Monthly Archives: May 2020

Greencoat UK Wind: May 2020 Dividend

Today, Greencoat UK Wind pays out its May 2020 Dividend.

https://www.greencoat-ukwind.com/

The dividend is 1.775p a share:

https://www.londonstockexchange.com/exchange/news/market-news/market-news-detail/UKW/14525219.html

The total voting rights figure will be 1,518,162,889

Thus:-

1,518,162,889 x 1.775p = £26,947,391.27975

That is £26m.

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=7013076&action=

5.1% yield.

The Investment of Stevie Nicks

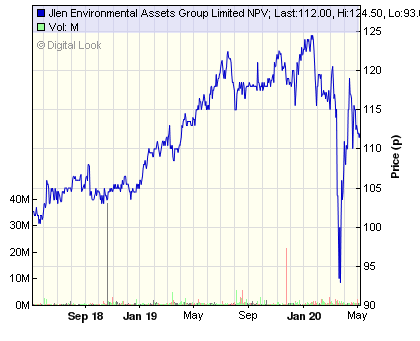

Jlen Environmental Assets Group Limited

You can see the 2 year trajectory of JLEN

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=28067217&action=

UK Gilt Auction: Negative Rates.

The UK Government, HM Treasury is borrowing money to fund its day to day operations as tax revenues (income) are lower than government expenditure. Now with the Covid19 pandemic, HM Government is tapping the bond market to borrow money by issuing Gilts.

The British Government sold a government bond with a negative yield for the first time.

On Wed 20th May 2020, the British Government borrowed £3,869.6240 Million (£3.869624 Billion).

The Yield at Auction Price was -0.003%

That means at the end of the 12 months, the Gilt owner would have had their oringial capital reduced by 0.003%.

It is a 3 year gilt.

Thus:-

£3,869.6240 Million on the 20th May 2020:

Capital reduced by 0.003% after year 1 = £3869.507911 Million

Capital reduced by 0.003% after year 2 = £3869.391826 Million

Capital reduced by 0.003% after year 3 = £3869.275744 Million

So after 3 years years the initial capital of £3,869.6240 Million becomes £3869.275744 Million.

A capital reduction of 0.348256 Million = £348,256.

In effect, negative yield effectively means investors have to pay to lend money to fund the government’s response to the Covid-19 pandemic. In searching for a safe haven for their money they bought gilts knowing they would get back less than they paid for them when the bonds mature in three years’ time, because it Trusts the UK Government

HSBC Shareprice: Covid19

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10048&action=

HSBC is one of the world’s largest banks. It has had a rollercoaster sharerprice:-

Berkshire Hathaway Annual General Meeting 2020

Ray Dalio goes into detail on debt

Bernie Madoff: CNBC American Greet

2008 Financial Crisis

Ten reasons why a ‘Greater Depression’ for the 2020s is inevitable:- Nouriel Roubini

Ominous and risky trends were around long before Covid-19, making an L-shaped depression very likely.

After the 2007-09 financial crisis, the imbalances and risks pervading the global economy were exacerbated by policy mistakes. So, rather than address the structural problems that the financial collapse and ensuing recession revealed, governments mostly kicked the can down the road, creating major downside risks that made another crisis inevitable. And now that it has arrived, the risks are growing even more acute. Unfortunately, even if the Greater Recession leads to a lacklustre U-shaped recovery this year, an L-shaped “Greater Depression” will follow later in this decade, owing to 10 ominous and risky trends.

The first trend concerns deficits and their corollary risks: debts and defaults. The policy response to the Covid-19 crisis entails a massive increase in fiscal deficits – on the order of 10% of GDP or more – at a time when public debt levels in many countries were already high, if not unsustainable.

Worse, the loss of income for many households and firms means that private-sector debt levels will become unsustainable, too, potentially leading to mass defaults and bankruptcies. Together with soaring levels of public debt, this all but ensures a more anaemic recovery than the one that followed the Great Recession a decade ago.

A second factor is the demographic timebomb in advanced economies. The Covid-19 crisis shows that much more public spending must be allocated to health systems, and that universal healthcare and other relevant public goods are necessities, not luxuries. Yet, because most developed countries have ageing societies, funding such outlays in the future will make the implicit debts from today’s unfunded healthcare and social security systems even larger.

A third issue is the growing risk of deflation. In addition to causing a deep recession, the crisis is also creating a massive slack in goods (unused machines and capacity) and labour markets (mass unemployment), as well as driving a price collapse in commodities such as oil and industrial metals. That makes debt deflation likely, increasing the risk of insolvency.

