“The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.“

Monthly Archives: October 2024

Investment in Bob Dylan

‘Twas in another lifetime, one of toil and blood

When blackness was a virtue the road was full of mud

I came in from the wilderness, a creature void of form

Come in, she said

I’ll give ya shelter from the storm

And if I pass this way again, you can rest assured

I’ll always do my best for her, on that I give my word

In a world of steel-eyed death, and men who are fighting to be warm

Come in, she said

I’ll give ya shelter from the storm

Not a word was spoke between us, there was little risk involved

Everything up to that point had been left unresolved

Try imagining a place where it’s always safe and warm

Come in, she said

I’ll give ya shelter from the storm

I was burned out from exhaustion, buried in the hail

Poisoned in the bushes an’ blown out on the trail

Hunted like a crocodile, ravaged in the corn

Come in, she said

I’ll give ya shelter from the storm

Suddenly I turned around and she was standin’ there

With silver bracelets on her wrists and flowers in her hair

She walked up to me so gracefully and took my crown of thorns

Come in, she said

I’ll give ya shelter from the storm

Now there’s a wall between us, somethin’ there’s been lost

I took too much for granted, I got my signals crossed

Just to think that it all began on an uneventful morn

Come in, she said

I’ll give ya shelter from the storm

Well, the deputy walks on hard nails and the preacher rides a mount

But nothing really matters much, it’s doom alone that counts

And the one-eyed undertaker, he blows a futile horn

Come in, she said

I’ll give ya shelter from the storm

I’ve heard newborn babies wailin’ like a mournin’ dove

And old men with broken teeth stranded without love

Do I understand your question, man, is it hopeless and forlorn

Come in, she said

I’ll give ya shelter from the storm

In a little hilltop village, they gambled for my clothes

I bargained for salvation and she gave me a lethal dose

I offered up my innocence I got repaid with scorn

Come in, she said

I’ll give ya shelter from the storm

Well, I’m livin’ in a foreign country but I’m bound to cross the line

Beauty walks a razor’s edge, someday I’ll make it mine

If I could only turn back the clock to when God and her were born

Come in, she said

I’ll give ya shelter from the storm

iShares S&P 500 Equal Weight UCITS ETF GBP Hedged (Acc)

iShares S&P 500 Equal Weight UCITS ETF GBP Hedged (Acc) is a fund that invests equally in the S&P500 Index.

The fund aims to achieve a return on investment, through capital and income returns on its assets, which reflects the return of the S&P 500 Equal Weight Index

It gives investors:-

Provides exposure to 500 stocks from top US companies in leading industries of the US economy

The Index measures the performance of securities within the S&P 500 Index (Parent Index) with each security being equally weighted within the Index at the rebalance date

Exposure to companies in the S&P 500 with a greater weighting in the smaller market capitalization companies

Courtesy of Investors Chronicle

Courtesy of The London Stock Exchange

Risks of the S&P500 Index

The “Magnificent Seven” is a term coined by Bank of America analyst Michael Hartnett to describe seven industry-leading tech-focused companies: Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), Amazon (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), and Tesla (NASDAQ: TSLA).

What this actually means is that these seven companies are now so valuable that they make up a combined 35.5% of the S&P 500.

Thus the index of 500 companies is 35.5% dominated by the 7 technology titans.

Thus, the risk is that The Magnificent Seven are so valuable that they can single-handedly spark a so-called correction in the S&P 500. A correction is a fall of 10% to 20% in a major market index, so an average decline of 28% in the Magnificent Seven could put the S&P 500 in correction territory

HM Government Borrowings: September 2024

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties. Now we are in a post Covid 19 world. UK’s HM Government needs to fund many new demands. https://www.dmo.gov.uk

Another deficit month, thus to bridge the gap, needs to borrow on the bond market in August 2024, the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is the PSNCR: The Public Sector Net Cash Requirement. There were “only” 7 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

25-Sep-2024 4% Treasury Gilt 2031 3,750.00 £3,750.0000 Million

24-Sep-2024 0¾% Index-linked Treasury Gilt 2033 £1,500.00 Million

18-Sep-2024 0 7/8% Green Gilt 2033 £2,750.00 Million

17-Sep-2024 4 3/8% Treasury Gilt 2054 £2,250.00 Million

11-Sep-2024 4¼% Treasury Gilt 2034 £3,750.00 Million

10-Sep-2024 0 5/8% Index-linked Treasury Gilt 2045 £900.00 Million

05-Sep-2024 4 1/8% Treasury Gilt 2029 £4,000.00 Million

3,750.0000 Million + 1,500.00 Million + 2,750.0000 Million + 3,750.00 Million + 900.00 Million + 4,000 Million = £18,900 Million

£18,900 Million = £18.9 Billion

On another way of looking at it, is in the 30 days Sept 2024, HM Government borrowed:- £630 Million each day for the 30 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bonds maturing from 2029 to 2054. All long-term borrowings, we are mortgaging our futures, but at least “We Are In It Together……“

Investment in CyberDyne Systems

Sundar Pichai

Courtesy of Bloomberg

Cash of $277Bn reserves….Berkshire Hathaway

Aviva October 2024 Dividend.

