Courtesy of The National News

Category Archives: Uncategorized

Bluefield Solar Income Fund [BSIF]

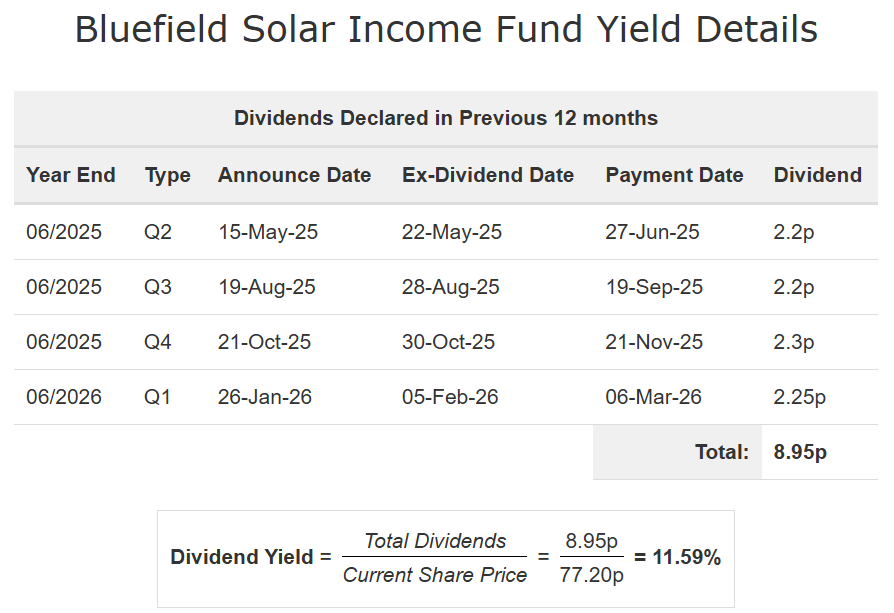

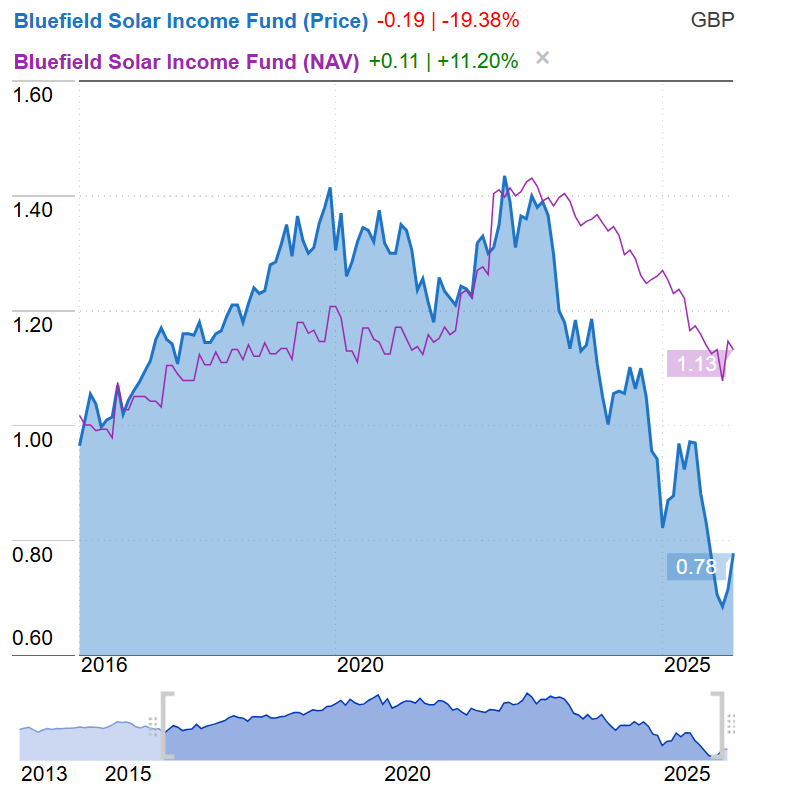

The Bluefield Solar Income Fund is a London listed investment trust that invests in UK solar farms. Bluefield Solar Income Fund (BSIF) is a pioneer in the renewable energy space. It primarily targets utility-scale solar, wind and energy storage assets and portfolios on greenfield, industrial and/or commercial sites. BSIF aims to deliver long-term stable dividends and has one of the most successful track records in the sector.

BSIF seeks to provide shareholders with an attractive return. This is mainly in the form of quarterly income distributions through being invested primarily in renewable energy assets in the UK.

Courtesy of Bluefield Solar

Courtesy of https://www.dividenddata.co.uk/

BLUEFIELD SOLAR INCOME FUND LIMITED BSIF Stock | London Stock Exchange

Courtesy of AJ Bell

BlackRock American Income Trust Plc

The BlackRock American Income Trust Plc in a London listed investment trust whose objective is to provide long-term capital growth, whilst paying an attractive level of income.

BlackRock American Income Trust plc – BRAI | BlackRock

Courtesy of Interactive Investor

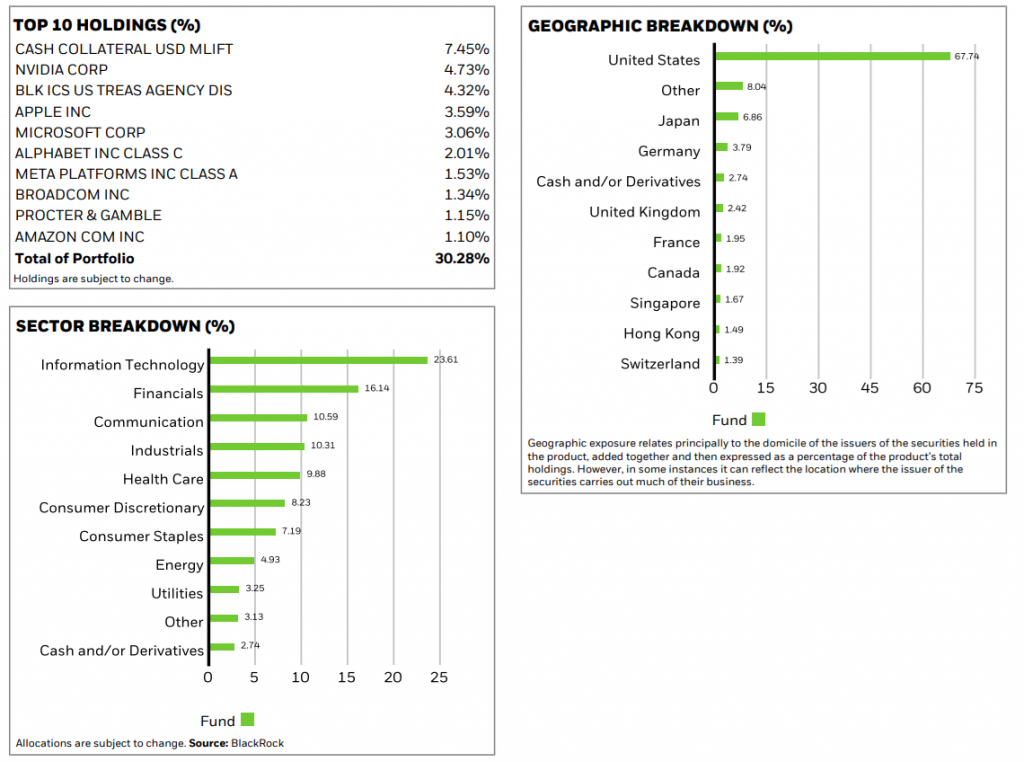

Courtesy of BlackRock

Courtesy of BlackRock

iShares World Equity High Income UCITS ETF USD (Dist)

The iShares World Equity High Income UCITS ETF USD (Dist) is a London listed ETF

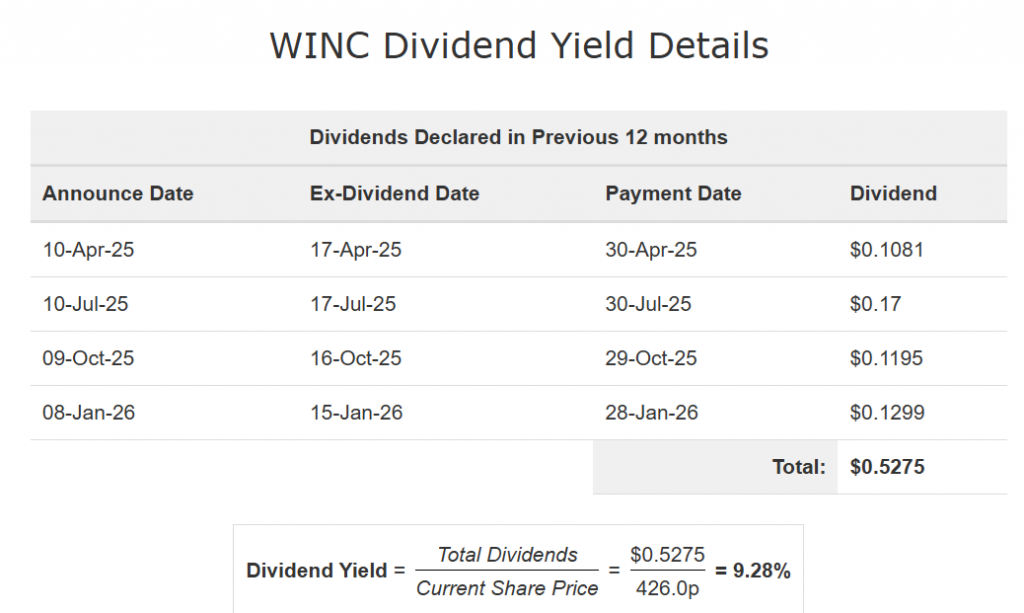

iShares World Equity High Income Active UCITS ETF | WINC

Courtesy of BlackRock

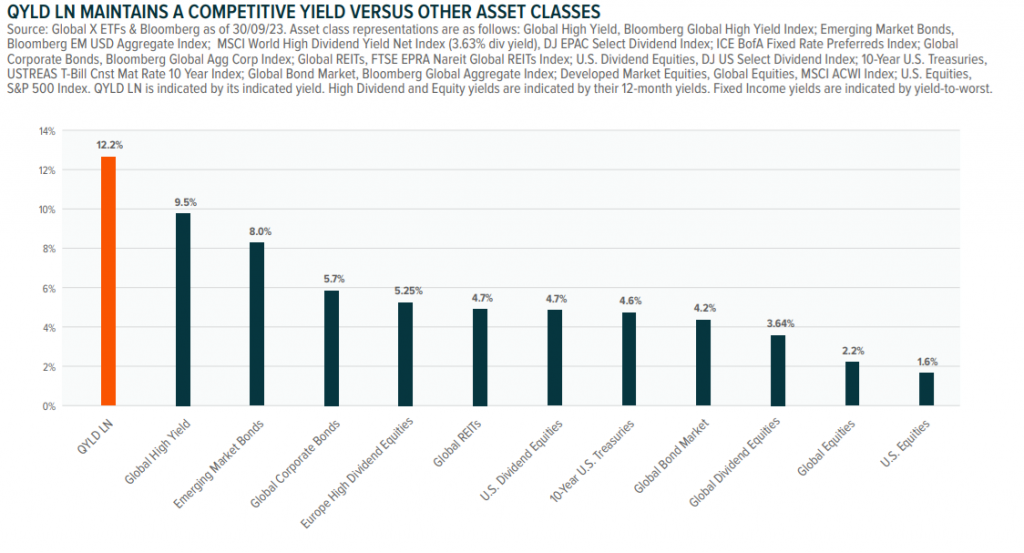

A yield of over 9% per year….

Courtesy of https://www.dividenddata.co.uk/

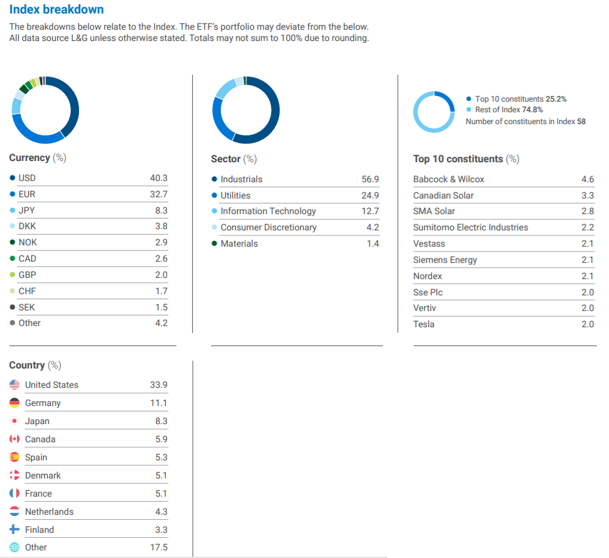

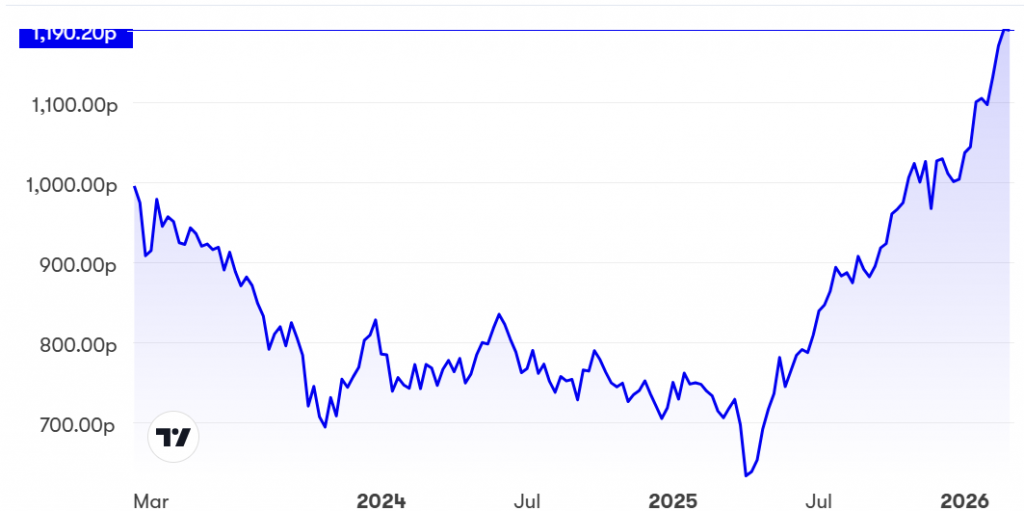

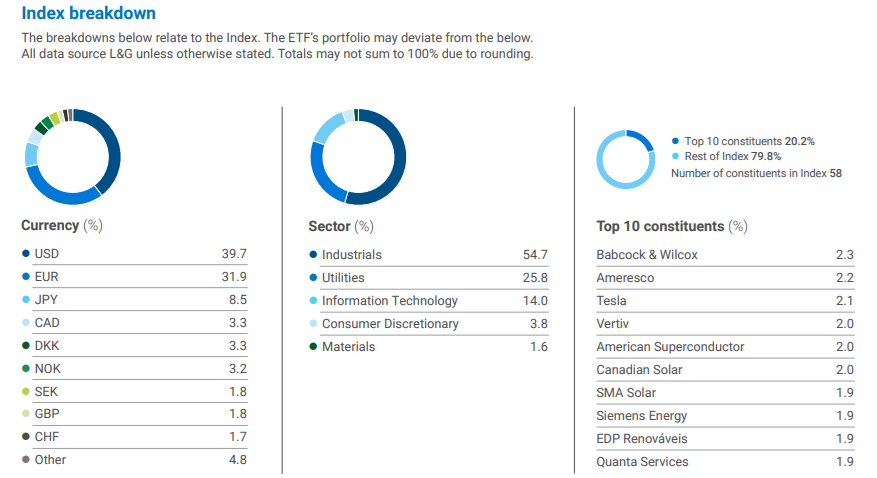

L&G Clean Energy ETF

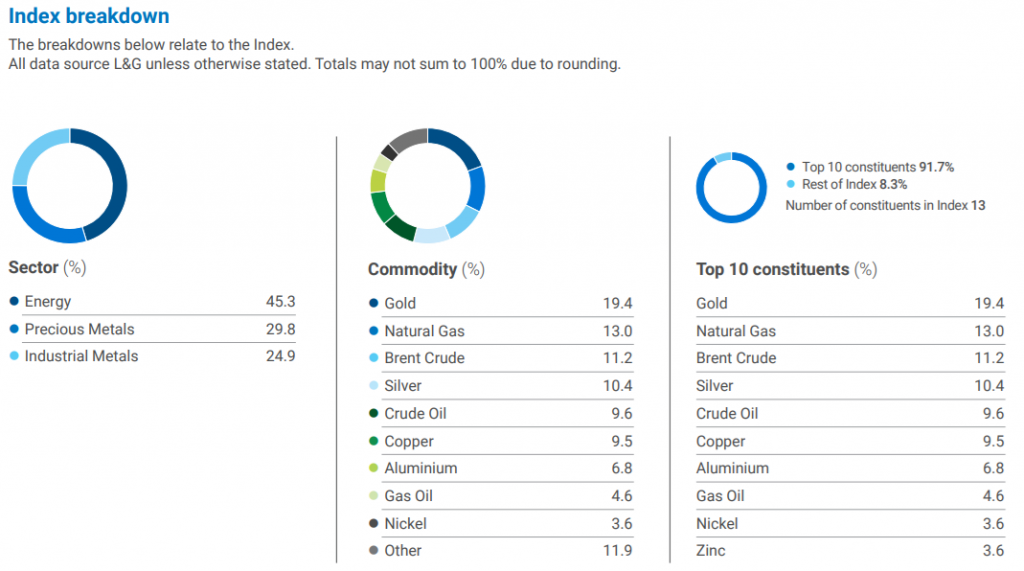

L&G Market Neutral Commodities UCITS ETF

The L&G Market Neutral Commodities UCITS ETF has the investment objective to provide a long/short exposure to a broad base of futures contracts on physical commodities.

L&G Market Neutral Commodities UCITS ETF | L&G Fund Centre

It’s holdings:-

CBOT Soybean Oil Future

CBOT Corn No 2 Future

NYBOT Cocoa Future

NYMEX Crude Oil Future

IPE Brent Crude Future

NYBOT Cotton No 2 Future

COMEX Copper Future

NYMEX Heating Oil No 2 Future

NYMEX Heating Oil No 2 Future

NYBOT Coffee Future

KCBT Wheat Future

LME Aluminium Future

CME Live Cattle Future

CME Lean Hogs Future

LME Lead Future

LME Nickel Future

LME Zinc Future

NYMEX Natural Gas Future (Henry Hub)

NYMEX Natural Gas Future (Henry Hub)

IPE Gas Oil Future

IPE Gas Oil Future

CBOT Soybean Future

NYBOT Sugar No 11 Future

CBOT Soybean Meal Future

CBOT Wheat Future

NYMEX RBOB Gasoline Future

CBOT Soybean Oil Future

CBOT Corn No 2 Future

NYBOT Cocoa Future

NYMEX Crude Oil Future

IPE Brent Crude Future

NYBOT Cotton No 2 Future

COMEX Copper Future

NYMEX Heating Oil No 2 Future

NYBOT Coffee Future

KCBT Wheat Future

LME Aluminium Future

CME Live Cattle Future

CME Lean Hogs Future

LME Lead Future

LME Nickel Future

LME Zinc Future

NYMEX Natural Gas Future (Henry Hub)

IPE Gas Oil Future

CBOT Soybean Future

NYBOT Sugar No 11 Future

CBOT Soybean Meal Future

CBOT Wheat Future

NYMEX RBOB Gasoline Future

LEGAL AND GENERAL ASSET MANAGEMENT CMNG Stock | London Stock Exchange

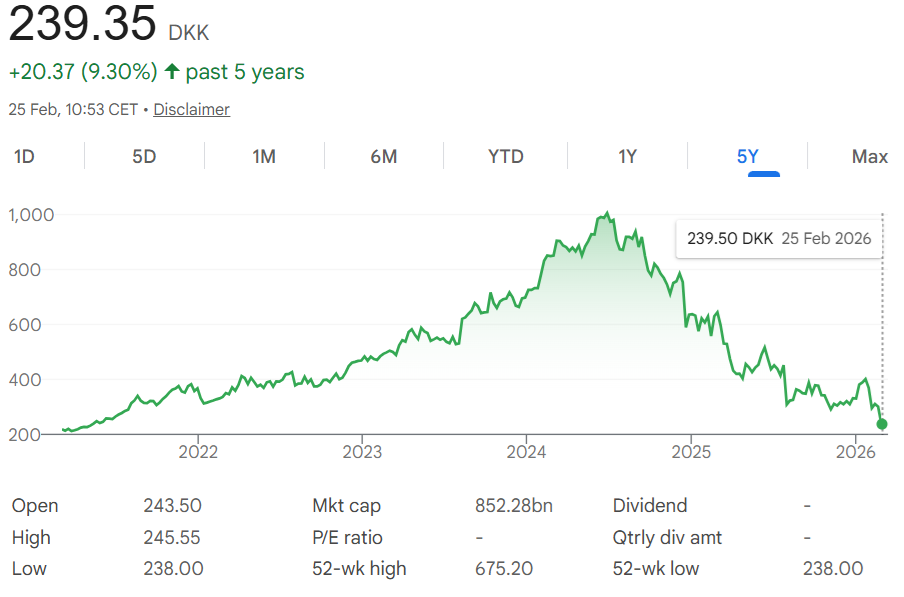

Novo Nordisk Share Price

JPMorgan CEO Jamie Dimon: The David Rubenstein Show

Courtesy of Bloomberg

Market Capitalisation of JP Morgan Chase & Co

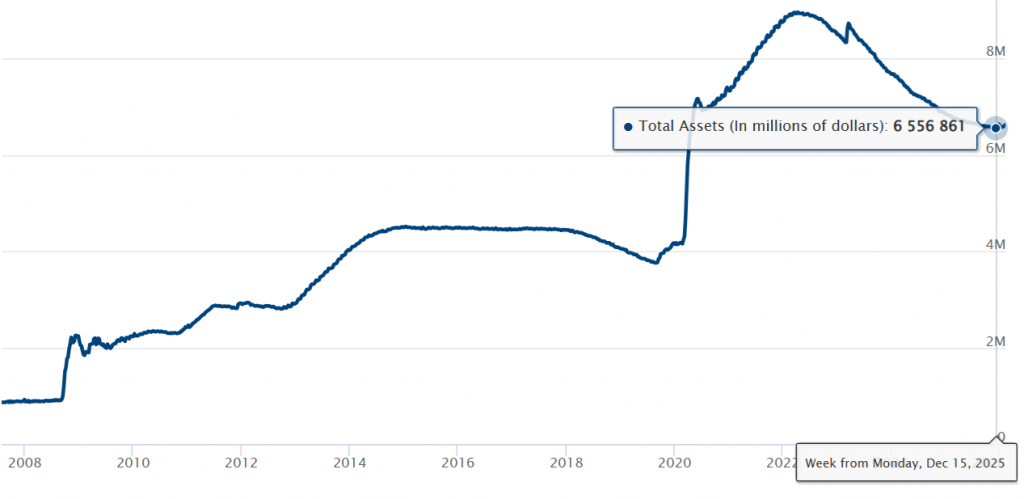

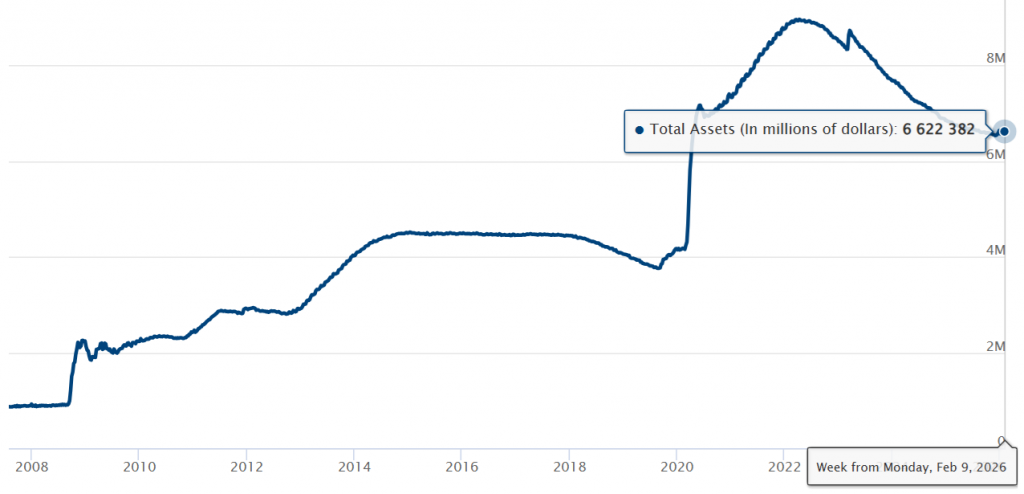

Federal Reserve Balance Sheet US$6,662,382 Million ($6.6 Trillion)

