The 2nd largest UK telecoms operator is Vodafone PLC.

The largest and most dynamic telecoms operator is British Telecommunications PLC

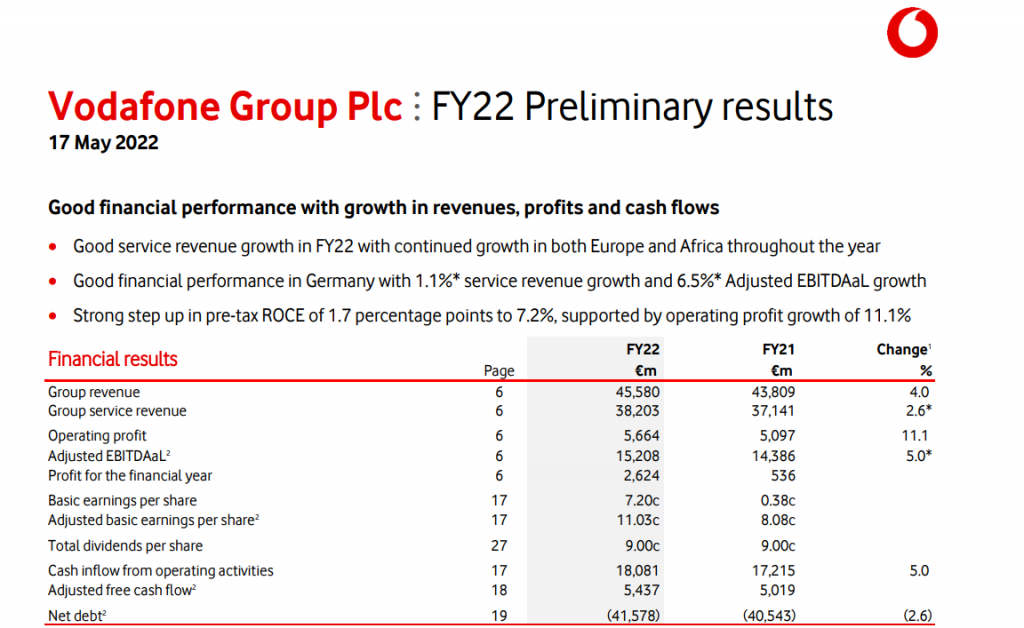

Some interesting points can be found in the results of Vodafone

https://investors.vodafone.com/sites/vodafone-ir/files/2022-05/FY22-Press-release-Final.pdf

The revenues are huge. Cash in the door from the business operations.

