Courtesy of The FT

Courtesy of The BBC

Tomorrow the Chancellor of the Exchequer will announced the long awaited budget. For weeks we have seen the bond market reacting to ill timed and ill advised leaks, undermining confidence in the UK Gilt market. Lenders to UK Government have to have confidence in the UK able to pay on the debts outstanding, and also lenders need to have confidence in the UK to lend new money.

When the government spends more than it receives in tax and other revenues it borrows to cover the difference. This borrowing is known as ‘public sector net borrowing’ but is often referred to as the deficit.

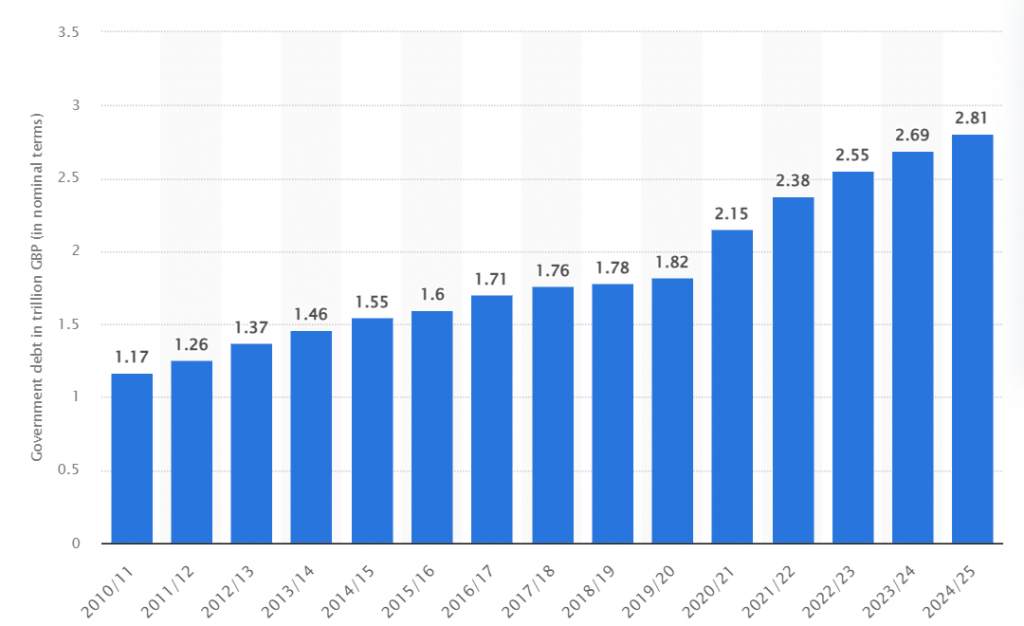

Total public sector net debt in the United Kingdom from 2010/11 to 2024/25

Courtesy of [UK government debt 2025| Statista]

One can see each year the HM Government has been spending more than it earns in taxation over the last 15 years. This is NOT sustainable. Consequently, debt interest payments are now above £100 billion a year, and the OBR has warned that, without action, debt could rise to 270 per cent of GDP by the early 2070s. Note, £100 billion interests is money that can NOT be paid finance our brave armed forces, or build new schools.

In 2024-25, it is expected public spending to amount to £1,278.6 billion, and thus out of that £1278 billion, £100 billion is on debt interest.

Also we are seeing huge media speculation on whether the Chancellor of the Exchequer will break the election promise in the party manifesto of not increase taxes, and this speculation has now become normalised on social media with arm chair political economists saying the Chancellor of the Exchequer will break an election pledge, these ‘experts’ have zero knowledge of the importance of the bond market or a decent grasp of economics.

