Tomorrow the Chancellor of the Exchequer will announced the long awaited budget. For weeks we have seen the bond market reacting to ill timed and ill advised leaks, undermining confidence in the UK Gilt market. Lenders to UK Government have to have confidence in the UK able to pay on the debts outstanding, and also lenders need to have confidence in the UK to lend new money.

When the government spends more than it receives in tax and other revenues it borrows to cover the difference. This borrowing is known as ‘public sector net borrowing’ but is often referred to as the deficit.

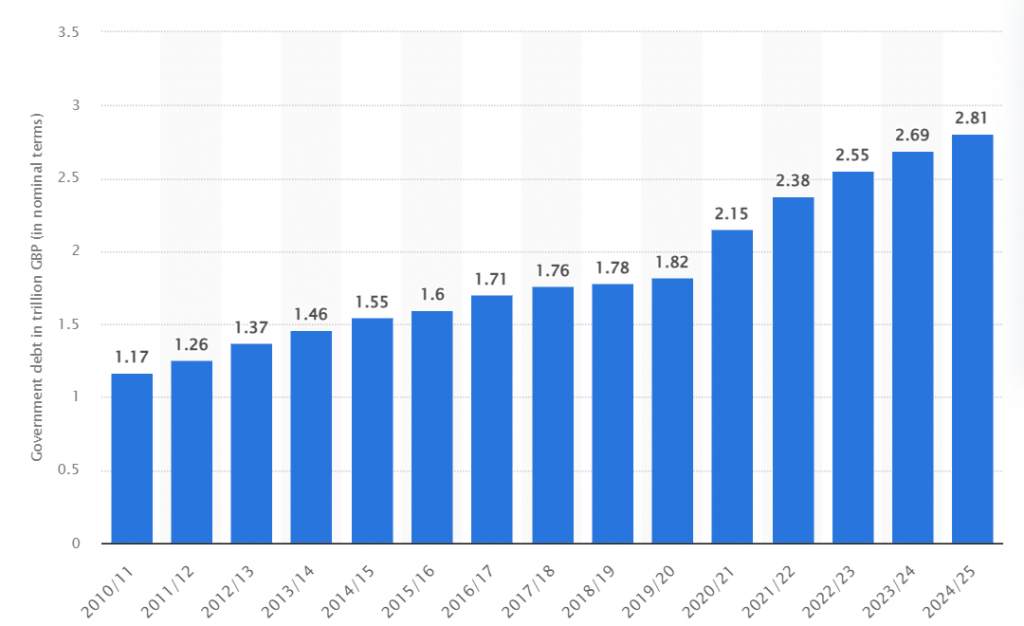

Total public sector net debt in the United Kingdom from 2010/11 to 2024/25

Courtesy of [UK government debt 2025| Statista]

One can see each year the HM Government has been spending more than it earns in taxation over the last 15 years. This is NOT sustainable. Consequently, debt interest payments are now above £100 billion a year, and the OBR has warned that, without action, debt could rise to 270 per cent of GDP by the early 2070s. Note, £100 billion interests is money that can NOT be paid finance our brave armed forces, or build new schools.

In 2024-25, it is expected public spending to amount to £1,278.6 billion, and thus out of that £1278 billion, £100 billion is on debt interest.

Also we are seeing huge media speculation on whether the Chancellor of the Exchequer will break the election promise in the party manifesto of not increase taxes, and this speculation has now become normalised on social media with arm chair political economists saying the Chancellor of the Exchequer will break an election pledge, these ‘experts’ have zero knowledge of the importance of the bond market or a decent grasp of economics.

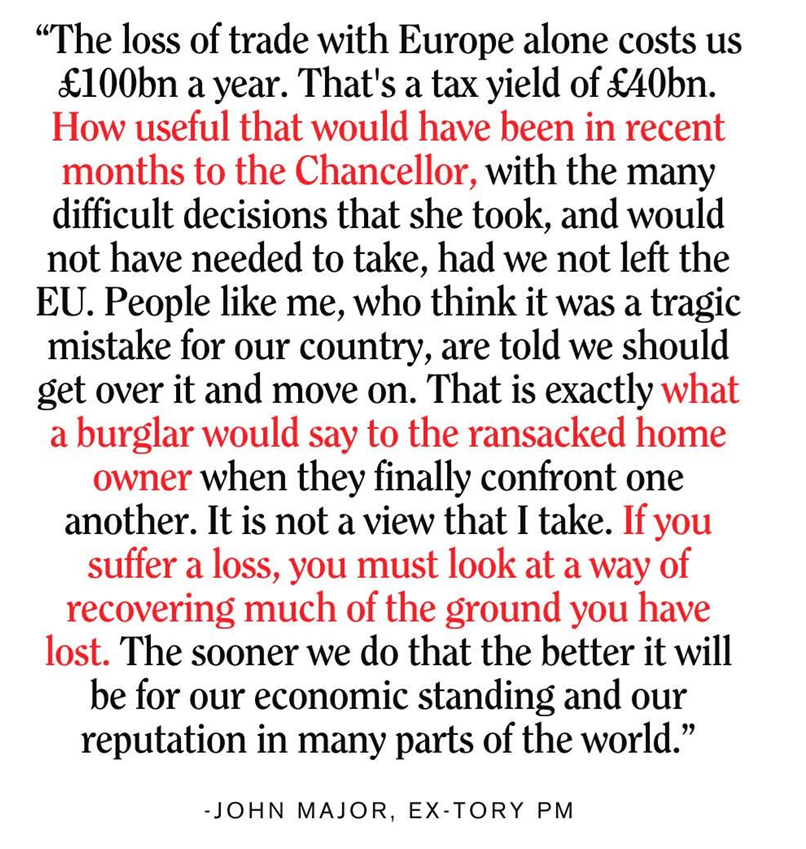

However in the interests of fairness and equality it was David Cameron who maintained his promise and manifesto pledge to ask the UK population for the referendum on the UK continued membership the European Union, and he kept his promise:-

Courtesy of John Major

As shown above, keeping manifesto pledges is NOT a holy or sacred act.

The UK needs to raise taxes to be able to fund the annual budget deficit, if not, the UK Government can not actually fund day to day operations. It needs that funding to finance public services, and if we do NOT, we face a Liz Truss / Kwasi Kwarteng moment, where the UK struggles to raise money, with borrowing costs surge, as lenders get worried over economic competence and stewardship of the UK economy. Sadly, taxes will have to rise, and breaking that manifesto pledge is the right things to do for the UK Government to be able borrow from on the Bond Market and fund public services.

Are Higher Taxes Inevitable for the UK? Economic Analysis from IFS Director | Pod Save the UK

Are Higher Taxes Inevitable for the UK? Economic Analysis from former IFS Director.

UK Taxes NEED to rise, to keep confidence with our creditors.

Very good summary.

Now please give a good noshing to Sarah KafTaZ

All the best.

you love her, as you always talk about here.