Courtesy of Cyber Dyne Systems

Monthly Archives: January 2026

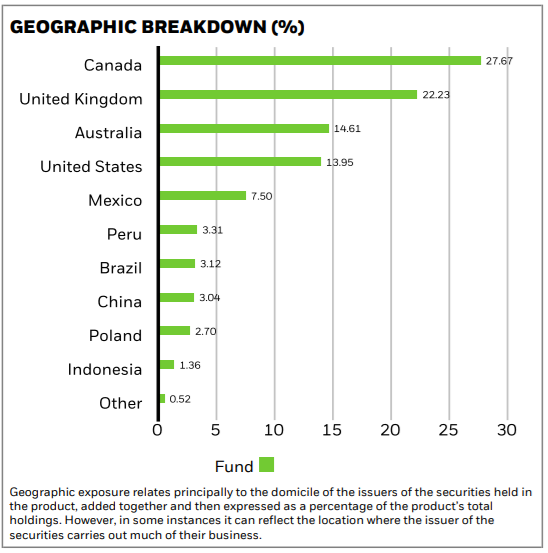

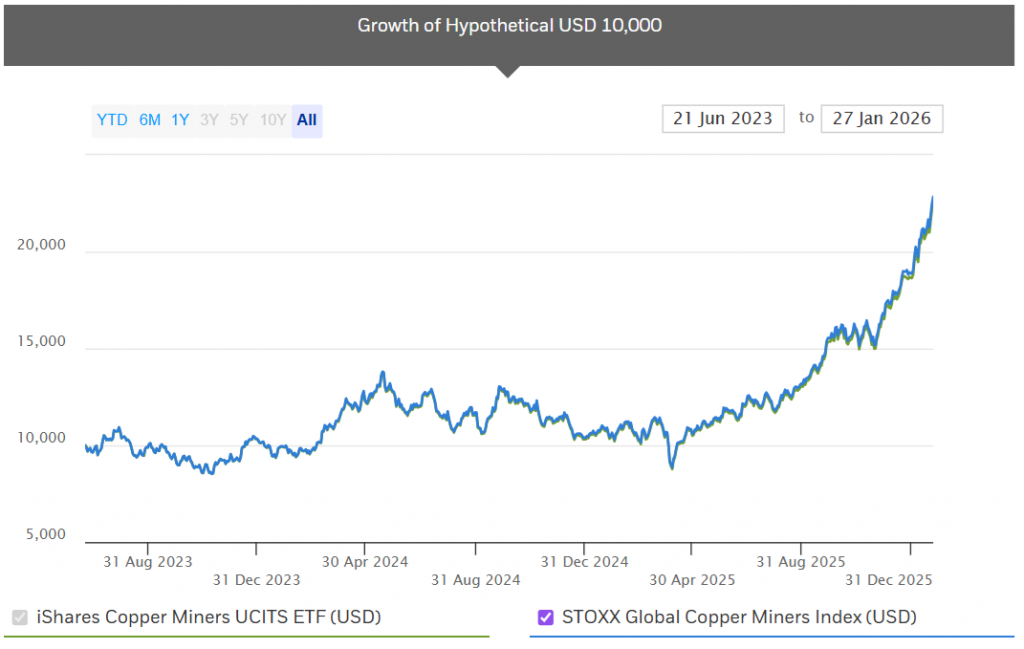

The ISHARES COPPER MINERS UCITS ETF

The fund (iSHARES COPPER MINERS UCITS ETF) aims to achieve a return on your investment, through a combination of capital growth and income on the Fund’s assets, which reflects the return of the STOXX Global Copper Miners Index, the Fund’s benchmark index (Index).

