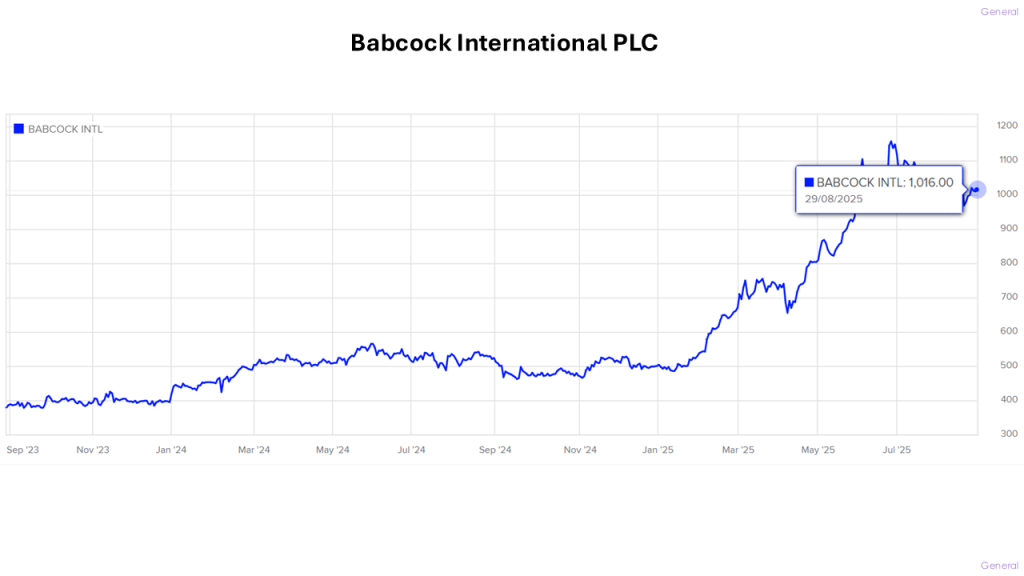

Courtesy of The London Stock Exchange

BABCOCK INTERNATIONAL GROUP PLC BAB Stock | London Stock Exchange

Courtesy of The London Stock Exchange

BABCOCK INTERNATIONAL GROUP PLC BAB Stock | London Stock Exchange

Today, Greencoat UK Wind pays out its August 2025 dividend

2.59p a share

https://www.greencoat-ukwind.com

https://www.londonstockexchange.com/news-article/UKW/total-voting-rights/17163109