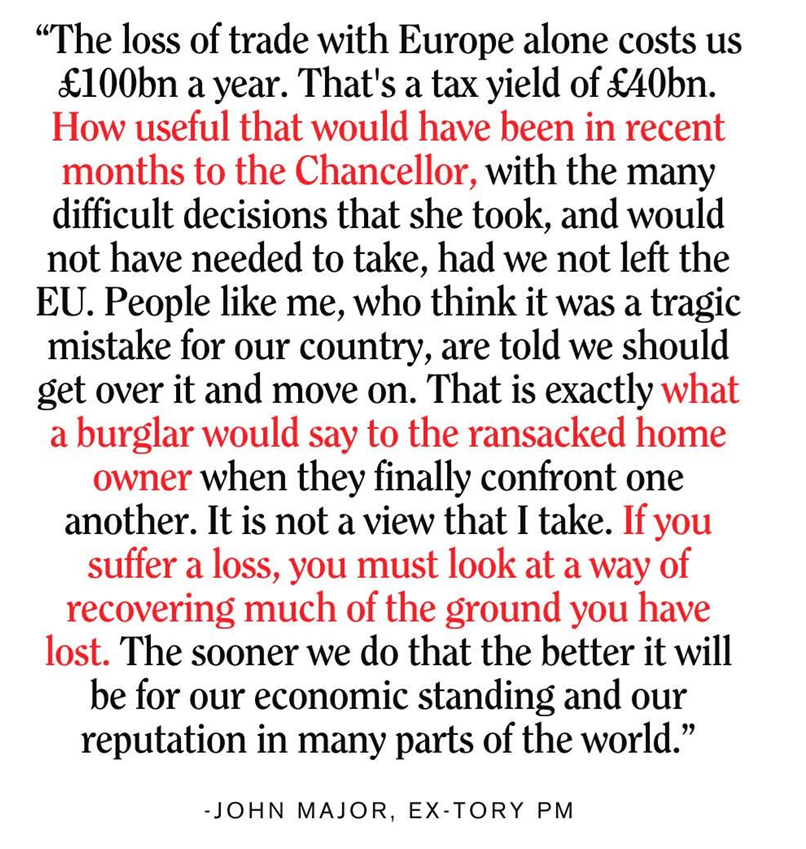

However in the interests of fairness and equality it was David Cameron who maintained his promise and manifesto pledge to ask the UK population for the referendum on the UK continued membership the European Union, and he kept his promise:-

Courtesy of John Major

As shown above, keeping manifesto pledges is NOT a holy or sacred act.

The UK needs to raise taxes to be able to fund the annual budget deficit, if not, the UK Government can not actually fund day to day operations. It needs that funding to finance public services, and if we do NOT, we face a Liz Truss / Kwasi Kwarteng moment, where the UK struggles to raise money, with borrowing costs surge, as lenders get worried over economic competence and stewardship of the UK economy. Sadly, taxes will have to rise, and breaking that manifesto pledge is the right things to do for the UK Government to be able borrow from on the Bond Market and fund public services.

Are Higher Taxes Inevitable for the UK? Economic Analysis from IFS Director | Pod Save the UK

Are Higher Taxes Inevitable for the UK? Economic Analysis from former IFS Director.

UK Taxes NEED to rise, to keep confidence with our creditors.

