Monthly Archives: January 2023

HM Government Borrowings: December 2022

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a post Covid 19 world. UK’s HM Government needs to fund many new demands. [www.dmo.gov.uk]

https://dmo.gov.uk/data/pdfdatareport?reportCode=D2.1PROF7

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In December 2022, the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is the PSNCR: The Public Sector Net Cash Requirement. There were “only” 6 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

20-Dec-2022 0¼% Treasury Gilt 2025 £3,619.2500 Million

13-Dec-2022 1% Treasury Gilt 2032 £3,749.9990 Million

07-Dec-2022 0 1/8% Index-linked Treasury Gilt 2031 3 months £744.6500 Million

06-Dec-2022 4 1/8% Treasury Gilt 2027 £4,062.4980 Million

06-Dec-2022 1 1/8% Treasury Gilt 2039 £2,812.5000 Million

01-Dec-2022 1¼% Treasury Gilt 2051 £2,812.4990 Million

£3,619.2500 Million + £3,749.9990 Million + £744.6500 Million + £4,062.4980 Million + £2,812.5000 Million + £2,812.4990 Million = £17,801.396 Million.

£17,801.396 Million = £17.801396 Billion

On another way of looking at it, is in the 31 days in December 2022, HM Government borrowed:- £574.23858064516129032258064516129 Million each day for the 31 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bonds maturing from 2025 to 2051. All long-term borrowings, we are mortgaging our futures, but at least “We Are In It Together……“

Investment in Star Trek

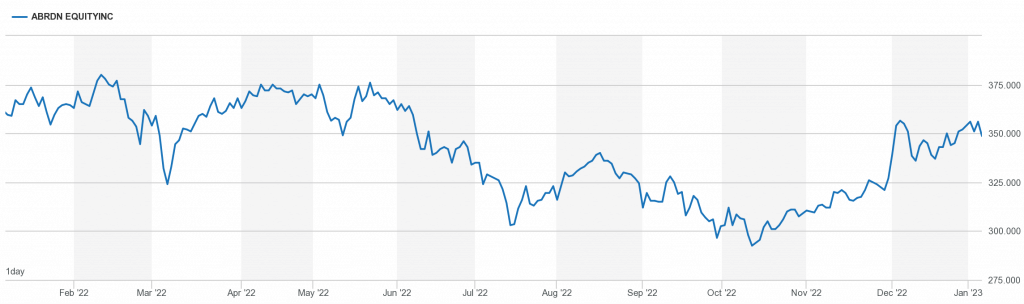

The abrdn Equity Income Trust

The abrdn Equity Income Trust is a London listed investment trust.

https://www.abrdnequityincome.com/en-gb

Twenty largest equity holdings (%)

BP 5.5% of the fund

Shell 4.6% of the fund

Thungela 4.0% of the fund

Glencore 3.8% of the fund

Imperial Brands 3.2% of the fund

Diversified 3.1% of the fund

SSE 3.0% of the fund

Natwest 2.9% of the fund

National Grid 2.8% of the fund

Barclays 2.8% of the fund

British American Tobacco 2.7% of the fund

Close Brothers 2.6% of the fund

CMC 2.5% of the fund

Anglo American 2.2% of the fund

BHP 2.1% of the fund

OSB 2.1% of the fund

Chesnara 2.0% of the fund

Mondi 1.9% of the fund

Legal & General 1.9% of the fund

Playtech 1.8% of the fund

Total 57.5% of the fund

Total number of investments 64

https://www.londonstockexchange.com/stock/AEI/abrdn-equity-income-trust-plc/company-page

Investment in Humanity.

