Monthly Archives: October 2021

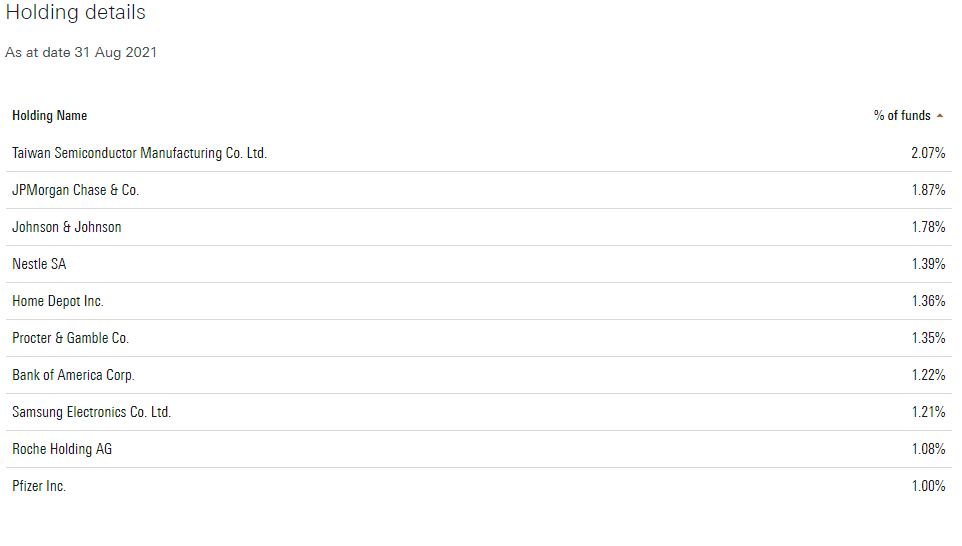

FTSE All-World High Dividend Yield UCITS ETF

The FTSE All-World High Dividend Yield UCITS ETF employs a passive management – or indexing – investment approach, through physical acquisition of securities, and seeks to track the performance of the FTSE All-World High Dividend Yield Index (the “Index”). The Index is comprised of large and mid-sized company stocks, excluding real estate trusts, in developed and emerging markets that pay dividends that are generally higher than average.

Number of stocks held: 1580 securities.

The BMO Managed Portfolio Trust PLC

The BMO Managed Portfolio Trust PLC is a ‘multi-manager’ investment trust, investing in a range of investment companies giving you exposure to different investment providers and markets within a single investment trust managed by BMO. : The objective for the Growth Portfolio is to provide growth shareholders with capital growth from a diversified portfolio of investment companies. The Growth Portfolio invests in a diversified portfolio of at least 25 investment companies that have underlying investment exposures across a range of geographic regions and sectors and the focus of which is to maximise total returns, principally through capital growth

https://www.londonstockexchange.com/stock/BMPG/bmo-managed-portfolio-trust-plc/company-page

Top Ten Equity Holdings

Monks Investment Trust 4.6% of the fund

Allianz Technology Trust 4.5% of the fund

Scottish Mortgage Investment Trust 4.3% of the fund

Polar Capital Technology Trust 3.7% of the fund

HgCapital Trust 3.6% of the fund

Chrysalis Investments 3.5% of the fund

Impax Environmental Markets 3.1% of the fund

Herald Investment Trust 3.0% of the fund

Mid Wynd International Investment Trust 2.8% of the fund

Fidelity Special Values 2.8% of the fund

Total 35.9% of the fund

Ray Dalio: CEO of Bridgewater Associates: How to invest in 2021 and 2022

HM Government Borrowings: September 2021

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a Covid 19 world. UK’s HM Government needs to fund many new demands. [www.dmo.gov.uk]

https://www.dmo.gov.uk/dmo_static_reports/Gilt%20Operations.pdf

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In September 2021, the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 8 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

