Vodafone Dividend

Today, Vodafone PLC pays out its August 2018 dividend.

€0.1023 a share:

The total number of voting rights in Vodafone plc is 26.714,482,765

Thus:

26,714,482,764 x €0.1023 a share = €2,732,891,586.7

That is £2,427,800,000 = £2.427 Billion

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10097

a yield of over 7%

The Foreign & Colonial Investment Trust August Dividend

Today, the Foreign & Colonial Investment Trust pays out it’s dividend.

http://www.fandc.com/foreign-and-colonial-investment-trust/

2.7p a share.

https://www.londonstockexchange.com/exchange/news/market-news/market-news-detail/FRCL/13703325.html

The total number of voting rights that can be exercised in the Company is, therefore, 542,180,712.

Thus:-

542,180,712 x £0.027 = £14,638,879.224

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10192&action=

1.5% yield.

Wise Words

The four most dangerous words in investing are: this time it’s different.

HM Government Borrowings: June 2018

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties. Another deficit month, thus to bridge the gap, needs to borrow on the bond market.

In June 2018 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement.

There were “only” 3 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office (http://www.dmo.gov.uk/) to raise cash for HM Treasury:-

26-Jun-2018 1¾% Treasury Gilt 2037 £2,587.4950 Million

20-Jun-2018 0 1/8% Index-linked Treasury Gilt 2028 3 months £1,381.4000 Million

06-Jun-2018 0¾% Treasury Gilt 2023 £2,750.0000 Million

When you add the cash raised:-

(2,587.4950 Million + £1,381.4000 Million + £2,750.0000 Million) = £6718.895 Million

£6718.895 Million = £6.718895 Billion

On another way of looking at it, is in the 30 days in June, HM Government borrowed:-

£223 million each day for the 30 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature 2023, 2028 and 2037. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

The Weiss Korea Opportunity Fund

The Weiss Korea Opportunity Fund

The Weiss Korea Opportunity Fund is an investment company, that is geographically focused on investing in South Korean companies.

http://www.weisskoreaopportunityfund.com/

Top 10 Holdings

Samsung Electronics Co. 23% of the fund

LG Electronics Inc. 8% of the fund

Samsung Electro-Mechanics Co. 6% of the fund

Samsung SDI Co., Ltd. 5% of the fund

CJ CheilJedang Corp. 5% of the fund

Hyundai Motor Company. 5% of the fund

Korea Investment Holdings Co. 4% of the fund

CJ Corporation. 3% of the fund

Hyundai Motor Company. 3% of the fund

LG Household & Health Care Ltd. 3% of the fund

Top 10 Holdings 66% of the fund

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=8703386&action=

The Truth

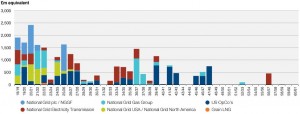

The National Grid Debt

The UK’s National Grid is the power transmission company of the United Kingdom.

It carries a lot of debt to fund its operations.

The current outstanding debt is £23.0 billion (2017: £19.3 billion).

The interest payments on the debt (statutory net finance costs) were £745 million.

The effective interest rate on Treasury managed debt for the year was 4.6%

However, one has to note, that cash generated from continuing operations was £4,702 million, (£4.7 Billion)

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=51261

A yield of 5%

The Debt of Thames Water

Thames Water is the London water Utility.

www.thameswater.co.uk

It is owned by a group of investors:-

“Ontario Municipal Employees Retirement System (“OMERS”), one of Canada’s largest pension plans, and Wren House, the global direct infrastructure investment arm of the Kuwait Investment Authority, acquired the 26.3% managed stake from Macquire an Australian bank. OMERS has since agreed to increase its investment by a further 5.530%. When our recent sales complete towards the end of 2017, Thames Water will be jointly owned by 14 institutional investors – made up mostly of pension funds and sovereign wealth funds. The three largest

investors will represent pension funds – one based in Canada and two in the UK. All of our investors take a long-term view of the company’s infrastructure, its customers and the natural environment”

It carries debt to fund its business:-

a total of debt of £10,749.4 Million. That is £10.749 Billion

| Book Value Bonds including accretion Class A | 7,101.5 |

| Book Value Bonds including accretion Class B | 850.0 |

| Total Book Value Bonds including accretion | 7,951.5 |

| Class A USPP Notes | 479.1 |

| Class B USPP Notes | 119.8 |

| Class A RPI linked loans including accretion of £134.4m | 1,264.4 |

| Accretion on Index-linked Swaps | 223.3 |

| Class A Floating Rate Loans | 492.0 |

| Class A Cross-currency swaps | (78.9) |

| Class B Cross-currency swaps | (23.2) |

| Class B Loans | 179.0 |

| Less TWUL Cash Investments | (57.5) |

| TWUL Net Debt as per Compliance Certificate | 10,549.5 |

| Fees and Discounts | (75.2) |

| Intercompany Loans* | 300.0 |

| Derivative financial liabilities | (208.4) |

| Interest payable on amounts owed to group undertakings | 179.2 |

| Interest payable on secured bank loans | 4.3 |

| TWUL Net Debt as per accounts at 31 March 2017 | 10,749.4 |

| Issuer | Currency | Face Value

(currency m) |

Coupon % | Maturity Date | Class | Description | Face Value and accretion at 31 Mar 17 (£m) | |