The US Central Bank has recently began increasing its balance sheet. See the graphs

Federal Reserve Board – Recent balance sheet trends

Potentially Quantitive Easing may have re-started

The Return of Quantitative Easing | The Daily Economy

On the 15th Dec 2025 it was US$ 6,556,861 Million

Courtesy of the US Federal Reserve

As shown below, on the 9th Feb it stood at US$6,662,382 Million

Courtesy of the US Federal Reserve

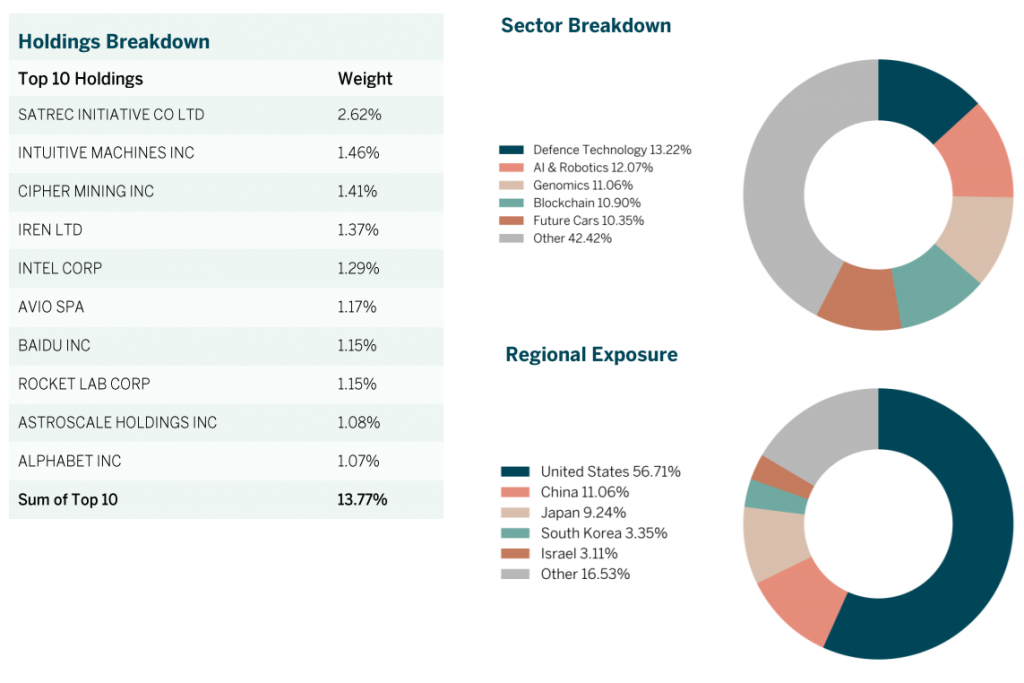

HAN -GINS Tech Megatrend Equal Weight UCITS ETF

The HAN -GINS Tech Megatrend Equal Weight UCITS ETF invests to provide exposure to the disruptive technology companies in “Industry 4.0” that are changing the world through global megatrends. The tech megatrend ETF provides equal weight access to companies that are driving innovation in eight sub -sectors including Robotics & Automation, Cloud Computing & Big Data, Cyber Security, Future Cars, Genomics, Social Media, Blockchain, Digital Entertainment, Defence Technology and

Quantum Computing.

Courtesy of Interactive Investor

Courtesy of Han ETF

GinsGlobal Index Fund CEO Anthony Ginsberg Discusses Tech Megatrend ETF and Global Tech Landscape

Courtesy of YouTube

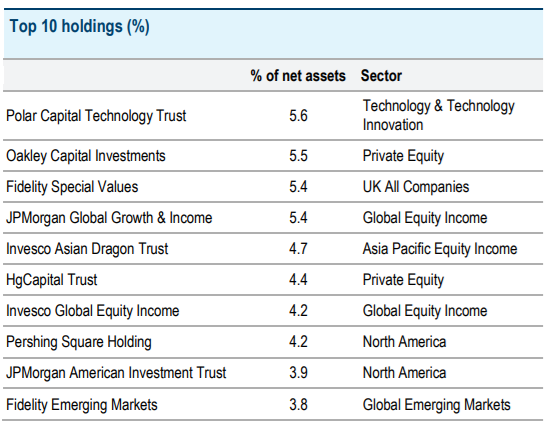

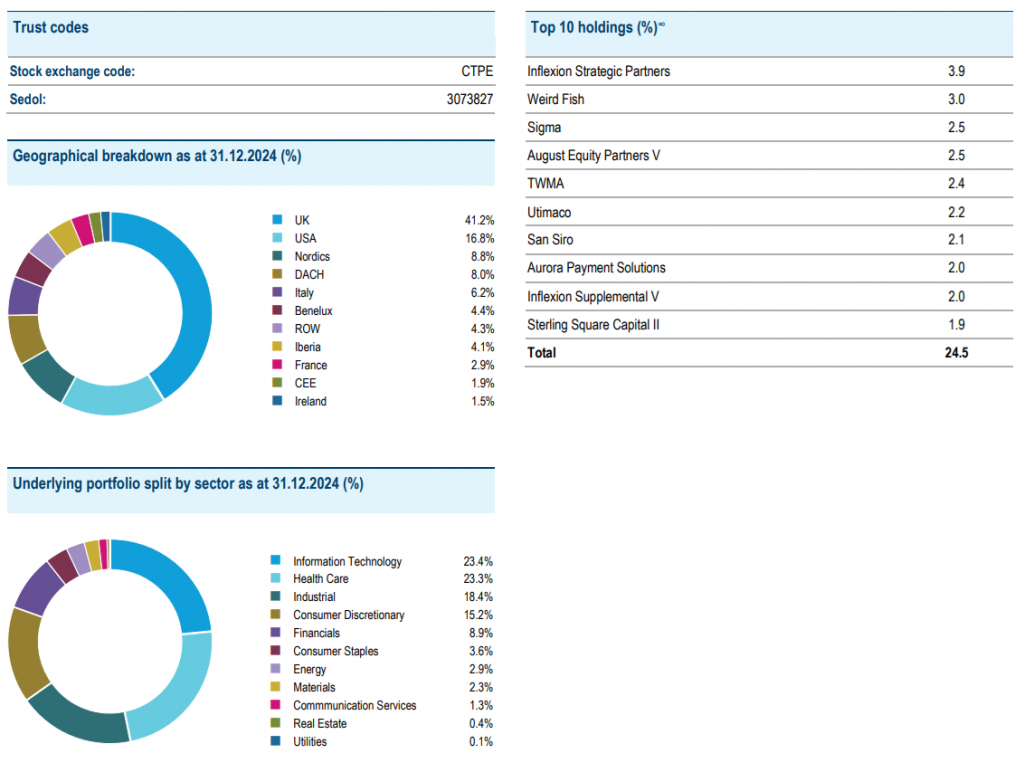

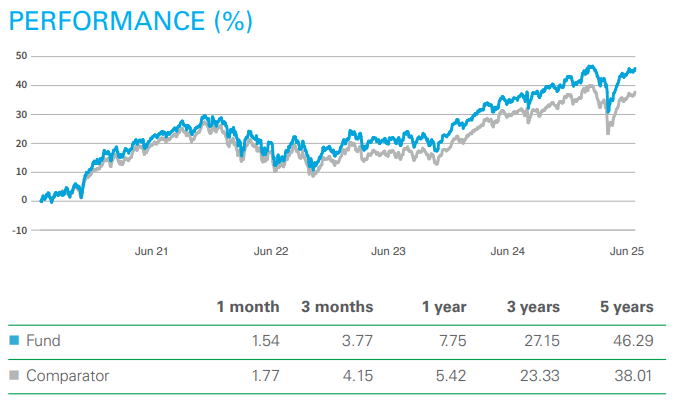

CT GLOBAL MANAGED PORTFOLIO TRUST PLC – Review of 2025 and outlook for 2026

CT GLOBAL MANAGED PORTFOLIO TRUST PLC – Review of 2025 and outlook for 2026

Courtesy of Columbia Threadneedle

Courtesy of Columbia Threadneedle

Courtesy of Columbia Threadneedle

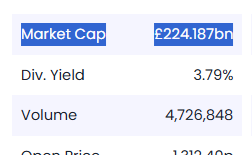

Ascent of HSBC Holdings PLC

British Telecommunications PLC: Feb 2026 Dividend.

Today, Wed 11th Feb, BT Group PLC, pays out its Feb 2026 Dividend.

The UK’s premier telecoms group pays out 2.45p per share.

The market leader in the UK, rewards its long term shareholders.

https://www.londonstockexchange.com/news-article/BT.A/total-voting-rights/17439530

The total number of voting rights in BT Group plc on the 30th Jan 2026 was 9,967,630,290

Thus:-

9,967,630,290 x £0.0245 = £244,206,942.105

£245 million paid to shareholders.

https://www.londonstockexchange.com/stock/BT.A/bt-group-plc/company-page

Courtesy of Interactive Investor

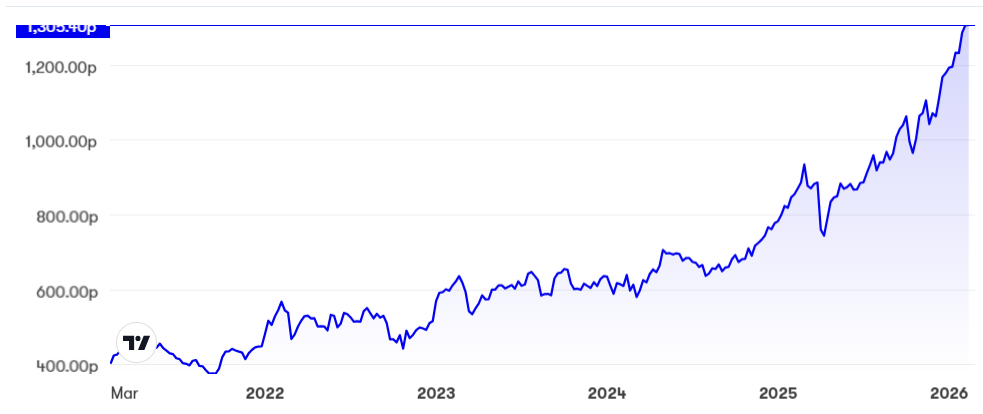

iShares MSCI Korea UCITS ETF USD (Acc)

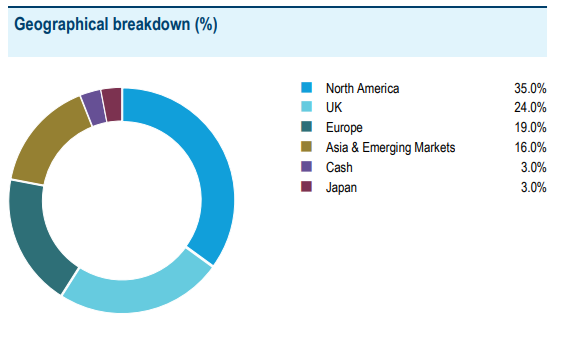

HSBC Balance Sheet:- £2.425 TRILLION

The UK’s largest bank is The Hong Kong and Shanghai Banking Corporation

The Q3 annual results make interesting reading:-

All reporting – Group | HSBC Holdings plc

Courtesy of HSBC Holdings PLC

The Balance Sheet reports total asset of US$ 3,324,223 Million = £2,425,518 Million

£2,425,518 Million = £2425 Billion

£2425 Billion = £2.425 TRILLION

The HSBC balance sheet of £2.425 Trillion is larger than the annual UK GDP

Vodafone Feb 2026 Dividend

Today, Thursday 5th Feb 2026, Vodafone, the UK’s 2nd telecommunications company (BT being the premier player https://www.bt.com), pays out its dividend.

| Interim dividend (eurocents per ordinary share) | 2.25 |

| Pence per ordinary share | 1.95116 |

£0.0195116 per share

https://www.londonstockexchange.com/news-article/VOD/total-voting-rights/17441902

The total number of voting rights in Vodafone is 23,413,913,916

Thus:

23,413,913,916 x £0.0195116 = £456,842,922.7634256

£456,842,922.7634256 = £456 Million paid to shareholders

VODAFONE GROUP PLC VOD Stock | London Stock Exchange

The Most Valuable US companies

Wise Quote: Warren Buffett

Artificial Intelligence

Courtesy of Cyber Dyne Systems

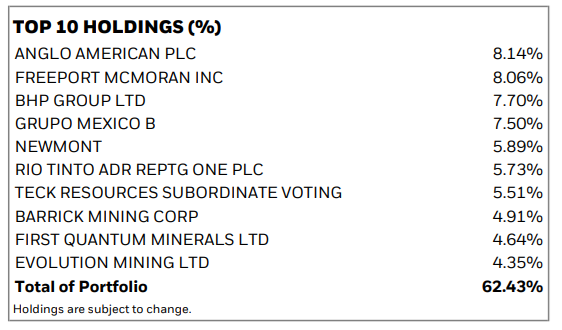

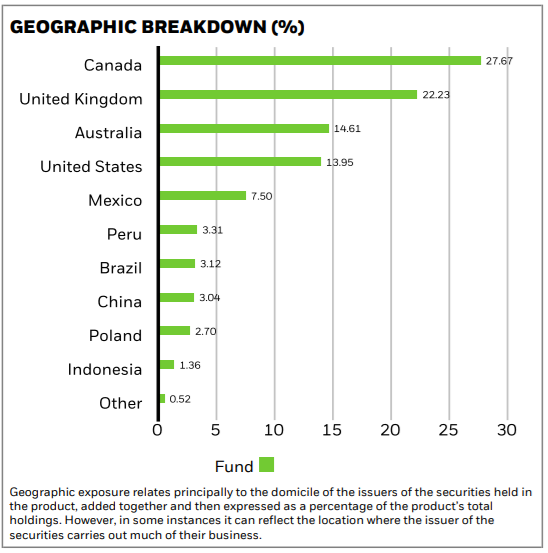

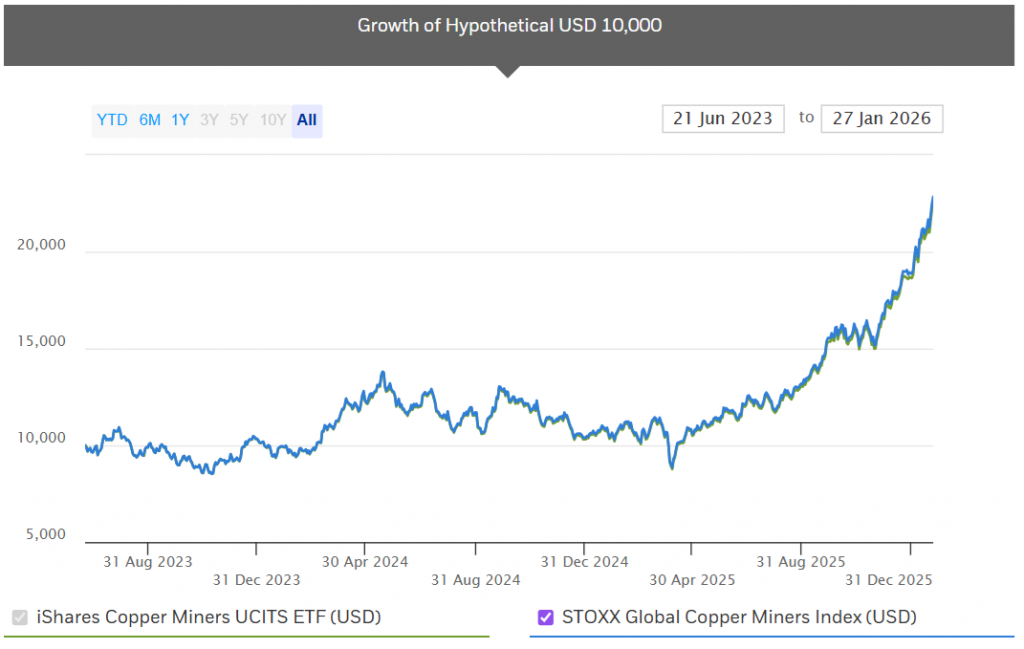

The ISHARES COPPER MINERS UCITS ETF

The fund (iSHARES COPPER MINERS UCITS ETF) aims to achieve a return on your investment, through a combination of capital growth and income on the Fund’s assets, which reflects the return of the STOXX Global Copper Miners Index, the Fund’s benchmark index (Index).

Courtesy of BlackRock

Courtesy of BlackRock

ISHARES MINE Stock | London Stock Exchange

Courtesy of BlackRock

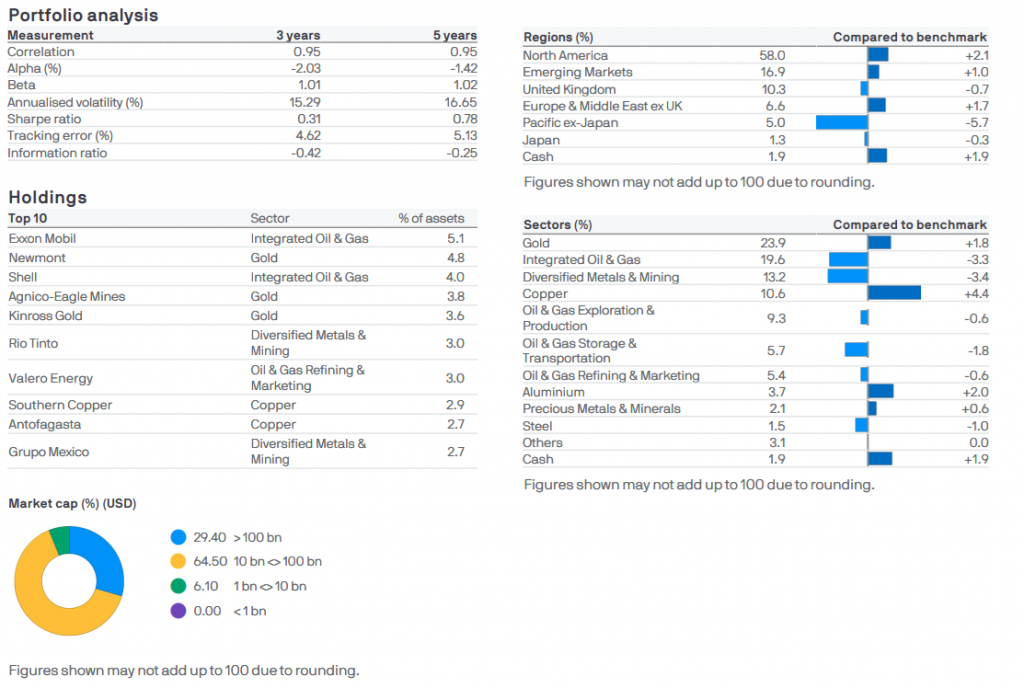

JPM Natural Resources Fund

The JPM Natural Resources Fund aims to provide capital growth over the long-term (5-10 years) by investing at least 80% of the Fund’s assets in the shares of companies throughout the world engaged in the production and marketing of commodities.

Fund size: [As of 23/01/2026] GBP £1.12 Billion

Top holdings

As of 31/12/2025

| Name | Sector | Weight |

|---|---|---|

| Exxon Mobil | Integrated Oil & Gas | 5.1% |

| Newmont | Gold | 4.8% |

| Shell | Integrated Oil & Gas | 4.0% |

| Agnico-Eagle Mines | Gold | 3.8% |

| Kinross Gold | Gold | 3.6% |

| Rio Tinto | Diversified Metals & Mining | 3.0% |

| Valero Energy | Oil & Gas Refining & Marketing | 3.0% |

| Southern Copper | Copper | 2.9% |

| Antofagasta | Copper | 2.7% |

| Grupo Mexico | Diversified Metals & Mining | 2.7% |

Courtesy of JP Morgan Asset Management

JPM Natural Resources Fund B – Net Accumulation | J.P. Morgan Asset Management

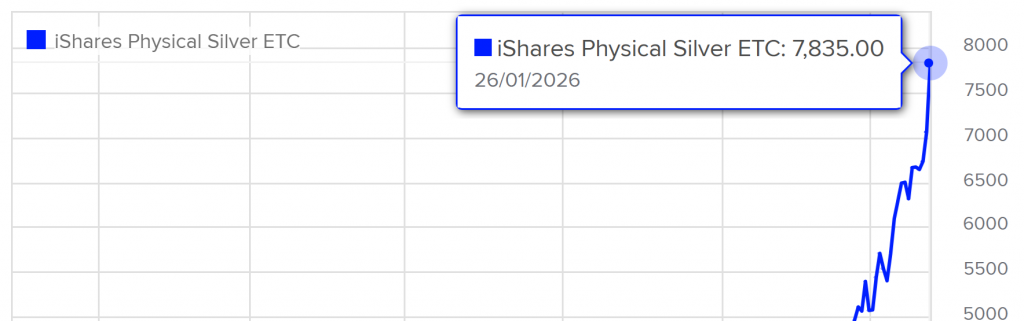

SILVER !

