Monthly Archives: November 2020

Ray Dalio on Inflation that is on the horizon

The Legal and General Global Technology Index Fund.

The Legal and General Global Technology Index Fund is a Unit Trust. The objective of the Fund is to provide growth by tracking the performance of the FTSE World -Technology Index (the “Index”). This objective is after the deduction of charges and taxation.

£967.2m of Technology assets.

Top 10 holdings (%)

Apple Inc 16.5% of the fund

Microsoft Corp 13.4% of the fund

Facebook 4.6% of the fund

Alphabet Cl A 4.1% of the fund

Alphabet Cl C 4.1% of the fund

Taiwan Semiconductor Manufacturing 3.4% of the fund

Nvidia Corp 3.0% of the fund

Adobe Inc 2.2% of the fund

Samsung Electronics Co Ltd 2.2% of the fund

Intel Corp 2.1% of the fund

The graph below shows its growth:-

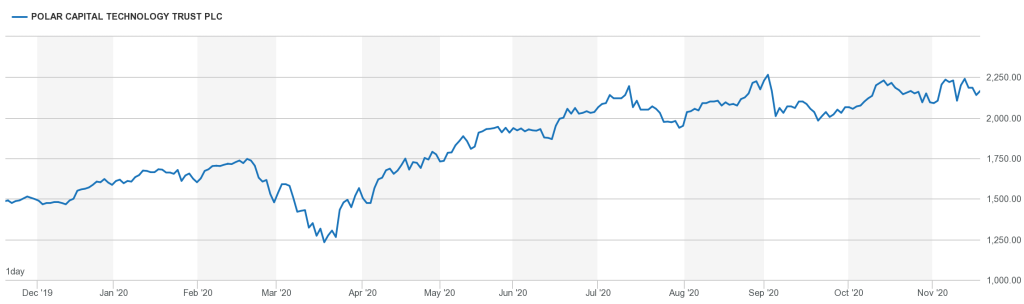

The Polar Capital Technology Investment Trust plc

The Polar Capital Technology Investment Trust plc is a London listed investment trust.

https://www.polarcapitaltechnologytrust.co.uk/

£2,972.87m is it market capitalisation

Its top 15 holdings (%)

Apple 9.3% of the trust

Microsoft 8.2% of the trust

Alphabet 6.3% of the trust

Facebook 5.0% of the trust

Alibaba 4.0% of the trust

Tencent 3.8% of the trust

Samsung 2.8% of the trust

Amazon.com 2.6% of the trust

Taiwan Semiconductors 2.6% of the trust

Adobe Systems 2.2% of the trust

NVIDIA 2.0% of the trust

Advanced Micro Devices 1.8% of the trust

Salesforce.com 1.7% of the trust

Netflix 1.4% of the trust

Qualcomm 1.3% of the trust

https://www.londonstockexchange.com/stock/PCT/polar-capital-technology-trust-plc/company-page

The graph below shows its growth:-

Sainsburys Bank

Their is news in the media, that Sainsbury’s Bank (part of the Sainsbury’s supermaket group) is to be sold to National Westminister Group.

Some figures from the Sainsbury’s annual report

Customer deposits of £6300 million.

Customer lending £7400 million

Ray Dalio on the Economy

Legal & General Japan Index Trust

The Legal & General Japan Index Trust in an Index Fund managed by Legal and General.

A £1,321.9m fund. The objective of the Fund is to provide growth by tracking the capital performance of the FTSE Japan Index

Its top ten holdings are:

Toyota Motor Corp 4.2% of the fund

Sony Corp 2.4% of the fund

Softbank Group Corp 2.3% of the fund

Keyence Corp 2.2% of the fund

Nintendo 1.6% of the fund

Daiichi Sankyo Co Ltd 1.5% of the fund

Takeda Pharmaceutical Co Ltd 1.4% of the fund

Shin-Etsu Chemical Co Ltd 1.3% of the fund

Mitsubishi UFJ Financial Group 1.3% of the fund

Recruit Holdings Co Ltd 1.3% of the fund

It invests across 10 sectors:

Industrials 24.0% of the fund

Consumer Goods 22.7% of the fund

Health Care 11.6% of the fund

Financials 11.2% of the fund

Consumer Services 9.9% of the fund

Technology 6.8% of the fund

Telecommunications 6.2% of the fund

Basic Materials 5.5% of the fund

Utilities 1.5% of the fund

Oil & Gas 0.6% of the fund

Investment in ONE

Or do you feel the same?

Will it make it easier on you now?

You got someone to blame

You say one love, one life (One life)

It’s one need in the night

One love (one love), get to share it

Leaves you darling, if you don’t care for it

Did I disappoint you?

Or leave a bad taste in your mouth?

You act like you never had love

And you want me to go without

Well it’s too late, tonight

To drag the past out into the light

We’re one, but we’re not the same

We get to carry each other

Carry each other

One, one

One, one

One, one

One, one

Have you come here for forgiveness?

Have you come to raise the dead?

Have you come here to play Jesus?

To the lepers in your head

Well, did I ask too much, more than a lot?