A fourth (related) factor will be currency debasement. As central banks try to fight deflation and head off the risk of surging interest rates (following from the massive debt build-up), monetary policies will become even more unconventional and far-reaching. In the short run, governments will need to run monetised fiscal deficits to avoid depression and deflation. Yet, over time, the permanent negative supply shocks from accelerated de-globalisation and renewed protectionism will make stagflation all but inevitable.

A fifth issue is the broader digital disruption of the economy. With millions of people losing their jobs or working and earning less, the income and wealth gaps of the 21st-century economy will widen further. To guard against future supply-chain shocks, companies in advanced economies will re-shore production from low-cost regions to higher-cost domestic markets. But rather than helping workers at home, this trend will accelerate the pace of automation, putting downward pressure on wages and further fanning the flames of populism, nationalism, and xenophobia.

This points to the sixth major factor: deglobalisation. The pandemic is accelerating trends toward balkanisation and fragmentation that were already well underway. The US and China will decouple faster, and most countries will respond by adopting still more protectionist policies to shield domestic firms and workers from global disruptions. The post-pandemic world will be marked by tighter restrictions on the movement of goods, services, capital, labour, technology, data, and information. This is already happening in the pharmaceutical, medical-equipment, and food sectors, where governments are imposing export restrictions and other protectionist measures in response to the crisis.

The backlash against democracy will reinforce this trend. Populist leaders often benefit from economic weakness, mass unemployment, and rising inequality. Under conditions of heightened economic insecurity, there will be a strong impulse to scapegoat foreigners for the crisis. Blue-collar workers and broad cohorts of the middle class will become more susceptible to populist rhetoric, particularly proposals to restrict migration and trade.

This points to an eighth factor: the geostrategic standoff between the US and China. With the Trump administration making every effort to blame China for the pandemic, Chinese President Xi Jinping’s regime will double down on its claim that the US is conspiring to prevent China’s peaceful rise. The Sino-American decoupling in trade, technology, investment, data, and monetary arrangements will intensify.

Worse, this diplomatic breakup will set the stage for a new cold war between the US and its rivals – not just China, but also Russia, Iran, and North Korea. With a US presidential election approaching, there is every reason to expect an upsurge in clandestine cyber warfare, potentially leading even to conventional military clashes. And because technology is the key weapon in the fight for control of the industries of the future and in combating pandemics, the US private tech sector will become increasingly integrated into the national-security-industrial complex.

Internet Investment: Vint Cerf-Our Internet is working. Thank these Cold War-era pioneers who designed it to handle almost anything.

Coronavirus may have forced people to stay at home, but the Internet these scientists envisioned long ago is keeping the world connected

Coronavirus knocked down — at least for a time — Internet pioneer Vinton Cerf, who offers this reflection on the experience: “I don’t recommend it … It’s very debilitating.”

Cerf, 76 and now recovering in his Northern Virginia home, has better news to report about the computer network he and others spent much of their lives creating. Despite some problems, the Internet overall is handling unprecedented surges of demand as it keeps a fractured world connected at a time of global catastrophe.

“This basic architecture is 50 years old, and everyone is online,” Cerf noted in a video interview over Google Hangouts, with a mix of triumph and wonder in his voice. “And the thing is not collapsing.”

The Internet, born as a Pentagon project during the chillier years of the Cold War, has taken such a central role in 21st Century civilian society, culture and business that few pause any longer to appreciate its wonders — except perhaps, as in the past few weeks, when it becomes even more central to our lives.

Many facets of human life — work, school, banking, shopping, flirting, live music, government services, chats with friends, calls to aging parents — have moved online in this era of social distancing, all without breaking the network. It has groaned here and there, as anyone who has struggled through a glitchy video conference knows, but it has not failed.

“Resiliency and redundancy are very much a part of the Internet design,” explained Cerf, whose passion for touting the wonders of computer networking prompted Google in 2005 to name him its “Chief Internet Evangelist,” a title he still holds.

Sign up for our Coronavirus Updates newsletter to track the outbreak. All stories linked in the newsletter are free to access.

Comcast, the nation’s largest source of residential Internet, serving more than 26 million homes, reports peak traffic was up by nearly one third in March, with some areas reaching as high as 60 percent above normal. Demand for online voice, video and VPN connections — all staples of remote work — have surged, and peak usage hours have shifted from evenings, when people typically stream video for entertainment, to daytime work hours.

Concerns about shifting demands prompted European officials to request downgrades in video streaming quality from major services such as Netflix and YouTube, and there have been localized Internet outages and other problems, including the breakage of a key transmission cable running down the West coast of Africa — an incident with no connection to the coronavirus pandemic. Heavier use of home WiFi also has revealed frustrating limits to those networks.