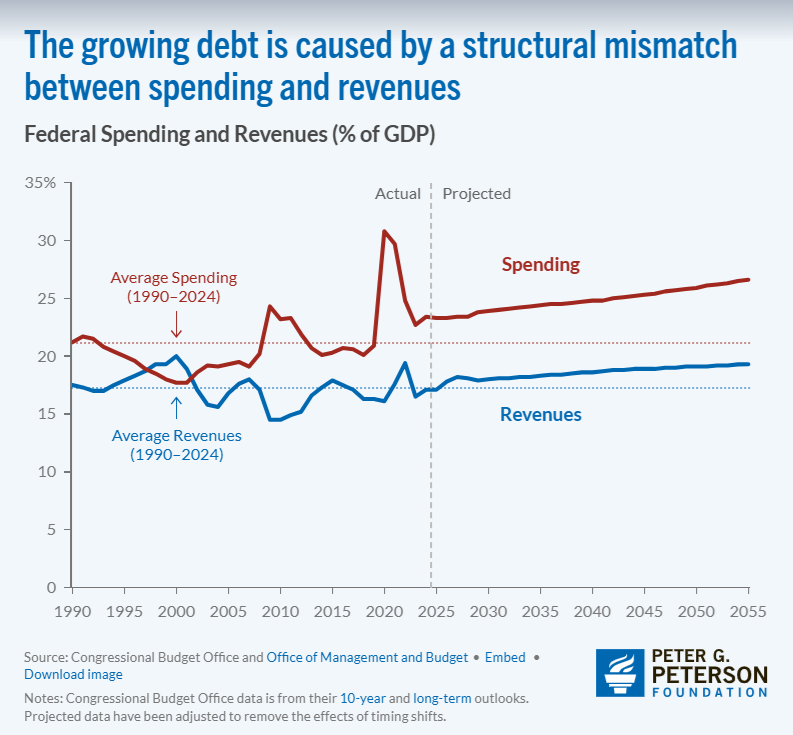

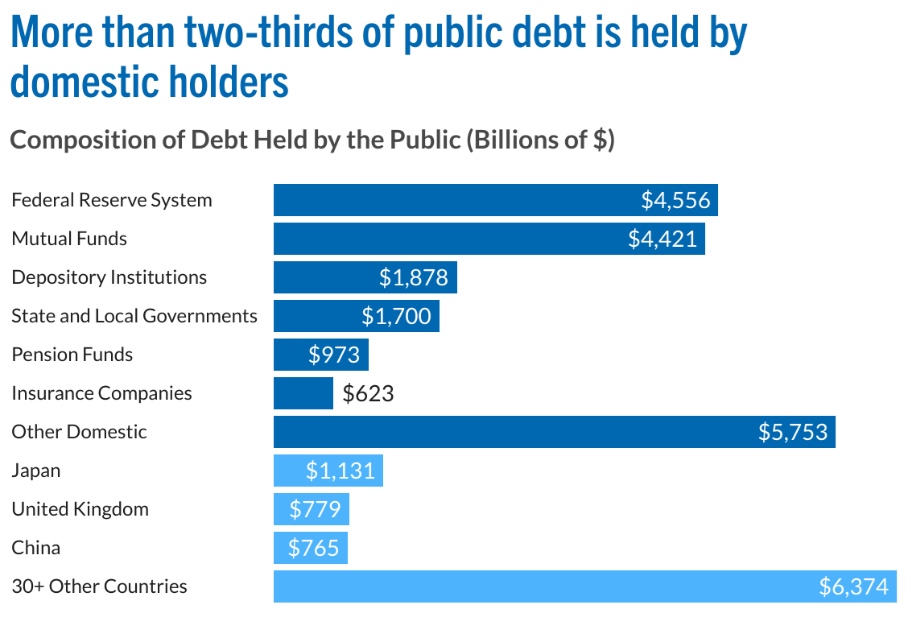

Courtesy of the Peter G Peterson Foundation

Why is the National Debt so high?

America’s growing debt is the result of simple math — each year, there is a mismatch between spending and revenues. When the federal government spends more than it takes in, it has to borrow money to cover that annual deficit. And each year’s deficit adds to the USA’s growing national debt.

Historically, the largest deficits were caused by increased spending around national emergencies like major wars or the Great Depression. Today, deficits are caused mainly by predictable structural factors: our aging baby-boom generation, rising healthcare costs, higher interest rates, and a tax system that does not bring in enough money to pay for what the government has promised its citizens. Moving forward, it will be critical for America’s leaders to address our rising debt, and its structural factors, which are described below.

Courtesy of the Peter G Peterson Foundation

Today, Tesco PLC pays out its November 2025 dividend.

4.8p a share

https://www.londonstockexchange.com/news-article/TSCO/total-voting-rights/17308359

The Company’s share capital as at 31 October 2025 consisted of 6,467,582,349 ordinary shares of 6 1/3 pence each