ISHARES SSLN Stock | London Stock Exchange

Courtesy of The London Stock Exchange

Courtesy of The London Stock Exchange

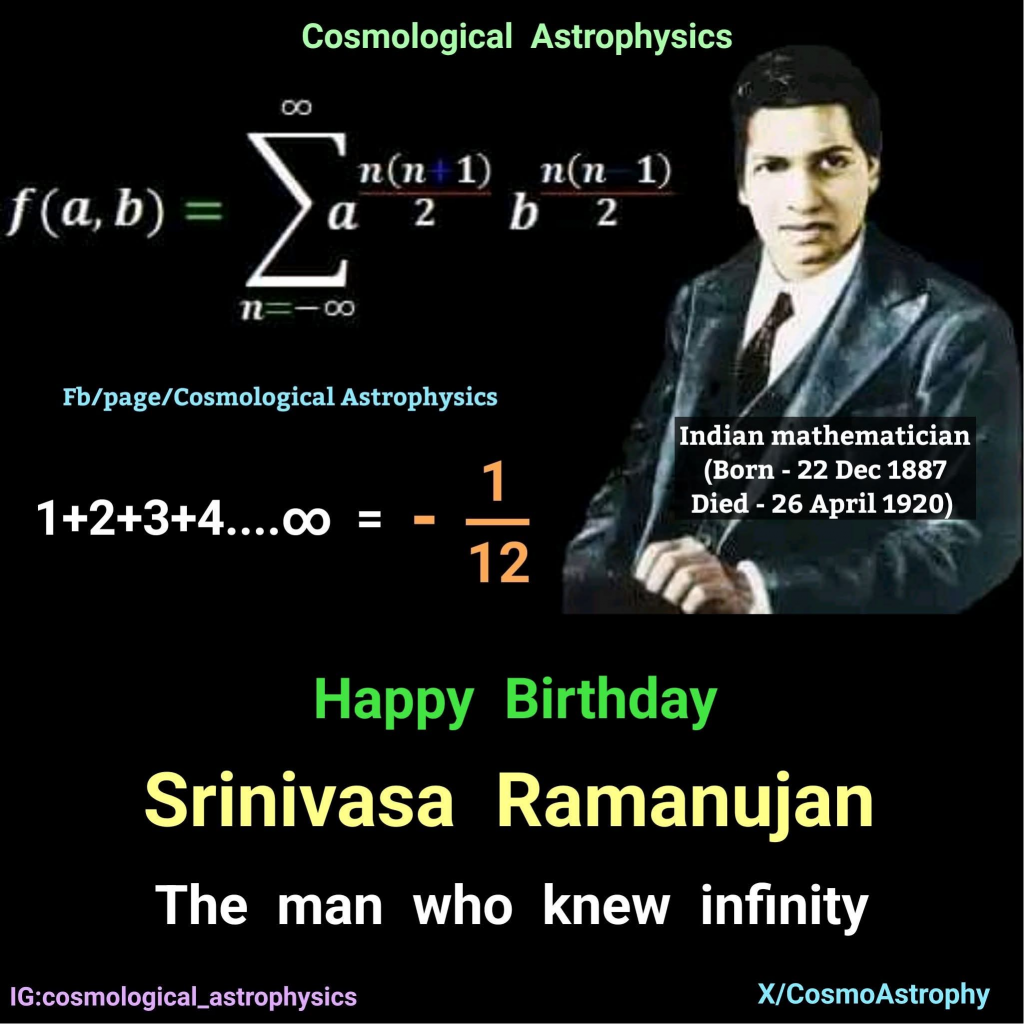

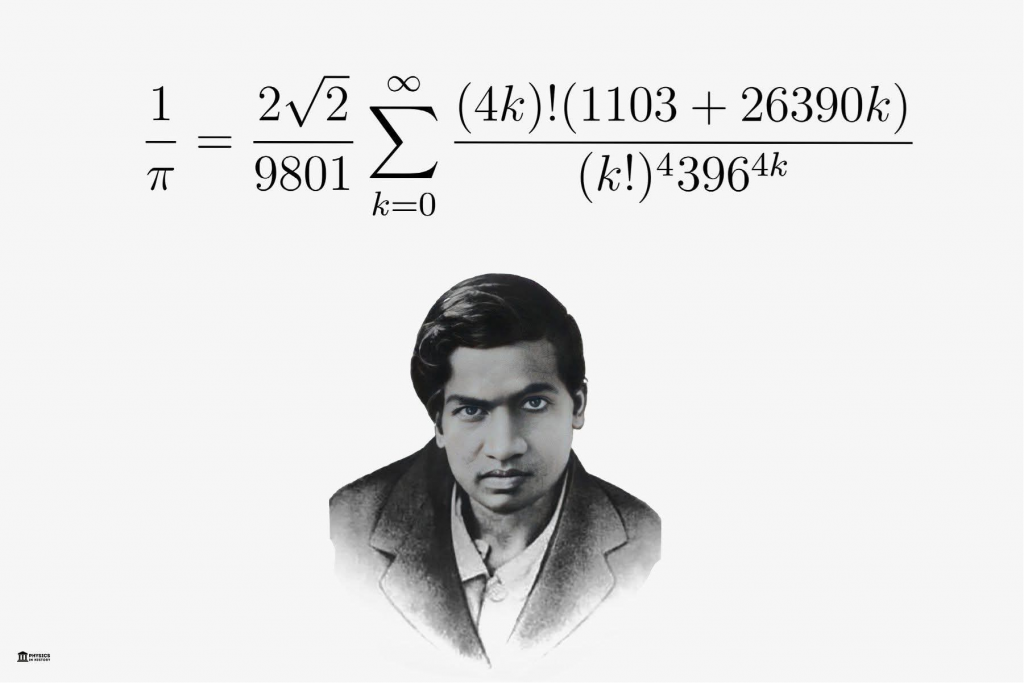

Freeman Dyson – Early work on Ramanujan and the continued relevance of mathematics (he referred to Ramanujan as “this Indian genius”

Courtesy of the late great Freeman Dyson

Warren Buffett officially steps down as CEO of Berkshire Hathaway

Courtesy of CNBC

Ray Dalio: Speaking to David Rubenstein

Courtesy of Bloomberg

US Government Borrowings: Week Commencing Monday 12th Jan 2025

US Government Sold $654 Billion of Treasuries, week commencing Monday 12th January 2025.

In the week, the US Government sold $654 billion in Treasury securities spread over 9 auctions, including 10-year Treasury notes and 30-year Treasury bonds.

Of these auction sales, $500 billion were Treasury bills with maturities from 4 weeks to 26 weeks, most of them to replace maturing T-bills.

| Type | Auction date | Billion $ | Auction yield |

| Bills 6-week | Jan-13 | 77.5 | 3.585% |

| Bills 13-week | Jan-12 | 88.8 | 3.570% |

| Bills 17-week | Jan-14 | 69.2 | 3.560% |

| Bills 26-week | Jan-12 | 79.5 | 3.580% |

| Bills 4-week | Jan-15 | 95.3 | 3.595% |

| Bills 8-week | Jan-15 | 90.3 | 3.600% |

| Bills | $500.5 Billion |

And of these $654 billion in auction sales, $154 billion were notes and bonds, including $50 billion in 10-year Treasury notes.

| Notes & Bonds | Auction date | Billion $ | Auction yield |

| Notes 3-year | Jan-12 | 74.9 | 3.609% |

| Notes 10-year | Jan-12 | 50.4 | 4.173% |

| Bonds 30-year | Jan-13 | 28.4 | 4.825% |

| Notes & bonds | $153.6 Billion |

Added up, this is $654 Billion, in US Government borrowings. The US Government has to borrow, as the taxes collected are not enough to fund the US Federal Government’s spending commitments, and thus borrows.

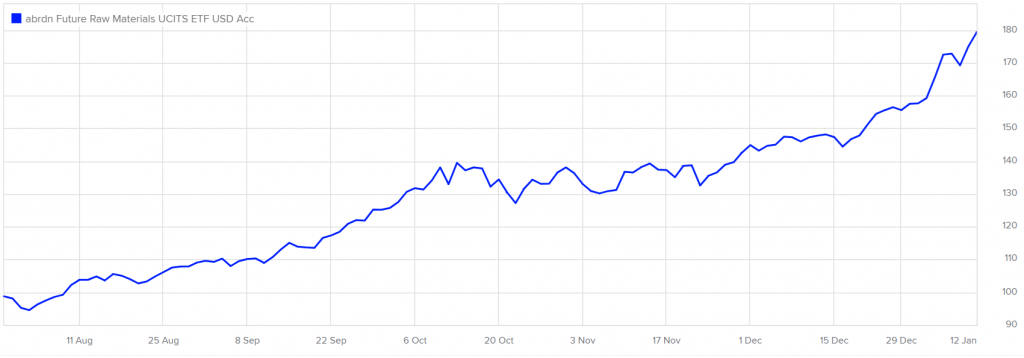

The Abrdn Future Raw Materials ETF

Courtesy of The London Stock Exchange

Top Ten Holdings:-

| 1 | SIGMA LITHIUM CORP ORD | 4.52% |

| 2 | CHINA HONGQIAO GROUP LTD ORD | 4.07% |

| 3 | PLS GROUP LTD ORD | 4.02% |

| 4 | ALCOA CORP ORD | 3.93% |

| 5 | HUDBAY MINERALS INC ORD | 3.71% |

| 6 | CHINA NONFERROUS MINING CORP LTD ORD | 3.63% |

| 7 | ALUMINUM CORPORATION OF CHINA LTD ORD | 3.51% |

| 8 | MP MATERIALS CORP ORD | 3.47% |

| 9 | LYNAS RARE EARTHS LTD ORD | 3.43% |

| 10 | PRESS METAL ALUMINIUM HOLDINGS BHD ORD | 3.38% |

Top Ten Holdings make up 37% of the fund.

3i Infrastructure PLC: January 2026 Dividend

On Monday 12th Jan 2026, the listed infrastructure investor, 3i Infrastructure PLC paid out its dividend.

https://www.3i-infrastructure.com/

6.725p a share.

the total number of voting rights for 3i Infrastructure plc was 922,350,000

Thus:-

922,350,000 x £0.06725 = £62,028,037.5

That is £62 million paid to shareholders in 3i Infrastructure PLC

Courtesy of The London Stock Exchange

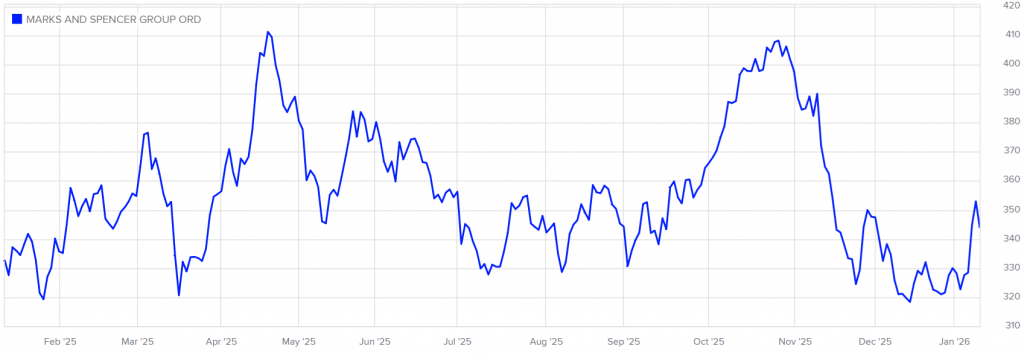

Marks and Spencer Group: Jan 2026 Dividend

On Friday 9th Jan 2026, the UK Flagship high street retailer paid out its Jan 2026 dividend.

https://corporate.marksandspencer.com

1.2p a share.

https://www.londonstockexchange.com/news-article/MKS/total-voting-rights/17396499

The Company’s capital consists of 2,057,140,555 ordinary shares with voting rights

Thus:-

2,057,140,555 x £0.012 = £24,685,686.66

That is £24million paid to shareholders in Marks & Sparks

Courtesy of The London Stock Exchange

MARKS AND SPENCER GROUP PLC MKS Stock | London Stock Exchange

Running Up That Hill….

Sad Reality of Modern Life “Everyone Is An Expert” :- Truth, there are few experts

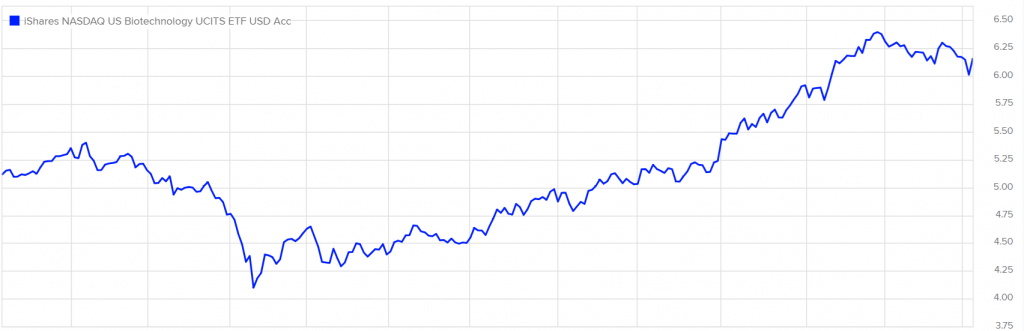

BTEK ISHARES NASDAQ US BIOTEC UCITS USD

The iShares Nasdaq US Biotechnology UCITS ETF seeks to track the investment results of an

index composed of biotechnology and pharmaceutical equities listed on the NASDAQ.

ISHARES BTEK Stock | London Stock Exchange

FromToTotal ReturnThis is an input box to enter up to four benchmarks that you want to compare with the base ric.Use left and right arrow keys to navigate, enter to create, delete to delete tags Only list items can be added as tagsThis is an input box to enter up to ten indicators.Use left and right arrow keys to navigate, enter to create, delete to delete tags Use up and down arrow keys to navigate list items and enter to add a new tag Only list items can be added as tags

Top holdings, as of 30 November 2025

| Rank | Name | % Weight |

|---|---|---|

| 1 | AMGEN INC ORD | 7.80 |

| 2 | GILEAD SCIENCES INC ORD | 7.24 |

| 3 | VERTEX PHARMACEUTICALS INC ORD | 7.20 |

| 4 | REGENERON PHARMACEUTICALS INC ORD | 6.33 |

| 5 | ALNYLAM PHARMACEUTICALS INC ORD | 4.61 |

| 6 | ASTRAZENECA ADR REP 0.5 ORD | 3.77 |

| 7 | INSMED INC ORD | 3.45 |

| 8 | ARGENX ADR REP ORD | 2.19 |

| 9 | BIOGEN INC ORD | 2.10 |

| 10 | UNITED THERAPEUTICS CORP ORD | 1.73 |

Courtesy of the London Stock Exchange

Net Assets of Fund (M) : 859.37 Million USD

Courtesy of the London Stock Exchange

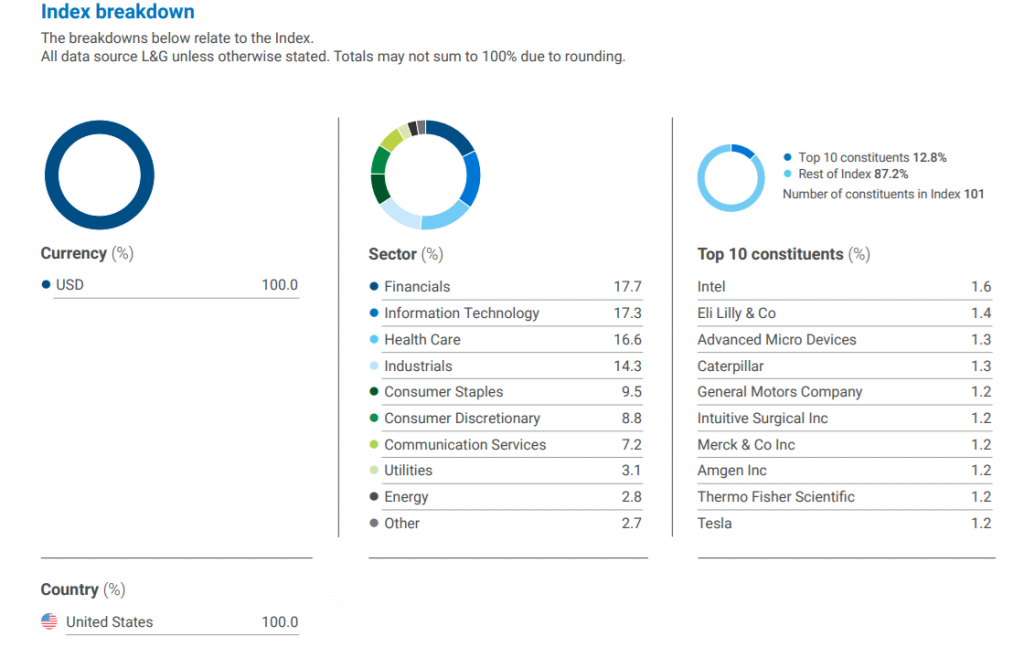

L&G S&P 100 Equal Weight UCITS ETF

The future of intelligence | Demis Hassabis

Bon Jovi: New Years Day

Cordiant Digital Infrastructure: Dec 2025 Dividend.

Cordiant Digital Infrastructure is the first UK-listed investment company to provide investors with dedicated exposure to the core infrastructure of the digital economy.

Home – Cordiant Digital Infrastructure Limited

On the 22nd Dec 2025 it paid out:-

| 2.175p | a share |

Shares In Issue: 765,715,477 thus:-

765,715,477 x £0.02175 = £16,654,311.62475

That is £16.654 Million

Courtesy of The London Stock Exchange

CORDIANT DIGITAL INFRASTRUCTURE LIMITED CORD Stock | London Stock Exchange

Gold: ETF Price Ascent

Bridgewater Associates Founder Ray Dalio Interview at the Oxford Union

Merry Xmas

Chris Rea – Loving You Again

BP December 2025 Dividend

Last week, on Friday 19th December, the UK Oil Major, paid out its December 2025 dividend

| $0.0832 = 6.2394p | a share |

Total Voting Rights – 12:00:01 01 Dec 2025 – BP. News article | London Stock Exchange

The total number of voting rights in BP p.l.c. is 15,657,405,169.

Thus:-

15,657,405,169 x £0.062394 = £976,928,138.114586 Million

£976,928,138.114586 Million = £976 Million paid to shareholders

BP PLC BP. Stock | London Stock Exchange

Courtesy of The London Stock Exchange

Dec 22nd (1887) Ramanujan’s Birthday

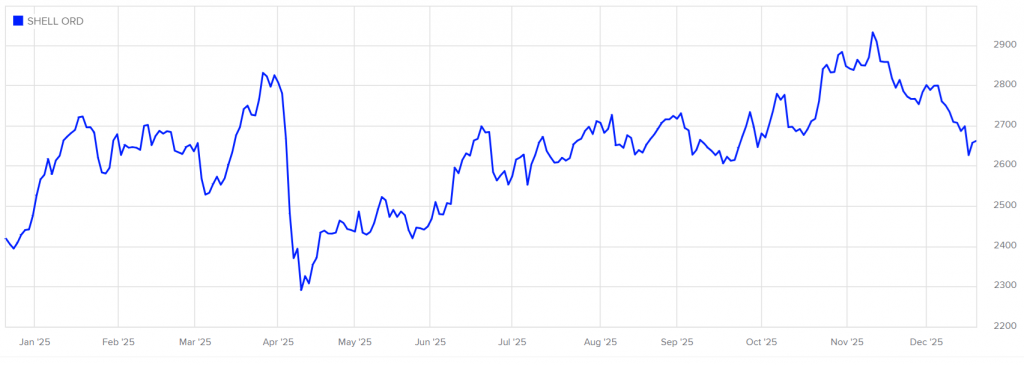

Shell PLC December 2025 Dividend

On Thursday 18th December, Shell PLC, the UK’s largest oil company and one of the world’s largest oil companies, paid out its December 2025 dividend.

$0.358 = 26.85p a share.

Voting Rights and Capital – 16:41:33 28 Nov 2025 – SHEL News article | London Stock Exchange

Shell plc’s capital as at November 28, 2025, consists of 5,750,420,233 ordinary shares of €0.07 each. Shell plc holds no shares in Treasury.

Thus:-

5,750,420,233 x £0.2685 = £1,543,987,832.5605 Million

1,543,987,832.5605 Million = £1.543 Billion paid to shareholders

SHELL PLC SHEL Stock | London Stock Exchange

Courtesy of The London Stock Exchange

HSBC December 2025 Dividend

Yesterday, Thursday 18th December, one of the world’s largest banks, HSBC Holdings PLC, paid out its December 2025 dividend.

$0.1 = 7.5079p a share.

Total Voting Rights – 15:01:01 28 Nov 2025 – HSBA News article | London Stock Exchange

The total number of voting rights in HSBC Holdings plc is 17,175,239,862

Thus:-

17,175,239,862 x £0.075079 = £1,289,499,833.599098 Million

£1,289,499,833.599098 Million = £1.289 Billion paid to shareholders.

HSBC HOLDINGS PLC HSBA Stock | London Stock Exchange

Courtesy of The London Stock Exchange

Micron

Andrew Ross Sorkin on What 1929 Teaches Us About 2025 | The New Yorker Interview

The Ascent of “Ag” Silver

Ray Dalio: We’re Heading Into Very, Very Dark Times! America & The UK’s Decline Is Coming!

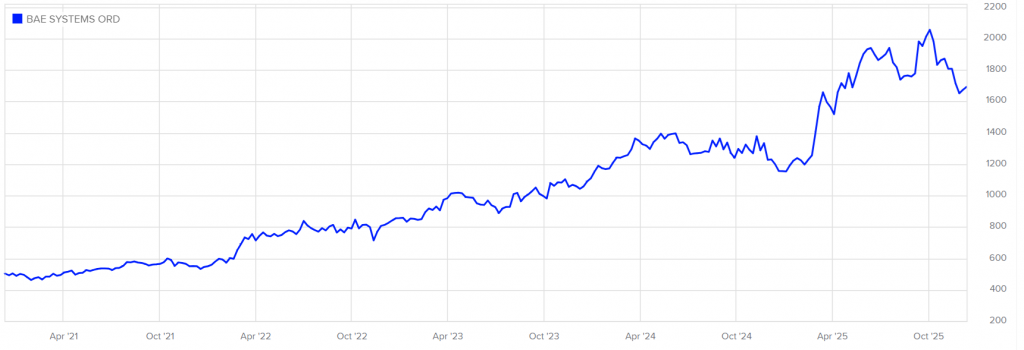

BAE Systems Plc December Dividend.