| TWUCF | GBP | 550.0 | 5.375% | 21/07/2017* | B | Fixed Rate Bond | 550.0 | |

| TWUF | GBP | 200.0 | 5.050% | 30/06/2020 | A | Fixed Rate Bond | 200.0 | |

| TWUF | GBP | 225.0 | 6.590% | 20/04/2021 | A | Fixed Rate Bond | 225.0 | |

| TWUF | GBP | 175.0 | 3.375% | 21/07/2021 | A | RPI Linked Bond | 264.3 | |

| TWUCF | EUR | 113.0 | 2.300% | 18/07/2022 | A | CPI Linked Bond | 100.6 | |

| TWUCF | GBP | 300.0 | 5.750% | 13/09/2030 | B | Fixed Rate Bond | 300.0 | |

| TWUCF | GBP | 500.0 | 4.000% | 19/06/2025 | A | Fixed Rate Bond | 500.0 | |

| TWUCF | GBP | 45.0 | 0.721% | 21/12/2027 | A | RPI Linked Bond | 46.0 | |

| TWUCF | GBP | 300.0 | 3.5% | 25/02/2028 | A | Fixed Rate Bond | 300.0 | |

| TWUF | GBP | 330.0 | 6.750% | 16/11/2028 | A | Fixed Rate Bond | 330.0 | |

| TWUF | GBP | 200.0 | 6.500% | 09/02/2032 | A | Fixed Rate Bond | 200.0 | |

| TWUCF | GBP | 300.0 | 4.375% | 03/07/2034 | A | Fixed Rate Bond | 300.0 | |

| TWUCF | GBP | 40.0 | 0.75% | 18/12/2034 | A | RPI Linked Bond | 40.9 | |

| TWUF | GBP | 600.0 | 5.125% | 28/09/2037 | A | Fixed Rate Bond | 600.0 | |

| TWUCF | JPY | 20,000.0 | 3.280% | 20/08/2038 | A | Fixed Rate Bond | 143.3 | |

| TWUCF | GBP | 50.0 | 3.853% | 15/12/2040 | A | LPI Linked Bond | 60.9 | |

| TWUCF | GBP | 500.0 | 5.500% | 11/02/2041 | A | Fixed Rate Bond | 500.0 | |

| TWUCF | GBP | 50.0 | 1.980% | 28/08/2042 | A | RPI Linked Bond | 64.4 | |

| TWUCF | GBP | 55.0 | 2.091% | 06/10/2042 | A | RPI Linked Bond | 68.4 | |

| TWUCF | GBP | 40.0 | 1.974% | 12/10/2045 | A | RPI Linked Bond | 45.7 | |

| TWUCF | GBP | 300.0 | 4.625% | 04/06/2046 | A | Fixed Rate Bond | 300.0 | |

| TWUCF | GBP | 100.0 | 1.846% | 28/08/2047 | A | RPI Linked Bond | 128.9 | |

| TWUCF | GBP | 200.0 | 1.819% | 28/08/2049 | A | RPI Linked Bond | 257.8 | |

| TWUF | GBP | 300.0 | 1.680% | 11/07/2053 | A | RPI Linked Bond | 408.2 | |

| TWUF | GBP | 300.0 | 1.681% | 11/07/2055 | A | RPI Linked Bond | 408.2 | |

| TWUCF | GBP | 200.0 | 1.771% | 28/08/2057 | A | RPI Linked Bond | 257.8 | |

| TWUCF | GBP | 400.0 | 7.738% | 09/04/2058 | A | Fixed Rate Bond | 400.0 | |

| TWUCF | GBP | 350.0 | 1.760% | 28/08/2062 | A | RPI Linked Bond | 451.1 | |

| TWUCF | GBP | 250.0 | 1.875% | 24/01/2024 | A | Fixed Rate Bond | 250.0 | |

| TWUCF | GBP | 250.0 | 2.625% | 24/01/2032 | A | Fixed Rate Bond | 250.0 | |

| Total | 7,951.5

|

|||||||

The Value of the FTSE-100

Today the FTSE-100, the UK Flagship Index of the UK’s largest 100 companies is worth a lot of money.

£2,129,423.22 Million to be precise.

That is £2.129 TRILLION. That figure is larger than UK GDP.

101 companies because of the dual listing for Royal Dutch Shell, which trades as Royal Dutch Shell “A” and Royal Dutch Shell “B”