thus:-

6,467,582,349 x £0.048 = £310,443,952.752

That is £310 Million paid to Tesco shareholders

https://www.londonstockexchange.com/stock/TSCO/tesco-plc/company-page

Courtesy of the London Stock Exchange

Courtesy of Bloomberg

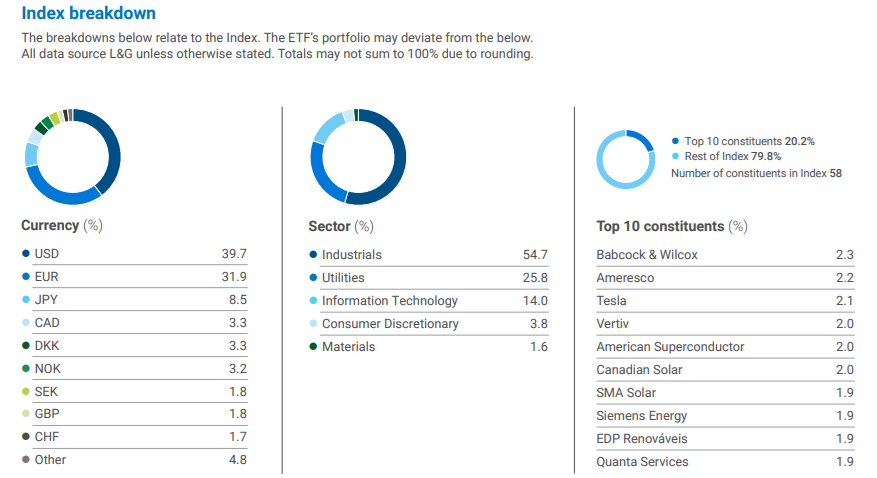

The L&G Clean Energy UCITS ETF aims to track the performance of the Solactive

Clean Energy Index NTR

Courtesy of Legal and General Investment Management

LEGAL AND GENERAL ASSET MANAGEMENT RENG Stock | London Stock Exchange

Courtesy of Yahoo Finance

Courtesy of Norges Bank Investment Management

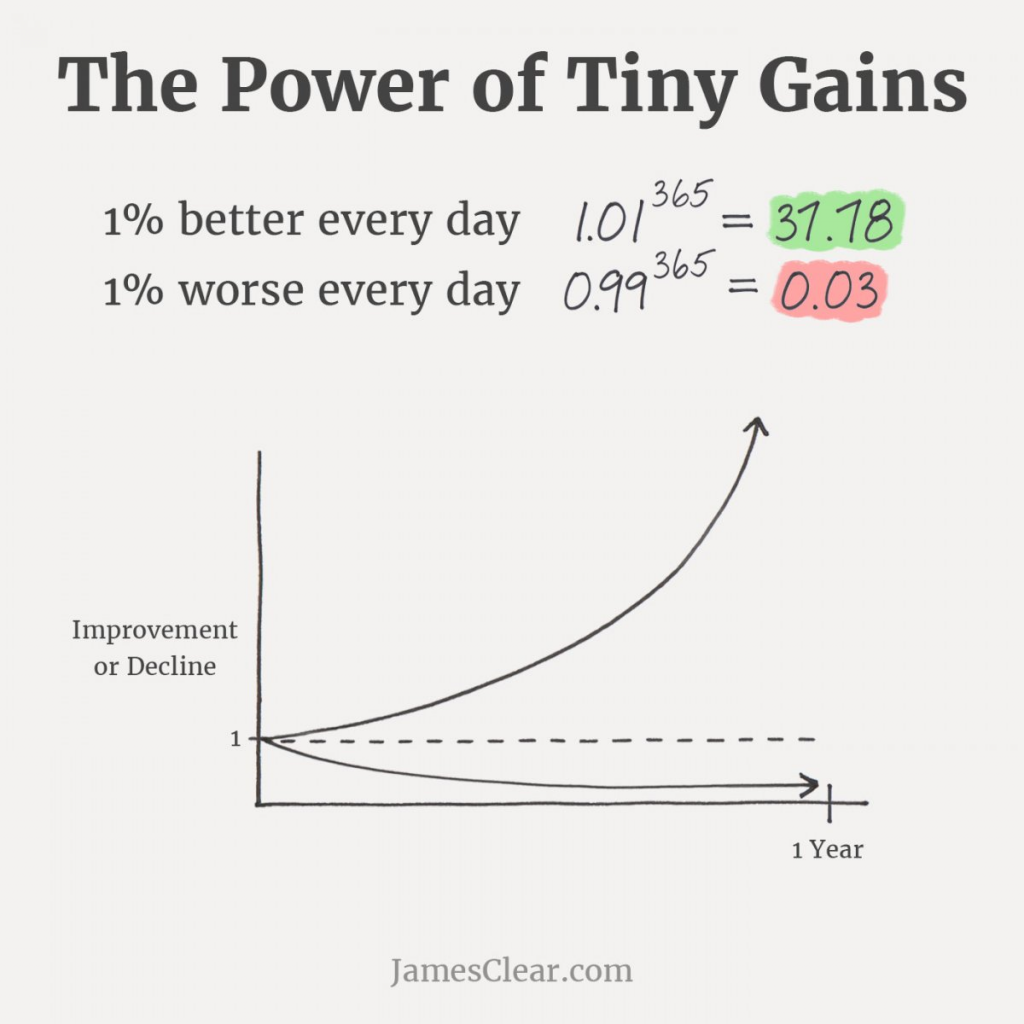

In the beginning, there is basically no difference between making a choice that is 1 percent better or 1 percent worse. (In other words, it won’t impact you very much today.) But as time goes on, these small improvements or declines compound and you suddenly find a very big gap between people who make slightly better decisions on a daily basis and those who don’t.