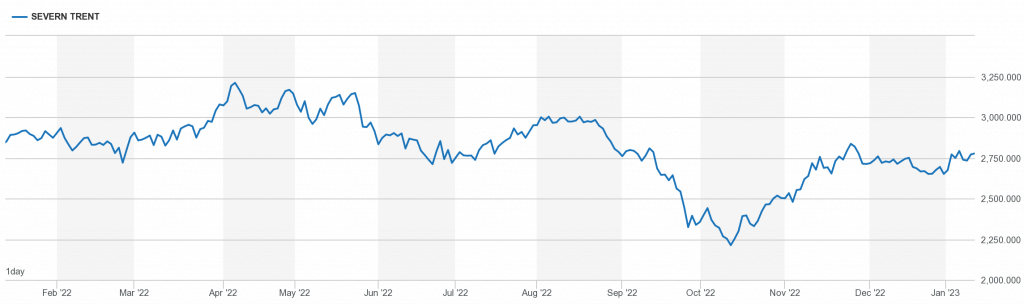

Severn Trent PLC

On the 11th Jan, a few weeks ago, Severn Trent PLC paid out its Jan 2023 dividend.

42.73p a share

https://www.londonstockexchange.com/news-article/SVT/total-voting-rights/15780464

The total number of voting rights in Severn Trent Plc is 251,554,009

Thus:-

251,554,009 x £0.4273 = £107,489,028.0457

That is £107m paid out to shareholders.

https://www.londonstockexchange.com/stock/SVT/severn-trent-plc/company-page

Investment in Chevron

Very interesting interview, especially on his views on a Windfall tax.