| Position | Symbol | Company | Market Capitalisation £m |

| 1 | HSBA | HSBC Holdings | £142,052.77 |

| 2 | RDSA | Royal Dutch Shell A | £120,008.21 |

| 3 | BP. | BP | £115,576.52 |

| 4 | RDSB | Royal Dutch Shell B | £100,716.11 |

| 5 | BATS | British American Tobacco | £87,849.26 |

| 6 | GSK | GlaxoSmithKline | £75,870.76 |

| 7 | DGE | Diageo | £66,984.00 |

| 8 | AZN | AstraZeneca | £66,536.99 |

| 9 | RIO | Rio Tinto | £55,246.45 |

| 10 | GLEN | Glencore | £52,217.56 |

| 11 | ULVR | Unilever | £50,680.14 |

| 12 | VOD | Vodafone | £49,036.85 |

| 13 | LLOY | Lloyds Banking Group | £45,474.30 |

| 14 | PRU | Prudential | £44,955.83 |

| 15 | RB. | Reckitt Benckiser Group | £44,052.37 |

| 16 | SHP | Shire | £38,982.71 |

| 17 | BLT | BHP Billiton | £36,030.68 |

| 18 | BARC | Barclays | £32,335.08 |

| 19 | RBS | Royal Bank of Scotland Group | £30,801.96 |

| 20 | NG. | National Grid | £28,141.47 |

| 21 | IMB | Imperial Brands | £26,914.46 |

| 22 | CPG | Compass Group | £25,631.83 |

| 23 | TSCO | Tesco | £25,261.01 |

| 24 | SKY | Sky | £25,123.44 |

| 25 | AAL | Anglo American | £23,808.03 |

| 26 | STAN | Standard Chartered | £23,141.48 |

| 27 | CRH | CRH | £22,394.66 |

| 28 | ABF | Associated British Foods | £21,676.04 |

| 29 | BT.A | BT Group | £21,609.90 |

| 30 | BA. | BAE Systems | £20,652.56 |

| 31 | AV. | Aviva | £20,351.60 |

| 32 | RR. | Rolls-Royce Holdings | £18,475.16 |

| 33 | EXPN | Experian | £17,198.38 |

| 34 | REL | RELX | £16,988.15 |

| 35 | LGEN | Legal & General Group | £15,850.56 |

| 36 | LSE | London Stock Exchange Group | £15,558.49 |

| 37 | WPP | WPP | £15,052.46 |

| 38 | FERG | Ferguson | £14,255.63 |

| 39 | SSE | SSE | £13,755.76 |

| 40 | IAG | International Consolidated Airlines | £13,490.74 |

| 41 | SN. | Smith & Nephew | £12,225.21 |

| 42 | RRS | Randgold Resources | £11,425.01 |

| 43 | AHT | Ashtead Group | £11,115.20 |

| 44 | INF | Informa | £10,450.37 |

| 45 | MRO | Melrose Industries | £10,179.66 |

| 46 | TUI | TUI AG | £9,765.31 |

| 47 | ANTO | Antofagasta | £9,759.98 |

| 48 | SLA | Standard Life Aberdeen | £9,704.01 |

| 49 | HL. | Hargreaves Lansdown | £9,351.19 |

| 50 | CCH | Coca Cola HBC AG | £9,317.48 |

| 51 | ITRK | Intertek Group | £9,225.23 |

| 52 | BRBY | Burberry Group | £9,028.27 |

| 53 | IHG | InterContinental Hotels Group | £8,999.62 |

| 54 | CCL | Carnival | £8,933.55 |

| 55 | CNA | Centrica | £8,894.88 |

| 56 | III | 3i Group | £8,762.00 |

| 57 | SDR | Schroders | £8,541.95 |

| 58 | NXT | Next | £8,507.67 |

| 59 | FRES | Fresnillo | £8,426.38 |

| 60 | PSN | Persimmon | £7,885.55 |

| 61 | BNZL | Bunzl | £7,716.97 |

| 62 | SMT | Scottish Mortgage Investment Trust | £7,547.63 |

| 63 | MNDI | Mondi | £7,532.11 |

| 64 | NMC | NMC Health | £7,458.11 |

| 65 | EVR | Evraz | £7,338.00 |

| 66 | SKG | Smurfit Kappa Group | £7,272.91 |

| 67 | WTB | Whitbread | £7,268.77 |

| 68 | OCDO | Ocado Group | £7,166.75 |

| 69 | RSA | RSA Insurance Group | £7,137.38 |

| 70 | LAND | Land Securities Group | £7,095.03 |

| 71 | SBRY | Sainsbury (J) | £7,065.51 |

| 72 | ITV | ITV | £7,004.21 |

| 73 | JMAT | Johnson Matthey | £7,003.97 |

| 74 | PPB | Paddy Power Betfair | £6,953.87 |

| 75 | PSON | Pearson | £6,908.93 |

| 76 | SGE | Sage Group | £6,811.02 |

| 77 | SGRO | Segro | £6,771.34 |

| 78 | SMIN | Smiths Group | £6,720.00 |

| 79 | EZJ | Easyjet | £6,645.29 |

| 80 | BLND | British Land | £6,602.15 |

| 81 | RTO | Rentokil Initial | £6,466.41 |

| 82 | KGF | Kingfisher | £6,340.13 |

| 83 | CRDA | Croda International | £6,321.50 |

| 84 | DCC | DCC | £6,158.74 |

| 85 | GVC | GVC Holdings | £6,074.96 |

| 86 | STJ | St. James’s Place | £6,073.72 |

| 87 | MRW | Morrison (Wm) Supermarkets | £5,936.99 |

| 88 | TW. | Taylor Wimpey | £5,861.90 |

| 89 | MCRO | Micro Focus International | £5,774.67 |

| 90 | SMDS | Smith (DS) | £5,600.61 |

| 91 | ADM | Admiral Group | £5,488.66 |

| 92 | JE. | Just Eat | £5,302.28 |

| 93 | BDEV | Barratt Developments | £5,218.67 |

| 94 | UU. | United Utilities Group | £5,204.17 |

| 95 | HLMA | Halma | £5,201.09 |

| 96 | BKG | Berkeley Group Holdings | £5,077.83 |

| 97 | RMG | Royal Mail | £5,054.00 |

| 98 | RMV | Rightmove | £4,810.83 |

| 99 | MKS | Marks & Spencer Group | £4,794.72 |

| 100 | DLG | Direct Line Insurance Group | £4,714.88 |

| 101 | SVT | Severn Trent | £4,687.63 |

| £2,129,423.22 |

Legal & General Global Infrastructure Index Fund

The Legal & General Global Infrastructure Index Fund targets companies that own, operate, manage or maintain essential infrastructure across a range of sectors, including utilities, industrials, and oil and gas.

a £250m fund

http://www.lgim.com/files/_document-library/adviser/global-infrastructure-index-fund-profile.pdf

Top 10 Holdings %

Union Pacific Corp 5.95% of the fund

Nextera Energy Inc 4.30% of the fund

American Tower Corp 3.45% of the fund

Canadian National Railway 3.09% of the fund

Duke Energy Corp 3.06% of the fund

Enbridge 2.92% of the fund

CSX Corp 2.67% of the fund

Southern Co 2.50% of the fund

Crown Castle Intl Corp 2.48% of the fund

Dominion Energy 2.43% of the fund

Total 32.85% of the fund are the top 10 holdings.