Here’s the punchline:

If you get one percent better each day for one year, you’ll end up thirty-seven times better by the time you’re done.

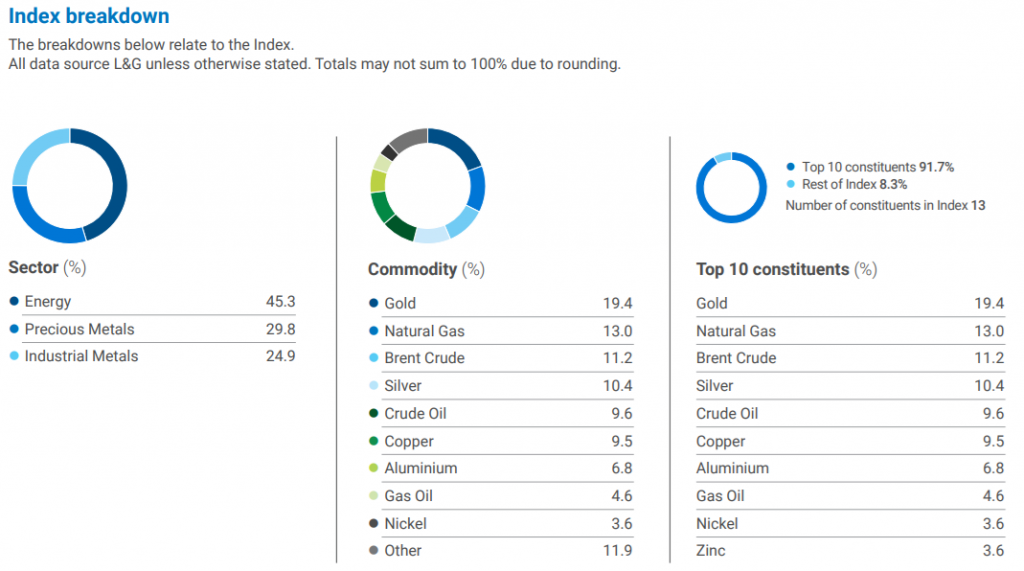

The L&G Multi-Strategy Enhanced Commodities ex-Agriculture & Livestock UCITS ETF is a London Listed ETF that aims to track the performance of the Barclays Backwardation Tilt Multi-Strategy Ex-Agriculture & Livestock Capped Total Return Index.

Fund size $88.4m

The fund provides broad-based exposure to commodities via a diversified basket of commodity futures with different expiry dates of up to 1 year.

The upside point of this fund:-

-Diversification Commodities are a distinct asset class with returns that are largely uncorrelated with stock and bond returns

-Inflation hedge Commodity indices tend to benefit from rising inflation

-Broad commodities exposure Basket of commodity futures, excluding Agriculture and Livestock, with dynamically determined expiry dates

Courtesy of Legal and General Investment Management

L&G Multi-Strategy Enhanced Commodities ex-Agriculture & Livestock UCITS ETF | LGIM Fund Centre