Last week the UK defence contractor, BAE Systems paid its Dec 2025 dividend

13.5p a share.

https://www.londonstockexchange.com/news-article/BA./total-voting-rights/17350280

On the 28th November 2025, BAE had total voting rights of 3,002,516,095

Thus:-

3,002,516,095 x £0.135 = £405,339,672.825

That is £405million paid to BAE Shareholders.

https://www.londonstockexchange.com/stock/BA./bae-systems-plc/analysis

Courtesy of The London Stock Exchange

The Thinking Game

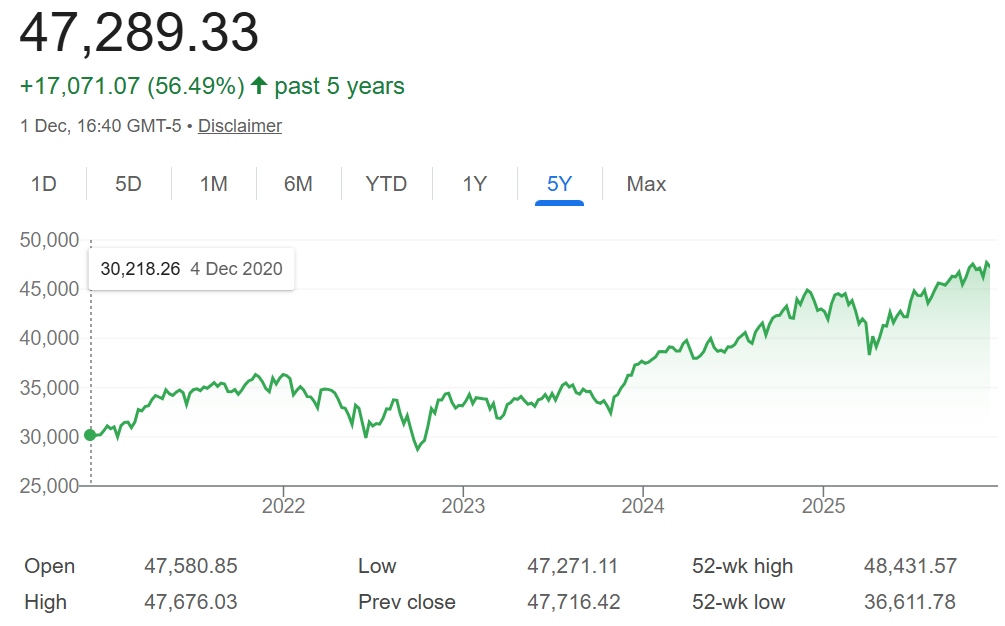

5 Years of the Dow Jones 30

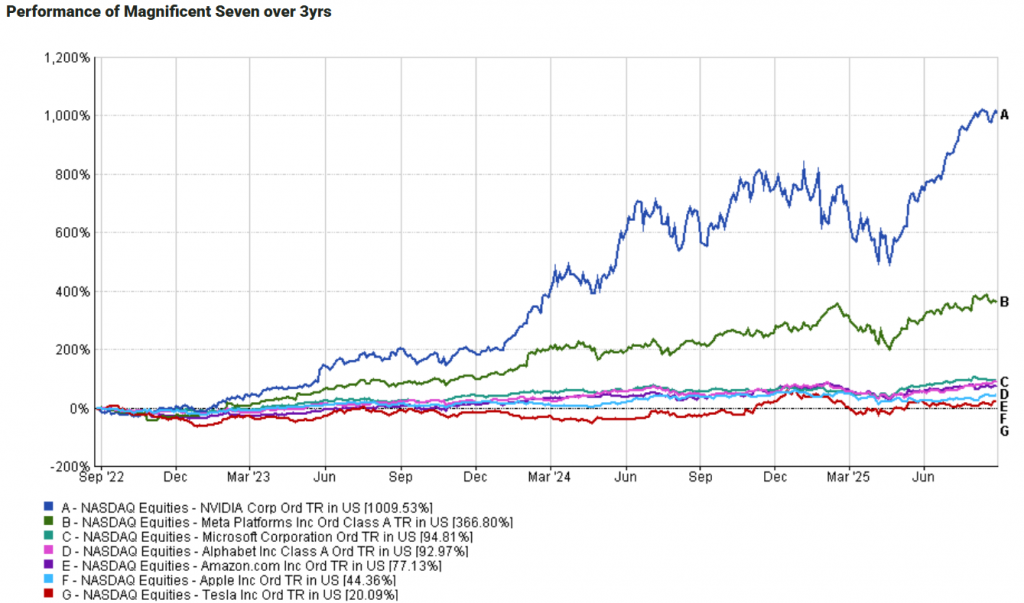

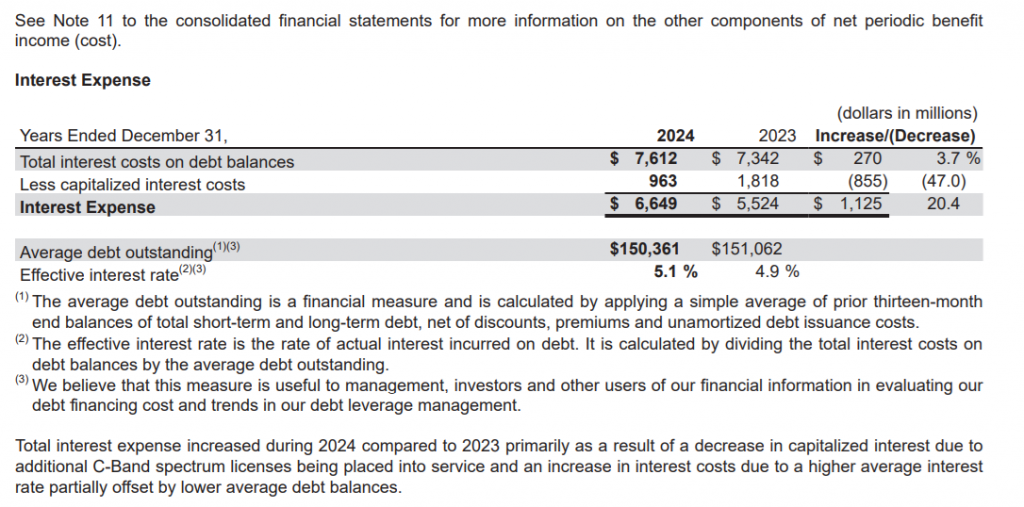

Verizon job losses; Verizon debt $151.501 Billion

The US telecommunications carrier, Verizon has announced 13,000 job losses:-

- Verizon job cuts are equal to 20% of non-union employee wage costs

- Wireless company to convert 179 company-owned retail stores to franchise operations

- Verizon to create $20 million fund to assist laid off employees with job search, skills in AI era

WASHINGTON, Nov 20 (Reuters) – U.S. wireless carrier Verizon (VZ.N) on Thursday said it will cut more than 13,000 jobs in its largest single layoff as it works to shrink costs and restructure operations.

Verizon cutting more than 13,000 jobs as it restructures | Reuters

However, it has a huge debt level: $151,501 Million = $151.5 Billion

From the 2024 annual report (the latest one published) we can see the interest payments on Verizon’s total debt is $7612 Million = £7.612 Billion.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION (annual report)

DEBT MATURING WITHIN ONE YEAR:-

Commercial Paper $0 $0

Verizon Communications Inc. $686 0.850% 20-Nov-2025

Verizon Communications Inc. $826 1.450% 20-Mar-2026

Verizon Communications Inc. $206 SOFR + 0.79% 20-Mar-2026

Verizon Communications Inc. $4 1.100% 15-Jun-2026

Verizon Communications Inc. $2 1.050% 15-Jun-2026 1,723

Private Placements $17,530 $17,530

TOTAL DEBT MATURING WITHIN ONE YEAR: $ 19,253

LONG TERM DEBT:

