Matt Hancock Ripped To Shreds – YouTube

Monthly Archives: January 2021

The David Rubenstein Show: Warren Buffett

HM Government Borrowings: Dec 2020

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a Covid 19 world. UK’s HM Government needs to fund many new demands. [www.dmo.gov.uk]

https://www.dmo.gov.uk/dmo_static_reports/Gilt%20Operations.pdf

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In October 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 7 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

09-Dec-2020 0 5/8% Treasury Gilt 2035 £3,011.1020 Million

08-Dec-2020 0 1/8% Treasury Gilt 2024 £4,029.3720 Million

08-Dec-2020 0 5/8% Treasury Gilt 2050 £2,500.0000 Million

02-Dec-2020 0 1/8% Index-linked Treasury Gilt 2028 3 months £1,250.0000 Million

02-Dec-2020 0¼% Treasury Gilt 2031 £2,750.0000 Million

01-Dec-2020 0 1/8% Treasury Gilt 2026 £3,669.3550 Million

01-Dec-2020 1¼ % Treasury Gilt 2041 £2,250.0000 Million

(£3,011.1020 Million) + (£4,029.3720 Million) + (£2,500.0000 Million) + (£1,250.0000 Million) + (£2,750.0000 Million) + (£3,669.3550 Million) + (£2,250.0000 Million) = £19,459.83 Million.

£19,459.83 Million = £19.459 Billion

On another way of looking at it, is in the 31 days in December 2020, HM Government borrowed:- £627.7364194 Million each day for the 31 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature from 2024 through to 2050. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

Investment in Hallucinations

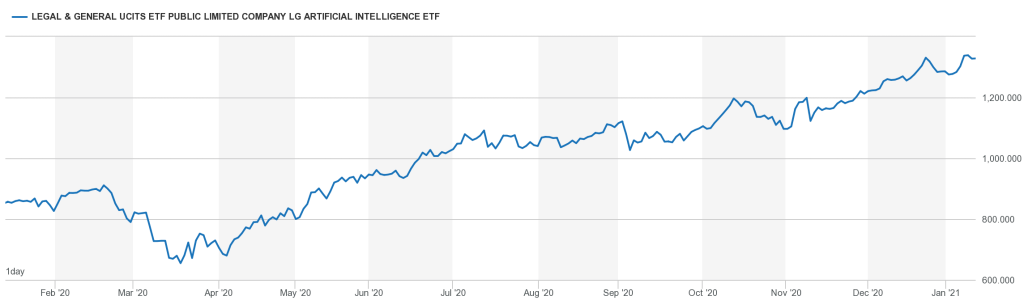

AIAG Legal and General ARTIFICIAL INTELLIGENCE ETF: Rapid Rise

Aviva PLC dividend

Today, one of the UK largest insurance firms Aviva PLC pays out its Jan 2021 dividend.

www.aviva.com

The dividend is 7p a share

https://www.londonstockexchange.com/news-article/AV./total-voting-rights/14810813

Thus they payout is:-

Therefore, the total number of voting rights in Aviva plc is 3,928,488,308 * £0.07 = £274,994,181.56

That is £274 Million.

A yield of 5.9%

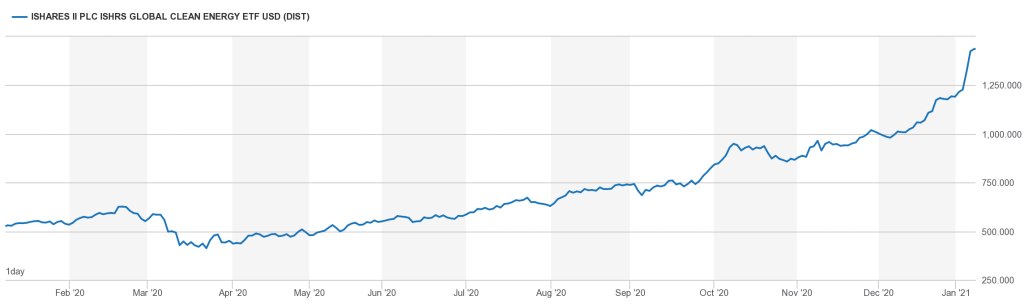

The Ascent of the ISHRS GLOBAL CLEAN ENERGY ETF

The ISHRS GLOBAL CLEAN ENERGY ETF is a Exchange Traded Fund that invests in Clean Energy Technology.

https://www.londonstockexchange.com/stock/INRG/ishares/company-page

It’s objective is to track the investment results of an index composed of global equities in the clean energy sector

https://www.ishares.com/us/products/239738/ishares-global-clean-energy-etf

Fixed Income ETFs

Investment in Science

The 30 Dow Jones Components

The Dow Jones Industrial Average is made up of 30 US companies:-

MSFT Microsoft

AAPL Apple

JNJ Johnson & Johnson

V Visa

WMT Walmart

PG Procter & Gamble

JPM JPMorgan Chase

UNH UnitedHealth

INTC Intel

HD Home Depot

VZ Verizon

MRK Merck & Co

KO Coca-Cola

DIS Walt Disney

CSCO Cisco Systems

CVX Chevron

CRM Salesforce.com

AMGN Amgen

NKE Nike

MCD McDonalds

IBM IBM

HON Honeywell International

MMM 3M

BA Boeing

AXP American Express

GS Goldman Sachs

CAT Caterpillar

GE General Electric

DWDP DuPont de Nemours, Inc.

TRV Travelers Companies

3i Infrastructure Jan 2021 Dividend

Today on Monday 11th Jan 2021, 3i Infrastructure pays out its Jan 2021 dividend.

https://www.3i-infrastructure.com/

4.9p a share.

https://www.londonstockexchange.com/news-article/3IN/total-voting-rights/14288784

3i Infrastructure had 891,434,010 issued ordinary shares with voting rights, thus:

891,434,010 * £0.049 = £43,680,266.49

That is £43m

https://www.londonstockexchange.com/stock/3IN/3i-infrastructure-plc/company-page

20 Years of the FTSE-100

In Jan 2001 it was 6,200 points

In Jan 2021 it was 6,600 points.

21 Years of the Dow Jones Industrial Average