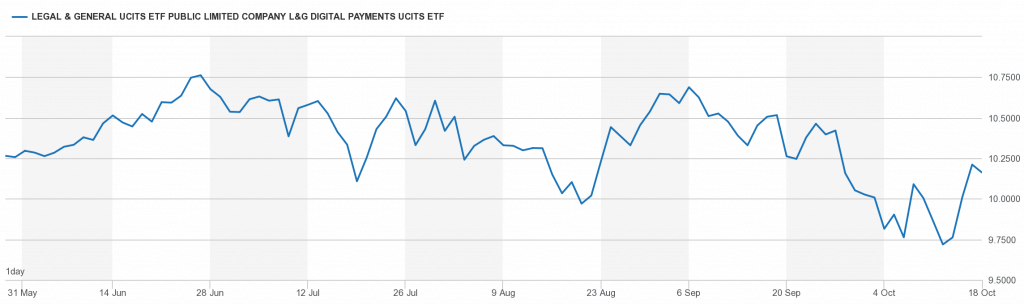

The L&G Digital Payments is an ETF that invests in companies in the digital payments sector.

Its top ten holdings are:-

GreenSky 4.6% of the fund

Nuvei 3.7% of the fund

Lightspeed 3.2% of the fund

Green Dot 3.0% of the fund

Adyen 2.9% of the fund

Afterpay 2.9% of the fund

Zuora 2.7% of the fund

International Money Express 2.6% of the fund

Shopify 2.6% of the fund

Square, Inc. 2.6% of the fund

The L&G Digital Payments UCITS ETF (the “ETF”) aims to track the performance of the Solactive Digital Payments Index NTR

The Index is designed to provide exposure to equity securities of global companies that are actively engaged in the digital payments ecosystem. The digital payments ecosystem consists of the card payment and the cardless open-banking payment ecosystems. The index universe encompasses companies that are actively engaged in the value-chain of digital payments, which includes payment acquirer, card issuers, payment gateways, payment processors, payment technology providers, and cardless payment service providers.