Verizon Pennsylvania LLC $44 6.000% 1-Dec-2028

Verizon Pennsylvania LLC $31 8.350% 15-Dec-2030

Verizon Pennsylvania LLC $35 8.750% 15-Aug-2031 $110

Verizon Maryland LLC $20 8.000% 15-Oct-2029

Verizon Maryland LLC $21 8.300% 1-Aug-2031

Verizon Maryland LLC $139 5.125% 15-Jun-2033 $180

Verizon Virginia LLC $9 8.375% 1-Oct-2029 $9

Verizon Delaware LLC $2 8.625% 15-Oct-2031 $2

Verizon New Jersey Inc. $45 7.850% 15-Nov-2029 $45

Verizon New England Inc. $133 7.875% 15-Nov-2029 $133

Verizon New York Inc. $35 6.500% 15-Apr-2028

Verizon New York Inc. $99 7.375% 1-Apr-2032 $134

Alltel Corporation $38 6.800% 1-May-2029

Alltel Corporation $56 7.875% 1-Jul-2032 $94

Verizon Communications Inc. € 746 (a) 1.375% 27-Oct-2026

Verizon Communications Inc. $2,357 4.125% 16-Mar-2027

Verizon Communications Inc. $463 3.000% 22-Mar-2027

Verizon Communications Inc. € 623 (a) 0.875% 8-Apr-2027

Verizon Communications Inc. CHF 400 (a) 1.000% 30-Nov-2027

Verizon Communications Inc. $2,130 2.100% 22-Mar-2028

Verizon Communications Inc. CAD 1,000 (a) 2.375% 22-Mar-2028

Verizon Communications Inc. CHF 375 (a) 0.193% 24-Mar-2028

Verizon Communications Inc. $250 6.940% 15-Apr-2028

Verizon Communications Inc. $2,786 4.329% 21-Sep-2028

Verizon Communications Inc. € 750 (a) 1.375% 2-Nov-2028

Verizon Communications Inc. € 60 (a) 1.375% 2-Nov-2028

Verizon Communications Inc. € 250 (a) 1.375% 2-Nov-2028

Verizon Communications Inc. € 600 (a) 1.125% 3-Nov-2028

Verizon Communications Inc. $1,000 3.875% 8-Feb-2029

Verizon Communications Inc. € 1,000 (a) 0.375% 22-Mar-2029

Verizon Communications Inc. $2 3.500% 15-Apr-2029

Verizon Communications Inc. $105 6.800% 1-May-2029

Verizon Communications Inc. $1 4.000% 15-May-2029

Verizon Communications Inc. $3 4.150% 15-May-2029

Verizon Communications Inc. $0 3.900% 15-May-2029

Verizon Communications Inc. $1 5.100% 15-May-2029

Verizon Communications Inc. $1 5.000% 15-May-2029

Verizon Communications Inc. $1 5.000% 15-May-2029

Verizon Communications Inc. $2 3.950% 15-Jun-2029

Verizon Communications Inc. $1 3.800% 15-Jun-2029

Verizon Communications Inc. $0 3.850% 15-Jun-2029

Verizon Communications Inc. $0 4.300% 15-Jun-2029

Verizon Communications Inc. $0 5.000% 15-Jun-2029

Verizon Communications Inc. $2 5.000% 15-Jun-2029

Verizon Communications Inc. $1 5.000% 15-Jun-2029

Verizon Communications Inc. $0 3.800% 15-Aug-2029

Verizon Communications Inc. $1 4.000% 15-Aug-2029

Verizon Communications Inc. $0 3.900% 15-Aug-2029

Verizon Communications Inc. $2 4.600% 15-Aug-2029

Verizon Communications Inc. $0 4.450% 15-Aug-2029

Verizon Communications Inc. $1 4.400% 15-Aug-2029

Verizon Communications Inc. $1 4.100% 15-Sep-2029

Verizon Communications Inc. $0 4.500% 15-Sep-2029

Verizon Communications Inc. $1 4.500% 15-Sep-2029

Verizon Communications Inc. $1 4.800% 15-Sep-2029

Verizon Communications Inc. $1 4.150% 15-Sep-2029

Verizon Communications Inc. $2 4.050% 15-Sep-2029

Verizon Communications Inc. $2 4.050% 15-Oct-2029

Verizon Communications Inc. € 750 (a) 1.875% 26-Oct-2029

Verizon Communications Inc. $1 5.550% 15-Nov-2029

Verizon Communications Inc. $3 5.600% 15-Nov-2029

Verizon Communications Inc. $3 5.150% 15-Nov-2029

Verizon Communications Inc. $3,366 4.016% 3-Dec-2029

Verizon Communications Inc. $3 5.000% 15-Dec-2029

Verizon Communications Inc. $0 4.700% 15-Dec-2029

Verizon Communications Inc. $1 4.700% 15-Dec-2029

Verizon Communications Inc. $1 4.800% 15-Feb-2030

Verizon Communications Inc. $1 5.050% 15-Mar-2030

Verizon Communications Inc. $1 5.150% 15-Mar-2030

Verizon Communications Inc. $1 5.150% 15-Mar-2030

Verizon Communications Inc. $1,151 3.150% 22-Mar-2030

Verizon Communications Inc. € 1,250 (a) 1.250% 8-Apr-2030

Verizon Communications Inc. $1 1.900% 15-May-2030

Verizon Communications Inc. $1 2.050% 15-May-2030

Verizon Communications Inc. $1 4.650% 15-May-2030

Verizon Communications Inc. $0 4.700% 15-May-2030

Verizon Communications Inc. $1 4.700% 15-May-2030

Verizon Communications Inc. CAD 1,000 (a) 2.500% 16-May-2030

Verizon Communications Inc. $0 1.850% 15-Jun-2030

Verizon Communications Inc. $1 5.000% 15-Jun-2030

Verizon Communications Inc. $1 5.050% 15-Jun-2030

Verizon Communications Inc. $1 5.000% 15-Jul-2030

Verizon Communications Inc. $1 5.250% 15-Aug-2030

Verizon Communications Inc. $0 5.300% 15-Aug-2030

Verizon Communications Inc. $0 5.150% 15-Aug-2030

Verizon Communications Inc. $0 5.400% 15-Aug-2030

Verizon Communications Inc. $1 5.400% 15-Sep-2030

Verizon Communications Inc. $1 5.450% 15-Sep-2030

Verizon Communications Inc. $1 5.500% 15-Sep-2030

Verizon Communications Inc. $1,000 1.500% 18-Sep-2030

Verizon Communications Inc. £550 (a) 1.875% 19-Sep-2030

Verizon Communications Inc. $2 5.600% 15-Oct-2030

Verizon Communications Inc. $784 1.680% 30-Oct-2030

Verizon Communications Inc. € 1,250 (a) 4.250% 31-Oct-2030

Verizon Communications Inc. $2 1.650% 15-Nov-2030

Verizon Communications Inc. $2 5.900% 15-Nov-2030

Verizon Communications Inc. $1 5.550% 15-Nov-2030

Verizon Communications Inc. $2 5.650% 15-Nov-2030

Verizon Communications Inc. $529 7.750% 1-Dec-2030

Verizon Communications Inc. $0 1.600% 15-Dec-2030

Verizon Communications Inc. $2 5.300% 15-Dec-2030

Verizon Communications Inc. $1 5.000% 15-Dec-2030

Verizon Communications Inc. $4 5.100% 15-Dec-2030

Verizon Communications Inc. $2,173 1.750% 20-Jan-2031

Verizon Communications Inc. $0 4.900% 15-Mar-2031

Verizon Communications Inc. $0 4.900% 15-Mar-2031

Verizon Communications Inc. $0 4.800% 15-Mar-2031

Verizon Communications Inc. $3,608 2.550% 21-Mar-2031

Verizon Communications Inc. CHF 325 (a) 0.555% 24-Mar-2031

Verizon Communications Inc. £500 (a) 2.500% 8-Apr-2031

Verizon Communications Inc. $5 2.350% 15-May-2031

Verizon Communications Inc. $4 2.350% 15-Jun-2031

Verizon Communications Inc. $3 2.200% 15-Jun-2031

Verizon Communications Inc. $1 2.650% 15-Aug-2031

Verizon Communications Inc. $2 2.000% 15-Aug-2031

Verizon Communications Inc. $2 2.150% 15-Sep-2031

Verizon Communications Inc. € 1,000 (a) 2.625% 1-Dec-2031

Verizon Communications Inc. $4,467 2.355% 15-Mar-2032

Verizon Communications Inc. € 800 (a) 0.875% 19-Mar-2032

Verizon Communications Inc. € 1,000 (a) 0.750% 22-Mar-2032

Verizon Communications Inc. $107 7.750% 15-Jun-2032

Verizon Communications Inc. € 1,000 (a) 3.500% 28-Jun-2032

Verizon Communications Inc. $101 7.875% 1-Jul-2032

Verizon Communications Inc. € 1,000 (a) 3.500% 29-Oct-2032

Verizon Communications Inc. $1,000 5.050% 9-May-2033

Verizon Communications Inc. $7 2.550% 15-May-2033

Verizon Communications Inc. € 1,350 (a) 1.300% 18-May-2033

Verizon Communications Inc. $2 2.550% 15-Jun-2033

Verizon Communications Inc. $2 2.550% 15-Jun-2033

Verizon Communications Inc. $0 5.100% 15-Jun-2033

Verizon Communications Inc. $2 2.300% 15-Jul-2033

Verizon Communications Inc. $2,137 4.500% 10-Aug-2033

Verizon Communications Inc. $4 2.200% 15-Aug-2033

Verizon Communications Inc. $1 2.200% 15-Aug-2033

Verizon Communications Inc. $354 6.400% 15-Sep-2033

Verizon Communications Inc. $1 2.200% 15-Sep-2033

Verizon Communications Inc. $3 2.250% 15-Sep-2033

Verizon Communications Inc. $2 2.450% 15-Nov-2033

Verizon Communications Inc. $1 2.350% 15-Nov-2033

Verizon Communications Inc. $1 2.450% 15-Nov-2033

Verizon Communications Inc. $2 2.550% 15-Dec-2033

Verizon Communications Inc. $1 2.400% 15-Dec-2033

Verizon Communications Inc. £457 (a) 4.750% 17-Feb-2034

Verizon Communications Inc. $151 5.050% 15-Mar-2034

Verizon Communications Inc. $1 5.000% 15-Mar-2034

Verizon Communications Inc. $1 4.950% 15-Apr-2034

Verizon Communications Inc. $0 4.300% 15-May-2034

Verizon Communications Inc. $1 4.550% 15-May-2034

Verizon Communications Inc. $1 5.300% 15-May-2034

Verizon Communications Inc. $1 5.150% 15-May-2034

Verizon Communications Inc. $2 5.150% 15-May-2034

Verizon Communications Inc. $0 5.100% 15-Jun-2034

Verizon Communications Inc. $0 5.150% 15-Jun-2034

Verizon Communications Inc. $1 5.150% 15-Jun-2034

Verizon Communications Inc. € 1,250 (a) 4.750% 31-Oct-2034

Verizon Communications Inc. $1,888 4.400% 1-Nov-2034

Verizon Communications Inc. $2,191 4.780% 15-Feb-2035

Verizon Communications Inc. $2,250 5.250% 2-Apr-2035

Verizon Communications Inc. $278 5.850% 15-Sep-2035

Verizon Communications Inc. $142 5.850% 15-Sep-2035

Verizon Communications Inc. € 750 (a) 1.125% 19-Sep-2035

Verizon Communications Inc. £450 (a) 3.125% 2-Nov-2035

Verizon Communications Inc. $1,290 4.272% 15-Jan-2036

Verizon Communications Inc. € 1,000 (a) 3.750% 28-Feb-2036

Verizon Communications Inc. $5 5.050% 15-Aug-2036

Verizon Communications Inc. $1 5.000% 15-Aug-2036

Verizon Communications Inc. $1 4.900% 15-Aug-2036

Verizon Communications Inc. £1,000 (a) 3.375% 27-Oct-2036

Verizon Communications Inc. $1,095 5.250% 16-Mar-2037

Verizon Communications Inc. $241 6.250% 1-Apr-2037

Verizon Communications Inc. $2,162 5.401% 2-Jul-2037

Verizon Communications Inc. € 1,000 (a) 3.500% 6-Aug-2037

Verizon Communications Inc. € 1,500 (a) 2.875% 15-Jan-2038

Verizon Communications Inc. $172 6.400% 15-Feb-2038

Verizon Communications Inc. $152 6.900% 15-Apr-2038

Verizon Communications Inc. £600 (a) 1.875% 3-Nov-2038

Verizon Communications Inc. $107 8.950% 1-Mar-2039

Verizon Communications Inc. $1,136 4.812% 15-Mar-2039

Verizon Communications Inc. $6 4.250% 15-Mar-2039

Verizon Communications Inc. $112 7.350% 1-Apr-2039

Verizon Communications Inc. $2 4.050% 15-Apr-2039

Verizon Communications Inc. $6 4.000% 15-May-2039

Verizon Communications Inc. $5 4.000% 15-May-2039

Verizon Communications Inc. $5 4.000% 15-May-2039

Verizon Communications Inc. € 500 (a) 1.500% 19-Sep-2039

Verizon Communications Inc. € 800 (a) 1.850% 18-May-2040

Verizon Communications Inc. $2,552 2.650% 20-Nov-2040

Verizon Communications Inc. $3,003 3.400% 22-Mar-2041

Verizon Communications Inc. $122 6.000% 1-Apr-2041

Verizon Communications Inc. $1,000 2.850% 3-Sep-2041

Verizon Communications Inc. $488 4.750% 1-Nov-2041

Verizon Communications Inc. $634 3.850% 1-Nov-2042

Verizon Communications Inc. $803 6.550% 15-Sep-2043

Verizon Communications Inc. $910 4.125% 15-Aug-2046

Verizon Communications Inc. $2,360 4.862% 21-Aug-2046

Verizon Communications Inc. $457 5.500% 16-Mar-2047

Verizon Communications Inc. $173 4.900% 15-May-2047

Verizon Communications Inc. $25 4.750% 15-Jun-2047

Verizon Communications Inc. $26 4.700% 15-Jun-2047

Verizon Communications Inc. $12 4.550% 15-Jul-2047

Verizon Communications Inc. $42 4.800% 15-Aug-2047

Verizon Communications Inc. $18 4.800% 15-Aug-2047

Verizon Communications Inc. $33 4.900% 15-Aug-2047

Verizon Communications Inc. $25 4.850% 15-Aug-2047

Verizon Communications Inc. $14 4.750% 15-Sep-2047

Verizon Communications Inc. $13 4.750% 15-Sep-2047

Verizon Communications Inc. $26 4.700% 15-Sep-2047

Verizon Communications Inc. $35 4.700% 15-Nov-2047

Verizon Communications Inc. $32 4.700% 15-Nov-2047

Verizon Communications Inc. $14 4.650% 15-Nov-2047

Verizon Communications Inc. $18 4.650% 15-Nov-2047

Verizon Communications Inc. $15 4.550% 15-Dec-2047

Verizon Communications Inc. $12 4.500% 15-Dec-2047

Verizon Communications Inc. $20 4.500% 15-Dec-2047

Verizon Communications Inc. $12 4.550% 15-Feb-2048

Verizon Communications Inc. $4 4.450% 15-Feb-2048

Verizon Communications Inc. $4 4.550% 15-Feb-2048

Verizon Communications Inc. $11 4.750% 15-Feb-2048

Verizon Communications Inc. $8 4.750% 15-Mar-2048

Verizon Communications Inc. $6 4.750% 15-Mar-2048

Verizon Communications Inc. $6 4.750% 15-Mar-2048

Verizon Communications Inc. $7 4.800% 15-Mar-2048

Verizon Communications Inc. $15 4.850% 15-Apr-2048

Verizon Communications Inc. $4 4.850% 15-May-2048

Verizon Communications Inc. $6 4.850% 15-May-2048

Verizon Communications Inc. $9 4.900% 15-May-2048

Verizon Communications Inc. $4 4.850% 15-May-2048

Verizon Communications Inc. $47 5.000% 15-Jun-2048

Verizon Communications Inc. $8 4.950% 15-Jun-2048

Verizon Communications Inc. $10 4.900% 15-Jun-2048

Verizon Communications Inc. $34 5.050% 15-Jul-2048

Verizon Communications Inc. $5 4.800% 15-Aug-2048

Verizon Communications Inc. $2 4.700% 15-Aug-2048

Verizon Communications Inc. $2 4.650% 15-Aug-2048

Verizon Communications Inc. $4 4.800% 15-Aug-2048

Verizon Communications Inc. $2 4.650% 15-Aug-2048

Verizon Communications Inc. $1,247 4.522% 15-Sep-2048

Verizon Communications Inc. $4 4.850% 15-Sep-2048

Verizon Communications Inc. $3 4.700% 15-Sep-2048

Verizon Communications Inc. $2 4.700% 15-Sep-2048

Verizon Communications Inc. $2 4.750% 15-Oct-2048

Verizon Communications Inc. $7 5.000% 15-Nov-2048

Verizon Communications Inc. $5 5.000% 15-Nov-2048

Verizon Communications Inc. $1 4.900% 15-Nov-2048

Verizon Communications Inc. $6 5.000% 15-Dec-2048

Verizon Communications Inc. $1 4.900% 15-Dec-2048

Verizon Communications Inc. $2 4.850% 15-Jan-2049

Verizon Communications Inc. $5 4.550% 15-Feb-2049

Verizon Communications Inc. $3 4.500% 15-Mar-2049

Verizon Communications Inc. $1 4.550% 15-Mar-2049

Verizon Communications Inc. $3 4.500% 15-Mar-2049

Verizon Communications Inc. $697 5.012% 15-Apr-2049

Verizon Communications Inc. $2 4.050% 15-May-2049

Verizon Communications Inc. $2 4.100% 15-Jun-2049

Verizon Communications Inc. $4 4.050% 15-Jun-2049

Verizon Communications Inc. $4 3.500% 15-Aug-2049

Verizon Communications Inc. $3 3.500% 15-Aug-2049

Verizon Communications Inc. $1 3.300% 15-Sep-2049

Verizon Communications Inc. $5 3.550% 15-Sep-2049

Verizon Communications Inc. $6 3.550% 15-Oct-2049

Verizon Communications Inc. $7 3.550% 15-Oct-2049

Verizon Communications Inc. $2 3.500% 15-Nov-2049

Verizon Communications Inc. $2 3.550% 15-Nov-2049

Verizon Communications Inc. $3 3.500% 15-Nov-2049

Verizon Communications Inc. $2 3.450% 15-Dec-2049

Verizon Communications Inc. $2 3.450% 15-Dec-2049

Verizon Communications Inc. $2 3.400% 15-Dec-2049

Verizon Communications Inc. $2 3.000% 15-Mar-2050

Verizon Communications Inc. $1,138 4.000% 22-Mar-2050

Verizon Communications Inc. $0 2.750% 15-May-2050

Verizon Communications Inc. $1 2.950% 15-May-2050

Verizon Communications Inc. $1 2.950% 15-May-2050

Verizon Communications Inc. CAD 300 (a) 3.625% 16-May-2050

Verizon Communications Inc. $3 2.800% 15-Jun-2050

Verizon Communications Inc. $950 5.150% 15-Sep-2050

Verizon Communications Inc. $3 2.750% 15-Nov-2050

Verizon Communications Inc. $2,239 2.875% 20-Nov-2050

Verizon Communications Inc. $1 2.650% 15-Dec-2050

Verizon Communications Inc. $510 5.000% 15-Mar-2051

Verizon Communications Inc. $3,593 3.550% 22-Mar-2051

Verizon Communications Inc. CAD 500 (a) 4.050% 22-Mar-2051

Verizon Communications Inc. $4 3.350% 15-May-2051

Verizon Communications Inc. $4 3.400% 15-May-2051

Verizon Communications Inc. $3 3.350% 15-Jun-2051

Verizon Communications Inc. $3 3.400% 15-Jun-2051

Verizon Communications Inc. $4 3.350% 15-Jun-2051

Verizon Communications Inc. $4 3.250% 15-Jun-2051

Verizon Communications Inc. $3 3.050% 15-Jul-2051

Verizon Communications Inc. $1 2.950% 15-Aug-2051

Verizon Communications Inc. $4 3.000% 15-Aug-2051

Verizon Communications Inc. $4 3.000% 15-Aug-2051

Verizon Communications Inc. $3 3.000% 15-Sep-2051

Verizon Communications Inc. $4 3.050% 15-Sep-2051

Verizon Communications Inc. $1 2.950% 15-Sep-2051

Verizon Communications Inc. $2 2.900% 15-Sep-2051

Verizon Communications Inc. $4 3.100% 15-Nov-2051

Verizon Communications Inc. $2 3.000% 15-Nov-2051

Verizon Communications Inc. $2 3.050% 15-Nov-2051

Verizon Communications Inc. $1 3.050% 15-Dec-2051

Verizon Communications Inc. $1 3.050% 15-Dec-2051

Verizon Communications Inc. $0 2.900% 15-Dec-2051

Verizon Communications Inc. $1 3.050% 15-Dec-2051

Verizon Communications Inc. $1,000 3.875% 1-Mar-2052

Verizon Communications Inc. $1 4.000% 15-Apr-2052

Verizon Communications Inc. $0 4.550% 15-May-2052

Verizon Communications Inc. $0 4.800% 15-May-2052

Verizon Communications Inc. $0 4.650% 15-May-2052

Verizon Communications Inc. $0 4.650% 15-Jun-2052

Verizon Communications Inc. $0 4.450% 15-Jun-2052

Verizon Communications Inc. $0 4.450% 15-Jun-2052

Verizon Communications Inc. $1 4.600% 15-Aug-2052

Verizon Communications Inc. $0 4.650% 15-Aug-2052

Verizon Communications Inc. $0 4.650% 15-Aug-2052

Verizon Communications Inc. $0 4.850% 15-Sep-2052

Verizon Communications Inc. $730 5.320% 2-May-2053

Verizon Communications Inc. $1 5.450% 15-Jun-2053

Verizon Communications Inc. $2 5.400% 15-Jul-2053

Verizon Communications Inc. $1 5.500% 15-Aug-2053

Verizon Communications Inc. $1 5.800% 15-Aug-2053

Verizon Communications Inc. $1 5.800% 15-Aug-2053

Verizon Communications Inc. $0 5.900% 15-Aug-2053

Verizon Communications Inc. $0 5.750% 15-Sep-2053

Verizon Communications Inc. $0 5.800% 15-Sep-2053

Verizon Communications Inc. $1 5.900% 15-Sep-2053

Verizon Communications Inc. $0 5.950% 15-Oct-2053

Verizon Communications Inc. $3 6.400% 15-Nov-2053

Verizon Communications Inc. $0 6.100% 15-Nov-2053

Verizon Communications Inc. $1 6.050% 15-Nov-2053

Verizon Communications Inc. $1 5.750% 15-Dec-2053

Verizon Communications Inc. $1 5.450% 15-Dec-2053

Verizon Communications Inc. $1 5.400% 15-Dec-2053

Verizon Communications Inc. $1,000 5.500% 23-Feb-2054

Verizon Communications Inc. $0 5.300% 15-Mar-2054

Verizon Communications Inc. $5 5.400% 15-Mar-2054

Verizon Communications Inc. $1 5.300% 15-Mar-2054

Verizon Communications Inc. $1 5.300% 15-Mar-2054

Verizon Communications Inc. $0 5.250% 15-Apr-2054

Verizon Communications Inc. $794 5.012% 21-Aug-2054

Verizon Communications Inc. $3 5.150% 15-Sep-2054

Verizon Communications Inc. $3 5.100% 15-Sep-2054

Verizon Communications Inc. $2 5.050% 15-Oct-2054

Verizon Communications Inc. $655 4.100% 4-Mar-2055

Verizon Communications Inc. $723 4.672% 15-Mar-2055

Verizon Communications Inc. $3,651 2.987% 30-Oct-2056

Verizon Communications Inc. $2,385 3.600% 24-Feb-2060

Verizon Communications Inc. $1,123 3.000% 29-Sep-2060

Verizon Communications Inc. $1,894 3.000% 20-Nov-2060

Verizon Communications Inc. $2,978 3.700% 22-Mar-2061 $114,591

Private Placements $16,949 $16,949

TOTAL LONG TERM DEBT: $ 132,248

TOTAL DEBT AS OF September 30, 2025 $ 151,501

Indexation:-

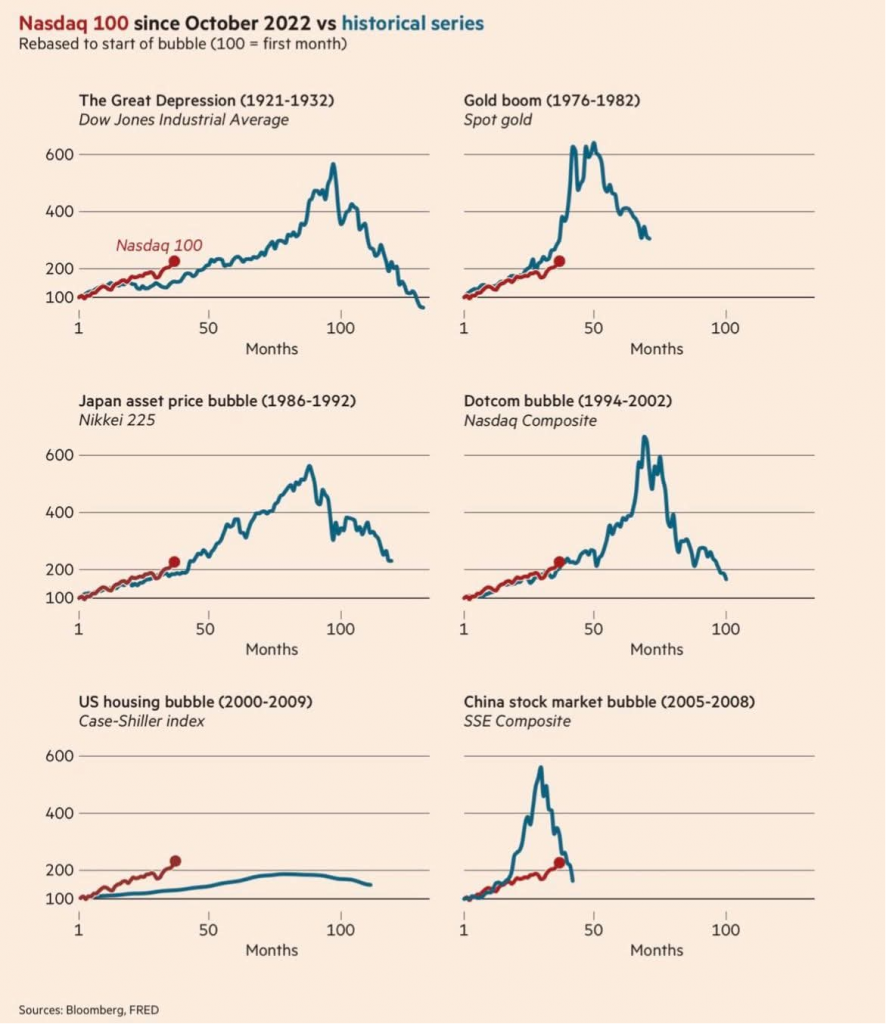

Bubbles

A tribute: Jimmy Cliff

Courtesy of The BBC

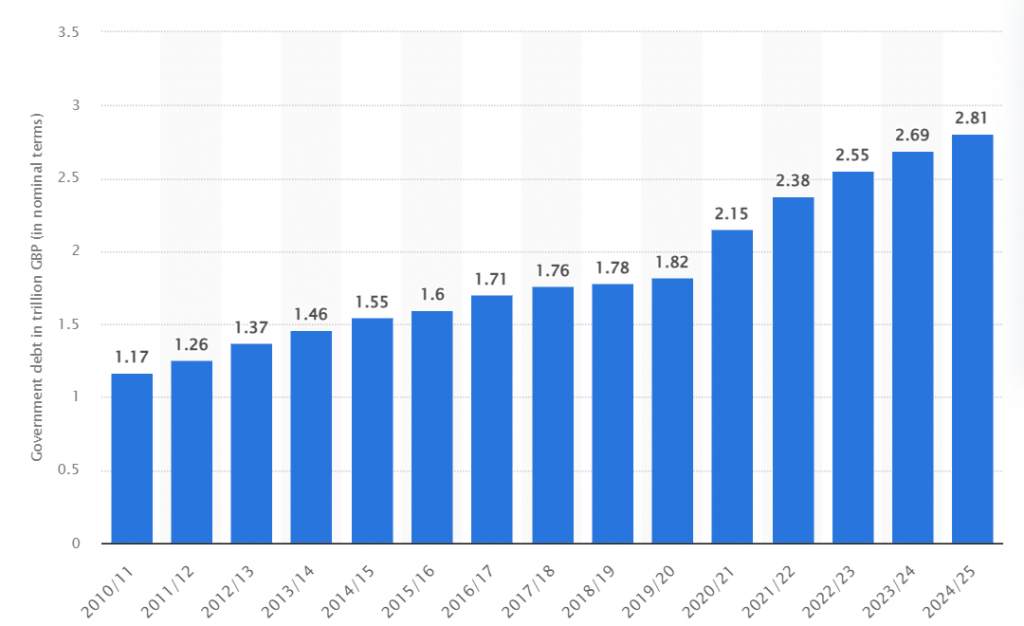

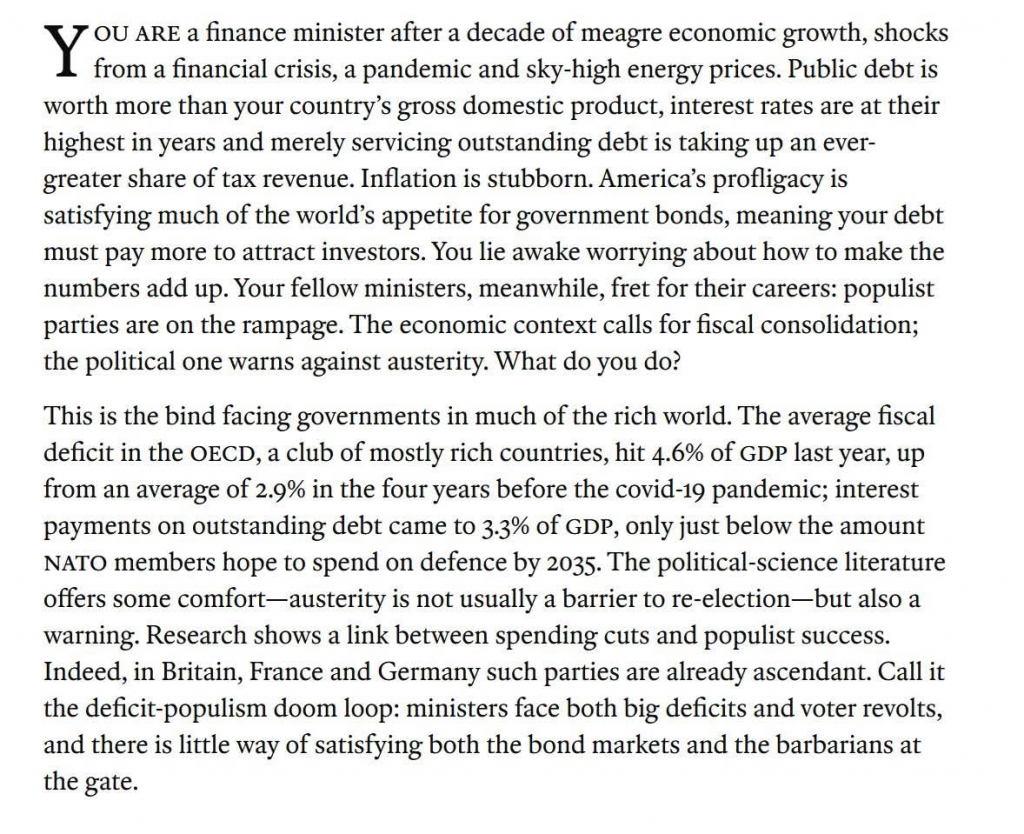

Breaking Manifesto Pledges: UK National Debt, why taxes have to rise.

Tomorrow the Chancellor of the Exchequer will announced the long awaited budget. For weeks we have seen the bond market reacting to ill timed and ill advised leaks, undermining confidence in the UK Gilt market. Lenders to UK Government have to have confidence in the UK able to pay on the debts outstanding, and also lenders need to have confidence in the UK to lend new money.

When the government spends more than it receives in tax and other revenues it borrows to cover the difference. This borrowing is known as ‘public sector net borrowing’ but is often referred to as the deficit.

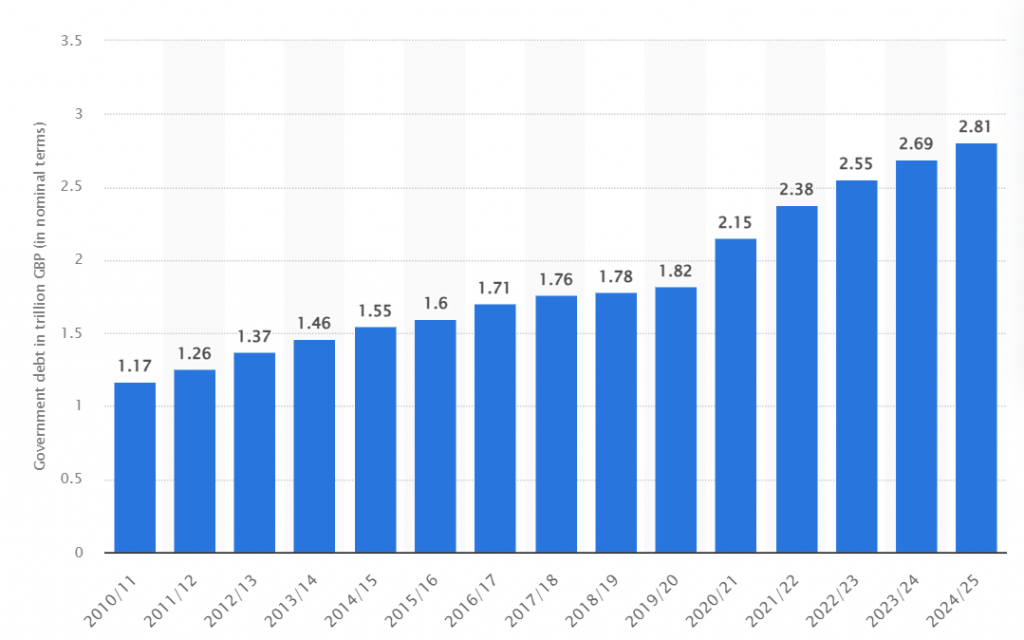

Total public sector net debt in the United Kingdom from 2010/11 to 2024/25

Courtesy of [UK government debt 2025| Statista]

One can see each year the HM Government has been spending more than it earns in taxation over the last 15 years. This is NOT sustainable. Consequently, debt interest payments are now above £100 billion a year, and the OBR has warned that, without action, debt could rise to 270 per cent of GDP by the early 2070s. Note, £100 billion interests is money that can NOT be paid finance our brave armed forces, or build new schools.

In 2024-25, it is expected public spending to amount to £1,278.6 billion, and thus out of that £1278 billion, £100 billion is on debt interest.

Also we are seeing huge media speculation on whether the Chancellor of the Exchequer will break the election promise in the party manifesto of not increase taxes, and this speculation has now become normalised on social media with arm chair political economists saying the Chancellor of the Exchequer will break an election pledge, these ‘experts’ have zero knowledge of the importance of the bond market or a decent grasp of economics.

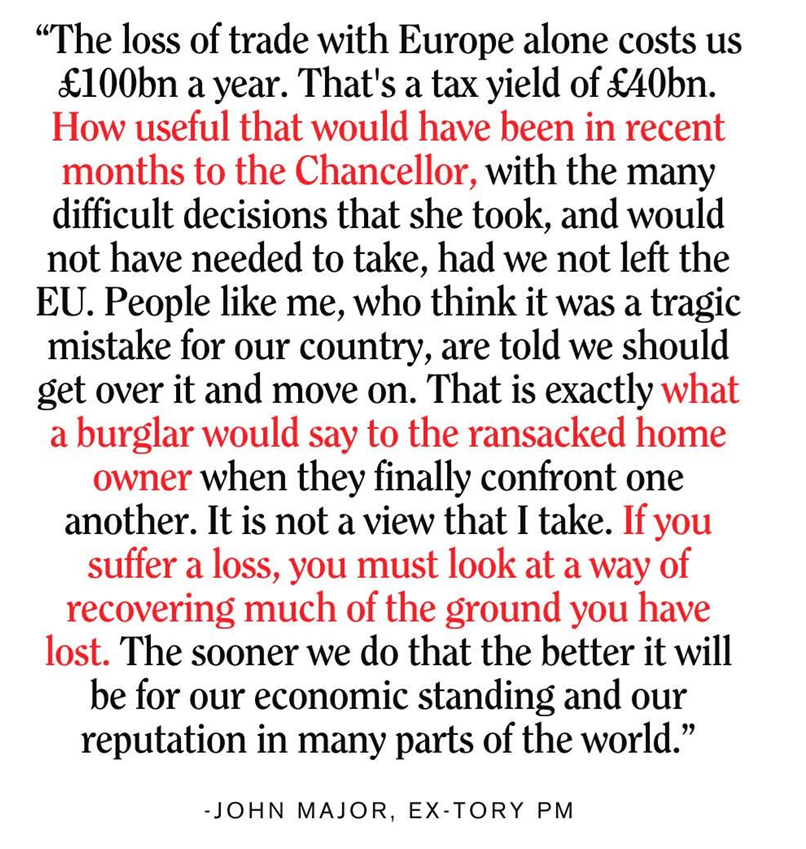

However in the interests of fairness and equality it was David Cameron who maintained his promise and manifesto pledge to ask the UK population for the referendum on the UK continued membership the European Union, and he kept his promise:-

Courtesy of John Major

As shown above, keeping manifesto pledges is NOT a holy or sacred act.

The UK needs to raise taxes to be able to fund the annual budget deficit, if not, the UK Government can not actually fund day to day operations. It needs that funding to finance public services, and if we do NOT, we face a Liz Truss / Kwasi Kwarteng moment, where the UK struggles to raise money, with borrowing costs surge, as lenders get worried over economic competence and stewardship of the UK economy. Sadly, taxes will have to rise, and breaking that manifesto pledge is the right things to do for the UK Government to be able borrow from on the Bond Market and fund public services.

Are Higher Taxes Inevitable for the UK? Economic Analysis from IFS Director | Pod Save the UK

Are Higher Taxes Inevitable for the UK? Economic Analysis from former IFS Director.

UK Taxes NEED to rise, to keep confidence with our creditors.