28-Sep-2021 1¼% Treasury Gilt 2051 £2,000.0000 Million

22-Sep-2021 0 1/8% Index-Linked Treasury Gilt 2056 3 months £350.0000 Million

15-Sep-2021 0¼% Treasury Gilt 2031 £2,857.9160 Million

14-Sep-2021 0 3/8% Treasury Gilt 2026 £3,000.0000 Million

08-Sep-2021 0 1/8% Index-linked Treasury Gilt 2031 3 months £1,010.7250 Million

07-Sep-2021 0¼% Treasury Gilt 2025 £3,250.0000 Million

07-Sep-2021 1 5/8% Treasury Gilt 2071 £1,250.0000 Million

01-Sep-2021 0½% Treasury Gilt 2029 £2,859.0000 Million

Thus:-

£2,000.0000 Million+ £350.0000 Million + £2,857.9160 Million + £3,000.0000 Million + £3,250.0000 Million + £1,250.0000 Million + £2,859.0000 Million= £16,577.641 Million

£16,577.641 Million = £16.577641 Billion

On another way of looking at it, is in the 30 days in Sept 2021, HM Government borrowed:- £552.58803333333333333333333333333 Million each day for the 30 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature from 2025 through to 2071. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

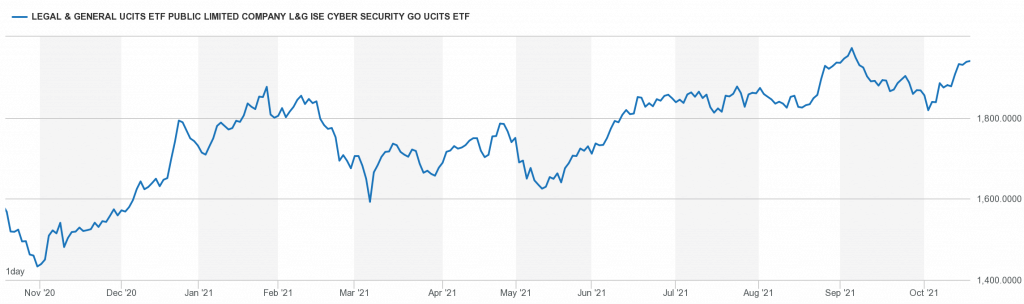

L&G Cyber Security ETF

The L&G Cyber Security ETF investing in companies that are working in the in field of network and IT security.

The Legal and General Cyber Security ETF is rocketing in value.

Now trading at over £19 a share.

Top Ten holdings:-

Palo Alto Networks 3.6% of the fund

Fortinet 3.5% of the fund

Cyberark 3.4% of the fund

Avast 3.2% of the fund

Qualys 3.1% of the fund

Radware 3.1% of the fund

Cloudflare 3.0% of the fund

Trend Micro 3.0% of the fund

Cisco Systems 2.9% of the fund

Juniper Networks 2.8% of the fund

The Debt of AT&T and its Balance Sheet

AT&T, the US US phone and telecoms giant carries a lot of debt.

These are large debt numbers:

$179,783,248,238

That is $179 Billion of debt.

How we need to understand this figure.

It needs to repay $82.1bn in the next 12months (liabilities due in the next year).

It has cash reserves of $11.9bn (immediate liquidity)

It also has receivables of $20.1bn in the next 12months (money owed to AT&T).

It still carries a large level of debt.

https://investors.att.com/financial-reports/debt/debt-information

The cost of interest on this debt is about $8,048 million = $8.048 Billion

So while interest rates are low, paying $8bn on interest is quite manageable, when its turnover is $171,760 million = $171 Billion.

So the Debt to Revenue is at 4%.

Big numbers from American Telephone and Telegraph

https://www.stock-analysis-on.net/NYSE/Company/ATT-Inc/Analysis/Debt

Investment in Fraud: Elizabeth Holmes: The ‘Valley of Hype’ behind the rise and fall of Theranos

Investment in Water Conservation

The AXA ACT Framlington Clean Economy

The AXA ACT Framlington Clean Economy is a UK Unit Trust. The aim of this Fund is to: (i) provide long-term capital growth over a period of 5 years or more; and (ii) seek to achieve sustainable investment objective, in line with a responsible investment approach.

The Fund invests at least 80% of its assets in shares of listed companies of any size which are based anywhere in the world and which the fund manager believes will generate both above-average returns and a positive and measurable impact on environmental, social and governance (ESG) factors.In selecting shares, the fund manager applies AXA IM Group’s sector specific investment guidelines relating to responsible investment to the Fund.