Courtesy of CNBC

LEGAL AND GENERAL ASSET MANAGEMENT XAGZ Stock | London Stock Exchange

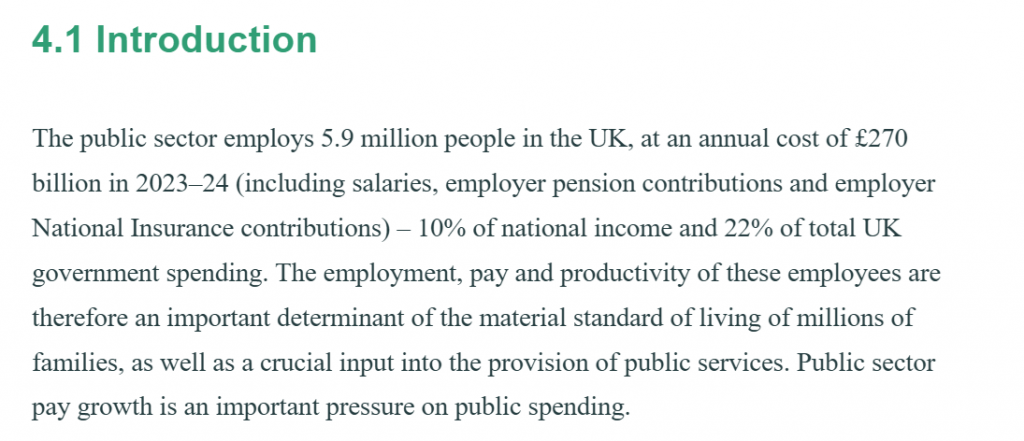

The highly regarded Institute of Fiscal Studies is a wealth of information:-

Pressures on public sector pay | Institute for Fiscal Studies

“The public sector employs 5.9 million people in the UK, at an annual cost of £270 billion in 2023–24 (including salaries, employer pension contributions and employer National Insurance contributions) – 10% of national income and 22% of total UK government spending. The employment, pay and productivity of these employees are therefore an important determinant of the material standard of living of millions of families, as well as a crucial input into the provision of public services. Public sector pay growth is an important pressure on public spending.”

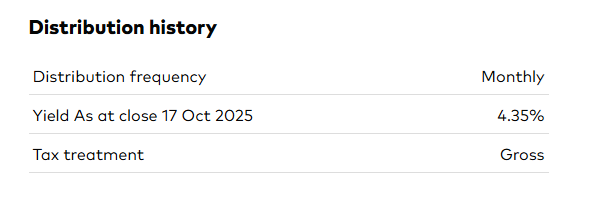

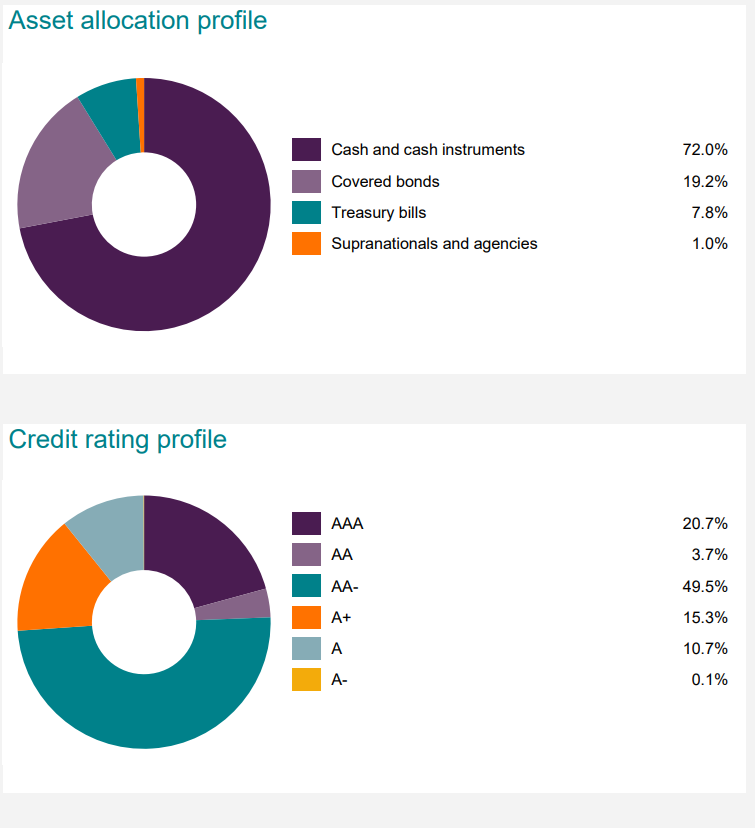

The Vanguard Sterling Short-Term Money Market Fund (the “Fund”) seeks to provide stability in the value of investments, liquidity and exposure to a variety of investments that typically perform differently from one another while maximising income earned from distributions such as interest

Courtesy of Vanguard

Courtesy of Vanguard

4.35% effective interest rate, the total assets £1.9 Billion in the fund.

