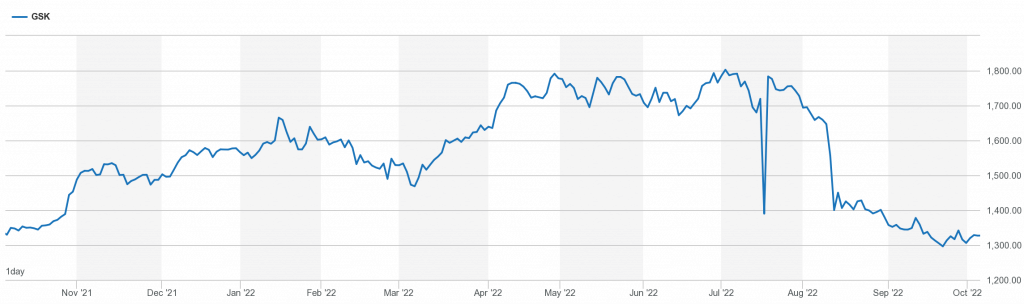

GSK October 2022 Dividend.

Yesterday, the UK pharmaceuticals giant GSK paid out its dividend.

It was £0.1625 a share.

https://www.londonstockexchange.com/news-article/GSK/total-voting-rights/15654991

the total number of voting rights in the Company is 4,067,377,650

Thus:-

4,067,377,650 x £0.1625 = £660,948,868.125

That is £660 million paid to shareholders

https://www.londonstockexchange.com/stock/GSK/gsk-plc/company-page

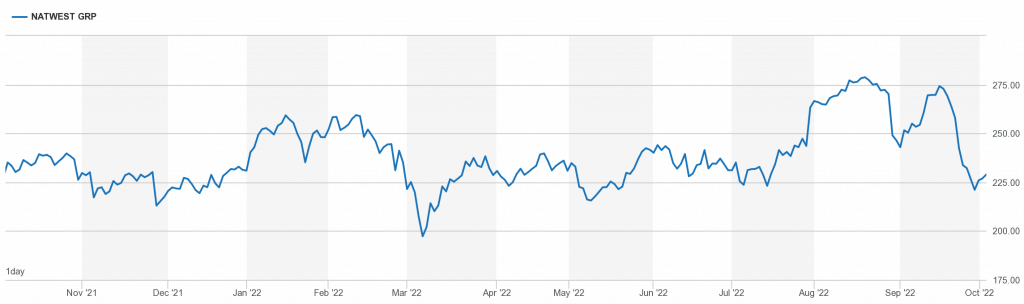

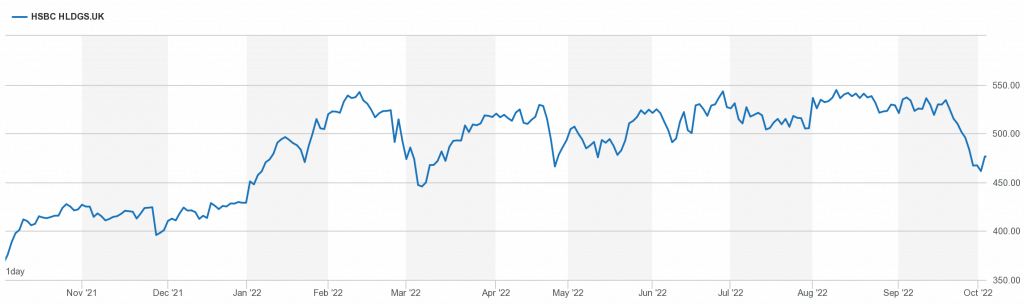

Market Reaction to the HM Government “Fiscal Event” = Mini Budget

Wise Quote

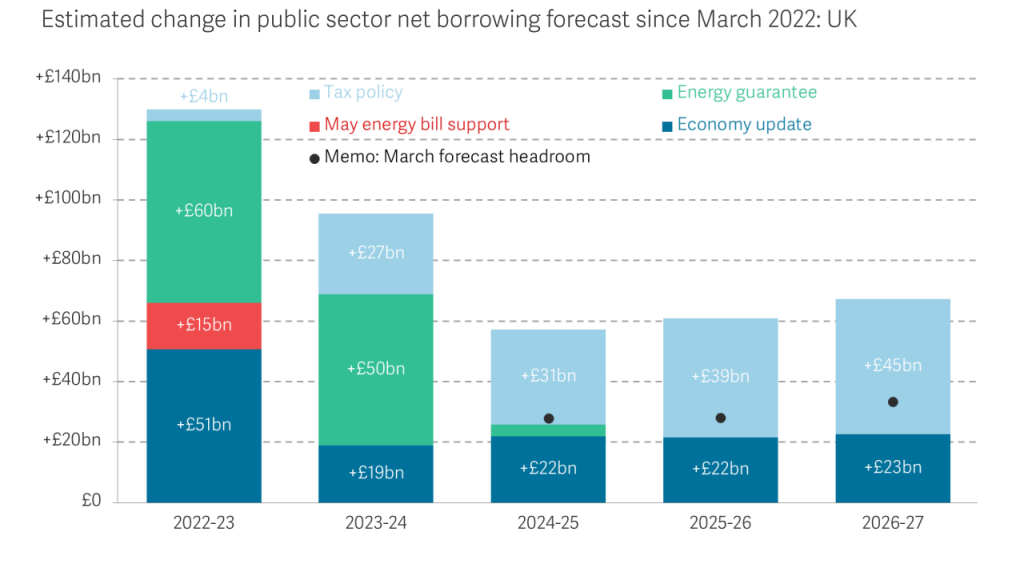

The impact of Trussonomics

PowerPoint Presentation (resolutionfoundation.org)

The last few days have seen a radical reshaping of the Government’s economic policy and a radical reaction from financial markets. HM Government is will to ramp up borrowing, and reducing its tax revenues (by lowering income tax) in their plan (hope) for economic growth. However surging borrowing costs for Government was surely never part of the plan.

In the presentation link above from the very well respected Resolution Foundation they explore what this means for the UK economy going forwards. You can also can watch the YouTube video below with key input from Stephanie Flanders, Senior Executive Editor at Bloomberg and Head of Bloomberg Economics and Robert Colvile, Director of the Centre for Policy Studies