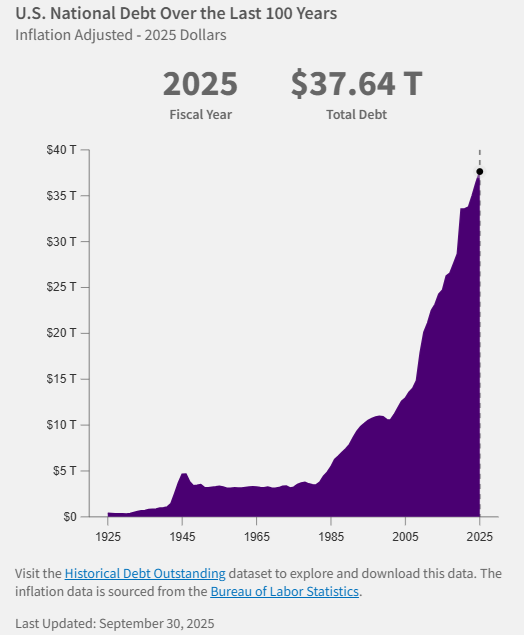

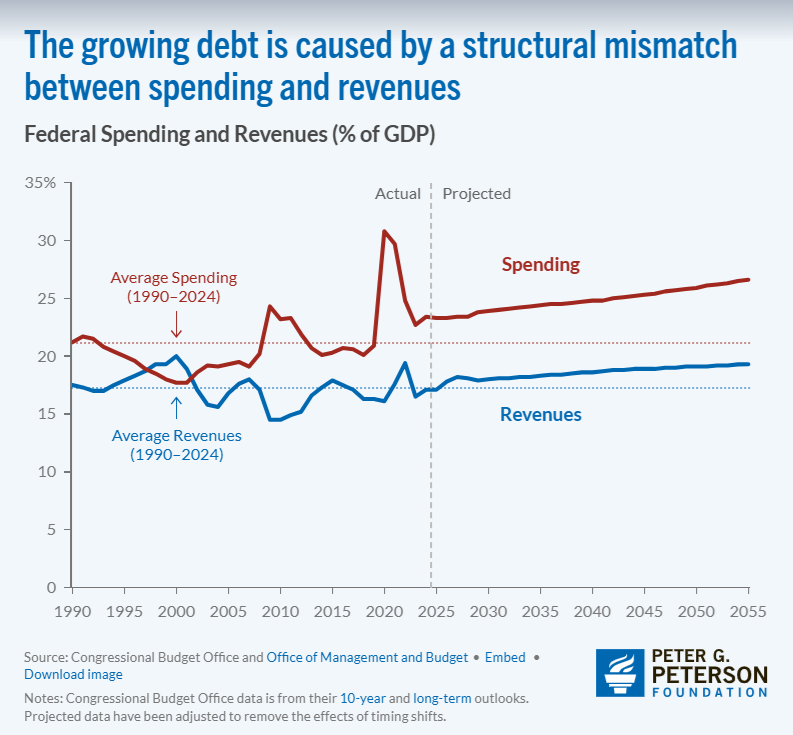

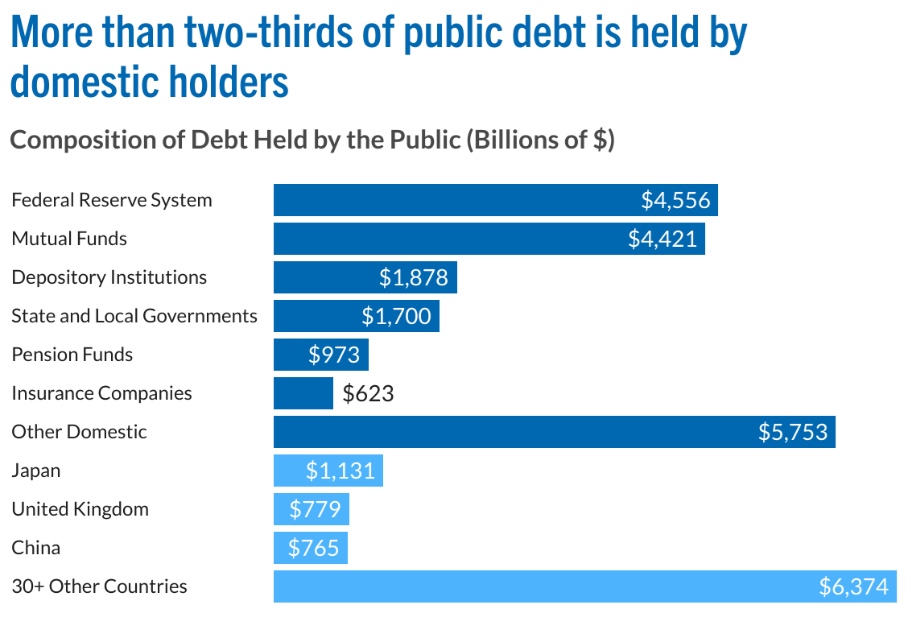

US National Debt

Courtesy of the Peter G Peterson Foundation

Why is the National Debt so high?

America’s growing debt is the result of simple math — each year, there is a mismatch between spending and revenues. When the federal government spends more than it takes in, it has to borrow money to cover that annual deficit. And each year’s deficit adds to the USA’s growing national debt.

Historically, the largest deficits were caused by increased spending around national emergencies like major wars or the Great Depression. Today, deficits are caused mainly by predictable structural factors: our aging baby-boom generation, rising healthcare costs, higher interest rates, and a tax system that does not bring in enough money to pay for what the government has promised its citizens. Moving forward, it will be critical for America’s leaders to address our rising debt, and its structural factors, which are described below.

Courtesy of the Peter G Peterson Foundation

Tesco Dividend November 2025

Today, Tesco PLC pays out its November 2025 dividend.

4.8p a share

https://www.londonstockexchange.com/news-article/TSCO/total-voting-rights/17308359

The Company’s share capital as at 31 October 2025 consisted of 6,467,582,349 ordinary shares of 6 1/3 pence each

thus:-

6,467,582,349 x £0.048 = £310,443,952.752

That is £310 Million paid to Tesco shareholders

https://www.londonstockexchange.com/stock/TSCO/tesco-plc/company-page

Courtesy of the London Stock Exchange

Ray Dalio and Bloomberg’s Francine Lacqua Discuss Life, Debt & Global Crisis

Courtesy of Bloomberg

The L&G CLEAN ENERGY ETF

The L&G Clean Energy UCITS ETF aims to track the performance of the Solactive

Clean Energy Index NTR

Courtesy of Legal and General Investment Management

LEGAL AND GENERAL ASSET MANAGEMENT RENG Stock | London Stock Exchange

There will be ‘tears’ for some with AI, Mohamed El-Erian says

Courtesy of Yahoo Finance

Al Gore | Former US Vice President | Norges Bank Climate Conference

Courtesy of Norges Bank Investment Management

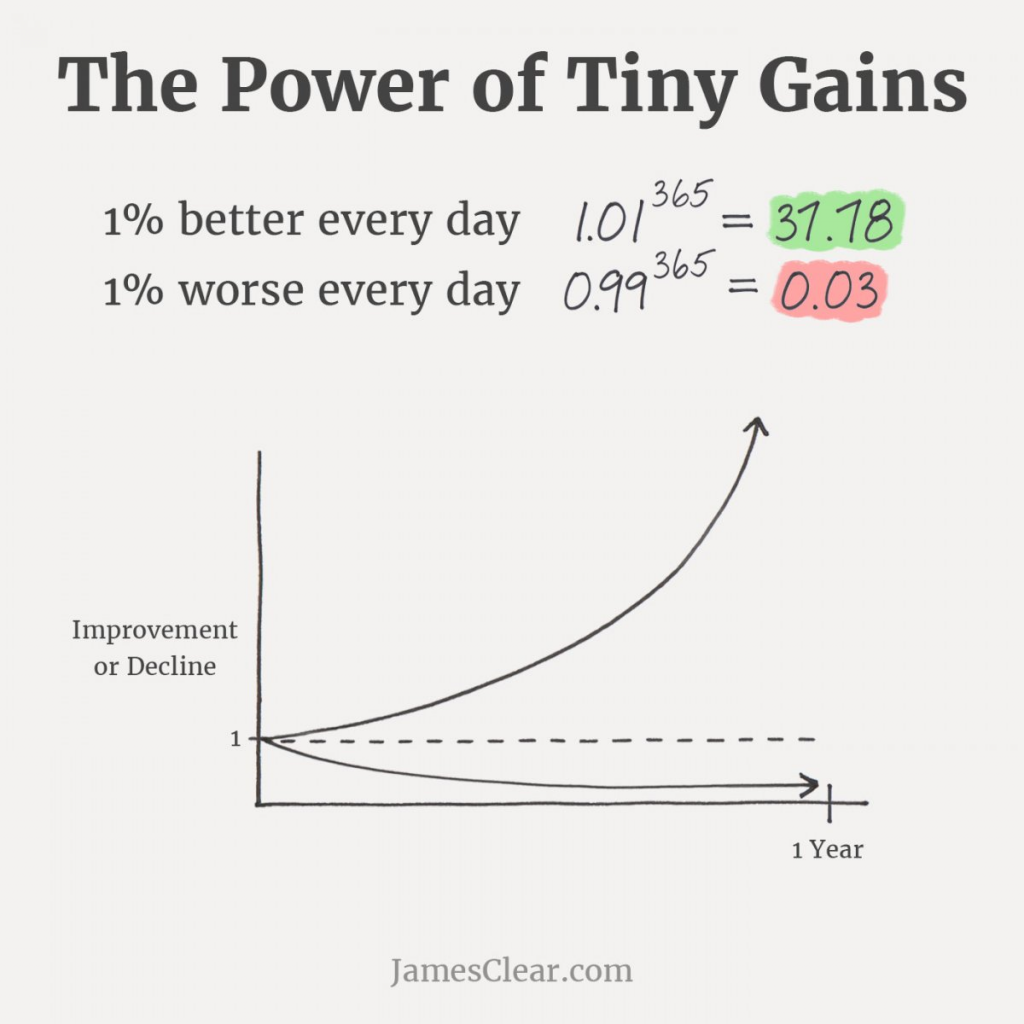

The James Clear Graph

In the beginning, there is basically no difference between making a choice that is 1 percent better or 1 percent worse. (In other words, it won’t impact you very much today.) But as time goes on, these small improvements or declines compound and you suddenly find a very big gap between people who make slightly better decisions on a daily basis and those who don’t.

Here’s the punchline:

If you get one percent better each day for one year, you’ll end up thirty-seven times better by the time you’re done.

L&G Multi-Strategy Enhanced Commodities ex-Agriculture & Livestock UCITS ETF

The L&G Multi-Strategy Enhanced Commodities ex-Agriculture & Livestock UCITS ETF is a London Listed ETF that aims to track the performance of the Barclays Backwardation Tilt Multi-Strategy Ex-Agriculture & Livestock Capped Total Return Index.

Fund size $88.4m

The fund provides broad-based exposure to commodities via a diversified basket of commodity futures with different expiry dates of up to 1 year.

The upside point of this fund:-

-Diversification Commodities are a distinct asset class with returns that are largely uncorrelated with stock and bond returns

-Inflation hedge Commodity indices tend to benefit from rising inflation

-Broad commodities exposure Basket of commodity futures, excluding Agriculture and Livestock, with dynamically determined expiry dates

Courtesy of Legal and General Investment Management

L&G Multi-Strategy Enhanced Commodities ex-Agriculture & Livestock UCITS ETF | LGIM Fund Centre

Courtesy of CNBC

LEGAL AND GENERAL ASSET MANAGEMENT XAGZ Stock | London Stock Exchange

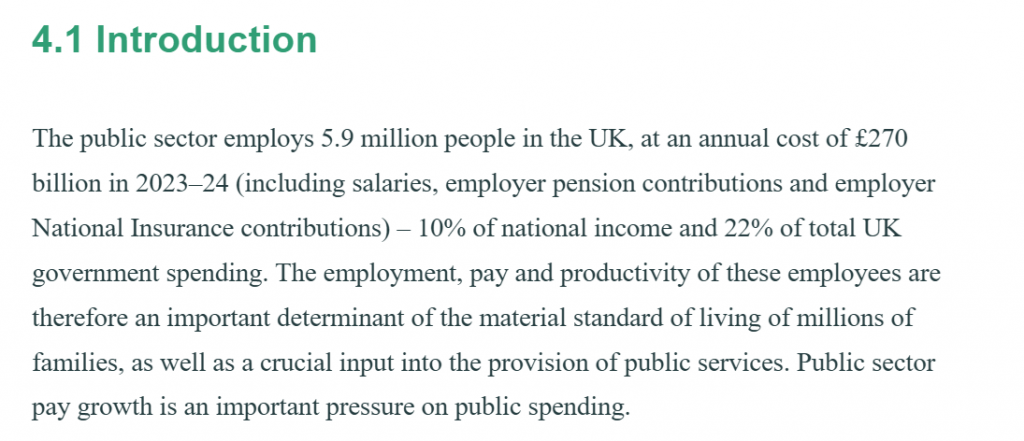

Public Sector Pay

The highly regarded Institute of Fiscal Studies is a wealth of information:-

Pressures on public sector pay | Institute for Fiscal Studies

“The public sector employs 5.9 million people in the UK, at an annual cost of £270 billion in 2023–24 (including salaries, employer pension contributions and employer National Insurance contributions) – 10% of national income and 22% of total UK government spending. The employment, pay and productivity of these employees are therefore an important determinant of the material standard of living of millions of families, as well as a crucial input into the provision of public services. Public sector pay growth is an important pressure on public spending.”

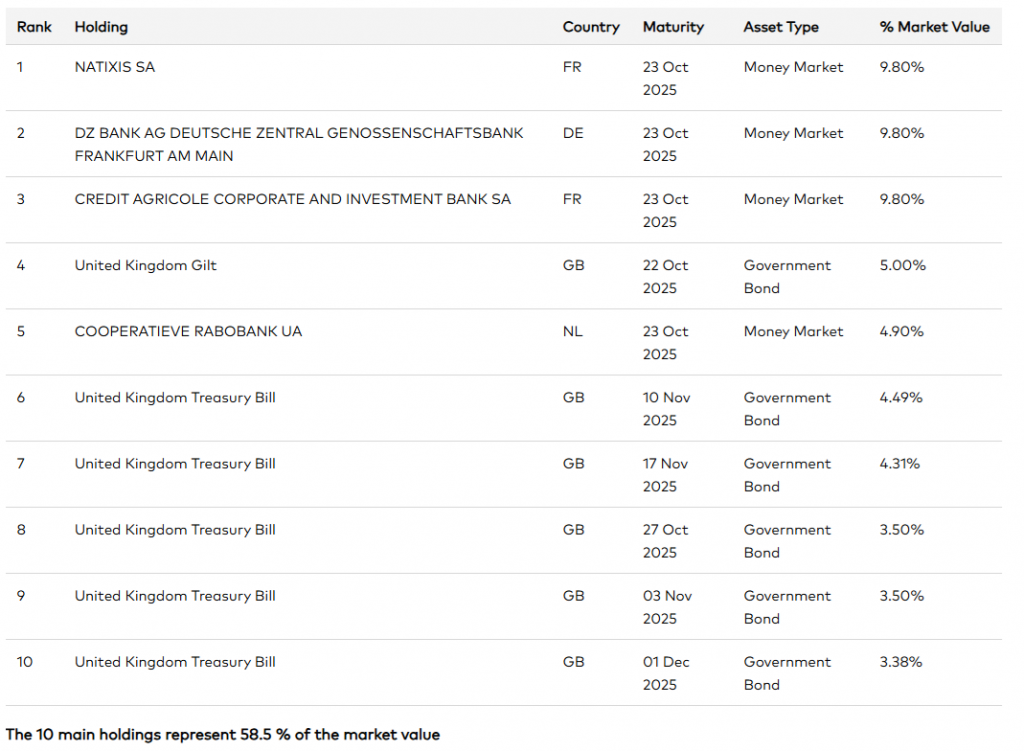

The Vanguard Sterling Short-Term Money Market Fund

The Vanguard Sterling Short-Term Money Market Fund (the “Fund”) seeks to provide stability in the value of investments, liquidity and exposure to a variety of investments that typically perform differently from one another while maximising income earned from distributions such as interest

Courtesy of Vanguard

Courtesy of Vanguard

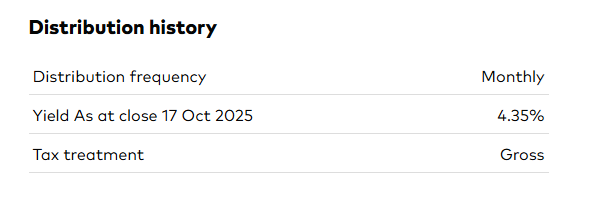

4.35% effective interest rate, the total assets £1.9 Billion in the fund.

Ray Dalio & Andrew Ross Sorkin on His New Book “1929” and How Debt Drives Every Crash

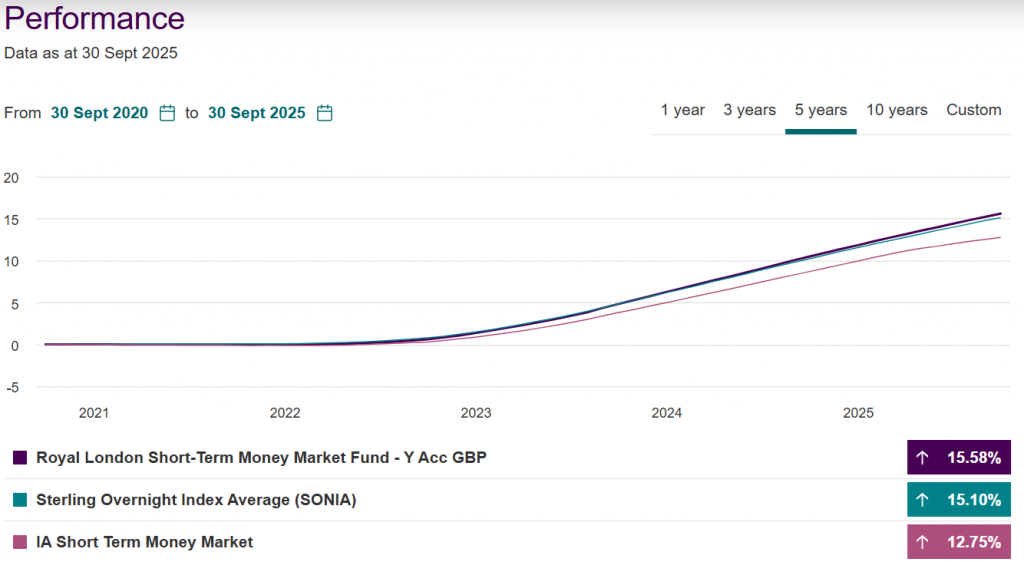

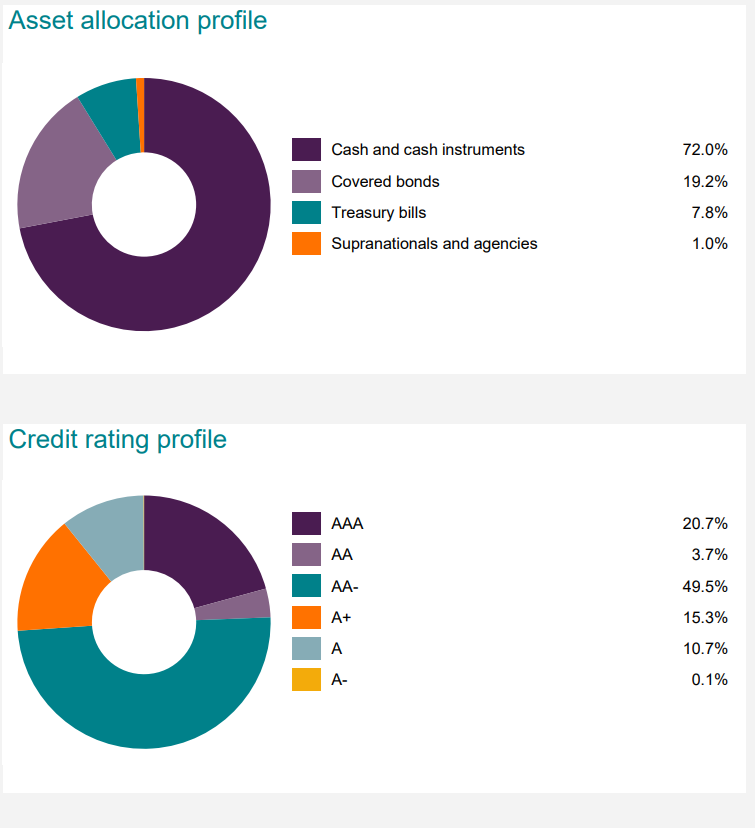

The Royal London Short-Term Money Market Fund

The Royal London Short-Term Money Market Fund is a £9,808.20m fund, holding near cash assets.

Courtesy of Royal London Asset Management

The Fund’s investment objective is to preserve capital and provide an income over rolling

12-month periods by predominantly investing (at least 80% of its assets) in cash and cash

equivalents. The Fund’s comparator benchmark is the Bank of England Sterling Overnight

Interbank Average (SONIA).

Courtesy of Royal London Asset Management

Investment in Reality

US National Debt: $37.64 Trillion, annual interest payments $1216 Billion ($1.216 Trillion)

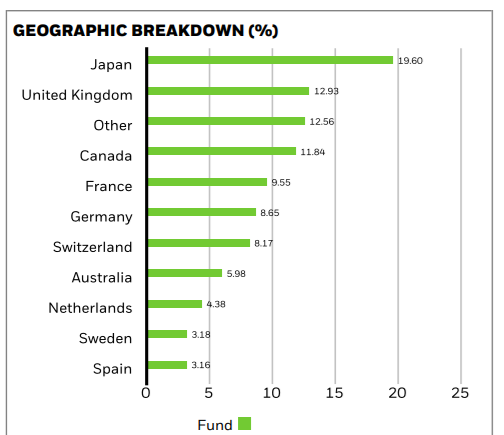

The iShares MSCI World ex-USA UCITS ETF

The iShares MSCI World ex-USA UCITS ETF is a London listed fund aims to achieve a total return, taking into account both capital and income returns, which reflects the return of the MSCI World ex USA Index, the Fund’s benchmark index.

https://www.ishares.com/uk/individual/en/products/340748/ishares-msci-world-ex-usa-ucits-etf

Courtesy of BlackRock

Courtesy of BlackRock

Courtesy of BlackRock

The Vanguard FTSE Emerging Markets UCITS ETF

abrdn Future Raw Materials Fund

The abrdn Future Raw Materials Fund is an ETF that invests in the global raw materials.

Investment objective is to generate growth over the long term (five years or more) by investing primarily in companies aligned with the future raw materials theme.