Pi

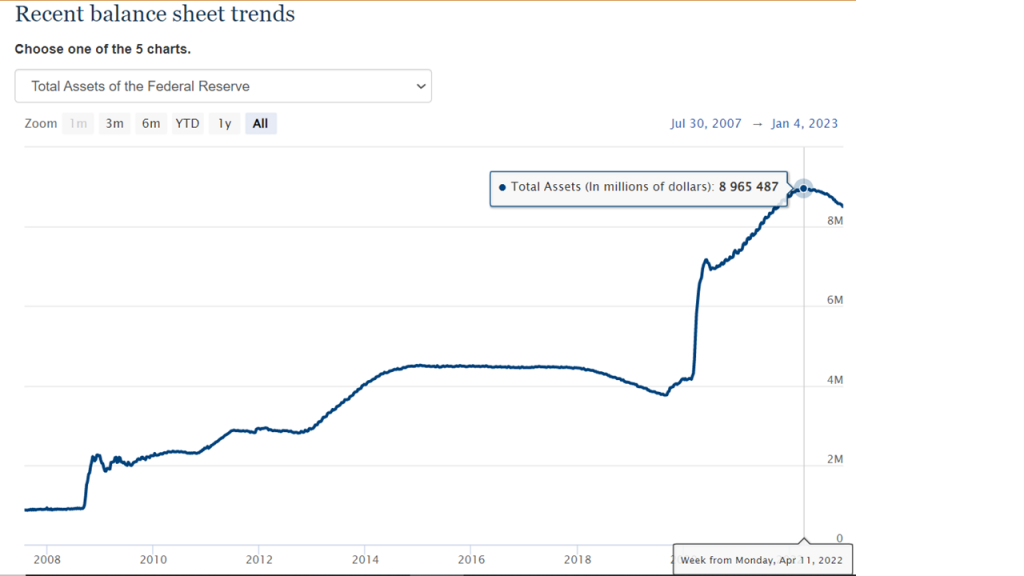

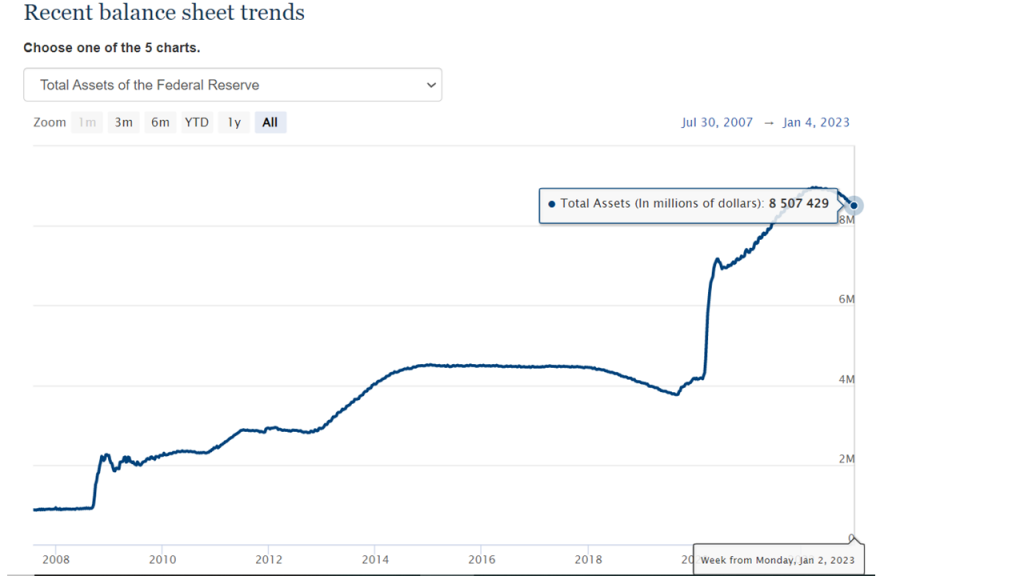

The Federal Reserve Balance Sheet

The US Central Bank (The Fed) is shrinking its balance sheet, it is reversing the QE programme.

The Peak: $8.965487 Trillion

The Current Size: $8.507429 Trillion

Federal Reserve Board – Recent balance sheet trends

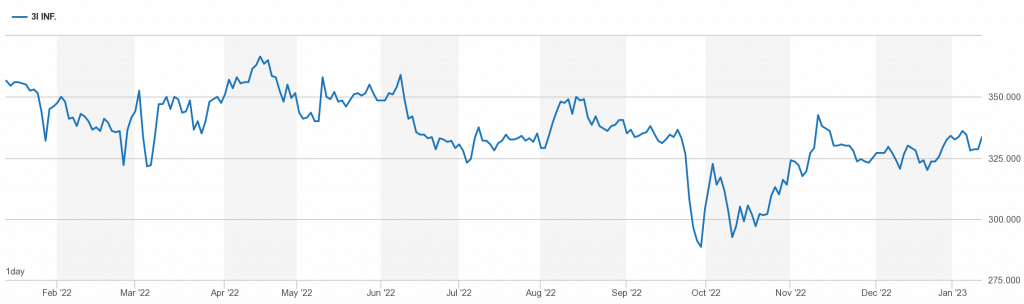

3i Infrastructure January dividend

Yesterday, the FTSE-250 infrastructure giant, 3i Infrastructure paid out its Jan dividend.

https://www.3i-infrastructure.com/

5.575p a share.

The Company’s issued share capital as at 8.00 a.m. on 15 March 2018 consisted of 810,434,010 ordinary shares with voting rights.

Thus:-

810,434,010 x £0.05575 = £45,181,696.0575

That is £45million paid to shareholders.

https://www.londonstockexchange.com/stock/3IN/3i-infrastructure-plc/company-page

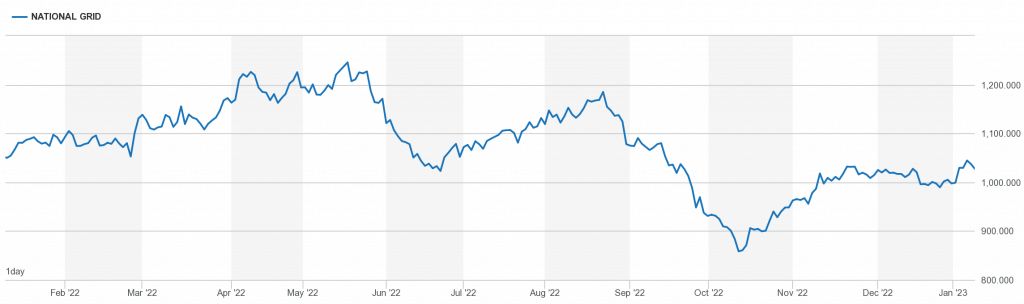

National Grid dividend

Today, the UK electricity infrastructure giant, pays out its Jan 2023 dividend

17.84p a share.

National Grid’s registered capital as of 31 December 2022 consisted of 3,914,359,015 ordinary shares, of which, 254,041,798 were held as treasury shares; leaving a balance of 3,660,317,217 shares with voting rights

Thus:-

3,660,317,217 x £0.1784 = 653,000,591.5128

That is £653 million paid to shareholders

https://www.londonstockexchange.com/stock/NG./national-grid-plc/company-page

Assets of the Alliance Trust.