Today, Thursday 17th Oct 2024, Aviva PLC one of the UK largest casualty and life insurers and money managers (Aviva Investors) pays out its October 2024 dividend.

11.9p a share.

https://www.londonstockexchange.com/news-article/AV./total-voting-rights/16693420

The total number of voting rights in Aviva plc was 2,677,089,316.

Thus:-

2,677,089,316 x £0.119 = £318,573,628.604

That is £318.573 Million paid to shareholders in Aviva plc

https://www.londonstockexchange.com/stock/AV./aviva-plc/company-page

Funny Advice from the America’s Greatest Investor

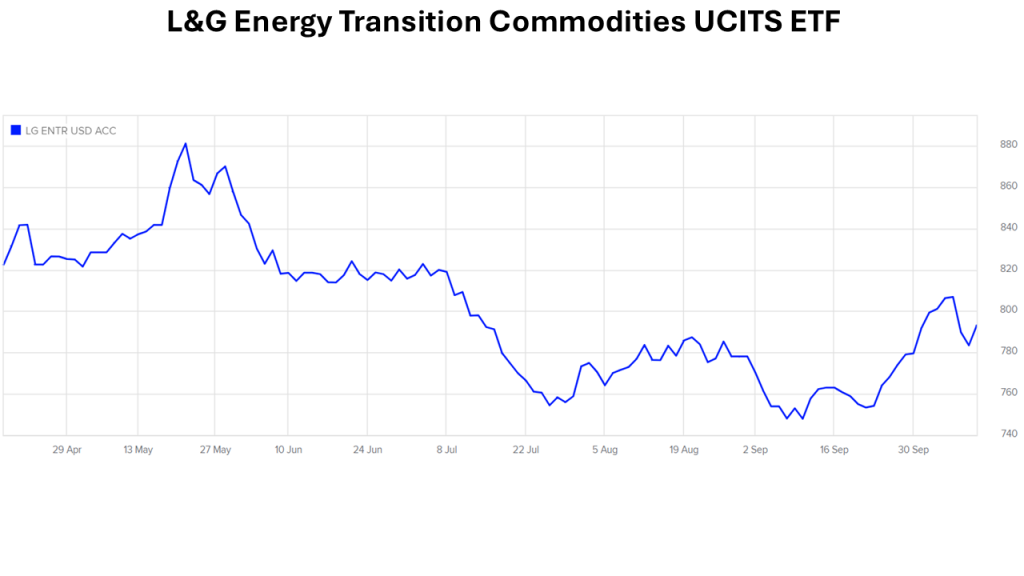

L&G Energy Transition Commodities UCITS ETF

The L&G Energy Transition Commodities UCITS ETF aims to track the performance of the Solactive Energy Transition Commodity TR Index

Its objective is to give investors:-

Transition metals exposure

Futures on transition metals, which are used in clean energy generation, storage and distribution equipment.

Transition energy exposure

Futures on transition energy, which emits less carbon than most other fossil fuels and can help overcome peak energy demand and the challenge of ‘hard to abate’ sectors.

Carbon exposure

Allocation to an exchange listed certificate (the “Certificate”) which provides exposure to an index of global carbon futures. Carbon pricing makes polluting less profitable and incentivises the switch to low- and no-carbon activities.

Courtesy of Legal and General Investment Management

Courtesy of The London Stock Exchange

China rally, US jobs and Japan’s new PM

The Future with Professor Hannah Fry

The abrdn Sustainable Index World Equity Pension Fund

The aim of the abrdn Sustainable Index World Equity Fund is to generate growth over the long term (5 years or more) by tracking the return of the MSCI World Select ESG Climate Solutions Target Index.