ABRDN III ICAV ARAW Stock | London Stock Exchange

Courtesy of The London Stock Exchange

Fund Holdings:-

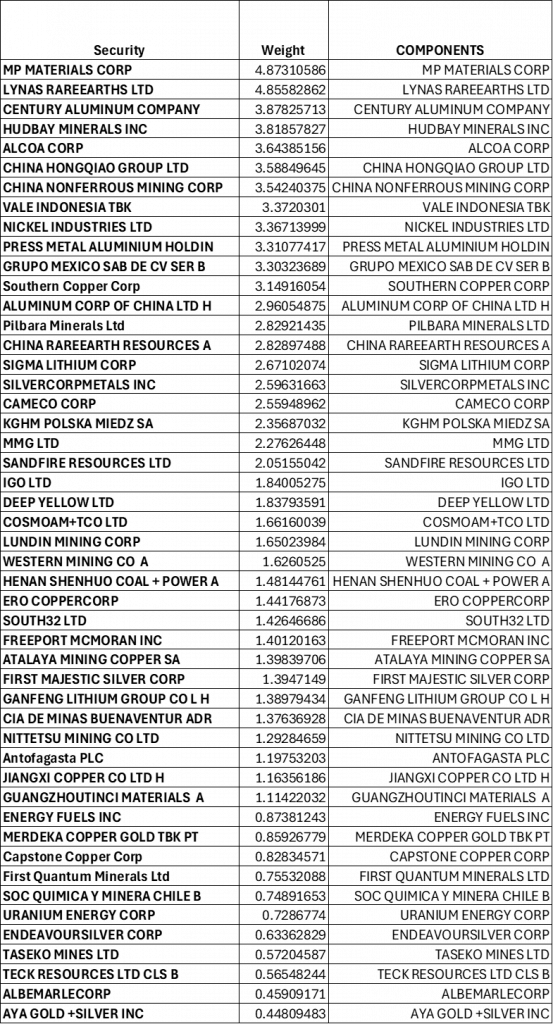

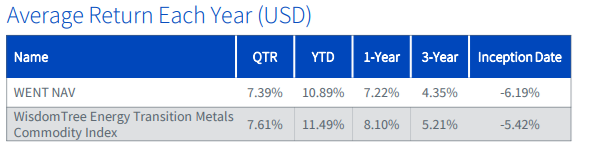

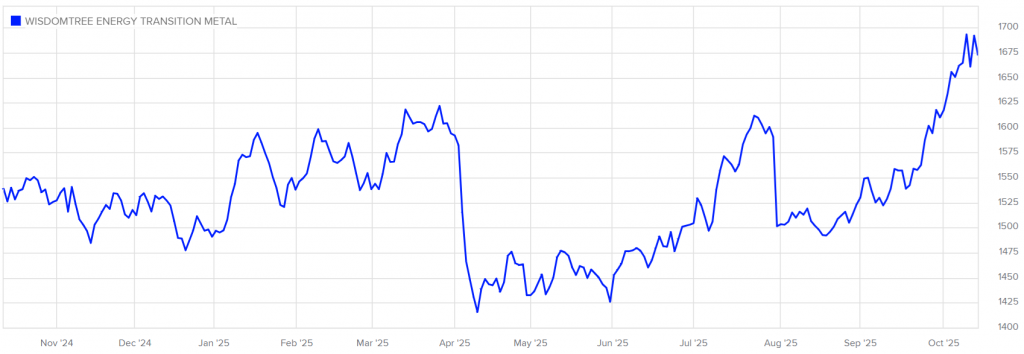

WisdomTree Energy Transition Metals

WisdomTree Energy Transition Metals is a fully collateralised, UCITS eligible Exchange-Traded Commodity (ETC) designed to provide investors with a total return exposure to a basket of Thematic Metals Baskets futures contracts. The Index is designed to track the performance of a diversified basket of metal commodities that are associated with the energy transition theme, which include, but are not limited to Electric Vehicles, Transmission, Charging, Energy Storage, Solar, Wind, and Hydrogen production.

Courtesy of Wisdom Tree

WISDOMTREE NRGT Stock | London Stock Exchange

Courtesy of The London Stock Exchange

Investment: An Awkward Introduction

Courtesy of The BBC

The UK total public sector net debt from 2010/11 to 2024/25: Why Taxes have to rise…..

Their is a LOT of talk about the UK impending budget and why taxes will have to rise.

Rachel Reeves says she is looking at tax rises ahead of Budget – BBC News

However lets look at the rising national debt in the UK and see how it rose over the past 15 years.

Number are in UK £Pounds: Trillion.

Courtesy of Statista

Government debt in the United Kingdom reached over 2.81 Trillion British pounds in 2024/25, compared with 2.69 trillion pounds in the previous financial year. Although debt has been increasing throughout this period, there is a noticeable jump between 2019/20, and 2020/21, when debt increased from 1.82 trillion pounds, to 2.15 trillion. The UK’s government debt was the equivalent of 95.8 percent of GDP in 2024/25, and is expected to increase slightly in coming years, and not start falling until the end of this decade

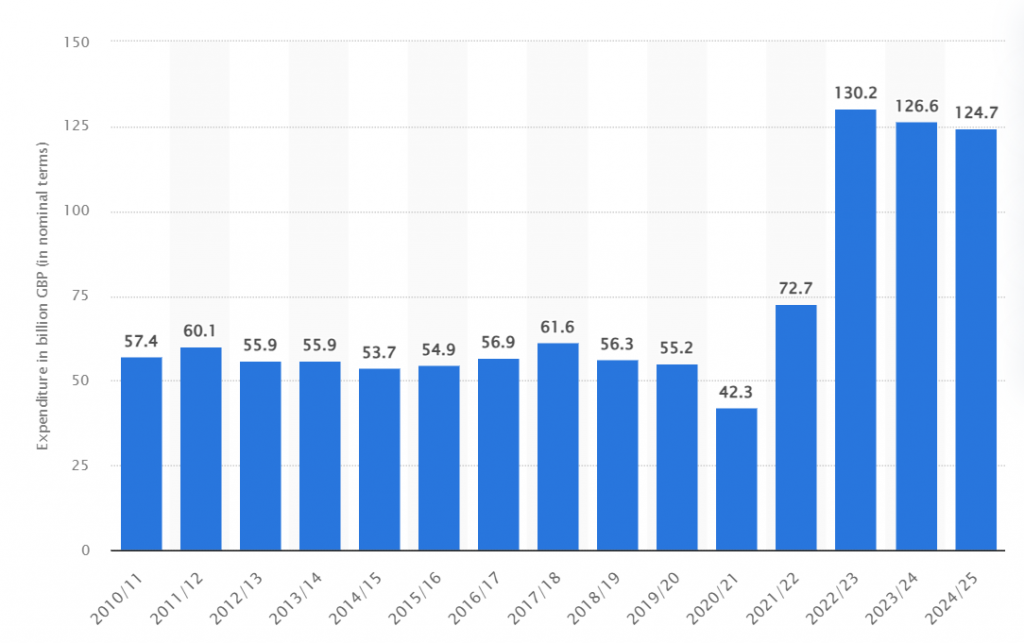

Now, the big issue is looking at the total debt of £2810 Billion = £2.81 Trillion. Thus when carrying this level of debt, there is huge public sector expenditure on public sector debt interest in the United Kingdom from 2010/11 to 2024/25, see below:-

Courtesy of Statista

As you can see above, in 2024/25, total interest payments on HM Government debt was £124.7 Billion, money that is paid to the creditors of the UK (the lenders), which means, money that can NOT be used on the UK, e.g. not able to use £124.7 Billion on new hospitals or new schools or better roads. Servicing the debt is now a large part of HM Government expenditure.

Emerging Markets: The FT

Oasis – ‘Morning Glory (Unplugged)’

Renewables overtake coal as world’s biggest source of electricity

Renewables overtake coal as world’s biggest source of electricity – BBC News

“Renewable energy overtook coal as the world’s leading source of electricity in the first half of this year – a historic first, according to new data from the global energy think tank Ember.

Electricity demand is growing around the world but the growth in solar and wind was so strong it met 100% of the extra electricity demand, even helping drive a slight decline in coal and gas use”