UK National Debt

Public sector net debt, excluding public sector banks, is £1,781.4bn that is equivalent to 85% of GDP.

Or with 60m people in the UK, that is about £30,000 per person in the UK.

The Wise Global Investors

A Beautiful Story. Berkshire Hathaway

https://www.youtube.com/watch?v=tqTOZLd3Cjw

JPMorgan Global Growth & Income plc

The JPMorgan Global Growth & Income plc is a London listed investment trust.

The objective of the fund is to deliver total returns and outperform the MSCI All Country World Index over the long-term by investing in companies based around the world. The Company makes quarterly dividends.

10 Largest Holdings are:

Alphabet 4.4% of the fund

Microsoft Technology 2.8% of the fund

United Health Group 2.8% of the fund

Prudential 2.0% of the fund

Pioneer Natural Resources 1.9% of the fund

Union Pacific 1.7% of the fund

Visa 1.6% of the fund

Standard Chartered 1.6% of the fund

Citigroup 1.6% of the fund

O Reilly Auto Parts 1.5% of the fund

2% yield.

Wise Quote

Warren Buffet quote:-

“Cash combined with courage in a time of crisis is priceless.”

The Investment Horizon View: The Clever Investor

The Dot.CON of 2001

The Debt of Vodafone 2017

Vodafone.

Carries a lot of debt.

http://www.vodafone.com/content/index/investors/debt_investors.html#

Reading the annual report you see it has revenues of £41,649.80 Million = £41.6Bn.

The level of debt is very interesting:-

The Debt of Vodafone 2017:- €m €m €m

Short-Term Long-Term Total

Bank loans: 867 2,741 3,608

Bonds: 660 19,345 20,005

Other liabilities: 4,632 305 4,937

Bonds in designated hedge relationships 2,244 12,132 14,37

Total: 12,051 34,523 46,574

That is €m 46,574 = £40,725.5 = £40.725 Bn

The Diverse Income Trust plc

The The Diverse Income Trust plc is a London Listed £400 investment trust.

https://www.mitongroup.com/private/fund/the-diverse-income-trust-plc/

The Company invests primarily in quoted or traded UK companies with a wide range of market capitalisations, but a long-term bias toward small and medium sized companies. The Company may also invest in large companies, including FTSE 100 Index constituents

Top 20 Holdings are:-

Zotefoams plc 2.2% of the fund

2.Stobart Group Ltd 2.1% of the fund

3.Charles Taylor plc 2.0% of the fund

4.SafeCharge International Group Ltd 1.8% of the fund

5.Amino Technologies 1.6% of the fund

6.A&J Mucklow Group plc 1.5% of the fund

7.Royal Dutch Shell plc* 1.4% of the fund

8.Randall & Quilter Investment Holdings 1.3% of the fund

9.CML Microsystems plc 1.3% of the fund

10.K3 Capital Group plc 1.3% of the fund

11.FTSE Put Option 20/09/19 1.3% of the fund

12.International Greetings plc 1.2% of the fund

13.Smurfit Kappa Group plc 1.2% of the fund

14.PJSC Polyus GDR 1.2% of the fund

15.Sainsbury plc 1.2% of the fund

16.Aviva plc 1.2% of the fund

17.Rio Tinto plc 1.2% of the fund

18.Morses Club plc 1.2% of the fund

19.BP plc 1.1% of the fund

20.Legal & General Group plc 1.1% of the fund

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=2543596&action=

A 2.8% yield.

Index Funds for Beginners

The EP Global Opportunities Trust plc

The EP Global Opportunities Trust plc is a £130m London listed investment.

https://www.edinburghpartners.com/investment-trusts/ep-global-opportunities-trust-plc/documents

The Company’s objective is to provide Shareholders with an attractive real long-term total return by investing globally in undervalued securities.

Top 10 Holdings

Roche Holdings Health Care 3.3% of the fund

Astrazeneca Health Care 3.2% of the fund

BP Oil & Gas 3.1% of the fund

Tesco Retail 3.1% of the fund

Verizon Communications Inc Telecoms 3.0% of the fund

Sumitomo Mitsui Trust Banks 2.9% of the fund

Panasonic Personal & Household Goods 2.9% of the fund

ENI Oil & Gas 2.9% of the fund

Total Oil & Gas 2.7% of the fund

Sumitomo Mitsui Financial Group Banks 2.7% of the fund

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=54096

Assets of The TwentyFour Select Monthly Income Fund

TwentyFour Select Monthly Income Fund is a London listed closed-ended fund which is designed to take advantage of the premium returns available from “less liquid” instruments across the debt spectrum.

https://twentyfouram.com/funds/twentyfour-select-monthly-income-fund/

It’s top ten holdings are:-

NATIONWIDE BLDG 10.25 PERP Banks 3.72% of whole fund

BRACKEN MIDCO 10.5 15/11/2021 High Yield – EU 2.63% of whole fund

SHAWBROOK GROUP 7.875 PERP Banks 2.54% of whole fund

COVENTRY BDG SOC 6.375 PERP Banks 2.28% of whole fund

SANTANDER UK PLC 10.375 PERP Banks 2.15% of whole fund

ALDERMORE 11.875 PERP Banks 1.83% of whole fund

ARBR 3X FR ABS 1.68% of whole fund

OPTOM 3 MEZZ ABS 1.67% of whole fund

BANCO BILBAO VIZ 8.875 PERP Banks 1.63% of whole fund

CBFLU 1 MEZZ ABS 1.56% of whole fund

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=26656574

6.6% yield, paying 0.5p out a month.

