The JPM Natural Resources Fund aims to provide capital growth over the long-term (5-10 years) by investing at least 80% of the Fund’s assets in the shares of companies throughout the world engaged in the production and marketing of commodities.

Fund size: [As of 23/01/2026] GBP £1.12 Billion

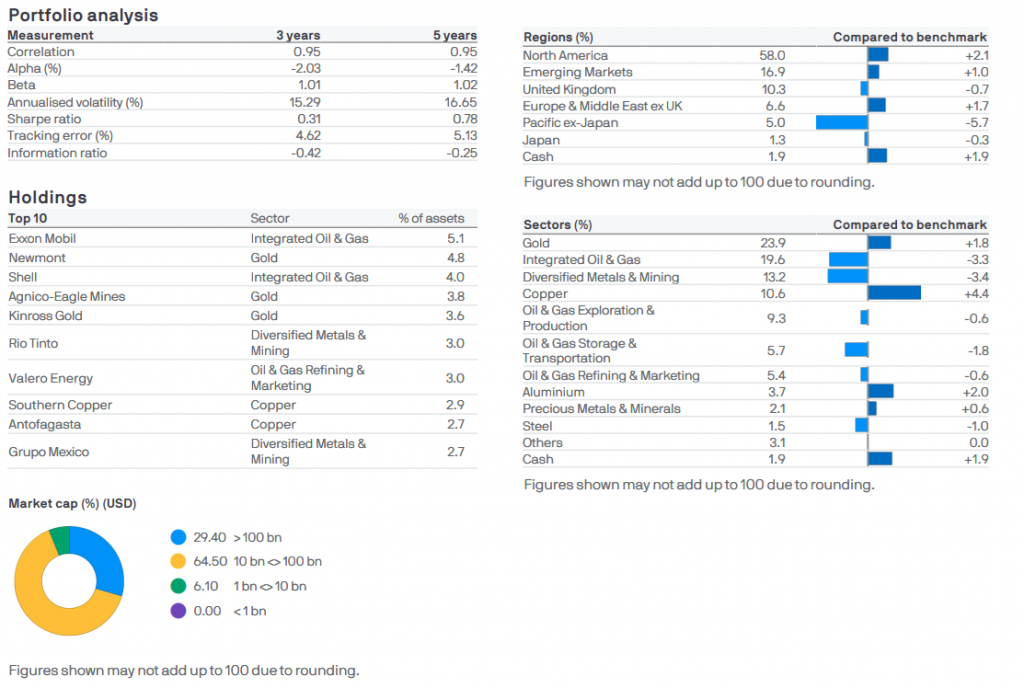

Top holdings

As of 31/12/2025

| Name | Sector | Weight |

|---|---|---|

| Exxon Mobil | Integrated Oil & Gas | 5.1% |

| Newmont | Gold | 4.8% |

| Shell | Integrated Oil & Gas | 4.0% |

| Agnico-Eagle Mines | Gold | 3.8% |

| Kinross Gold | Gold | 3.6% |

| Rio Tinto | Diversified Metals & Mining | 3.0% |

| Valero Energy | Oil & Gas Refining & Marketing | 3.0% |

| Southern Copper | Copper | 2.9% |

| Antofagasta | Copper | 2.7% |

| Grupo Mexico | Diversified Metals & Mining | 2.7% |

Courtesy of JP Morgan Asset Management

JPM Natural Resources Fund B – Net Accumulation | J.P. Morgan Asset Management