Underlying Fund Launch Date 12/11/2020

Underlying Fund Size (28/06/2024) £2,667.6m

Top 10 Holdings

MICROSOFT CORP 5.5% of the fund

NVIDIA CORP 5.3% of the fund

APPLE INC 4.2% of the fund

ALPHABET INC 2.8% of the fund

AMAZON.COM INC 2.5% of the fund

ELI LILLY & CO 1.3% of the fund

COCA-COLA CO/THE 1.2% of the fund

META PLATFORMS INC 1.0% of the fund

TRANE TECHNOLOGIES PLC 1.0% of the fund

NOVO NORDISK A/S 0.9% of the fund

Total 25.7% of the fund

Courtesy of Standard Life

AIAG: The Legal & General ARTIFICIAL INTELLIGENCE ETF

https://www.londonstockexchange.com/stock/AIAG/legal-and-general-asset-management/company-page

Top ETF holdings, as of 31 July 2024

1 SAMSARA INC ORD 2.57% of the fund

2 PALO ALTO NETWORKS INC ORD 2.41% of the fund

3 CLOUDFLARE INC ORD 2.35% of the fund

4 SERVICENOW INC ORD 2.34% of the fund

5 AUTODESK INC ORD 2.33% of the fund

6 MICROSOFT CORP ORD 2.25% of the fund

7 ARISTA NETWORKS INC ORD 2.24% of the fund

8 NVIDIA CORP ORD 2.21% of the fund

9 RAPID7 INC ORD 2.15% of the fund

10 COGNEX CORP ORD 2.14% of the fund

Courtesy of The London Stock Exchange

Target Retirement 2035 Fund

The Vanguard Target Retirement 2035 Fund The Fund’s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments that will pay out money for investors planning to retire in or within approximately five years after 2035. The Fund’s asset allocation will become more conservative as 2035 is approached and passed, moving from higher risk (such as shares) to mainly lower risk (such as bonds) investments. The Fund seeks to achieve its investment objective by investing more than 90% of its assets in passive funds that track an index

It is a fund of funds:-

Vanguard Global Bond Index Fund GBP Hedged Acc 19.3% of the fund

Vanguard FTSE Developed World ex-U.K. Equity Index Fund GBP Acc 19.0% of the fund

Vanguard U.S. Equity Index Fund GBP Acc 14.9% of the fund

Vanguard FTSE U.K. All Share Index Unit Trust GBP Acc 12.8% of the fund

Vanguard U.K. Government Bond Index Fund GBP Acc 6.6% of the fund

Vanguard Emerging Markets Stock Index Fund GBP Acc 4.9% of the fund

Vanguard FTSE North America UCITS ETF (USD) Accumulating 4.4% of the fund

Vanguard Global Aggregate Bond UCITS ETF GBP Hedged Accumulating 4.4% of the fund

Vanguard FTSE 100 UCITS ETF (GBP) Accumulating 3.8% of the fund

Vanguard U.K. Investment Grade Bond Index Fund GBP Acc 3.6% of the fund

Vanguard FTSE Developed Europe ex-U.K. Equity Index Fund GBP Acc 3.5% of the fund

Vanguard Japan Stock Index Fund GBP Acc 1.8% of the fund

Vanguard Pacific ex-Japan Stock Index Fund GBP Acc 0.8% of the fund

Total 100%

Courtesy of Vanguard

Verizon Debt Levels:- 157.515bn

One of the USA’s largest telecommunications group is Verizon.

Created from the merger of Bell Atlantic and NYNEX.

It carries a large level of debt:-

https://www.verizon.com/about/sites/default/files/Debt-Schedule-063024.pdf

COUPON MATURITY COMPANY: RATE DATE TOTAL TOTALS ($billion)

DEBT MATURING WITHIN ONE YEAR:-

Commercial Paper $605 $605

Verizon Communications Inc. $1,161 3.500% 1-Nov-2024

Verizon Communications Inc. $1,340 3.376% 15-Feb-2025

Verizon Communications Inc. $889 LIBOR+1.10% 15-May-2025

Verizon Communications Inc. € 747 0.875% 2-Apr-2025 $4,207

Private Placements $17,697 $17,697

TOTAL DEBT MATURING WITHIN ONE YEAR: $ 22,509bn

LONG TERM DEBT:

Verizon Pennsylvania LLC $44 6.000% 1-Dec-2028

Verizon Pennsylvania LLC $31 8.350% 15-Dec-2030

Verizon Pennsylvania LLC $35 8.750% 15-Aug-2031 $110

Verizon Maryland LLC $20 8.000% 15-Oct-2029

Verizon Maryland LLC $21 8.300% 1-Aug-2031

Verizon Maryland LLC $139 5.125% 15-Jun-2033 $180

Verizon Virginia LLC $9 8.375% 1-Oct-2029 $9

Verizon Delaware LLC $2 8.625% 15-Oct-2031 $2

Verizon New Jersey Inc. $45 7.850% 15-Nov-2029 $45

Verizon New England Inc. $133 7.875% 15-Nov-2029 $133

Verizon New York Inc. $35 6.500% 15-Apr-2028

Verizon New York Inc. $99 7.375% 1-Apr-2032 $134

Alltel Corporation $38 6.800% 1-May-2029

Alltel Corporation $56 7.875% 1-Jul-2032 $94

Verizon Communications Inc. $1,404 0.850% 20-Nov-2025

Verizon Communications Inc. € 843 3.250% 17-Feb-2026

Verizon Communications Inc. $1,916 1.450% 20-Mar-2026

Verizon Communications Inc. $526 SOFR + 0.79% 20-Mar-2026

Verizon Communications Inc. $4 1.100% 15-Jun-2026

Verizon Communications Inc. $2 1.050% 15-Jun-2026

Verizon Communications Inc. $1,869 2.625% 15-Aug-2026

Verizon Communications Inc. € 746 1.375% 27-Oct-2026

Verizon Communications Inc. $3,250 4.125% 16-Mar-2027

Verizon Communications Inc. $750 3.000% 22-Mar-2027

Verizon Communications Inc. € 623 0.875% 8-Apr-2027

Verizon Communications Inc. CHF 400 1.000% 30-Nov-2027

Verizon Communications Inc. $2,830 2.100% 22-Mar-2028

Verizon Communications Inc. CAD 1,000 2.375% 22-Mar-2028

Verizon Communications Inc. CHF 375 0.193% 24-Mar-2028

Verizon Communications Inc. $250 6.940% 15-Apr-2028

Verizon Communications Inc. $4,200 4.329% 21-Sep-2028

Verizon Communications Inc. € 750 1.375% 2-Nov-2028

Verizon Communications Inc. € 60 1.375% 2-Nov-2028

Verizon Communications Inc. € 250 1.375% 2-Nov-2028

Verizon Communications Inc. € 600 1.125% 3-Nov-2028

Verizon Communications Inc. $1,000 3.875% 8-Feb-2029

Verizon Communications Inc. € 1,000 0.375% 22-Mar-2029

Verizon Communications Inc. $2 3.500% 15-Apr-2029

Verizon Communications Inc. $105 6.800% 1-May-2029

Verizon Communications Inc. $1 4.000% 15-May-2029

Verizon Communications Inc. $3 4.150% 15-May-2029

Verizon Communications Inc. $0 3.900% 15-May-2029

Verizon Communications Inc. $1 5.100% 15-May-2029

Verizon Communications Inc. $1 5.000% 15-May-2029

Verizon Communications Inc. $1 5.000% 15-May-2029

Verizon Communications Inc. $2 3.950% 15-Jun-2029

Verizon Communications Inc. $1 3.800% 15-Jun-2029

Verizon Communications Inc. $0 3.850% 15-Jun-2029

Verizon Communications Inc. $0 4.300% 15-Jun-2029

Verizon Communications Inc. $0 5.000% 15-Jun-2029

Verizon Communications Inc. $2 5.000% 15-Jun-2029

Verizon Communications Inc. $1 5.000% 15-Jun-2029

Verizon Communications Inc. $0 3.800% 15-Aug-2029

Verizon Communications Inc. $1 4.000% 15-Aug-2029

Verizon Communications Inc. $0 3.900% 15-Aug-2029

Verizon Communications Inc. $1 4.100% 15-Sep-2029

Verizon Communications Inc. $0 4.500% 15-Sep-2029

Verizon Communications Inc. $1 4.500% 15-Sep-2029

Verizon Communications Inc. $1 4.800% 15-Sep-2029

Verizon Communications Inc. € 750 1.875% 26-Oct-2029

Verizon Communications Inc. $1 5.550% 15-Nov-2029

Verizon Communications Inc. $3 5.600% 15-Nov-2029

Verizon Communications Inc. $3 5.150% 15-Nov-2029

Verizon Communications Inc. $4,000 4.016% 3-Dec-2029

Verizon Communications Inc. $3 5.000% 15-Dec-2029

Verizon Communications Inc. $0 4.700% 15-Dec-2029

Verizon Communications Inc. $1 4.700% 15-Dec-2029

Verizon Communications Inc. $1 4.800% 15-Feb-2030

Verizon Communications Inc. $1 5.050% 15-Mar-2030