You gave me nothing, now it’s all I got

We’re one,…

HM Government Borrowings: October 2020

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a Covid 19 world. UK’s HM Government needs to fund many new demands. [www.dmo.gov.uk]

https://www.dmo.gov.uk/dmo_static_reports/Gilt%20Operations.pdf

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In October 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 15 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

28-Oct-2020 0 3/8% Treasury Gilt £3,084.9990 Million

27-Oct-2020 0 1/8% Treasury Gilt 2024 £3,510.7420 Million

27-Oct-2020 1 5/8% Treasury Gilt 2071 £1,249.9990 Million

22-Oct-2020 0 5/8% Treasury Gilt 2035 £2,632.0000 Million

22-Oct-2020 0 5/8% Treasury Gilt 2050 £1,986.8750 Million

20-Oct-2020 1¼% Index-linked Treasury Gilt 2032 3 months £697.0490 Million

14-Oct-2020 0 7/8% Treasury Gilt 2029 £3,125.0000 Million

13-Oct-2020 0 1/8% Treasury Gilt 2026 £3,000.0000 Million

13-Oct-2020 1¾% Treasury Gilt 2057 £1,562.4990 Million

07-Oct-2020 0 3/8% Treasury Gilt 2030 £2,500.0000 Million

07-Oct-2020 0 1/8% Index-linked Treasury Gilt 2041 3 months £884.1490 Million

06-Oct-2020 0 1/8% Treasury Gilt 2024 £3,518.4520 Million

06-Oct-2020 1¾% Treasury Gilt 2049 £2,000.0000 Million

01-Oct-2020 0 1/8% Treasury Gilt 2023 £3,250.0000 Million

01-Oct-2020 1¼ % Treasury Gilt 2041 £2,000.0000 Million

(£3,084.9990 Million + £3,510.7420 Million + £1,249.9990 Million + £2,632.0000 Million + £1,986.8750 Million + £697.0490 Million + £3,125.0000 Million + £3,000.0000 Million + £1,562.4990 Million + £2,500.0000 Million + £884.1490 Million + £3,518.4520 Million + £2,000.0000 Million + £3,250.0000 Million + £2,000.0000 Million) = £35,001.764 Million

£35,001.764 Million = £35 Billion

On another way of looking at it, is in the 31 days in October 2020, HM Government borrowed:- £1129.089161 Million each day for the 31 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature from 2023 through to 2071. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

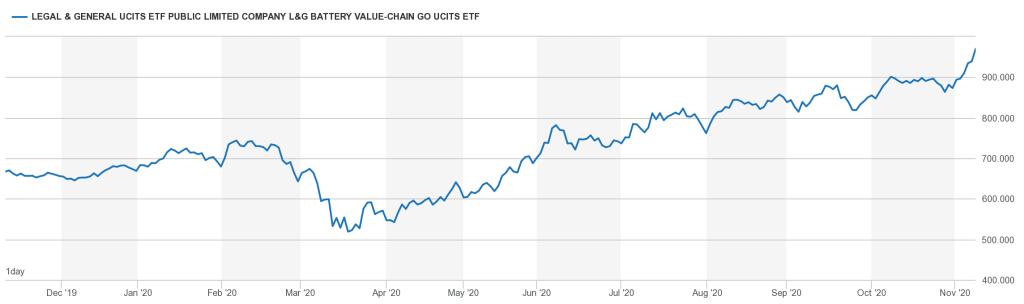

The Ascent of the Lithium Ion Battery Exchange Traded Fund – BATG

BATG is a London Listed Exchange Traded Fund (ETF)

https://www.londonstockexchange.com/stock/BATG/legal-and-general-asset-management/company-page

The graph speaks volumes.

Over 900p a share.

Investment in Good US Comedy

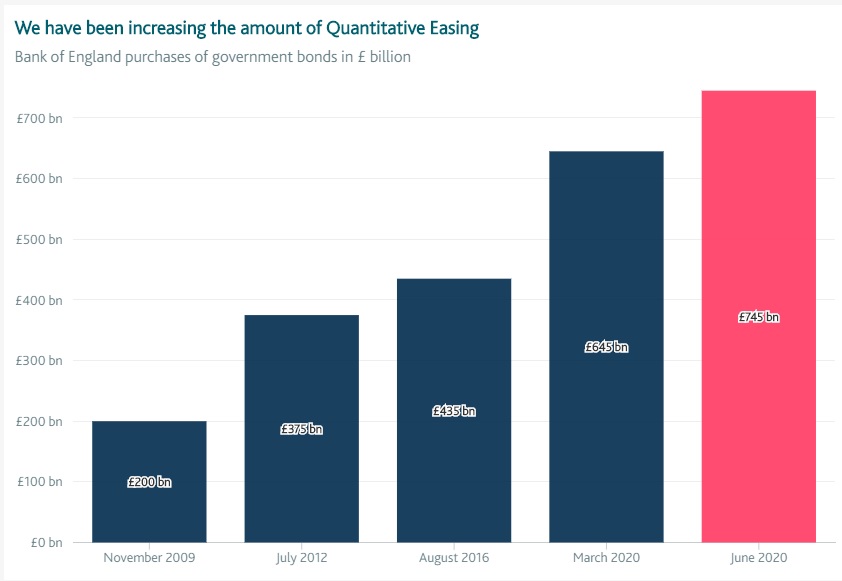

Bank of England November 2020 QE Programme

https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2020/november-2020

On Thursday 5th November, The Bank of England, extended its QE programme by an additional £150bn.

” The Committee voted unanimously for the Bank of England to continue with the existing programme of £100 billion of UK government bond purchases, financed by the issuance of central bank reserves, and also for the Bank of England to increase the target stock of purchased UK government bonds by an additional £150 billion, financed by the issuance of central bank reserves, to take the total stock of government bond purchases to £875 billion. “

Since the start of the financial crisis that began in 2008, the UK Central Bank, has created £875 billion of new money.

Now the QW programme was at £435bn in June 2016, and since Covid has jumped. It went up by £200bn when Covid19 hit in March.

https://www.bankofengland.co.uk/monetary-policy/quantitative-easing

and now jumped again:-

Robotics and Automation ETF

Milton Friedman Quote.

Inflation is taxation without legislation. Milton Friedman

The Long Term Investors