Courtesy of BlackRock

Courtesy of BlackRock

ISHARES MINE Stock | London Stock Exchange

Courtesy of BlackRock

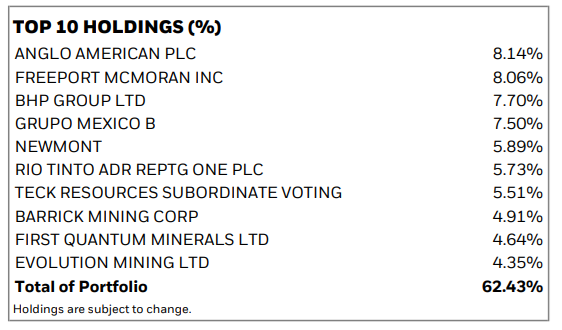

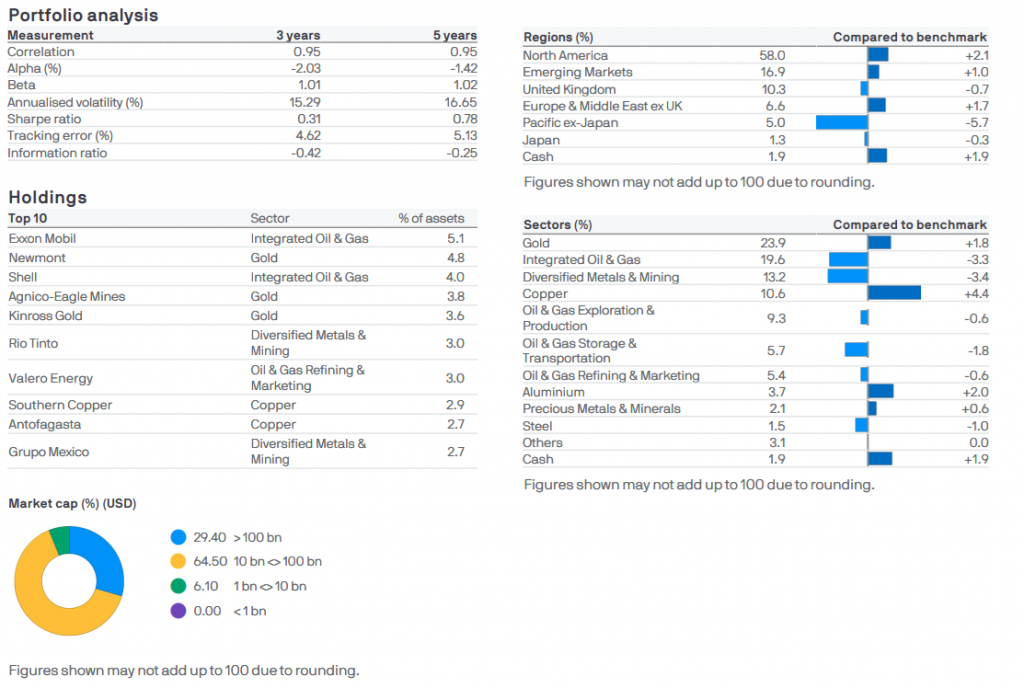

JPM Natural Resources Fund

The JPM Natural Resources Fund aims to provide capital growth over the long-term (5-10 years) by investing at least 80% of the Fund’s assets in the shares of companies throughout the world engaged in the production and marketing of commodities.

Fund size: [As of 23/01/2026] GBP £1.12 Billion

Top holdings

As of 31/12/2025

| Name | Sector | Weight |

|---|---|---|

| Exxon Mobil | Integrated Oil & Gas | 5.1% |

| Newmont | Gold | 4.8% |

| Shell | Integrated Oil & Gas | 4.0% |

| Agnico-Eagle Mines | Gold | 3.8% |

| Kinross Gold | Gold | 3.6% |

| Rio Tinto | Diversified Metals & Mining | 3.0% |

| Valero Energy | Oil & Gas Refining & Marketing | 3.0% |

| Southern Copper | Copper | 2.9% |

| Antofagasta | Copper | 2.7% |

| Grupo Mexico | Diversified Metals & Mining | 2.7% |

Courtesy of JP Morgan Asset Management

JPM Natural Resources Fund B – Net Accumulation | J.P. Morgan Asset Management

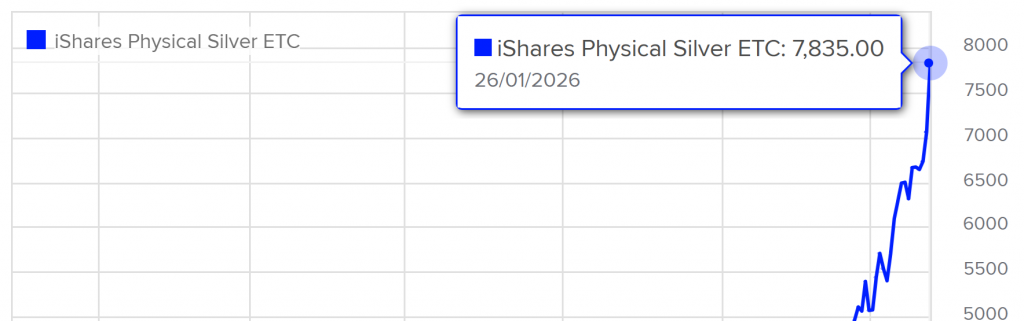

SILVER !