Verizon Communications Inc. $1 5.150% 15-Mar-2030

Verizon Communications Inc. $1 5.150% 15-Mar-2030

Verizon Communications Inc. $1,500 3.150% 22-Mar-2030

Verizon Communications Inc. € 1,250 1.250% 8-Apr-2030

Verizon Communications Inc. $1 1.900% 15-May-2030

Verizon Communications Inc. $1 2.050% 15-May-2030

Verizon Communications Inc. $1 4.650% 15-May-2030

Verizon Communications Inc. $0 4.700% 15-May-2030

Verizon Communications Inc. $1 4.700% 15-May-2030

Verizon Communications Inc. CAD 1,000 2.500% 16-May-2030

Verizon Communications Inc. $0 1.850% 15-Jun-2030

Verizon Communications Inc. $1 5.000% 15-Jun-2030

Verizon Communications Inc. $1 5.050% 15-Jun-2030

Verizon Communications Inc. $1 5.000% 15-Jul-2030

Verizon Communications Inc. $1 5.250% 15-Aug-2030

Verizon Communications Inc. $0 5.300% 15-Aug-2030

Verizon Communications Inc. $0 5.150% 15-Aug-2030

Verizon Communications Inc. $0 5.400% 15-Aug-2030

Verizon Communications Inc. $1 5.400% 15-Sep-2030

Verizon Communications Inc. $1 5.450% 15-Sep-2030

Verizon Communications Inc. $1 5.500% 15-Sep-2030

Verizon Communications Inc. $1,000 1.500% 18-Sep-2030

Verizon Communications Inc. £550 1.875% 19-Sep-2030

Verizon Communications Inc. $2 5.600% 15-Oct-2030

Verizon Communications Inc. $1,147 1.680% 30-Oct-2030

Verizon Communications Inc. € 1,250 4.250% 31-Oct-2030

Verizon Communications Inc. $2 1.650% 15-Nov-2030

Verizon Communications Inc. $2 5.900% 15-Nov-2030

Verizon Communications Inc. $1 5.550% 15-Nov-2030

Verizon Communications Inc. $2 5.650% 15-Nov-2030

Verizon Communications Inc. $563 7.750% 1-Dec-2030

Verizon Communications Inc. $0 1.600% 15-Dec-2030

Verizon Communications Inc. $2 5.300% 15-Dec-2030

Verizon Communications Inc. $1 5.000% 15-Dec-2030

Verizon Communications Inc. $4 5.100% 15-Dec-2030

Verizon Communications Inc. $2,243 1.750% 20-Jan-2031

Verizon Communications Inc. $0 4.900% 15-Mar-2031

Verizon Communications Inc. $0 4.900% 15-Mar-2031

Verizon Communications Inc. $0 4.800% 15-Mar-2031

Verizon Communications Inc. $3,707 2.550% 21-Mar-2031

Verizon Communications Inc. CHF 325 0.555% 24-Mar-2031

Verizon Communications Inc. $5 2.350% 15-May-2031

Verizon Communications Inc. £500 2.500% 8-Apr-2031

Verizon Communications Inc. $4 2.350% 15-Jun-2031

Verizon Communications Inc. $3 2.200% 15-Jun-2031

Verizon Communications Inc. $1 2.650% 15-Aug-2031

Verizon Communications Inc. $2 2.000% 15-Aug-2031

Verizon Communications Inc. $2 2.150% 15-Sep-2031

Verizon Communications Inc. € 1,000 2.625% 1-Dec-2031

Verizon Communications Inc. $4,639 2.355% 15-Mar-2032

Verizon Communications Inc. € 800 0.875% 19-Mar-2032

Verizon Communications Inc. € 1,000 0.750% 22-Mar-2032

Verizon Communications Inc. $107 7.750% 15-Jun-2032

Verizon Communications Inc. € 1,000 3.500% 28-Jun-2032

Verizon Communications Inc. $101 7.875% 1-Jul-2032

Verizon Communications Inc. $1,000 5.050% 9-May-2033

Verizon Communications Inc. $7 2.550% 15-May-2033

Verizon Communications Inc. € 1,350 1.300% 18-May-2033

Verizon Communications Inc. $2 2.550% 15-Jun-2033

Verizon Communications Inc. $2 2.550% 15-Jun-2033

Verizon Communications Inc. $2 2.300% 15-Jul-2033

Verizon Communications Inc. $0 5.100% 15-Jun-2033

Verizon Communications Inc. $2,137 4.500% 10-Aug-2033

Verizon Communications Inc. $4 2.200% 15-Aug-2033

Verizon Communications Inc. $1 2.200% 15-Aug-2033

Verizon Communications Inc. $354 6.400% 15-Sep-2033

Verizon Communications Inc. $1 2.200% 15-Sep-2033

Verizon Communications Inc. $3 2.250% 15-Sep-2033