Portfolio Analysis: Top 10 Holdings

Ameresco Inc 3.78% of the fund

NextEra Energy Inc 3.38% of the fund

Schneider Electric SE 3.24% of the fund

Darling Ingredients Inc 2.99% of the fund

TE Connectivity Ltd 2.98% of the fund

Trimble Inc 2.92% of the fund

Taiwan Semiconductor Manufacuting 2.86% of the fund

Infineon Technologies AG 2.76% of the fund

Hannon Armstrong Sustainable 2.73% of the fund

Aptiv PLC 2.56% of the fund

Total 30.16% of the fund.

He is Brilliant and Amazing

A question of investment trust

Hydrogen Investment

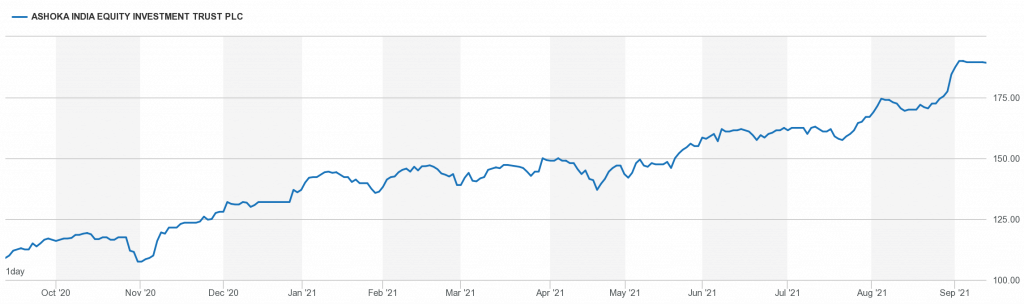

The Ashoka India Equity Investment Trust PLC

The Ashoka India Equity Investment Trust PLC is an London listed investment trust, that has the strategy to achieve long-term capital appreciation, mainly through investment in securities listed in India and listed securities of companies with a significant presence in India.

It’s top ten holdings are:-

- Laxmi Organic Industries Materials 6.8% of the fund

- ICICI Bank Financials 6.1% of the fund

- Infosys Information Technology 4.9% of the fund

- Axis Bank Financials 4.7% of the fund

- Coforge Information Technology 4.6% of the fund

- Asian Paints Materials 3.5% of the fund

- Nestle India Consumer Staples 3.0% of the fund

- Crompton Greaves Consumer Electricals Consumer Discretionary 2.9% of the fund

- Cartrade Tech Consumer Discretionary 2.9% of the fund

- Bajaj Finserv Financials 2.8% of the fund

Total 42.3% of the fund

https://www.londonstockexchange.com/stock/AIE/ashoka-india-equity-investment-trust-plc/company-page

Oxford Nanopore PLC

Oxford Nanopore Technologies plc was founded in 2005 as a spin-out from the University of Oxford. The company now employs about 600 employees from multiple disciplines including nanopore science, molecular biology and applications, informatics, engineering, electronics, manufacturing and commercialisation

It has just floated on the London Stock Exchange.

Floatation price of 425p a share.

https://www.londonstockexchange.com/news-article/ONT/announcement-of-offer-price/15154688

it is flying high.

https://www.londonstockexchange.com/stock/ONT/oxford-nanopore-technologies-plc/company-page

HSBC Holdings PLC September Dividend.

Yesterday, 30th Sept 2021, HSBC Holdings, paid out is Sept 2021 dividend.

$0.07 a share = £0.051203 a share

£0.051203 a share pence per share it the dividend that it to be paid.

https://www.londonstockexchange.com/news-article/HSBA/total-voting-rights/15117630

The total number of voting rights in HSBC Holdings plc is 20,426,332,840

Thus:

20,426,332,840 x £0.051203 = £1,045,889,520.40652

That is £1,045 Million = £1.045 Billion paid to shareholders, yesterday.

https://www.londonstockexchange.com/stock/HSBA/hsbc-holdings-plc/company-page