ISHARES SSLN Stock | London Stock Exchange

Courtesy of The London Stock Exchange

Courtesy of The London Stock Exchange

Freeman Dyson – Early work on Ramanujan and the continued relevance of mathematics (he referred to Ramanujan as “this Indian genius”

Courtesy of the late great Freeman Dyson

Warren Buffett officially steps down as CEO of Berkshire Hathaway

Courtesy of CNBC

Ray Dalio: Speaking to David Rubenstein

Courtesy of Bloomberg

US Government Borrowings: Week Commencing Monday 12th Jan 2025

US Government Sold $654 Billion of Treasuries, week commencing Monday 12th January 2025.

In the week, the US Government sold $654 billion in Treasury securities spread over 9 auctions, including 10-year Treasury notes and 30-year Treasury bonds.

Of these auction sales, $500 billion were Treasury bills with maturities from 4 weeks to 26 weeks, most of them to replace maturing T-bills.

| Type | Auction date | Billion $ | Auction yield |

| Bills 6-week | Jan-13 | 77.5 | 3.585% |

| Bills 13-week | Jan-12 | 88.8 | 3.570% |

| Bills 17-week | Jan-14 | 69.2 | 3.560% |

| Bills 26-week | Jan-12 | 79.5 | 3.580% |

| Bills 4-week | Jan-15 | 95.3 | 3.595% |

| Bills 8-week | Jan-15 | 90.3 | 3.600% |

| Bills | $500.5 Billion |

And of these $654 billion in auction sales, $154 billion were notes and bonds, including $50 billion in 10-year Treasury notes.

| Notes & Bonds | Auction date | Billion $ | Auction yield |

| Notes 3-year | Jan-12 | 74.9 | 3.609% |

| Notes 10-year | Jan-12 | 50.4 | 4.173% |

| Bonds 30-year | Jan-13 | 28.4 | 4.825% |

| Notes & bonds | $153.6 Billion |

Added up, this is $654 Billion, in US Government borrowings. The US Government has to borrow, as the taxes collected are not enough to fund the US Federal Government’s spending commitments, and thus borrows.

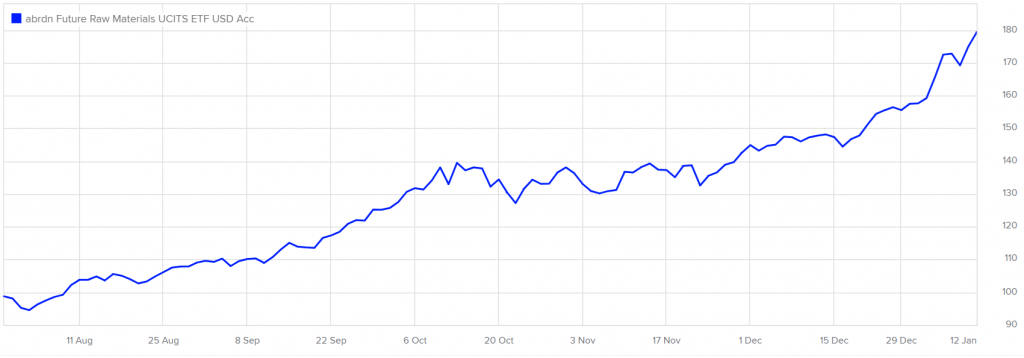

The Abrdn Future Raw Materials ETF

Courtesy of The London Stock Exchange

Top Ten Holdings:-

| 1 | SIGMA LITHIUM CORP ORD | 4.52% |

| 2 | CHINA HONGQIAO GROUP LTD ORD | 4.07% |

| 3 | PLS GROUP LTD ORD | 4.02% |

| 4 | ALCOA CORP ORD | 3.93% |

| 5 | HUDBAY MINERALS INC ORD | 3.71% |

| 6 | CHINA NONFERROUS MINING CORP LTD ORD | 3.63% |

| 7 | ALUMINUM CORPORATION OF CHINA LTD ORD | 3.51% |

| 8 | MP MATERIALS CORP ORD | 3.47% |

| 9 | LYNAS RARE EARTHS LTD ORD | 3.43% |

| 10 | PRESS METAL ALUMINIUM HOLDINGS BHD ORD | 3.38% |

Top Ten Holdings make up 37% of the fund.