Verizon Communications Inc. $2 2.450% 15-Nov-2033

Verizon Communications Inc. $1 2.350% 15-Nov-2033

Verizon Communications Inc. $1 2.450% 15-Nov-2033

Verizon Communications Inc. $2 2.550% 15-Dec-2033

Verizon Communications Inc. $1 2.400% 15-Dec-2033

Verizon Communications Inc. £457 4.750% 17-Feb-2034

Verizon Communications Inc. $151 5.050% 15-Mar-2034

Verizon Communications Inc. $1 5.000% 15-Mar-2034

Verizon Communications Inc. $1 4.950% 15-Apr-2034

Verizon Communications Inc. $0 4.300% 15-May-2034

Verizon Communications Inc. $1 4.550% 15-May-2034

Verizon Communications Inc. $1 5.300% 15-May-2034

Verizon Communications Inc. $1 5.150% 15-May-2034

Verizon Communications Inc. $2 5.150% 15-May-2034

Verizon Communications Inc. $0 5.100% 15-Jun-2034

Verizon Communications Inc. $0 5.150% 15-Jun-2034

Verizon Communications Inc. $1 5.150% 15-Jun-2034

Verizon Communications Inc. € 1,250 4.750% 31-Oct-2034

Verizon Communications Inc. $1,888 4.400% 1-Nov-2034

Verizon Communications Inc. $278 5.850% 15-Sep-2035

Verizon Communications Inc. $142 5.850% 15-Sep-2035

Verizon Communications Inc. € 750 1.125% 19-Sep-2035

Verizon Communications Inc. £450 3.125% 2-Nov-2035

Verizon Communications Inc. $1,290 4.272% 15-Jan-2036

Verizon Communications Inc. € 1,000 3.750% 28-Feb-2036

Verizon Communications Inc. £1,000 3.375% 27-Oct-2036

Verizon Communications Inc. $1,095 5.250% 16-Mar-2037

Verizon Communications Inc. $241 6.250% 1-Apr-2037

Verizon Communications Inc. € 1,500 2.875% 15-Jan-2038

Verizon Communications Inc. $172 6.400% 15-Feb-2038

Verizon Communications Inc. $152 6.900% 15-Apr-2038

Verizon Communications Inc. £600 1.875% 3-Nov-2038

Verizon Communications Inc. $107 8.950% 1-Mar-2039

Verizon Communications Inc. $1,136 4.812% 15-Mar-2039

Verizon Communications Inc. $6 4.250% 15-Mar-2039

Verizon Communications Inc. $112 7.350% 1-Apr-2039

Verizon Communications Inc. $2 4.050% 15-Apr-2039

Verizon Communications Inc. $6 4.000% 15-May-2039

Verizon Communications Inc. $5 4.000% 15-May-2039

Verizon Communications Inc. $5 4.000% 15-May-2039

Verizon Communications Inc. € 500 1.500% 19-Sep-2039

Verizon Communications Inc. € 800 1.850% 18-May-2040

Verizon Communications Inc. $2,847 2.650% 20-Nov-2040

Verizon Communications Inc. $3,442 3.400% 22-Mar-2041

Verizon Communications Inc. $122 6.000% 1-Apr-2041

Verizon Communications Inc. $1,000 2.850% 3-Sep-2041

Verizon Communications Inc. $488 4.750% 1-Nov-2041

Verizon Communications Inc. $708 3.850% 1-Nov-2042

Verizon Communications Inc. $803 6.550% 15-Sep-2043

Verizon Communications Inc. $920 4.125% 15-Aug-2046

Verizon Communications Inc. $2,360 4.862% 21-Aug-2046

Verizon Communications Inc. $457 5.500% 16-Mar-2047

Verizon Communications Inc. $179 4.900% 15-May-2047

Verizon Communications Inc. $26 4.750% 15-Jun-2047

Verizon Communications Inc. $27 4.700% 15-Jun-2047

Verizon Communications Inc. $13 4.550% 15-Jul-2047

Verizon Communications Inc. $43 4.800% 15-Aug-2047

Verizon Communications Inc. $20 4.800% 15-Aug-2047

Verizon Communications Inc. $34 4.900% 15-Aug-2047

Verizon Communications Inc. $26 4.850% 15-Aug-2047

Verizon Communications Inc. $15 4.750% 15-Sep-2047

Verizon Communications Inc. $14 4.750% 15-Sep-2047

Verizon Communications Inc. $28 4.700% 15-Sep-2047

Verizon Communications Inc. $37 4.700% 15-Nov-2047

Verizon Communications Inc. $33 4.700% 15-Nov-2047

Verizon Communications Inc. $14 4.650% 15-Nov-2047

Verizon Communications Inc. $19 4.650% 15-Nov-2047