But so far Internet industry officials report they’ve managed the shifting loads and surges. To a substantial extent, the network has managed them automatically because its underlying protocols adapt to shifting conditions, working around trouble spots to find more efficient routes for data transmissions and managing glitches in a way that doesn’t break connections entirely.

Net of Insecurity Part 2: The long life of a quick fix

Some credit goes to Comcast, Google and the other giant, well-resourced corporations essential to the Internet’s operation today. But perhaps even more goes to the seminal engineers and scientists like Cerf, who for decades worked to create a particular kind of global network — open, efficient, resilient and highly interoperable so anyone could join and nobody needed to be in charge.

“They’re deservedly taking a bit of a moment for a high five right now,” said Jason Livingood, a Comcast vice president who has briefed some members of the Internet’s founding generation about how the company has been handling increased demands.

Cerf, along with fellow computer scientist Robert E. Kahn, was a driving force in developing key Internet protocols in the 1970s for the Pentagon’s Defense Advanced Research Projects Agency, which provided early research funding but ultimately relinquished control of the network it spawned. Cerf also was among a gang of self-described “Netheads” who led an insurgency against the dominant forces in telecommunications at the time, dubbed the “Bellheads” for their loyalty to the Bell Telephone Company and its legacy technologies.

Bell, which dominated U.S. telephone service until it was broken up in the 1980s, and similar monopolies in other countries wanted to connect computers through a system much like their lucrative telephone systems, with fixed networks of connections run by central entities that could make all of the major technological decisions, control access and charge whatever the market — or government regulators — would allow.

The vision of the Netheads was comparatively anarchic, relying on technological insights and a lot of faith in collaboration. The result was a network — or really, a network of networks — with no chief executive, no police, no taxman and no laws.

In their place were technical protocols, arrived at through a process for developing expert consensus, that offered anyone access to the digital world from any properly configured device. Their numbers, once measured in the dozens, now rank in the tens of billions, including phones, televisions, cars, dams, drones, satellites, thermometers, garbage cans, refrigerators, watches and so much more.

This Netheads’ idea of a globe-spanning network that no single company or government controlled goes a long way toward explaining why an Indonesian shopkeeper with a phone made in China can log on to an American social network to chat — face to face and almost instantaneously — with her friend in Nigeria. That capability still exists, even as much of the world has banned or restricted international travel.

“You’re seeing a success story right now,” said David D. Clark, a Massachusetts Institute of Technology computer scientist who worked on early Internet protocols, speaking by the videoconferencing service Zoom. “If we didn’t have the Internet, we’d be in an incredibly different place right now. What if this had happened in the 1980s?”

Such a system carries a notable cost in terms of security and privacy, a fact the world rediscovers every time there’s a major data breach, ransomware attack or controversy over the amount of information governments and private companies collect about anyone who’s online — a category that includes more than half of the world’s almost 8 billion people.

Thousands of Zoom video calls left exposed on open Web

But the lack of a central authority is key to why the Internet works as well as it does, especially at times of unforeseen demands.

Some of the early Internet architects — Cerf among them, from his position at the Pentagon — were determined to design a system that could continue operating through almost anything, including a nuclear attack from the Soviets.

That’s one reason the system doesn’t have any preferred path from Point A to Point B. It continuously calculates and recalculates the best route, and if something in the middle fails, the computers that calculate transmission paths find new routes — without having to ask anyone’s permission to do so.

Steve Crocker, a networking pioneer like Cerf, compared this quality to that of a sponge, an organism whose functions are so widely distributed that breaking one part does not typically cause the entire organism to die.

“You can do damage to a portion of it, and the rest of it just lumbers forward,” Crocker said, also speaking by Zoom.

Even more elementally, the Netheads believed in an innovation called “packet-switching,” which broke from the telephone company’s traditional model, called “circuit switching,” that dedicated a line to a single conversation and left it open until the participants hung up.

The Netheads considered that terribly wasteful given that any conversation includes pauses or gaps that could be used to transmit data. Instead, they embraced a model in which all communications were broken into chunks, called packets, that continuously shuttled back and forth over shared lines, without pauses.

The computers at either end of these connections reassembled the packets into whatever they started as — emails, photos, articles or video — but the network itself didn’t know or care what it was carrying. It just moved the packets around and let the recipient devices figure out what to do.

That simplicity, almost an intentional brainlessness at the Internet’s most fundamental level, is a key to its adaptability. As many others have said, it’s a web of highways everyone can use for almost any purpose they desire.