3i Infrastructure PLC: January 2026 Dividend

On Monday 12th Jan 2026, the listed infrastructure investor, 3i Infrastructure PLC paid out its dividend.

https://www.3i-infrastructure.com/

6.725p a share.

the total number of voting rights for 3i Infrastructure plc was 922,350,000

Thus:-

922,350,000 x £0.06725 = £62,028,037.5

That is £62 million paid to shareholders in 3i Infrastructure PLC

Courtesy of The London Stock Exchange

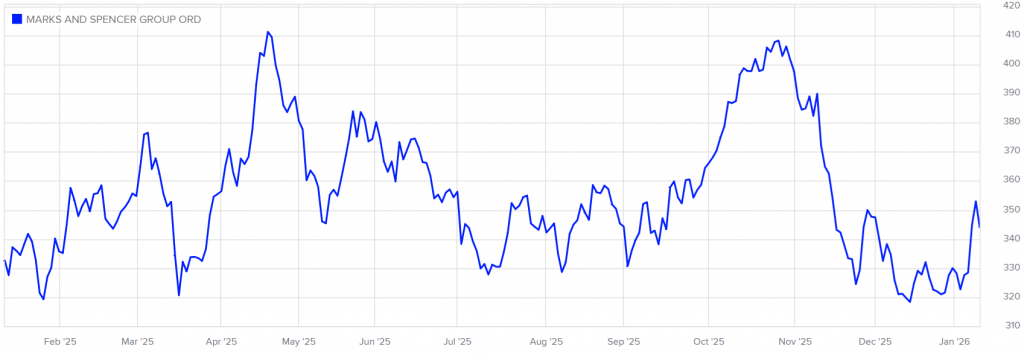

Marks and Spencer Group: Jan 2026 Dividend

On Friday 9th Jan 2026, the UK Flagship high street retailer paid out its Jan 2026 dividend.

https://corporate.marksandspencer.com

1.2p a share.

https://www.londonstockexchange.com/news-article/MKS/total-voting-rights/17396499

The Company’s capital consists of 2,057,140,555 ordinary shares with voting rights

Thus:-

2,057,140,555 x £0.012 = £24,685,686.66

That is £24million paid to shareholders in Marks & Sparks

Courtesy of The London Stock Exchange

MARKS AND SPENCER GROUP PLC MKS Stock | London Stock Exchange

Running Up That Hill….

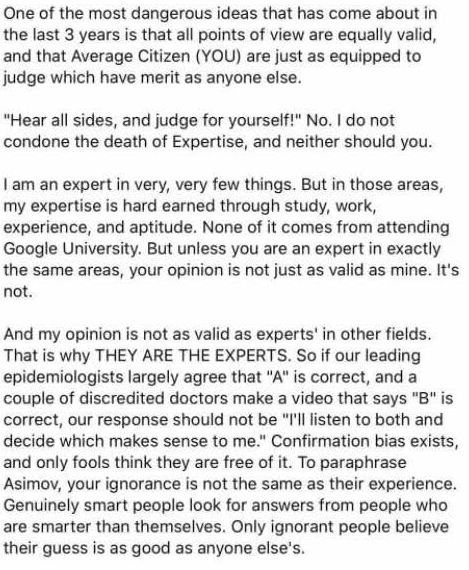

Sad Reality of Modern Life “Everyone Is An Expert” :- Truth, there are few experts

