The Nasdaq 100 Covered Call UCITS ETF is an ETF that seeks to generate income by replicating a buy-write index via premiums received from selling covered calls.

A covered call strategy is an option-based income strategy that involves selling call options against owned stocks to generate income while mitigating downside risk. This strategy can also provide a variety of diversification benefits.

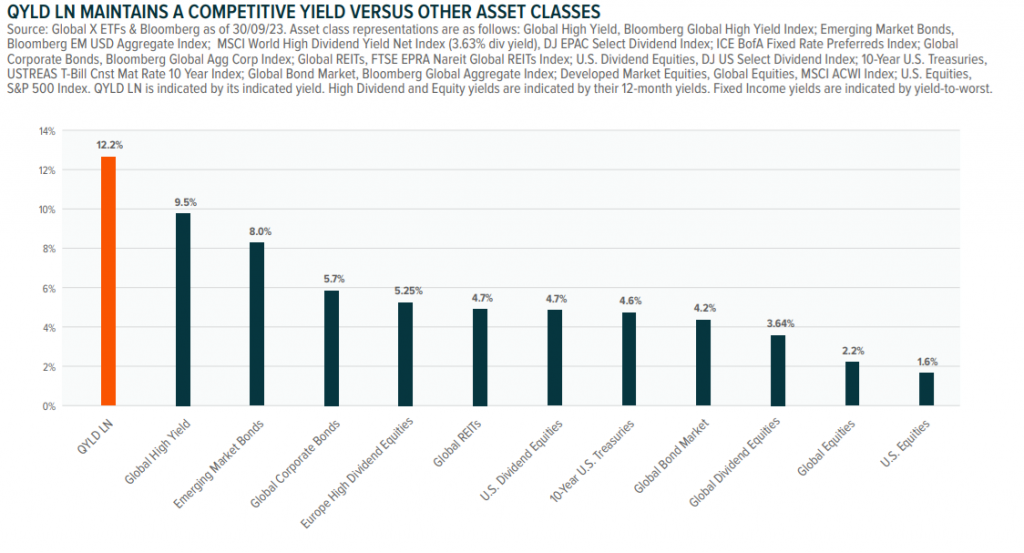

The covered call strategy has recently maintained a relatively higher yield. With a 12-month yield of 12.2%, QYLD LN

outperforms global high-yield bonds (9.5%) and emerging market bonds (8%), as well as traditional asset classes such as 10-Year U.S. Treasuries (4.6%) and U.S. Equities (1.6%).

Courtesy of Mirae Asset Management

Courtesy of Mirae Asset Management

GLOBAL X ETFS ICAV QYLP Stock | London Stock Exchange

Courtesy of The London Stock Exchange