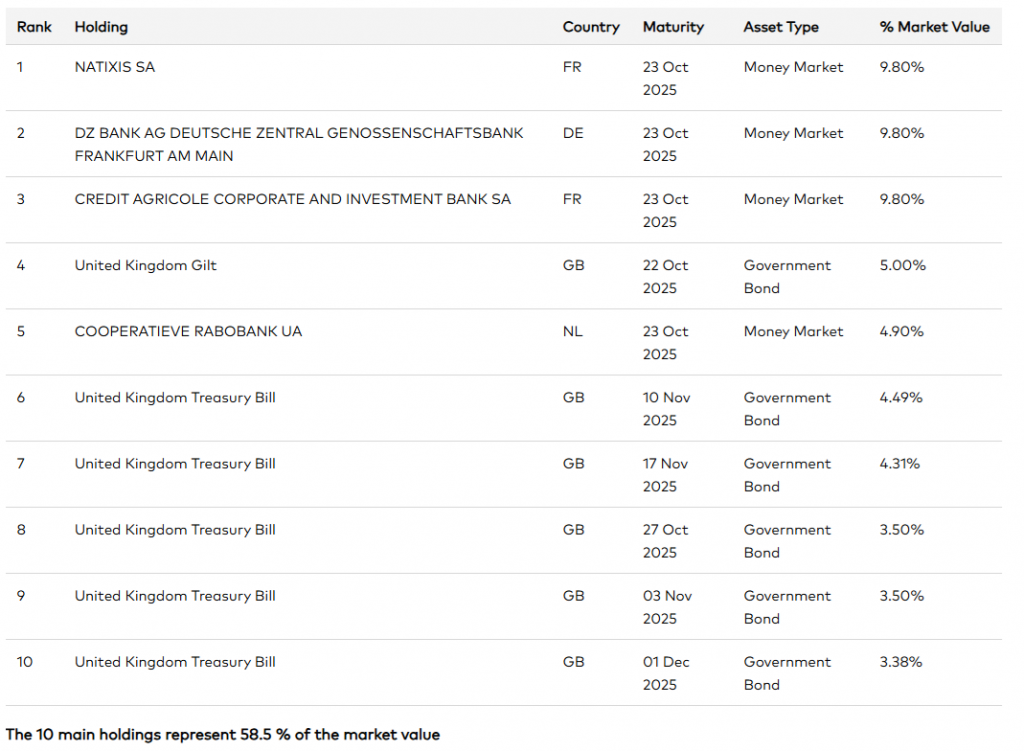

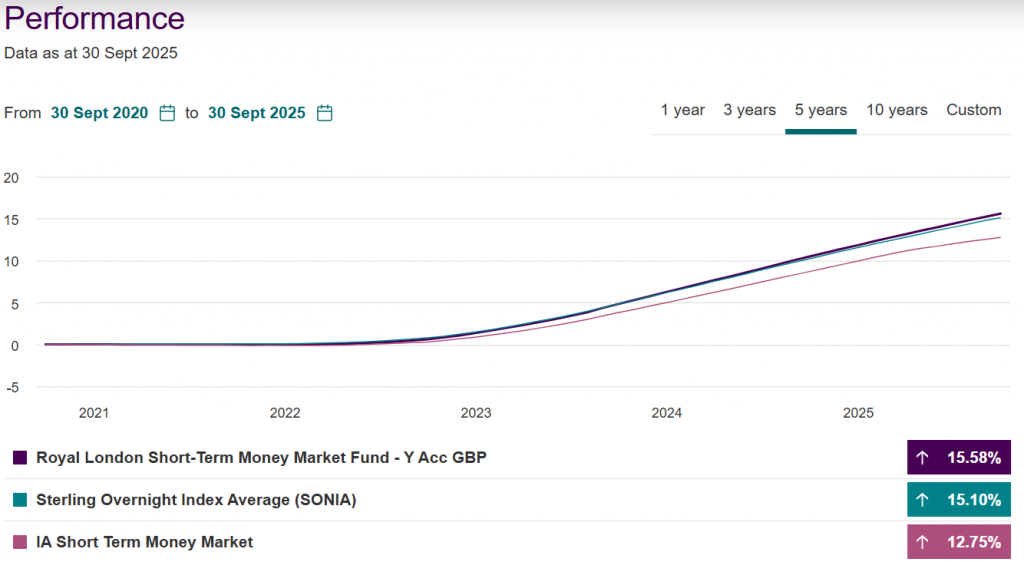

The Royal London Short-Term Money Market Fund is a £9,808.20m fund, holding near cash assets.

Courtesy of Royal London Asset Management

The Fund’s investment objective is to preserve capital and provide an income over rolling

12-month periods by predominantly investing (at least 80% of its assets) in cash and cash

equivalents. The Fund’s comparator benchmark is the Bank of England Sterling Overnight

Interbank Average (SONIA).

Courtesy of Royal London Asset Management