The total voting rights figure will be 2,212,096,082

Thus:-

2,212,096,082 x £0.0259 = £57,293,288.5238

£57m paid to shareholders

https://www.londonstockexchange.com/stock/UKW/greencoat-uk-wind-plc/analysis

Courtesy of Bach

At close of business on 31 July 2025, its investments were as follows:-

| Company | % of total net assets |

| Greencoat UK Wind | 7.0% |

| SSE | 6.3% |

| Clearway Energy A Class | 6.2% |

| RWE | 6.1% |

| Northland Power | 5.4% |

| Octopus Renewables Infrastructure Trust | 4.6% |

| Grenergy Renovables | 4.5% |

| NextEnergy Solar Fund | 4.3% |

| Bonheur | 4.0% |

| Foresight Solar Fund | 3.7% |

| Drax Group | 3.7% |

| National Grid | 3.7% |

| Hannon Armstrong Sustainable Infrastructure Capital REIT | 3.6% |

| SDCL Energy Efficiency Income Trust | 3.2% |

| iShares UK Gilts 0-5y ETF | 2.5% |

| Cadeler | 2.5% |

| iShares GBP Ultrashort Bond UC | 2.5% |

| The Renewables Infrastructure Group | 2.4% |

| GCP Infrastructure Investments | 2.1% |

| Greencoat Renewable | 1.8% |

| Fastned | 1.6% |

| Sequoia Economic Infrastructure Income | 1.4% |

| Polaris Renewable Energy | 1.2% |

| AES | 1.2% |

| Vanguard UK Gilt UCITS ETF | 1.2% |

| Orsted | 1.1% |

| Gore Street Energy Storage Fund | 1.1% |

| Serena Energia | 1.0% |

| VH Global Sustainable Energy Opportunities | 0.8% |

| Corporacion Acciona Energias Renovables | 0.7% |

| MPC Energy Solutions | 0.7% |

| Scatec Solar | 0.6% |

| 7C Solarparken | 0.5% |

| Foresight Environmental Infrastructure | 0.5% |

| Boralex | 0.5% |

| US Solar Fund | 0.3% |

| Westbridge Renewable Energy | 0.2% |

| Cash/Net Current Assets | 5.2% |

At close of business on 31 July 2025, the total net assets of Premier Miton Global Renewables Trust PLC amounted to £40.9 million. The sector breakdown and geographical allocation were as follows:

| Sector Breakdown | % of total net assets |

| Yieldcos & investment companies | 31.7% |

| Renewable energy developers | 26.6% |

| Renewable focused utilities | 7.5% |

| Energy storage | 1.1% |

| Biomass generation and production | 3.7% |

| Electricity networks | 3.7% |

| Renewable technology and service | 2.5% |

| Renewable financing and energy efficiency | 10.2% |

| Renewable Fuels and Charging | 1.6% |

| Fixed Interest Securities | 6.1% |

| Cash/Net Current Assets | 5.2% |

| Geographical Allocation | % of total net assets |

| United Kingdom | 33.7% |

| Europe (ex UK) | 21.9% |

| Global | 24.7% |

| North America | 11.6% |

| Latin America | 2.9% |

| Cash/Net Current Assets | 5.2% |

PREMIER MITON GLOBAL RENEWABLES TRUST PLC PMGR Stock | London Stock Exchange

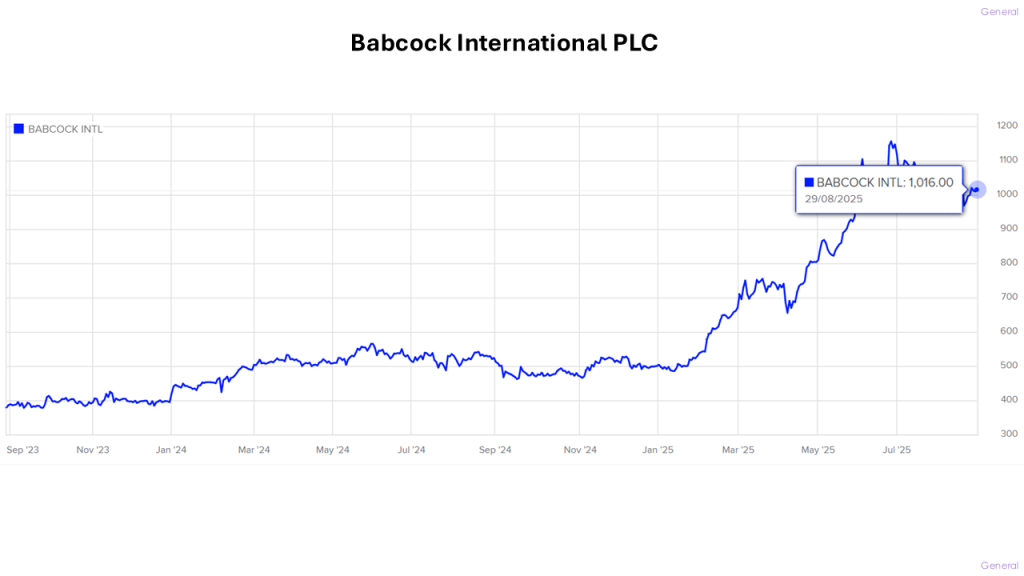

The CT Private Equity Trust PLC, is a London listed investment company whose objective is to achieve long-term capital growth through investment in private equity assets, whilst providing shareholders with a predictable and above average level of dividend funded from a combination of the Company’s revenue and realised capital profits.