Many of the Internet’s founding generation have memories of trying to convince various Bellheads packet-switching was the inevitable future of telecommunications — cheaper, faster, easier to scale and vastly more efficient and adaptable.

Those anecdotes all end the same way, with the telephone company titans of the day essentially treating the Netheads as precocious but fundamentally misguided children who, some day, might understand how telecommunications technology really worked. Several acknowledged they celebrated just a bit when the telephone companies gradually abandoned old-fashioned circuit-switching for what was called “Voice Over IP” or VoIP. It was essentially transmitting voice calls over the Internet — using the same technical protocols that Cerf and others had developed decades earlier.

Leonard Kleinrock, one of three scientists credited with inventing the concept of packet switching in the 1960s, also was present for the first transmission on the rudimentary network that would, years later, become the Internet.

That was Oct. 29, 1969, and Kleinrock was a computer scientist at the University of California at Los Angeles. A student programmer tried to send the message “login” to a computer more than 300 miles away, at the Stanford Research Institute, but got only as far as the first two letters — “L” and “O” — before the connection crashed.

Retelling the story by phone, over a line using the Internet’s packet-switching technology instead of the one long preferred by the “Bellheads,” he recalled his own experience in trying to convince some phone company executives that he had discovered a technology that would change the world.

“They said, ‘Little boy, go away,’” Kleinrock said. “So we went away.”

And now Kleinrock, 85 and staying home to minimize the risk of catching the coronavirus, is enjoying that his home Internet connection is 2,000 times faster than the phone-booth sized communications device that Internet pioneers used in 1969.

“The network,” he said, “has been able to adapt in a beautiful way.”

The Flu Pandemic @1918

HM Government Borrowing, April 2020

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a Covid 19 world. UK’s HM Government needs to fund many new demands.

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In March 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 17 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

29-Apr-2020 1¾% Treasury Gilt 2049 £2,152.5000 Million

29-Apr-2020 2¾% Treasury Gilt 2024 £3,616.3750 Million

28-Apr-2020 0 1/8% Index-linked Treasury Gilt 2028 3 months £1,499.9990 Million

28-Apr-2020 0 7/8% Treasury Gilt 2029 £3,749.9990 Million

22-Apr-2020 1% Treasury Gilt 2024 £3,671.4760 Million

22-Apr-2020 1¼% Treasury Gilt 2027 £3,141.0000 Million

21-Apr-2020 0 5/8% Treasury Gilt 2025 £4,062.4990 Million

21-Apr-2020 1 5/8% Treasury Gilt 2054 £1,874.9990 Million

16-Apr-2020 1½% Treasury Gilt 2026 £3,648.7500 Million

16-Apr-2020 1¾% Treasury Gilt 2049 £2,499.9980 Million

15-Apr-2020 0 7/8% Treasury Gilt 2029 £3,676.2490 Million

15-Apr-2020 1¾% Treasury Gilt 2037 £2,313.7490 Million

08-Apr-2020 2% Treasury Gilt 2025 £2,750.0000 Million

08-Apr-2020 4¾% Treasury Gilt 2030 £2,092.5000 Million

07-Apr-2020 0 1/8% Treasury Gilt 2023 £4,062.5000 Million

07-Apr-2020 1¾% Treasury Gilt 2057 £1,562.4990 Million

02-Apr-2020 1¼ % Treasury Gilt 2041 £2,299.9970 Million

When you add the cash raised:-

£2,152.50 Million

£3,616.38 Million

£1,500.00 Million

£3,750.00 Million

£3,671.48 Million

£3,141.00 Million

£4,062.50 Million

£1,875.00 Million

£3,648.75 Million

£2,500.00 Million

£3,676.25 Million

£2,313.75 Million

£2,750.00 Million

£2,092.50 Million

£4,062.50 Million

£1,562.50 Million

£2,300.00 Million

Total: £48,675.09 Million = £48.67509 Billion

On another way of looking at it, is in the 30 days in April 2020, HM Government borrowed:- £1622.502967 Million each day for the 30 days.

That is £1.622 Billion A DAY.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature 2024-2057. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

The Words of Ray Dalio: Clarity

Words of Investment on Covid 19

Do not obsess about the loss in value of your investments. Do not pontificate that you saw it coming. There is the important difference between wealth and income; stock and flow. The wealth you accumulated over a lifetime in investments has eroded in value as the markets have crashed. But what matters currently is the income, the flow. Do you have a job that offers salary even during the shutdown? Are you confident you will keep the job through and after this period? You are fortunate. Evaluate the reality of the situation………