BP’s June 2018 Quarterly Dividend.

Tomorrow, BP PLC one of the oil majors pays out its quarterly dividend of 7.4435p a share.

What does this dividend cost ?

https://otp.investis.com/clients/uk/bp_plc/rns/regulatory-story.aspx?cid=233&newsid=1036742

The total number of voting rights in BP p.l.c. is 19,954,945,428

Thus:-19,954,945,428

19,954,945,428 x £0.074435 = £1,485,346,362.93

That is £1.485 Billion.

A yield of 5.1%

WorldCom = A WorldCON

https://www.youtube.com/watch?v=7g_d-phoUrU

Shell’s Quarterly Dividend: June 2018

Tomorrow, Royal Dutch Shell pays out its quarterly dividend.

RDSA Royal Dutch Shell A $0.47 (35.18p)

RDSB Royal Dutch Shell B $0.47 (35.18p)

£0.3518 a share.

https://irssl.euroinvestor.com/asp/ir/IRM_Shell/ssl2017/NewsRead.aspx?storyid=13939519&ishtml=1

Royal Dutch Shell plc’s capital consists of 4,597,136,050 A shares and 3,745,486,731 B shares, each with equal voting rights.

Thus:

4,597,136,050 x £0.3518 = £1,617,272,462.39

3,745,486,731 x £0.3518 = £1,317,662,231.97

That is:-

£1,617,272,462.39 + 1,317,662,231.97 = £2,934,934,694.36

That is £2.934 Billion of cash.

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=133655

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=133755

That is over a 5% yield.

ETFS Battery Value-Chain GO UCITS ETF

The ETFS Battery Value-Chain GO UCITS ETF is a London Listed Exchange Traded Fund

It is now known as the L&G Battery Value-Chain UCITS ETF

The fund is investing in technology companies in the Battery sector. The ETFS Battery Value-Chain GO UCITS ETF (BATT) is designed to track the performance of the Solactive Battery Value-Chain Index.The Index aims to track the performance of a basket of stocks of companies that are providers of certain electro-chemical energy storage technologies and mining companies that produce metals used to manufacture batteries.

Ten Top Holdings

1 OROCOBRE LTD 4.39% of the fund

2 TOSHIBA CORP ORD 4.26% of the fund

3 TESLA INC 4.26% of the fund

4 NIDEC CORP ORD 4.25% of the fund

5 NEC CORP ORD 4.25% of the fund

6 GS YUASA CORP 4.17% of the fund

7 SONY CORP 4.14% of the fund

8 NISSAN MOTOR CO LTD ORD 4.11% of the fund

9 ENERSYS 3.91% of the fund

10 PANASONIC CORP 3.83% of the fund

Why Index Funds Work

Investment: A Miracle Drug

https://www.youtube.com/watch?v=AQedOz_Hsv8

I want to trip inside your head

Spend the day there

To hear the things you haven’t said

And see what you might see

I want to hear you when you call

Do you feel anything at all?

I want to see your thoughts take shape and walk right out

Freedom has a scent

Like the top of a newborn baby’s head

The songs are in your eyes

I see them when you smile

I’ve seen enough, I’m not giving up on a miracle drug

Of science and the human heart

There is no limit

There is no failure here, sweetheart

Just when you quit

I am you and you are mine

Love makes nonsense of space and time, will disappear

Love and logic keep us clear

Reason is on our side, love

The songs are in your eyes

I see them when you smile

I’ve had enough of romantic love

I’d give it up, yeah, I’d give it up

For a…

5% Yield from BT plc

British Telecommunications PLC is the world’s leading Telecommunications and Media organisation. It is the UK’s premier company.

The yield today on BT shares is now at 5%

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10025&action=

BT. Be There.

Legal & General May 2018 dividend.

Today, the Insurer and Investment Management giant, Legal and General paid out it’s June 2018 Dividend.

11.05p a share.

The total number of voting rights in the Company is 5,958,820,443

https://ir.euroinvestor.com/solutions/LegalAndGeneralGroup/3726/newsArticle.aspx?storyid=13904793

Thus:-

5,958,820,443 x £0.1105 = £658,449,658.95

that is £658million in cash.

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10055&action=

5.7% yield.

HM Government Borrowings: May 2018

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties. Another deficit month, thus to bridge the gap, needs to borrow on the bond market.

In May 2018 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement.

There were “only” 3 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office (http://www.dmo.gov.uk/) to raise cash for HM Treasury:-

24-May-2018 0 1/8% Index-linked Treasury Gilt 2036 3 months 1,146.8740 Million

09-May-2018 1 5/8% Treasury Gilt 2028 2,810.0810 Million

03-May-2018 0¾% Treasury Gilt 2023 3,427.0340 Million

When you add the cash raised:-

(£1,146.8740 Million + £2,810.0810 Million + £3,427.0340 Million) = £7383.989 Million

£7383.989 Million = £7.383989 Billion

On another way of looking at it, is in the 31 days in May, HM Government borrowed:-

£238 million each day for the 31 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature 2023, 2028 and 2036. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

Global Capitalism: Linking Trump and Marx’ Critique of Capitalism

Warren Buffet Quote.

