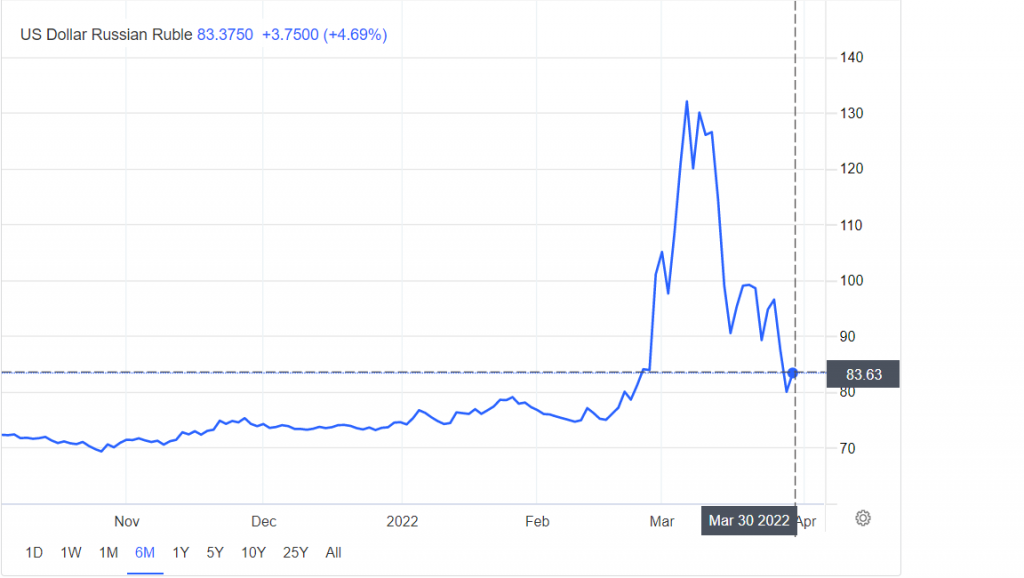

The graph below show the US Dollar vs The Russian Rouble over 6 months

The Russian Ruble (or Rouble) is the official currency of the Russian Federation, as well as South Ossetia and Abkhazia. The ruble is subdivided into 100 kopeks (or kopecks, copecks). There is currently no official symbol for the Ruble, though the abbreviation руб. is widely in use, and the country is considering several other possibilities.

The Russian Federation is one of the world’s largest market economies. By nominal GDP, Russia is ranked as the 10th largest economy in the world (6th largest by Purchasing Power Parity). Political stability and increased domestic consumption have driven significant growth since the early 2000s. The average salary increased from $80/month in 2000 to ~$640/month in 2008. Roughly 14% of Russians lived in poverty in 2010 vs. nearly 40% in 1999.

Oil, natural gasoline, timber, and precious metals represent ~80% of exported goods. Agricultural products is also a major export &mdash Russia is the third largest grain exporter globally, behind only the United States and European Union.

The Ruble has been the official currency of Russia for nearly 500 years. The kopek was first introduced in 1710, with a value of 1/100th of a Ruble.

In December, 1885, the Russian Ruble was revalued to a gold standard, pegged to the French Franc at 1 Ruble = 4 Francs. This value was revised in 1897 to 1 Ruble = 2 2/3 Francs.

During World War I, the gold standard was dropped leading to devaluation of the Ruble and hyperinflation.

The “second Ruble” was introduced on January 1, 1922, followed by the “third Ruble” in January 1923.

The “fourth Ruble” (or “Gold Ruble”) was issued in March, 1924.

Following World War II, the “fifth Ruble” was introduced in 1947, in order to revalue the currency and reduce the amount of paper tender in circulation.

The introduction of the “sixth Ruble” occurred in 1967, under a similar process to the “fifth Ruble” issue.

The “sixth Ruble” remained the official currency of Russia during the transition from the Soviet Union to the modern Russian Federation, though new notes were issued in 1993 to reflect the change.

The “seventh Ruble” was issued on January 1, 1998, essentially devaluing the Russian Ruble at a rate of 1 new Ruble = 1,000 old Rubles.