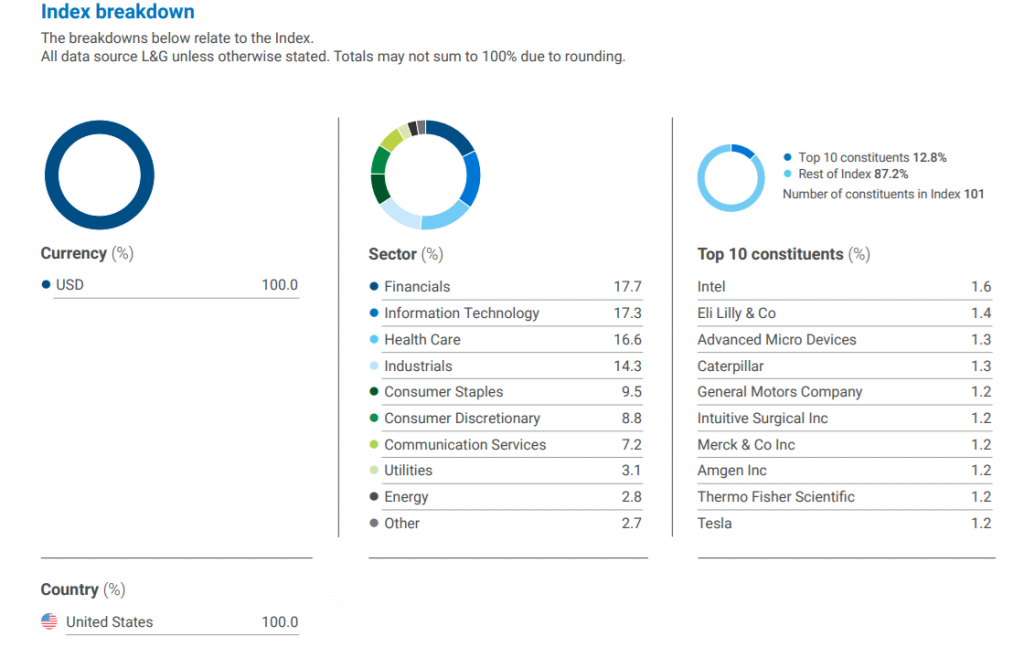

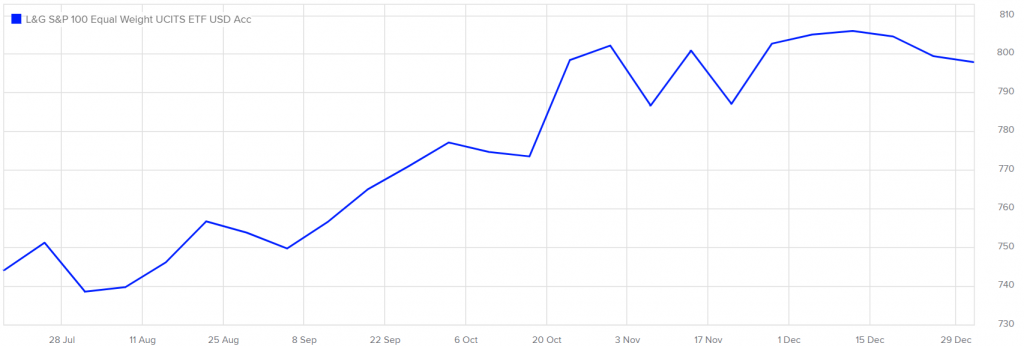

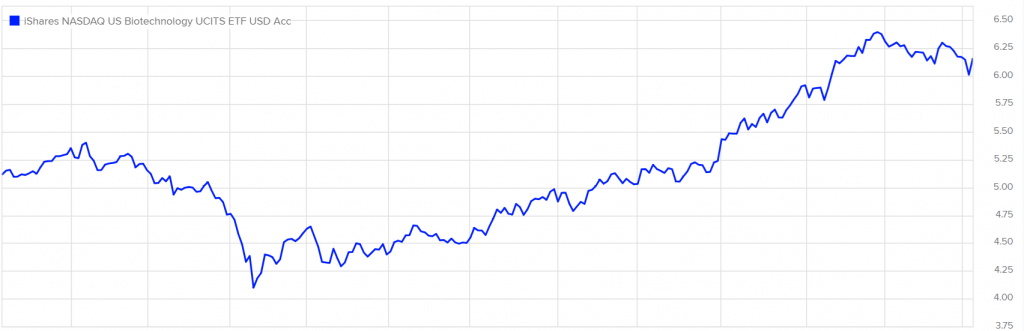

BTEK ISHARES NASDAQ US BIOTEC UCITS USD

The iShares Nasdaq US Biotechnology UCITS ETF seeks to track the investment results of an

index composed of biotechnology and pharmaceutical equities listed on the NASDAQ.

ISHARES BTEK Stock | London Stock Exchange

FromToTotal ReturnThis is an input box to enter up to four benchmarks that you want to compare with the base ric.Use left and right arrow keys to navigate, enter to create, delete to delete tags Only list items can be added as tagsThis is an input box to enter up to ten indicators.Use left and right arrow keys to navigate, enter to create, delete to delete tags Use up and down arrow keys to navigate list items and enter to add a new tag Only list items can be added as tags

Top holdings, as of 30 November 2025

| Rank | Name | % Weight |

|---|---|---|

| 1 | AMGEN INC ORD | 7.80 |

| 2 | GILEAD SCIENCES INC ORD | 7.24 |

| 3 | VERTEX PHARMACEUTICALS INC ORD | 7.20 |

| 4 | REGENERON PHARMACEUTICALS INC ORD | 6.33 |

| 5 | ALNYLAM PHARMACEUTICALS INC ORD | 4.61 |

| 6 | ASTRAZENECA ADR REP 0.5 ORD | 3.77 |

| 7 | INSMED INC ORD | 3.45 |

| 8 | ARGENX ADR REP ORD | 2.19 |

| 9 | BIOGEN INC ORD | 2.10 |

| 10 | UNITED THERAPEUTICS CORP ORD | 1.73 |

Courtesy of the London Stock Exchange

Net Assets of Fund (M) : 859.37 Million USD

Courtesy of the London Stock Exchange