“Investors should be skeptical of history-based models. Constructed by a nerdy-sounding priesthood using esoteric terms such as beta, gamma, sigma and the like, these models tend to look impressive. Too often, though, investors forget to examine the assumptions behind the models. Beware of geeks bearing formulas. ”

The Standard Life Aberdeen May Dividend.

Yesterday, the money manager, Standard Life Aberdeen paid out is May dividend.

14.3p per share.

https://www.standardlifeaberdeen.com/

The total number of voting rights in the Company, as at 30 April 2018, is therefore 2,979,383,303

http://www.londonstockexchange.com/exchange/news/market-news/market-news-detail/SLA/13626025.html

Thus the cost of the dividend:-

2,979,383,303 x 14.3p = £426,051,812.33

That is £426 million in cash.

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=186960

A yield of 5.9%

The Lloyds Banking Group May Dividend.

The Lloyds Banking Group Dividend of 2.05 pence was paid today.

The total number of shares issued by Lloyds Banking Group plc with rights to vote which are exercisable in all circumstances at general meetings is 71,992,041,055 ordinary shares of 10p

Thus the cost of the dividend:

71,992,041,055 x £0.0205 = £1,475,836,841.63

That is £1,475 Million = £1.475 Billion

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10056&action=

A yield of 4.6%

The Invesco Enhanced Income Limited

The Invesco Enhanced Income Limited is currently in a situation where the fund manager Invesco Perpetual has quit running the fund due to a dispute in management fees.

A £150m London Listed Investment Trust.

https://www.invescoperpetual.co.uk/uk/products/invesco-perpetual-enhanced-income-limited

The investment trust’s principal objective is to provide shareholders with a high level of income whilst seeking to maximise total return through investing in a diversified portfolio of high

yielding corporate and government bonds. The portfolio holds a core (around 47%) of non-financial high yield corporate bonds,focused on seasoned issuers that are considered have a low likelihood of default.

Top 10 holdings are:-

UniCredit International Bank 8.5925% FRN Perpetual, 8.125% FRN Perpetual 2.3% portfolio

Origin Energy 7.875% 16 Jun 2071 2.1% portfolio

Virgin Media Finance 7.0% 15 Apr 2023 (SNR), 5.125% 15 Jan 2025 (SNR) 2.0% portfolio

Premier Foods Finance FRN 15 Jul 2022 (SNR), 6.5% 15 Mar 2021 (SNR) 1.8% portfolio

NWEN Finance 5.875% 21 Jun 2021 (SNR) 1.8% portfolio

Standard Chartered 5.7% 26 Mar 2044, 5.125% 06 Jun 2034 1.8% portfolio

Enterprise Inns 6.5% 06 Dec 2018 (SNR), 6.375% 15 Feb 2022 (SNR) 1.8% portfolio

Société Genérale 8.875% FRN Perpetual, 7.875% FRN Perpetual 1.7% portfolio

Enel 7.75% 10 Sep 2075, 6.625% 15 Sep 2076 1.7% portfolio

NGG Finance 5.625% FRN 18 Jun 2073 1.7% portfolio

Total 18.7% portfolio

a yield of 6%

HM Government Borrowings: April 2018

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties. Another deficit month, thus to bridge the gap, needs to borrow on the bond market.

In April 2018 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement.

There were “only” 4 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office (http://www.dmo.gov.uk/) to raise cash for HM Treasury:-

24-Apr-2018 0 1/8% Index-linked Treasury Gilt 2048 3 months £750.0000 Million

19-Apr-2018 1 5/8% Treasury Gilt 2028 £2,500.0000 Million

10-Apr-2018 1¾% Treasury Gilt 2057 £2,185.1600 Million

04-Apr-2018 0¾% Treasury Gilt 2023 £2,750.0000 Million

When you add the cash raised:-

(£750.0000 Million + £2,500.0000 Million + £2,185.1600 Million + £2,750.0000 Million) = £8185.16 Million

£8185.16 Million = £8.18516 Billion

On another way of looking at it, is in the 30 days in April, HM Government borrowed:-

£272 million each day for the 30 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature 2023, 2028, 2048 and 2057. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

Sequoia Economic Infrastructure Income Fund Limited

The Sequoia Economic Infrastructure Income Fund Limited is a fund investing in core infrastructure. It is a debt investing vehicle.

The Fund focuses primarily on taking subordinated and select senior debt exposures to economic infrastructure projects, companies and special purpose vehicles

The 15 largest settled investments:-

Hawaiki Mezzanine Loan USD Private Mezz £49.2m TMT Undersea cable 11.9% yield

A’lienor S.A.S. (A65) EUR Private Senior £39.4m Transport Road 5.0% yield

Active Assistance GBP Private Senior £36.4m Accomm. Health care 8.4% yield

Tracy Hills TL 2025 USD Private Senior £34.2m Other Residential infra 10.3% yield

Cory Environmental GBP Private HoldCo £31.3m Utility Waste-to-energy 8.5% yield

Bulb Energy Senior Secured GBP Private Senior £26.9m Utility Electricity supply 9.0% yield

Warnow Tunnel EUR Private Senior £25.1m Transport Road 6.8% yield

Aquaventure USD Private Senior £25.0m Utility Water 7.7% yield

Abteen Ventures USD Private Senior £24.9m TMT Data centers 8.0% yield

Terra-Gen Power TL B USD Private Senior £22.4m Renewables Solar & wind 9.5% yield

Natgasoline USD Private Mezz £20.6m Other Industrial infra 10.0% yield

Exeltium Mezzanine EUR Private Mezz £19.3m Power PPA 9.4% yield

Welcome Break No.1 Ltd GBP Private Mezz £18.3m Transport Motorway services 8.5% yield

Clyde Street Glasgow GBP Private Senior £18.3m Accomm. Student housing 8.0% yield

Neoen Production EUR Private HoldCo £15.4m Renewables Solar & wind 7.0% yield

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=39587556&action=

The Foreign and Colonial Investment Trust: 150 years old

Launched in 1868, The Foreign and Colonial Investment Trust is a highly regarding investment trust.