https://www.columbiathreadneedle.com/private-equity-trust-plc

Total assets: £601.0 million

Share price: 459.00p

NAV – per IFRS: 693.40p

Discount/premium(-/+): -33.8%

CT PRIVATE EQUITY TRUST PLC CTPE Stock | London Stock Exchange

Courtesy of Columbia Threadneedle Investments

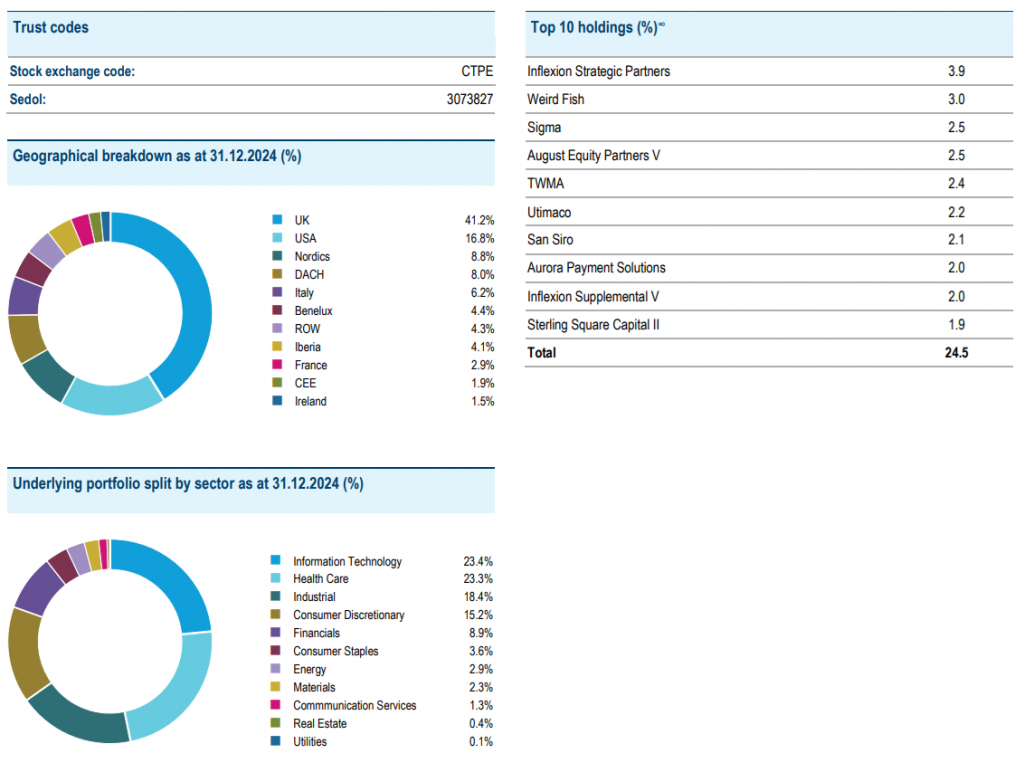

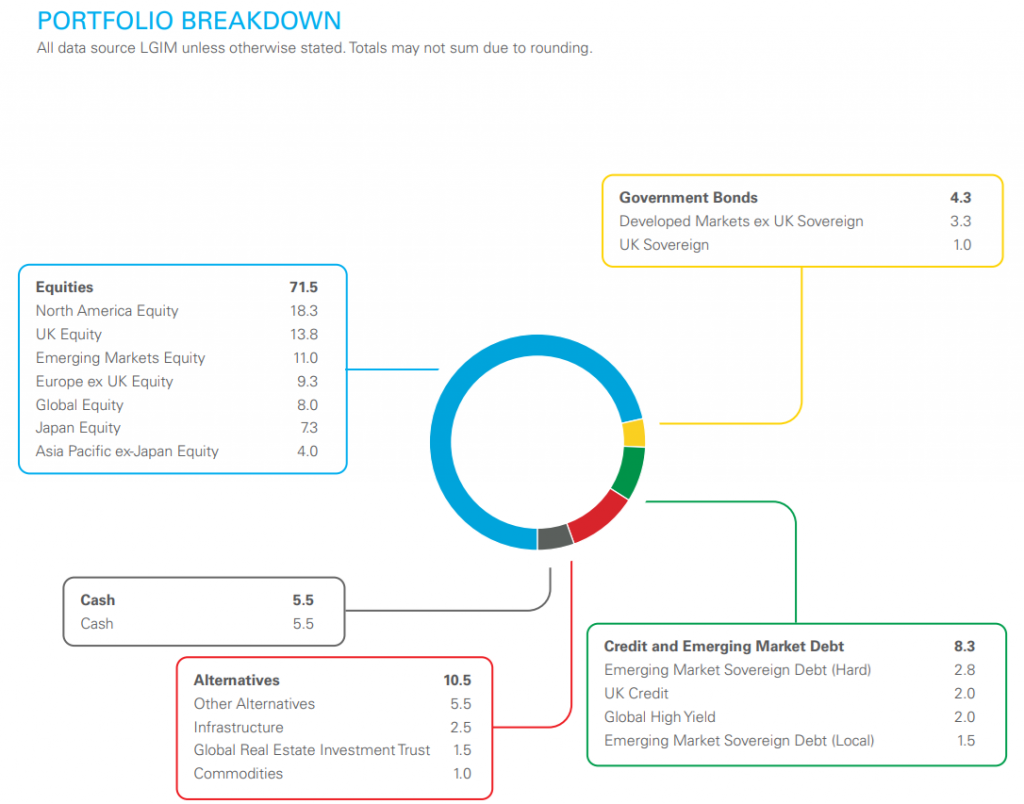

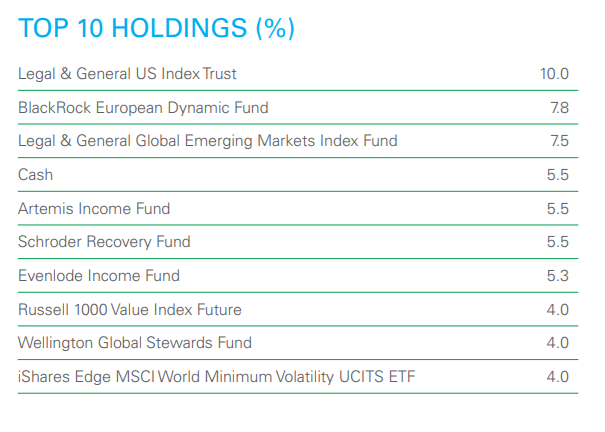

Legal & General Multi Manager Growth Trust

The Legal & General Multi Manager Growth Trust is a fund of funds

The objective of the Fund is to provide growth by investing in a broad range of asset classes through collective investment schemes

Courtesy of Legal and General Investment Management

£165.7m of assets in the fund.