The Alliance Trust an investment trust giant.

https://en.wikipedia.org/wiki/Alliance_Trust

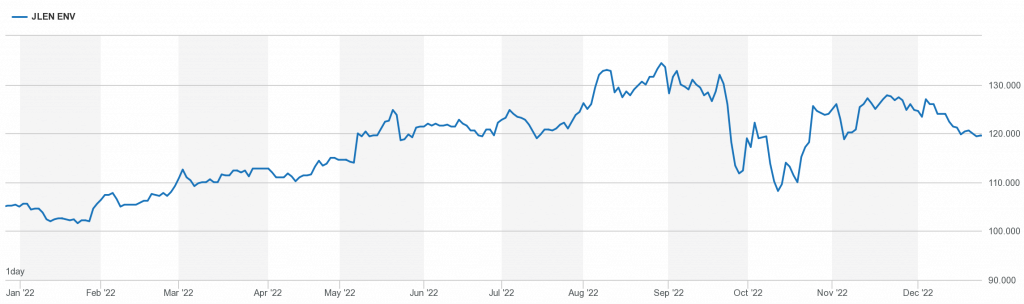

John Laing Environmental Assets Group Quarterly dividend

03Last week, on Friday 30th December, John Laing Environmental Assets Group, paid out its December quarterly dividend.

1.79p a share.

the total voting rights figure of 661,531,229.

https://www.londonstockexchange.com/news-article/JLEN/total-voting-rights/15346670

Thus:-

661,531,229 x £0.0179 = £11,841,408.9991

That is £11 million paid to shareholders

https://www.londonstockexchange.com/stock/JLEN/jlen-environmental-assets-group-limited/company-page

Charlie Munger

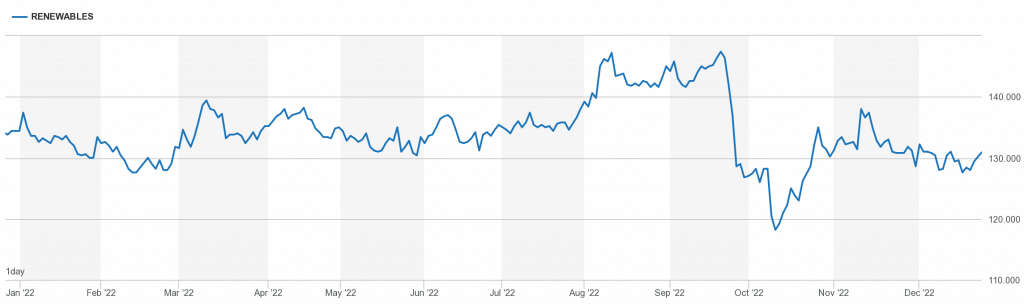

Renewables Infrastructure Group Quarterly dividend

A few days ago, on Friday 30th December, Renewables Infrastructure Group, paid out its December quarterly dividend.

TRIG plc is now a FTSE-250 company

1.71p a share.

The total issued share capital with voting rights is 2,482,824,562.

https://www.londonstockexchange.com/news-article/TRIG/total-voting-rights/15653185

Thus:-

2,482,824,562 x £0.0171 = £42,456,300.0102

That is £42million paid to shareholders

New Years Day

All is quiet on New Year’s Day

A world in white gets underway

I want to be with you

Be with you, night and day

Nothing changes on New Year’s Day

On New Year’s Day

I will be with you again

I will be with you again

Under a blood red sky

A crowd has gathered in black and white

Arms entwined, the chosen few

The newspapers says, says

Say it’s true, it’s true

And we can break through

Though torn in two

We can be one

I, I will begin again

I, I will begin again

Oh, oh

Oh, oh

Oh, oh

Oh, oh

Oh, oh

Oh, oh

Oh, oh

Ah, maybe the time is right

Oh, maybe tonight

I will be with you again

I will be with you again

And so we’re told this is the golden age

And gold is the reason for the wars we wage

Though I want to be with you, be with you

Night and day

Nothing changes

On New Year’s Day

On New Year’s Day

On New Year’s Day