Verizon Communications Inc. $16 4.550% 15-Dec-2047

Verizon Communications Inc. $13 4.500% 15-Dec-2047

Verizon Communications Inc. $21 4.500% 15-Dec-2047

Verizon Communications Inc. $12 4.550% 15-Feb-2048

Verizon Communications Inc. $5 4.450% 15-Feb-2048

Verizon Communications Inc. $4 4.550% 15-Feb-2048

Verizon Communications Inc. $12 4.750% 15-Feb-2048

Verizon Communications Inc. $8 4.750% 15-Mar-2048

Verizon Communications Inc. $7 4.750% 15-Mar-2048

Verizon Communications Inc. $7 4.750% 15-Mar-2048

Verizon Communications Inc. $8 4.800% 15-Mar-2048

Verizon Communications Inc. $15 4.850% 15-Apr-2048

Verizon Communications Inc. $4 4.850% 15-May-2048

Verizon Communications Inc. $7 4.850% 15-May-2048

Verizon Communications Inc. $9 4.900% 15-May-2048

Verizon Communications Inc. $4 4.850% 15-May-2048

Verizon Communications Inc. $48 5.000% 15-Jun-2048

Verizon Communications Inc. $9 4.950% 15-Jun-2048

Verizon Communications Inc. $10 4.900% 15-Jun-2048

Verizon Communications Inc. $36 5.050% 15-Jul-2048

Verizon Communications Inc. $5 4.800% 15-Aug-2048

Verizon Communications Inc. $2 4.700% 15-Aug-2048

Verizon Communications Inc. $3 4.650% 15-Aug-2048

Verizon Communications Inc. $5 4.800% 15-Aug-2048

Verizon Communications Inc. $3 4.650% 15-Aug-2048

Verizon Communications Inc. $1,247 4.522% 15-Sep-2048

Verizon Communications Inc. $4 4.850% 15-Sep-2048

Verizon Communications Inc. $3 4.700% 15-Sep-2048

Verizon Communications Inc. $2 4.700% 15-Sep-2048

Verizon Communications Inc. $3 4.750% 15-Oct-2048

Verizon Communications Inc. $7 5.000% 15-Nov-2048

Verizon Communications Inc. $6 5.000% 15-Nov-2048

Verizon Communications Inc. $1 4.900% 15-Nov-2048

Verizon Communications Inc. $6 5.000% 15-Dec-2048

Verizon Communications Inc. $1 4.900% 15-Dec-2048

Verizon Communications Inc. $2 4.850% 15-Jan-2049

Verizon Communications Inc. $5 4.550% 15-Feb-2049

Verizon Communications Inc. $3 4.500% 15-Mar-2049

Verizon Communications Inc. $1 4.550% 15-Mar-2049

Verizon Communications Inc. $3 4.500% 15-Mar-2049

Verizon Communications Inc. $697 5.012% 15-Apr-2049

Verizon Communications Inc. $2 4.050% 15-May-2049

Verizon Communications Inc. $3 4.100% 15-Jun-2049

Verizon Communications Inc. $4 4.050% 15-Jun-2049

Verizon Communications Inc. $4 3.500% 15-Aug-2049

Verizon Communications Inc. $4 3.500% 15-Aug-2049

Verizon Communications Inc. $2 3.300% 15-Sep-2049

Verizon Communications Inc. $6 3.550% 15-Sep-2049

Verizon Communications Inc. $7 3.550% 15-Oct-2049

Verizon Communications Inc. $8 3.550% 15-Oct-2049

Verizon Communications Inc. $2 3.500% 15-Nov-2049

Verizon Communications Inc. $2 3.550% 15-Nov-2049

Verizon Communications Inc. $3 3.500% 15-Nov-2049

Verizon Communications Inc. $2 3.450% 15-Dec-2049

Verizon Communications Inc. $3 3.450% 15-Dec-2049

Verizon Communications Inc. $2 3.400% 15-Dec-2049

Verizon Communications Inc. $3 3.000% 15-Mar-2050

Verizon Communications Inc. $1,175 4.000% 22-Mar-2050

Verizon Communications Inc. $0 2.750% 15-May-2050

Verizon Communications Inc. $1 2.950% 15-May-2050

Verizon Communications Inc. $1 2.950% 15-May-2050

Verizon Communications Inc. CAD 300 3.625% 16-May-2050

Verizon Communications Inc. $3 2.800% 15-Jun-2050

Verizon Communications Inc. $950 5.150% 15-Sep-2050

Verizon Communications Inc. $4 2.750% 15-Nov-2050

Verizon Communications Inc. $2,365 2.875% 20-Nov-2050

Verizon Communications Inc. $1 2.650% 15-Dec-2050

Verizon Communications Inc. $510 5.000% 15-Mar-2051

Verizon Communications Inc. $4,022 3.550% 22-Mar-2051