Philip Rose founded F&C Investment Trust alongside barrister Samuel Laing, and Samuel Laing’s business partner James Thompson Mackenzie, who was also Deputy Chairman of the East Bengal Railway. With the backing of influential politician Lord Westbury, F&C Investment Trust was launched on Thursday 19 March 1868. Today F&C Investment Trust has total assets of £4 billion (as at 31 December 2017), diversified across global holdings from over 30 different countries.

It has grown its dividend every year for the past 47 years

Foreign & Colonial Investment top 50 holdings:-

AMAZON.COM INC

MICROSOFT CORP

UNITEDHEALTH GROUP INC

FACEBOOK INC A

ANTHEM INC

UTILICO EMERGING MARKETS LTD

ALPHABET INC CL C

JPMORGAN CHASE + CO

PANTHEON EUROPE V A LP

ALIBABA GROUP HOLDING SP ADR

INTESA SANPAOLO

CITIGROUP INC

STATE STREET CORP

PRICELINE GROUP INC/THE

LOWE S COS INC

ARTEMIS US EXTENDED ALPHA FUND

APPLE INC

CONVENTUM LYRICAL FUND

ROYAL DUTCH SHELL PLC B SHS

BOEING CO/THE

VISA INC CLASS A SHARES

UBS GROUP AG REG

PFIZER INC

BANK MANDIRI PERSERO TBK PT

ISHARES CORE MSCI EM IMI UCITS

NOVO NORDISK A/S B

ING GROEP NV

CHEVRON CORP

CANON INC

SYNCONA LTD

CVS HEALTH CORP

DOWDUPONT INC

WELLS FARGO + CO

COMCAST CORP CLASS A

SANDS CHINA LTD

ORACLE CORP

HARBOURVEST PART. VIII BUYOUT

ASML HOLDING NV

BP PLC SPONS ADR

MASTERCARD INC A

FINDLAY PARK AMERICAN FUND

BAYER AG REG

PHILIP MORRIS INTERNATIONAL

QUALCOMM INC

SAP SE

MORGAN STANLEY

ALLIANZ SE REG

HARBOURVEST PART VIII VENTURE

WALMART DE MEXICO SAB DE CV

PANTHEON ASIA FUND V

Vanguard FTSE Emerging Markets ETF

https://www.youtube.com/watch?v=1YA836GcWBo

The Premier Global Infrastructure Trust

The Premier Global Infrastructure Trust is a London listed investment trust.

The fund will seek to achieve its objectives by investing principally in equity and equity-related securities of companies operating in the energy and water sectors, as well as other infrastructure investments.

Top 10 holdings are:-

Cia de Saneamento do Parana Latin America

First Trust MLP and Energy Income Fund North America

China Everbright International China Growth

SSE United Kingdom Yield

Huaneng Renewables China Growth

Avangrid North America Yield

NRG Yield * North America

Beijing Enterprises Holdings China Growth

Atlantia E u r o p e ( e x cluding UK)

DP World Middle East Growth

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=53460&action=

A yield of over 7%

The Components of the MSCI Emerging Markets Index

The MSCI Emerging Markets Index is made up of companies in the Emerging Markets world. The component companies are:-