€45,580 Million = £38,794.80 Million = £38.794 Billion

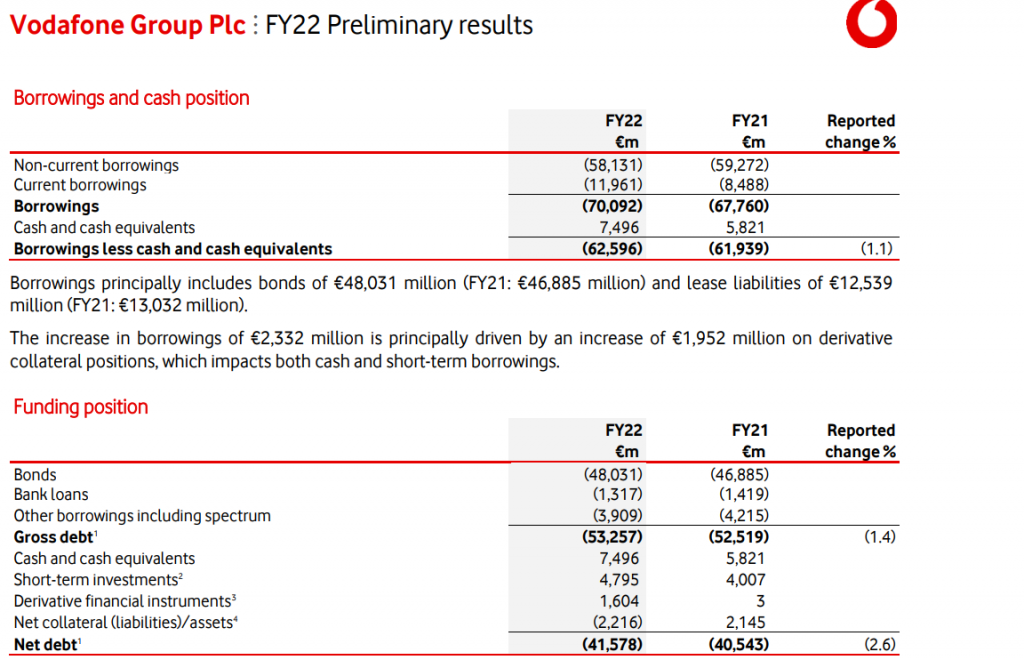

Total Debt of €41,578 Million = £35,388.60 Million = £35.3886 Billion

One can see total debt of €41,578 Million, but the total debt is €53,257 Million = £45,329 Million = £45.329 Billion.

Vodafone holds liquidity of cash and near term cash assets of €7,496 Million + €4,795 Million + €1,604) = €13,895 Million = £11.8265 Billion.

Now Total debt is €53,257 Million = £45,329 Million = £45.329 Billion.

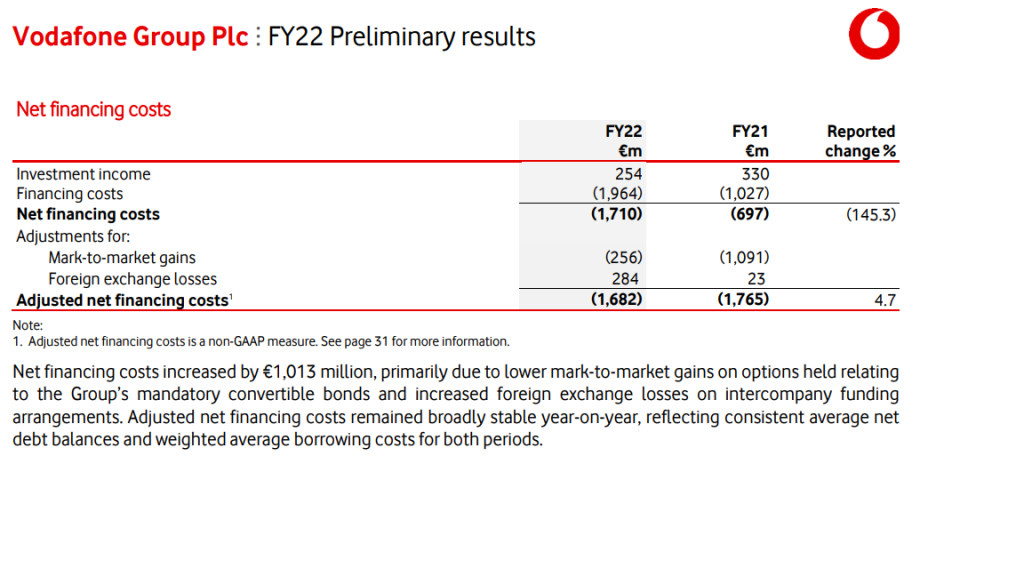

Financing costs = interest payment costs are €1,964 Million = £1,671.63 Million = £1.67163 Billion.

So a rough calculation on Vodafone’s interest payment of £1,671.63 Million on the total debt of £45.329 Billion, (£1.67163 Billion / £45.329 Billion) tells us that Vodafone on average is paying approximately an interest rate of 3.68% a year on its debt. That is cheap borrowing.

Consider the facts, revenues of £38.794 Billion, interest payments of £1.67163 Billion and holding cash and near cash assets of £11.8265 Billion