Verizon Communications Inc. CAD 500 4.050% 22-Mar-2051

Verizon Communications Inc. $4 3.350% 15-May-2051

Verizon Communications Inc. $4 3.400% 15-May-2051

Verizon Communications Inc. $3 3.350% 15-Jun-2051

Verizon Communications Inc. $3 3.400% 15-Jun-2051

Verizon Communications Inc. $5 3.350% 15-Jun-2051

Verizon Communications Inc. $4 3.250% 15-Jun-2051

Verizon Communications Inc. $3 3.050% 15-Jul-2051

Verizon Communications Inc. $1 2.950% 15-Aug-2051

Verizon Communications Inc. $4 3.000% 15-Aug-2051

Verizon Communications Inc. $5 3.000% 15-Aug-2051

Verizon Communications Inc. $4 3.000% 15-Sep-2051

Verizon Communications Inc. $4 3.050% 15-Sep-2051

Verizon Communications Inc. $2 2.950% 15-Sep-2051

Verizon Communications Inc. $2 2.900% 15-Sep-2051

Verizon Communications $4 3.100% 15-Nov-2051

Verizon Communications $2 3.000% 15-Nov-2051

Verizon Communications $2 3.050% 15-Nov-2051

Verizon Communications $1 3.050% 15-Dec-2051

Verizon Communications $2 3.050% 15-Dec-2051

Verizon Communications $0 2.900% 15-Dec-2051

Verizon Communications $1 3.050% 15-Dec-2051

Verizon Communications $1,000 3.875% 1-Mar-2052

Verizon Communications $1 4.000% 15-Apr-2052

Verizon Communications $0 4.550% 15-May-2052

Verizon Communications $1 4.800% 15-May-2052

Verizon Communications $0 4.650% 15-May-2052

Verizon Communications $0 4.650% 15-Jun-2052

Verizon Communications $0 4.450% 15-Jun-2052

Verizon Communications $0 4.450% 15-Jun-2052

Verizon Communications $1 4.600% 15-Aug-2052

Verizon Communications $0 4.650% 15-Aug-2052

Verizon Communications $0 4.650% 15-Aug-2052

Verizon Communications $0 4.850% 15-Sep-2052

Verizon Communications Inc. $730 5.320% 2-May-2053

Verizon Communications Inc. $1 5.450% 15-Jun-2053

Verizon Communications Inc. $2 5.400% 15-Jul-2053

Verizon Communications Inc. $1 5.500% 15-Aug-2053

Verizon Communications Inc. $1 5.800% 15-Aug-2053

Verizon Communications Inc. $1 5.800% 15-Aug-2053

Verizon Communications Inc. $0 5.900% 15-Aug-2053

Verizon Communications Inc. $0 5.750% 15-Sep-2053

Verizon Communications Inc. $1 5.800% 15-Sep-2053

Verizon Communications Inc. $1 5.900% 15-Sep-2053

Verizon Communications Inc. $0 5.950% 15-Oct-2053

Verizon Communications Inc. $3 6.400% 15-Nov-2053

Verizon Communications Inc. $0 6.100% 15-Nov-2053

Verizon Communications Inc. $1 6.050% 15-Nov-2053

Verizon Communications Inc. $1 5.750% 15-Dec-2053

Verizon Communications Inc. $1 5.450% 15-Dec-2053

Verizon Communications Inc. $1 5.400% 15-Dec-2053

Verizon Communications Inc. $1,000 5.500% 23-Feb-2054

Verizon Communications Inc. $0 5.300% 15-Mar-2054

Verizon Communications Inc. $5 5.400% 15-Mar-2054

Verizon Communications Inc. $1 5.300% 15-Mar-2054

Verizon Communications Inc. $1 5.300% 15-Mar-2054

Verizon Communications Inc. $0 5.250% 15-Apr-2054

Verizon Communications Inc. $794 5.012% 21-Aug-2054

Verizon Communications Inc. $655 4.100% 4-Mar-2055

Verizon Communications Inc. $723 4.672% 15-Mar-2055

Verizon Communications Inc. $3,651 2.987% 30-Oct-2056

Verizon Communications Inc. $2,385 3.600% 24-Feb-2060

Verizon Communications Inc. $1,123 3.000% 29-Sep-2060

Verizon Communications Inc. $1,939 3.000% 20-Nov-2060

Verizon Communications Inc. $3,086 3.700% 22-Mar-2061 $119,022

Private Placements $15,277 $15,277

TOTAL LONG TERM DEBT: $ 135,007bnb

TOTAL DEBT AS OF June 30, 2024 $ 157.515bn

From the 2023 annual report:-

Courtesy of the Verizon 2023 Annual Report

Interest payments on the $151bn (as reported in 2023) were costing $7.342 Billion a year