ISHARES INRG Stock | London Stock Exchange

Courtesy of The London Stock Exchange

Gold Price

Invesco MSCI World Equal Weight UCITS ETF Acc

Courtesy of The London Stock Exchange

INVESCO MWEQ Stock | London Stock Exchange

Full name ISIN Weight

WESTERN DIGITAL CORP USD0.01 US9581021055 0.1283%

SEAGATE TECHNOLOGY HOLDINGS USD NPV IE00BKVD2N49 0.124%

WARNER BROS DISCOVERY INC USD NPV US9344231041 0.1229%

APPLOVIN CORP-CLASS A USD 0.0000 US03831W1080 0.1214%

MONGODB INC USD0.001 US60937P1066 0.1173%

INTEL CORP USD0.001 US4581401001 0.1128%

PURE STORAGE INC – CLASS A USD0.0001 US74624M1027 0.111%

MICRON TECHNOLOGY INC USD0.1 US5951121038 0.1087%

Barrick Mining Corp CAD NPV CA06849F1080 0.1065%

UNITED THERAPEUTICS CORP USD0.01 US91307C1027 0.1053%

EVOLUTION MINING LTD NPV AU000000EVN4 0.104%

FRESNILLO PLC USD0.5 GB00B2QPKJ12 0.1039%

TESLA INC USD0.001 US88160R1014 0.1032%

ALAMOS GOLD INC-CLASS A NPV CA0115321089 0.1031%

GENMAB A/S DKK1 DK0010272202 0.1027%

ADVANTEST CORP NPV JP3122400009 0.1022%

TECK RESOURCES LTD-CLS B NPV CA8787422044 0.1022%

KERING EUR4 FR0000121485 0.1012%

NORTHERN STAR RESOURCES LTD NPV AU000000NST8 0.1011%

KINROSS GOLD CORP NPV CA4969024047 0.1004%

LAM RESEARCH CORP COM USD 0.001 US5128073062 0.0995%

FIRST QUANTUM MINERALS LTD NPV CA3359341052 0.0994%

CENTENE CORP USD0.001 US15135B1017 0.0993%

SUMITOMO METAL MINING CO LTD NPV JP3402600005 0.0988%

ASML HOLDING NV EUR0.09 NL0010273215 0.098%

LUNDIN MINING CORP NPV CA5503721063 0.0979%

LASERTEC CORP NPV JP3979200007 0.0975%

ANGLO AMERICAN PLC GBP 0.6239 GB00BTK05J60 0.0973%

ANTOFAGASTA PLC GBP0.05 GB0000456144 0.0961%

CELESTICA INC CAD NPV CA15101Q2071 0.096%

AGNICO EAGLE MINES LTD NPV CA0084741085 0.0959%

UNITEDHEALTH GROUP INC USD0.01 US91324P1021 0.0956%

FRANCO-NEVADA CORP CAD NPV CA3518581051 0.0956%

WIX.COM LTD ILS0.01 IL0011301780 0.0953%

UCB SA NPV BE0003739530 0.0953%

HENNES & MAURITZ AB-B SHS NPV SE0000106270 0.0953%

FIRST SOLAR INC USD0.001 US3364331070 0.0949%

CORNING INC USD0.5 US2193501051 0.0947%

TERADYNE INC USD0.125 US8807701029 0.0944%

FUJIKURA LTD NPV JP3811000003 0.0944%

SALMAR ASA NOK0.25 NO0010310956 0.0943%

HENSOLDT AG EUR NPV DE000HAG0005 0.094%

ROBINHOOD MARKETS INC – A USD 0.0001 US7707001027 0.094%

TOKYO ELECTRON LTD NPV JP3571400005 0.094%

EDP RENOVAVEIS SA EUR5 ES0127797019 0.0939%

IVANHOE MINES LTD-CL A NPV CA46579R1047 0.0939%

NEWMONT CORP USD1.6 US6516391066 0.0939%

PAN AMERICAN SILVER CORP NPV CA6979001089 0.0934%

BOLIDEN AB SEK 2.1100 SE0020050417 0.0933%

VALERO ENERGY CORP USD0.01 US91913Y1001 0.0928%

DATADOG INC – CLASS A USD0.00001 US23804L1035 0.0926%

ASM INTERNATIONAL NV EUR0.04 NL0000334118 0.0919%

RHEINMETALL AG NPV DE0007030009 0.0917%

VERTIV HOLDINGS CO USD 0.0001 US92537N1081 0.0914%

SUZUKI MOTOR CORP NPV JP3397200001 0.0913%

JDE PEET’S BV NPV NL0014332678 0.0907%

RIVIAN AUTOMOTIVE INC-A USD 0.0010 US76954A1034 0.0906%

MOLINA HEALTHCARE INC USD0.001 US60855R1005 0.0906%

INTL BUSINESS MACHINES CORP USD0.2 US4592001014 0.0906%

HALLIBURTON CO USD2.5 US4062161017 0.0906%

SCREEN HOLDINGS CO LTD NPV JP3494600004 0.0902%

CVS HEALTH CORP USD0.01 US1266501006 0.0898%

BARRY CALLEBAUT AG-REG CHF0.02 CH0009002962 0.0897%

OPEN TEXT CORP NPV CA6837151068 0.0894%

APTIV HOLDINGS LTD USD NPV JE00BTDN8H13 0.0894%

ELI LILLY & CO NPV US5324571083 0.0893%

PALO ALTO NETWORKS INC USD0.0001 US6974351057 0.0891%

ABBVIE INC USD0.01 US00287Y1091 0.089%

ENTEGRIS INC USD0.01 US29362U1043 0.089%

AGILENT TECHNOLOGIES INC USD0.01 US00846U1016 0.089%

GRAB HOLDINGS LTD – CL A USD 0.0001 KYG4124C1096 0.089%

MARATHON PETROLEUM CORP USD0.01 US56585A1025 0.0889%

TAPESTRY INC USD0.01 US8760301072 0.0889%

GSK PLC GBP 25.0000 GB00BN7SWP63 0.0888%

SNOWFLAKE INC-CLASS A NPV US8334451098 0.0888%

SOFTBANK GROUP CORP NPV JP3436100006 0.0888%

ARGENX SE NPV NL0010832176 0.0887%

ORACLE CORP USD0.01 US68389X1054 0.0886%

KLA CORP USD0.001 US4824801009 0.0886%

SAMSARA INC-CL A USD 0.0001 US79589L1061 0.0886%

WHEATON PRECIOUS METALS CORP NPV CA9628791027 0.0885%

MITSUI & CO LTD NPV JP3893600001 0.0883%

BXP Inc USD0.01 US1011211018 0.0883%

CYBERARK SOFTWARE LTD/ISRAEL ILS0.01 IL0011334468 0.0882%

MCKESSON CORP USD0.01 US58155Q1031 0.0882%

NOVA MEASURING INSTRUMENTS ILs 0.0100 IL0010845571 0.0879%

CROWDSTRIKE HOLDINGS INC – A NPV US22788C1053 0.0879%

HEWLETT PACKARD ENTERPRISE USD0.01 US42824C1099 0.0879%

BOMBARDIER INC-BCAD NPV CA0977518616 0.0878%

MARUBENI CORP NPV JP3877600001 0.0876%

FAIR ISAAC CORP USD0.01 US3032501047 0.0876%

VAT GROUP AG CHF0.1 CH0311864901 0.0875%

MURATA MANUFACTURING CO LTD NPV JP3914400001 0.0869%

CARVANA CO USD0.001 US1468691027 0.0869%

NOKIA OYJ NPV FI0009000681 0.0869%

SAINSBURY (J) PLC GBP0.285714 GB00B019KW72 0.0868%

APPLIED MATERIALS INC USD0.01 US0382221051 0.0867%

REPSOL SA EUR1 ES0173516115 0.0866%

PROSUS NV EUR0.05 NL0013654783 0.0865%

SUPER MICRO COMPUTER INC USD0.001 US86800U3023 0.0865%

Biogen Inc USD0.0005 US09062X1037 0.0863%

CIE FINANCIERE RICHEMO-A REG CHF1 CH0210483332 0.0863%

JD SPORTS FASHION GBP 0.0005 GB00BM8Q5M07 0.0861%

GLENCORE PLC GBP 0.0100 JE00B4T3BW64 0.0861%

CATERPILLAR INC USD1 US1491231015 0.0859%

SEMPRA ENERGY NPV US8168511090 0.0859%

Expand Energy Corporation USD 0.01 US1651677353 0.0858%

SCENTRE GROUP NPV AU000000SCG8 0.0857%

INPEX CORP NPV JP3294460005 0.0856%

NATIONAL AUSTRALIA BANK LTD NPV AU000000NAB4 0.0856%

ROCHE HOLDING AG-GENUSSCHEIN NPV CH0012032048 0.0856%

BAE SYSTEMS PLC GBP0.025 GB0002634946 0.0855%

BANK OF MONTREAL NPV CA0636711016 0.0855%

IHI CORP NPV JP3134800006 0.0854%

LOCKHEED MARTIN CORP USD1 US5398301094 0.0853%

BANK OF NOVA SCOTIA NPV CA0641491075 0.0853%

RWE AG NPV DE0007037129 0.0852%

UNIVERSAL HEALTH SERVICES-B USD0.01 US9139031002 0.0852%

NOVO NORDISK A/S DKK 0.1 DK0062498333 0.0851%

LEONARDO SPA EUR4.4 IT0003856405 0.0851%

DISCO CORP NPV JP3548600000 0.0851%

YANGZIJIANG SHIPBUILDING NPV SG1U76934819 0.085%

PRYSMIAN SPA EUR0.1 IT0004176001 0.085%

Rakuten Group Inc NPV JP3967200001 0.0849%

ALEXANDRIA REAL ESTATE EQUIT USD0.01 US0152711091 0.0849%

ZSCALER INC USD0.001 US98980G1022 0.0849%

Mitsubishi Chemical Group Corp NPV JP3897700005 0.0848%

Zoom Communications Inc USD 0.001 US98980L1017 0.0848%

TEVA PHARMACEUTICAL-SP ADR US8816242098 0.0848%

KINGFISHER PLC GBP0.157143 GB0033195214 0.0847%

MITSUBISHI CORP NPV JP3898400001 0.0845%

LUNDIN GOLD INC CAD NPV CA5503711080 0.0845%

ZALANDO SE NPV DE000ZAL1111 0.0844%

VESTAS WIND SYSTEM DKK 0.20 DK0061539921 0.0844%

LVMH MOET HENNESSY LOUIS VUI EUR0.3 FR0000121014 0.0843%

IRON MOUNTAIN INC USD0.01 US46284V1017 0.0843%

AMPHENOL CORP-CL A USD0.001 US0320951017 0.0843%

ELECTRONIC ARTS INC USD0.01 US2855121099 0.0843%

HEALTHPEAK PROPERTIES INC USD1 US42250P1030 0.0842%

Elevance Health Inc USD0.01 US0367521038 0.0842%

SANDVIK AB SEK1.2 SE0000667891 0.0841%

ADIDAS AG NPV DE000A1EWWW0 0.084%

Aisin Corp NPV JP3102000001 0.084%

BRAMBLES LTD AUD NPV AU000000BXB1 0.084%

BAYER AG-REG NPV DE000BAY0017 0.0839%

ROCKET LAB CORP USD NPV US7731211089 0.0838%

EDP S.A EUR1 PTEDP0AM0009 0.0838%

ARCELORMITTAL EUR NPV LU1598757687 0.0838%

COLES GROUP LTD NPV AU0000030678 0.0837%

BAKER HUGHES CO USD0.0001 US05722G1004 0.0837%

INDUSTRIA DE DISENO TEXTIL EUR0.03 ES0148396007 0.0837%

TOYOTA TSUSHO CORP NPV JP3635000007 0.0836%

SWEDISH ORPHAN BIOVITRUM AB SEK0.55 SE0000872095 0.0836%

THALES SA EUR3 FR0000121329 0.0835%

EMCOR GROUP INC USD0.01 US29084Q1004 0.0835%

ERICSSON LM-B SHS SEK5 SE0000108656 0.0835%

CLOUDFLARE INC – CLASS A USD0.001 US18915M1071 0.0834%

XCEL ENERGY INC USD2.5 US98389B1008 0.0834%

HOWMET AEROSPACE INC NPV US4432011082 0.0833%

General Aerospace Co USD 0.01 US3696043013 0.0832%

WILLIAMS COS INC USD1 US9694571004 0.0832%

Welltower OP Inc USD1 US95040Q1040 0.0832%

SARTORIUS AG-VORZUG EUR NPV PFD DE0007165631 0.0832%

SITC INTERNATIONAL HOLDINGS HKD0.1 KYG8187G1055 0.0831%

TDK CORP NPV JP3538800008 0.0831%

CENTRAL JAPAN RAILWAY CO NPV JP3566800003 0.0831%

SAAB AB-B SEK NPV SE0021921269 0.0831%

AUTODESK INC USD0.01 US0527691069 0.0831%

JARDINE MATHESON HLDGS LTD USD0.25 BMG507361001 0.0831%

AMERICAN EXPRESS CO USD0.2 US0258161092 0.083%

STEEL DYNAMICS INC USD0.005 US8581191009 0.083%

FERROVIAL SE EUR NPV NL0015001FS8 0.083%

SWATCH GROUP AG/THE-BR CHF2.25 CH0012255151 0.0829%

SHIMADZU CORP NPV JP3357200009 0.0829%

ENEOS HOLDINGS INC NPV JP3386450005 0.0829%

HOYA CORP NPV JP3837800006 0.0829%

QUANTA SERVICES INC USD0.00001 US74762E1029 0.0829%

ESSILORLUXOTTICA EUR0.18 FR0000121667 0.0828%

WEST PHARMACEUTICAL SERVICES USD0.25 US9553061055 0.0828%

KONGSBERG GRUPPEN ASA NOK 1.2500 NO0013536151 0.0828%

SOFI TECHNOLOGIES INC USD 0.0001 US83406F1021 0.0828%

MOWI ASA NOK7.5 NO0003054108 0.0827%

SCHNEIDER ELECTRIC SE EUR4 FR0000121972 0.0827%

LOGITECH INTERNATIONAL-REG CHF0.25 CH0025751329 0.0827%

L3HARRIS TECHNOLOGIES INC USD1 US5024311095 0.0826%

FORTINET INC USD0.001 US34959E1091 0.0826%

CAMECO CORP NPV CA13321L1085 0.0825%

CHECK POINT SOFTWARE TECH USD0.01 IL0010824113 0.0825%

CENOVUS ENERGY INC NPV CA15135U1093 0.0825%

PACKAGING CORP OF AMERICA USD0.01 US6951561090 0.0825%

ROYAL BANK OF CANADA NPV CA7800871021 0.0824%

LOTTERY CORP/THE AUD NPV AU0000219529 0.0824%

CHUGAI PHARMACEUTICAL CO LTD NPV JP3519400000 0.0824%

GALAXY ENTERTAINMENT GROUP L NPV HK0027032686 0.0824%

NUTANIX INC – A USD0.000025 US67059N1081 0.0824%

KONE OYJ-B NPV FI0009013403 0.0823%

AMERICAN FINANCIAL GROUP INC NPV US0259321042 0.0823%

APPLE INC USD0.00001 US0378331005 0.0823%

Phoenix Finance Ltd ILS 1 IL0007670123 0.0822%

MERCK & CO. INC. USD0.5 US58933Y1055 0.0822%

PROLOGIS INC USD0.01 US74340W1036 0.0822%

RIO TINTO LTD AUD NPV AU000000RIO1 0.0821%

STMICROELECTRONICS NV EUR1.04 NL0000226223 0.0821%

STOCKLAND NPV AU000000SGP0 0.0821%

TAKE-TWO INTERACTIVE SOFTWRE USD0.01 US8740541094 0.0821%

THERMO FISHER SCIENTIFIC INC USD1 US8835561023 0.0821%

HSBC HOLDINGS PLC GBP 0.5000 GB0005405286 0.0821%

MONSTER BEVERAGE CORP NPV US61174X1090 0.0821%

ARISTA NETWORKS INC USD NPV US0404132054 0.0821%

AIB GROUP PLC EUR0.625 IE00BF0L3536 0.0821%

MONCLER SPA NPV IT0004965148 0.082%

BRIDGESTONE CORP NPV JP3830800003 0.082%

PHILLIPS 66 NPV US7185461040 0.0819%

EISAI CO LTD NPV JP3160400002 0.0819%

VENTAS INC USD0.25 US92276F1003 0.0819%

CAN IMPERIAL BK OF COMMERCE NPV CA1360691010 0.0819%

MERCK KGAA NPV DE0006599905 0.0819%

C.H. ROBINSON WORLDWIDE INC USD0.1 US12541W2098 0.0818%

MINEBEA MITSUMI INC NPV JP3906000009 0.0818%

SGH LTD AUD NPV AU0000364754 0.0818%

NISSAN MOTOR CO LTD NPV JP3672400003 0.0818%

WESTPAC BANKING CORP NPV AU000000WBC1 0.0817%

BANK OF IRELAND GROUP PLC EUR1 IE00BD1RP616 0.0817%

NESTE OYJ NPV FI0009013296 0.0817%

EVERSOURCE ENERGY USD5 US30040W1080 0.0817%

PFIZER INC USD0.05 US7170811035 0.0816%

BEST BUY CO INC USD0.1 US0865161014 0.0816%

AGC INC NPV JP3112000009 0.0816%

LOEWS CORP USD0.01 US5404241086 0.0816%

AIRBUS SE EUR1 NL0000235190 0.0815%

SNAP INC – A USD0.00001 US83304A1060 0.0815%

AERCAP HOLDINGS NV EUR0.01 NL0000687663 0.0815%

WATERS CORP USD0.01 US9418481035 0.0815%

AKER BP ASA NOK 1.0000 NO0010345853 0.0814%

RIO TINTO PLC GBP 10.0000 GB0007188757 0.0814%

ELBIT SYSTEMS LTD ILS1 IL0010811243 0.0814%

HEXAGON AB SEK NPV SE0015961909 0.0814%

GENERAL MOTORS CO USD0.01 US37045V1008 0.0814%

GARMIN LTD CHF0.1 CH0114405324 0.0814%

NEXTERA ENERGY INC USD0.01 US65339F1012 0.0814%

BANCO BPM SPA NPV IT0005218380 0.0814%

AUTOZONE INC USD0.01 US0533321024 0.0814%

TJX COMPANIES INC USD1 US8725401090 0.0813%

NORSK HYDRO ASA NOK1.098 NO0005052605 0.0813%

AKZO NOBEL N.V. EUR0.5 NL0013267909 0.0813%

DOORDASH INC – A USD NPV US25809K1051 0.0813%

FEDEX CORP USD0.1 US31428X1063 0.0812%

KANSAI ELECTRIC POWER CO INC NPV JP3228600007 0.0812%

AECOM USD0.01 US00766T1007 0.0812%

PEMBINA PIPELINE CORP NPV CA7063271034 0.0812%

ORIENTAL LAND CO LTD NPV JP3198900007 0.0812%

ALLIANT ENERGY CORP USD0.01 US0188021085 0.0811%

IDEMITSU KOSAN CO LTD NPV JP3142500002 0.0811%

NICE LTD ILS 1.0000 IL0002730112 0.081%

BROOKFIELD RENEWABLE CORP CAD NPV CA11285B1085 0.081%

GREAT-WEST LIFECO INC NPV CA39138C1068 0.081%

DELIVERY HERO SE NPV DE000A2E4K43 0.081%

BANCO SANTANDER SA EUR0.5 ES0113900J37 0.0809%

RENAULT SA EUR3.81 FR0000131906 0.0809%

IMPERIAL OIL LTD NPV CA4530384086 0.0809%

GENERAL DYNAMICS CORP USD1 US3695501086 0.0809%

NETAPP INC USD0.001 US64110D1046 0.0809%

AJINOMOTO CO INC NPV JP3119600009 0.0808%

RTX CORPORATION USD 1 US75513E1010 0.0808%

FORD MOTOR CO USD0.01 US3453708600 0.0808%

CONSTELLATION ENERGY – W/I USD NPV US21037T1097 0.0808%

FUJI ELECTRIC CO LTD NPV JP3820000002 0.0807%

OCCIDENTAL PETROLEUM CORP USD0.2 US6745991058 0.0807%

IQVIA HOLDINGS INC USD0.01 US46266C1053 0.0807%

MONOLITHIC POWER SYSTEMS INC USD0.001 US6098391054 0.0807%

EQT CORP NPV US26884L1098 0.0807%

KUBOTA CORP NPV JP3266400005 0.0806%

HCA HEALTHCARE INC USD0.01 US40412C1018 0.0806%

TORONTO-DOMINION BANK NPV CA8911605092 0.0806%

MIZRAHI TEFAHOT BANK LTD ILS0.1 IL0006954379 0.0806%

TOYOTA INDUSTRIES CORP NPV JP3634600005 0.0805%

DASSAULT SYSTEMES EUR 0.1 FR0014003TT8 0.0805%

INTERACTIVE BROKERS GRO-CL A USD0.01 US45841N1072 0.0805%

TOROMONT INDUSTRIES LTD NPV CA8911021050 0.0805%

ITOCHU CORP NPV JP3143600009 0.0805%

SHIN-ETSU CHEMICAL CO LTD JPY NPV JP3371200001 0.0804%

ABB LTD-REG CHF0.12 CH0012221716 0.0804%

DELL TECHNOLOGIES -C NPV US24703L2025 0.0804%

ENBRIDGE INC NPV CA29250N1050 0.0804%

SIMON PROPERTY GROUP INC USD0.0001 US8288061091 0.0804%

DAIWA SECURITIES GROUP INC NPV JP3502200003 0.0804%

CANADIAN NATURAL RESOURCES NPV CA1363851017 0.0804%

IPSEN EUR1 FR0010259150 0.0804%

LEIDOS HOLDINGS INC USD0.0001 US5253271028 0.0803%

BROADCOM INC NPV US11135F1012 0.0803%

SIEMENS ENERGY AG NPV DE000ENER6Y0 0.0803%

ABN AMRO BANK NV-CVA EUR1 NL0011540547 0.0803%

SUMITOMO REALTY & DEVELOPMEN NPV JP3409000001 0.0803%

CRH PLC USD 0.3200 IE0001827041 0.0802%

FRESENIUS MEDICAL Care AG EUR NPV DE0005785802 0.0802%

ASTRAZENECA PLC USD0.25 GB0009895292 0.0802%

AEGON LIMITED EUR 0.12 BMG0112X1056 0.0802%

NITTO DENKO CORP NPV JP3684000007 0.0802%

CITIZENS FINANCIAL GROUP USD0.01 US1746101054 0.0801%

BANK HAPOALIM BM ILS1 IL0006625771 0.0801%

MITSUBISHI ESTATE CO LTD NPV JP3899600005 0.0801%

REGENERON PHARMACEUTICALS USD0.001 US75886F1075 0.0801%

DUPONT DE NEMOURS INC USD0.01 US26614N1028 0.0801%

TELEDYNE TECHNOLOGIES INC USD0.01 US8793601050 0.08%

WP CAREY INC USD0.001 US92936U1097 0.08%

BANK OF AMERICA CORP USD0.01 US0605051046 0.08%

ROBLOX CORP -CLASS A USD 0.0001 US7710491033 0.08%

WESFARMERS LTD NPV AU000000WES1 0.08%

COINBASE GLOBAL INC -CLASS A USD 0.0000 US19260Q1076 0.08%

SERVICENOW INC USD0.001 US81762P1021 0.08%

Metso Corporation EUR NPV FI0009014575 0.08%

SUMITOMO CORP NPV JP3404600003 0.0799%

APA GROUP NPV AU000000APA1 0.0799%

HALMA PLC GBP0.1 GB0004052071 0.0799%

TE CONNECTIVITY PLC USD NPV IE000IVNQZ81 0.0799%

ATMOS ENERGY CORP NPV US0495601058 0.0798%

STANTEC INC NPV CA85472N1096 0.0798%

NOVARTIS AG-REG CHF0.5 CH0012005267 0.0798%

LEGRAND SA EUR4 FR0010307819 0.0798%

SANDS CHINA LTD USD0.01 KYG7800X1079 0.0798%

Alimentation Couche-Tard Inc CAD NPV CA01626P1484 0.0798%

DAI NIPPON PRINTING CO LTD NPV JP3493800001 0.0797%

PRINCIPAL FINANCIAL GROUP USD0.01 US74251V1026 0.0797%

SLB USD 0.01 AN8068571086 0.0797%

ULTA BEAUTY INC NPV US90384S3031 0.0796%

ROLLS-ROYCE HOLDINGS PLC GBP0.2 GB00B63H8491 0.0796%

NORDSON CORP NPV US6556631025 0.0796%

BPER Banca EUR3 IT0000066123 0.0796%

JOHNSON & JOHNSON USD1 US4781601046 0.0796%

JAPAN EXCHANGE GROUP INC NPV JP3183200009 0.0796%

VEEVA SYSTEMS INC-CLASS A USD0.00001 US9224751084 0.0795%

OTSUKA HOLDINGS CO LTD NPV JP3188220002 0.0795%

SWEDBANK AB – A SHARES SEK22 SE0000242455 0.0795%

Subaru Corp NPV JP3814800003 0.0795%

JFE HOLDINGS INC NPV JP3386030005 0.0794%

EATON CORP PLC USD0.01 IE00B8KQN827 0.0793%

MARVELL TECHNOLOGY INC USD NPV US5738741041 0.0793%

TC ENERGY CORP NPV CA87807B1076 0.0793%

MAGNA INTERNATIONAL INC NPV CA5592224011 0.0793%

UNION PACIFIC CORP USD2.5 US9078181081 0.0792%

SUMITOMO ELECTRIC INDUSTRIES NPV JP3407400005 0.0792%

FRESENIUS SE & CO KGAA NPV DE0005785604 0.0792%

UBER TECHNOLOGIES INC USD0.00001 US90353T1007 0.0792%

ISRAEL DISCOUNT BANK-A ILS0.1 IL0006912120 0.0791%

SUNCOR ENERGY INC NPV CA8672241079 0.0791%

GJENSIDIGE FORSIKRING ASA NOK2 NO0010582521 0.0791%

Cencora Inc USD0.01 US03073E1055 0.0791%

OLYMPUS CORP NPV JP3201200007 0.0791%

AMUNDI SA EUR2.5 FR0004125920 0.0791%

YARA INTERNATIONAL ASA NOK1.7 NO0010208051 0.0791%

TEXTRON INC USD0.125 US8832031012 0.0791%

KYOCERA CORP NPV JP3249600002 0.0791%

SEA LTD-ADR US81141R1005 0.079%

MORGAN STANLEY USD0.01 US6174464486 0.079%

JOHNSON CONTROLS INTERNATION USD0.01 IE00BY7QL619 0.079%

KEYERA CORP NPV CA4932711001 0.079%

Hartford Insurance Group Inc/The USD 0.01 US4165151048 0.079%

INFORMA PLC GBP0.001 GB00BMJ6DW54 0.079%

SIGMA HEAUD NPV AU000000SIG5 0.079%

Keppel Ltd NPV SG1U68934629 0.079%

WR BERKLEY CORP USD0.2 US0844231029 0.079%

NORFOLK SOUTHERN CORP USD1 US6558441084 0.079%

CAE INC NPV CA1247651088 0.079%

JPMORGAN CHASE & CO USD1 US46625H1005 0.079%

PUBLICIS GROUPE EUR0.4 FR0000130577 0.0789%

ESSEX PROPERTY TRUST INC USD0.0001 US2971781057 0.0789%

ASAHI KASEI CORP NPV JP3111200006 0.0789%

SNAP-ON INC USD1 US8330341012 0.0789%

CARDINAL HEALTH INC NPV US14149Y1082 0.0789%

SARTORIUS STEDIM BIOTECH EUR0.2 FR0013154002 0.0789%

TOURMALINE OIL CORP NPV CA89156V1067 0.0789%

NRG ENERGY INC USD0.01 US6293775085 0.0789%

MARTIN MARIETTA MATERIALS USD0.01 US5732841060 0.0789%

OTIS WORLDWIDE CORP USD0.01 US68902V1070 0.0789%

AFLAC INC USD0.1 US0010551028 0.0789%

KOMATSU LTD NPV JP3304200003 0.0789%

FIRSTENERGY CORP USD0.1 US3379321074 0.0789%

KINDER MORGAN INC USD0.01 US49456B1017 0.0788%

QUALCOMM INC USD0.0001 US7475251036 0.0788%

EQUINOR ASA NOK 2.5000 NO0010096985 0.0788%

METLIFE INC USD0.01 US59156R1086 0.0788%

IA FINANCIAL CORP INC NPV CA45075E1043 0.0788%

BANKINTER SA EUR0.3 ES0113679I37 0.0787%

GILDAN ACTIVEWEAR INC CAD NPV CA3759161035 0.0787%

SKANDINAVISKA ENSKILDA BAN-A SEK10 SE0000148884 0.0787%

FAIRFAX FINANCIAL HLDGS LTD NPV CA3039011026 0.0787%

SOUTHERN CO/THE USD5 US8425871071 0.0787%

MELROSE INDUSTRIES PLC GBP NPV GB00BNGDN821 0.0787%

EVEREST GROUP LTD USD0.01 BMG3223R1088 0.0787%

NEUROCRINE BIOSCIENCES INC USD0.001 US64125C1099 0.0786%

ING GROEP NV EUR0.01 NL0011821202 0.0786%

ALSTOM EUR7 FR0010220475 0.0786%

REALTY INCOME CORP USD1 US7561091049 0.0786%

PRUDENTIAL PLC GBP 5.0000 GB0007099541 0.0786%

TEXAS PACIFIC LAND CORP USD NPV US88262P1021 0.0786%

FERRARI NV EUR0.01 NL0011585146 0.0786%

EAST JAPAN RAILWAY CO NPV JP3783600004 0.0786%

NITORI HOLDINGS CO LTD NPV JP3756100008 0.0786%

BANK LEUMI LE-ISRAEL ILS0.1 IL0006046119 0.0786%

WILLIS TOWERS WATSON PLC USD0.000304635 IE00BDB6Q211 0.0785%

NORTHROP GRUMMAN CORP USD1 US6668071029 0.0785%

WHITBREAD PLC GBP0.767974 GB00B1KJJ408 0.0785%

TENARIS SA EUR 1.0000 LU2598331598 0.0785%

ENDESA SA EUR1.2 ES0130670112 0.0785%

KEYSIGHT TECHNOLOGIES IN NPV US49338L1035 0.0785%

Expedia Group Inc USD0.001 US30212P3038 0.0785%

DR HORTON INC USD0.01 US23331A1097 0.0785%

FORTIVE CORP USD0.01 US34959J1088 0.0784%

PANASONIC CORP NPV JP3866800000 0.0784%

MITSUBISHI UFJ FINANCIAL GRO NPV JP3902900004 0.0784%

BE SEMICONDUCTOR INDUSTRIES EUR0.01 NL0012866412 0.0784%

HERSHEY CO/THE USD1 US4278661081 0.0784%

SHIMANO INC NPV JP3358000002 0.0784%

PULTEGROUP INC USD0.01 US7458671010 0.0784%

DASSAULT AVIATION EUR 0.8 FR0014004L86 0.0783%

TAISEI CORP NPV JP3443600006 0.0783%

UNITED RENTALS INC USD0.01 US9113631090 0.0783%

ALLEGION PLC USD0.01 IE00BFRT3W74 0.0783%

ALFA LAVAL AB SEK2.84 SE0000695876 0.0782%

OBAYASHI CORP NPV JP3190000004 0.0782%

EVERGY INC NPV US30034W1062 0.0782%

WORKDAY INC-CLASS A USD0.001 US98138H1014 0.0782%

CUMMINS INC USD2.5 US2310211063 0.0782%

GALDERMA GROUP CHF 0.010000000 CH1335392721 0.0782%

DICK’S SPORTING GOODS INC USD0.01 US2533931026 0.0782%

CHUBU ELECTRIC POWER CO INC NPV JP3526600006 0.0782%

FORTUM OYJ EUR3.4 FI0009007132 0.0782%

GOLDMAN SACHS GROUP INC USD0.01 US38141G1040 0.0782%

ENTERGY CORP USD0.01 US29364G1031 0.0782%

ACS ACTIVIDADES CONS Y SERV EUR0.5 ES0167050915 0.0781%

TELIA CO AB SEK3.2 SE0000667925 0.0781%

WEC ENERGY GROUP INC USD0.01 US92939U1060 0.0781%

MEDTRONIC PLC USD0.1 IE00BTN1Y115 0.078%

YUM! BRANDS INC NPV US9884981013 0.078%

BERKSHIRE HATHAWAY INC-CL B USD0.0033 US0846707026 0.078%

KEYENCE CORP NPV JP3236200006 0.078%

CAPITALAND INTEGRATED COMMER NPV SG1M51904654 0.078%

HANG SENG BANK LTD NPV HK0011000095 0.078%

RECORDATI INDUSTRIA CHIMICA EUR0.125 IT0003828271 0.078%

CINCINNATI FINANCIAL CORP USD2 US1720621010 0.078%

WABTEC CORP USD0.01 US9297401088 0.078%

LUNDBERGS AB-B SHS NPV SE0000108847 0.078%

O’REILLY AUTOMOTIVE INC USD0.01 US67103H1077 0.078%

AUST AND NZ BANKING GROUP NPV AU000000ANZ3 0.0779%

IGM FINANCIAL INC NPV CA4495861060 0.0779%

EXXON MOBIL CORP NPV US30231G1022 0.0779%

ARTHUR J GALLAGHER & CO USD1 US3635761097 0.0779%

GALP ENERGIA SGPS SA EUR1 PTGAL0AM0009 0.0779%

INTESA SANPAOLO NPV IT0000072618 0.0779%

POWER CORP OF CANADA NPV CA7392391016 0.0779%

MONDAY.COM LTD USD NPV IL0011762130 0.0779%

NEXT PLC GBP0.1 GB0032089863 0.0779%

CHARTER COMMUNICATIONS INC-A USD0.001 US16119P1084 0.0779%

XYLEM INC NPV US98419M1009 0.0779%

INGERSOLL-RAND INC USD0.01 US45687V1061 0.0779%

VULCAN MATERIALS CO USD1 US9291601097 0.0778%

Dominion Energy Inc NPV US25746U1097 0.0778%

ALNYLAM PHARMACEUTICALS INC USD0.01 US02043Q1076 0.0778%

AtkinsRealis Group Inc CAD NPV CA04764T1049 0.0778%

WHITECAP RESOURCES INC NPV CA96467A2002 0.0778%

Sumitomo Mitsui Trust Group Inc JPY NPV JP3892100003 0.0778%

ROSS STORES INC USD0.01 US7782961038 0.0777%

HONGKONG LAND HOLDINGS LTD USD0.1 BMG4587L1090 0.0777%

CapitaLand Ascendas REIT SGD NPV SG1M77906915 0.0777%

SODEXO SA EUR4 FR0000121220 0.0777%

STANDARD CHARTERED PLC USD0.5 GB0004082847 0.0777%

CAIXABANK SA EUR1 ES0140609019 0.0777%

LIBERTY MEDIA CORP-LIB-NEW-C USD NPV US5312297550 0.0777%

NESTLE SA-REG CHF0.1 CH0038863350 0.0777%

AVIVA GBP 0.33 GB00BPQY8M80 0.0776%

SHELL PLC GBP 0.0700 GB00BP6MXD84 0.0776%

MARKS & SPENCER GROUP PLC GBP0.25 GB0031274896 0.0775%

BUNZL PLC GBP0.3214286 GB00B0744B38 0.0775%

GARTNER INC USD0.0005 US3666511072 0.0775%

DENSO CORP NPV JP3551500006 0.0775%

HERMES INTERNATIONAL NPV FR0000052292 0.0775%

MONDELEZ INTERNATIONAL INC-A NPV US6092071058 0.0775%

WARTSILA OYJ ABP NPV FI0009003727 0.0775%

RECKITT BENCKISER GROUP PLC GBP0.1 GB00B24CGK77 0.0775%

EXTRA SPACE STORAGE INC USD0.01 US30225T1025 0.0775%

FIFTH THIRD BANCORP NPV US3167731005 0.0775%

DEVON ENERGY CORP USD0.1 US25179M1036 0.0775%

BANK OF NEW YORK MELLON CORP USD0.01 US0640581007 0.0775%

DAITO TRUST CONSTRUCT CO LTD NPV JP3486800000 0.0775%

OMNICOM GROUP USD0.15 US6819191064 0.0774%

DNB BANK ASA NOK NPV NO0010161896 0.0774%

KONINKLIJKE KPN NV EUR0.04 NL0000009082 0.0774%

E.ON SE NPV DE000ENAG999 0.0774%

Brookfield Corp CAD NPV CA11271J1075 0.0774%

OKTA INC NPV US6792951054 0.0774%

PENTAIR PLC USD0.01 IE00BLS09M33 0.0774%

Barratt Redrow PLC GBP 0.1 GB0000811801 0.0774%

TESCO GBP 0.0633333 GB00BLGZ9862 0.0774%

SUN LIFE FINANCIAL INC NPV CA8667961053 0.0773%

SEKISUI CHEMICAL CO LTD NPV JP3419400001 0.0773%

SINGAPORE EXCHANGE LTD NPV SG1J26887955 0.0773%

SEGRO PLC GBP0.1 GB00B5ZN1N88 0.0773%

SHOPIFY INC – CLASS A NPV CA82509L1076 0.0773%

ABBOTT LABORATORIES NPV US0028241000 0.0773%

SINGAPORE TELECOMMUNICATIONS SGD NPV SG1T75931496 0.0773%

DANONE EUR0.25 FR0000120644 0.0773%

PUBLIC STORAGE USD0.1 US74460D1090 0.0773%

INFRATIL LTD NPV NZIFTE0003S3 0.0773%

CITIGROUP INC USD0.01 US1729674242 0.0772%

INTERTEK GROUP PLC GBP0.01 GB0031638363 0.0772%

WH GROUP LTD USD0.0001 KYG960071028 0.0772%

SKANSKA AB-B SHS NPV SE0000113250 0.0771%

SONY GROUP CORP NPV JP3435000009 0.0771%

MEIJI HOLDINGS CO LTD NPV JP3918000005 0.0771%

LAND SECURITIES GROUP PLC GBP0.1066667 GB00BYW0PQ60 0.0771%

MIZUHO FINANCIAL GROUP INC NPV JP3885780001 0.0771%

INVESTOR AB SEK NPV SE0015811963 0.0771%

CHIBA BANK LTD/THE NPV JP3511800009 0.0771%

VERTEX PHARMACEUTICALS INC USD0.01 US92532F1003 0.0771%

NIPPON STEEL CORP NPV JP3381000003 0.0771%

DAIFUKU CO LTD NPV JP3497400006 0.0771%

F5 INC USD NPV US3156161024 0.0771%

SAFRAN SA EUR0.2 FR0000073272 0.0771%

NVIDIA CORP USD0.001 US67066G1040 0.077%

UNIVERSAL MUSIC GROUP EUR 10.0000 NL0015000IY2 0.077%

BP PLC GBP 0.2500 GB0007980591 0.077%

Kellanova USD 0.25 US4878361082 0.077%

TELENOR ASA NOK6 NO0010063308 0.077%

DIGITAL REALTY TRUST INC USD0.01 US2538681030 0.077%

NATERA INC USD0.0001 US6323071042 0.0769%

Mercedes-Benz Group AG EUR NPV DE0007100000 0.0769%