Courtesy of Legal and General Investment Management

Courtesy of Legal and General Investment Management

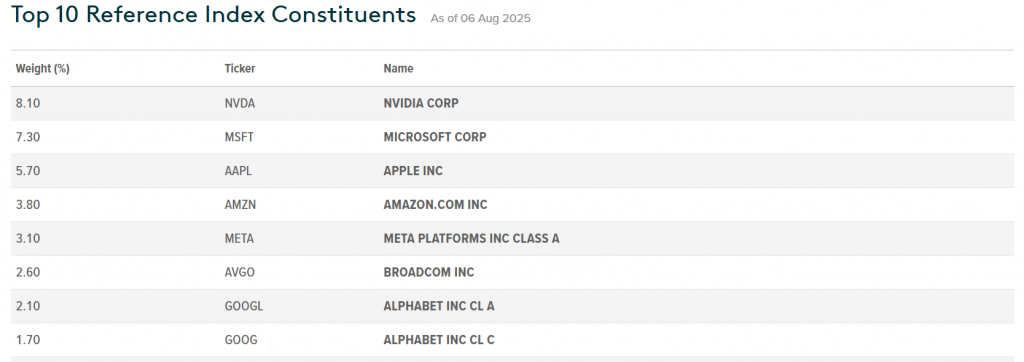

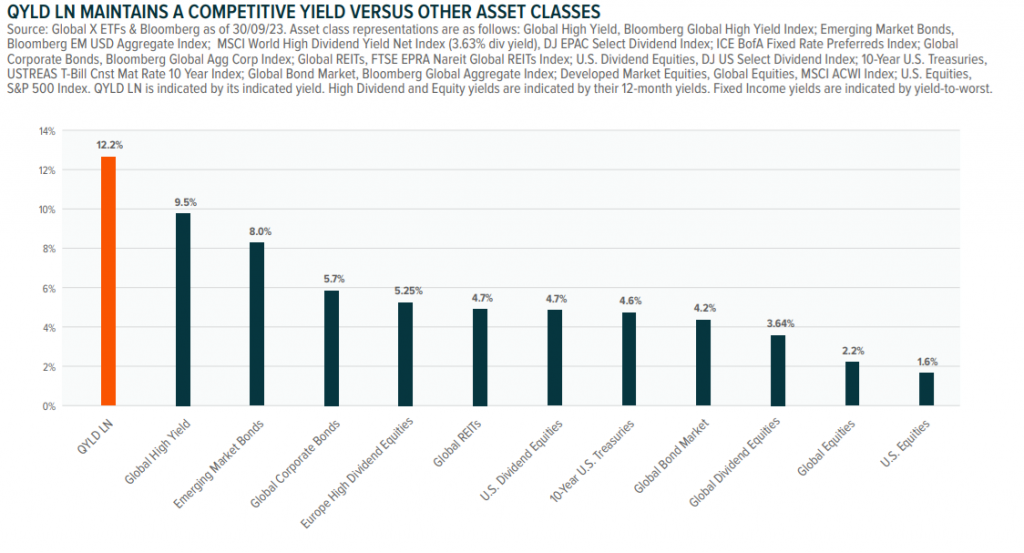

S&P 500 Covered Call UCITS ETF is an ETF that seeks to generate income by replicating a buy-write index via premiums received from selling covered calls.

A covered call strategy is an option-based income strategy that involves selling call options against owned stocks to generate income while mitigating downside risk. This strategy can also provide a variety of diversification benefits.

Courtesy of Mirae Asset Management

Courtesy of the London Stock Exchange

Courtesy of NBIM

The Nasdaq 100 Covered Call UCITS ETF is an ETF that seeks to generate income by replicating a buy-write index via premiums received from selling covered calls.

A covered call strategy is an option-based income strategy that involves selling call options against owned stocks to generate income while mitigating downside risk. This strategy can also provide a variety of diversification benefits.

The covered call strategy has recently maintained a relatively higher yield. With a 12-month yield of 12.2%, QYLD LN

outperforms global high-yield bonds (9.5%) and emerging market bonds (8%), as well as traditional asset classes such as 10-Year U.S. Treasuries (4.6%) and U.S. Equities (1.6%).

Courtesy of Mirae Asset Management

Courtesy of Mirae Asset Management

GLOBAL X ETFS ICAV QYLP Stock | London Stock Exchange

Courtesy of The London Stock Exchange

Today the FTSE100 member, Vodafone PLC, the UK’s 2nd largest telecoms carrier, paid out is August dividend

€0.0225 a share

https://investors.vodafone.com/shareholder-centre/dividends

FX €:£ 0.86853

Thus:-

€0.0225 a share = £0.019541925 a share

https://www.londonstockexchange.com/news-article/VOD/total-voting-rights/17113023

Therefore, the total number of voting rights in Vodafone is 24,473,216,478

Thus:-

24,473,216,478 x £0.019541925 = £478,253,760.92184015

that is £478 million paid to shareholders

https://www.londonstockexchange.com/stock/VOD/vodafone-group-plc/analysis