TENCENT HOLDINGS LI (CN) 5.369088%

SAMSUNG ELECTRONICS CO 4.353278%

ALIBABA GROUP HLDG ADR 3.846781%

TAIWAN SEMICONDUCTOR MFG 3.623682%

NASPERS N 2.148970%

CHINA CONSTRUCTION BK H 1.402290%

BAIDU ADR 1.232323%

CHINA MOBILE 1.184509%

ICBC H 1.097664%

HON HAI PRECISION IND CO 0.984212%

PING AN INSURANCE H 0.963201%

SK HYNIX 0.793184%

ITAU UNIBANCO PN 0.781257%

SBERBANK RUSSIA COM(RUB) 0.780627%

HOUSING DEV FINANCE CORP 0.744323%

BANK OF CHINA H 0.740674%

RELIANCE INDUSTRIES 0.701894%

VALE ON 0.659841%

SAMSUNG ELECTRONICS PREF 0.645329%

BANCO BRADESCO PN 0.583522%

AMBEV ON (NEW) 0.565592%

AMERICA MOVIL L 0.546767%

INFOSYS 0.522310%

NETEASE COM ADR 0.490737%

CNOOC 0.467625%

JD.COM ADR 0.467522%

LUKOIL HOLDING(RUB) 0.464357%

GAZPROM (RUB) 0.462702%

CHINA LIFE INSURANCE H 0.460701%

HYUNDAI MOTOR CO 0.438176%

POSCO 0.428367%

NAVER 0.409688%

KB FINANCIAL GROUP 0.407469%

PETROBRAS PN 0.359046%

TATA CONSULTANCY 0.358196%

SHINHAN FINANCIAL GROUP 0.353700%

CTRIP COM INTL ADR 0.347737%

CHINA PETRO & CHEM H 0.344015%

FEMSA UNIT UBD 0.342701%

LG CHEM 0.332643%

SASOL 0.332109%

GEELY AUTOMOBILE HLDGS 0.331300%

HYUNDAI MOBIS 0.322529%

LARGAN PRECISION CO 0.320969%

STANDARD BANK GROUP 0.315343%

MTN GROUP 0.302500%

MEDIATEK INC 0.301449%

YUM CHINA HOLDINGS 0.297279%

CELLTRION 0.296513%

TELEKOMUNIKASI INDONESIA 0.295590%

CHINA MERCHANTS BANK H 0.288390%

BANK CENTRAL ASIA 0.283622%

GRUPO FIN BANORTE O 0.282651%

CATHAY FINANCIAL HOLDING 0.282371%

PETROBRAS ON 0.281303%

BM&F BOVESPA ON 0.278031%

AAC TECHNOLOGIES (CN) 0.275236%

CREDICORP 0.273731%

PUBLIC BANK 0.270829%

PETROCHINA CO H 0.270550%

MARUTI SUZUKI INDIA 0.269835%

AXIS BANK 0.265610%

FIRSTRAND 0.264482%

PTT 0.260146%

ITC 0.258019%

BANK RAKYAT INDONESIA 0.251798%

CHUNGHWA TELECOM CO 0.251741%

KT&G CORP(KOREA TOBACCO) 0.248463%

TENAGA NASIONAL 0.245364%

FORMOSA PLASTIC CORP 0.244521%

ITAUSA PN 0.242504%

HINDUSTAN UNILEVER 0.240721%

CHINA PACIFIC INS GRP H 0.238399%

HANA FINANCIAL HOLDINGS 0.237765%

WALMART MEXICO V 0.235760%

STEINHOFF NV 0.233757%

CHINA OVERSEAS LAND &INV 0.233660%

AGRI BANK OF CHINA H 0.231458%

SK INNOVATION CO 0.230629%

SUNNY OPTICAL TECH 0.230330%

TATNEFT COMMON (RUB) 0.228941%

ASTRA INTERNATIONAL 0.228134%

CTBC FINANCIAL HOLDING 0.227395%

NAN YA PLASTIC 0.227267%

GRUPO MEXICO B 0.227129%

NEW ORIENTAL EDUCAT ADR 0.215915%

FUBON FINANCIAL HOLDING 0.215608%

ICICI BANK 0.214787%

CP ALL PCL 0.212833%

PKO BANK POLSKI 0.212258%

CEMEX CPO 0.209324%

CHINA EVERGRANDE GROUP 0.209253%

NORILSK NICKEL MMC(RUB) 0.208334%

SAMSUNG SDI CO 0.207631%

NOVATEK GDR 0.200585%

LG HOUSEHOLD & HEALTH 0.199349%

UNI-PRESIDENT ENT. 0.197760%

CHINA STEEL CORP COMMON 0.195992%

BANK MANDIRI 0.195213%

TATA MOTORS 0.187794%

MALAYAN BANKING 0.182833%

CSPC PHARMACEUTICAL GRP 0.177601%

SAMSUNG C&T CORPORATION 0.177569%

AMOREPACIFIC CORP (NEW) 0.176795%

FORMOSA CHEMICALS FIBRE 0.175984%

MAGNIT GDR 0.175966%

SUNAC CHINA HOLDINGS 0.175952%

LG ELECTRONICS (NEW) 0.175003%

POLSKI KONCERN NAF ORLEN 0.172332%

BHARTI AIRTEL 0.172121%

KEPCO KOREA ELECT. POWER 0.171472%

LARSEN & TOUBRO 0.171044%

GRUPO TELEVISA CPO 0.170884%

OTP BANK 0.170829%

DELTA ELECTRONICS 0.169961%

COUNTRY GARDEN HLDGS 0.168159%

CHINA UNICOM 0.167015%

PICC PPTY & CASUALTY H 0.166583%

CIELO ON 0.165792%

SIAM COMMERCIAL BANK 0.164951%

ASE 0.164798%

BANCO BRADESCO ON 0.164253%

MEGA FINANCIAL HOLDING 0.164202%

ASPEN PHARMACARE HLDGS 0.162617%

SK HOLDINGS 0.162401%

CHINA SHENHUA ENERGY H 0.161512%

STATE BANK OF INDIA 0.160065%

KASIKORNBANK FGN 0.158080%

REMGRO 0.157221%

CITIC 0.157182%

MAHINDRA & MAHINDRA 0.155703%

BANCO BRASIL ON 0.155196%

SAMSUNG LIFE INSURANCE 0.155195%

AIRPORTS OF THAILAND 0.155104%

BRILLIANCE CHINA AUTO 0.154083%

YES BANK 0.154065%

CHINA RESOURCES LAND 0.154005%

KIA MOTORS CORP 0.153692%

TAL EDUCATION GROUP ADR 0.153278%

SANLAM 0.152498%

BARCLAYS AFRICA GROUP 0.150655%

SUN PHARMACEUTICAL IND 0.149635%

EMIRATES TELECOM CORP 0.148449%

ULTRAPAR PART ON 0.148281%

LG CORP (NEW) 0.147624%

SHOPRITE HOLDINGS 0.145526%

KROTON EDUCACIONAL ON 0.144683%

POWSZECHNY ZAKLAD UBEZP 0.144030%

LOJAS RENNER ON 0.142355%

QATAR NATIONAL BANK 0.141827%

SAMSUNG FIRE & MARINE 0.140066%

NCSOFT CORP 0.138818%

EMAAR PROPERTIES 0.137844%

BID CORPORATION 0.137567%

HCL TECHNOLOGIES 0.137003%

CATCHER TECH CO 0.136984%

HENGAN INTL GROUP CO 0.134452%

CHINA MENGNIU DAIRY CO 0.134369%

SHENZHOU INTERNATIONAL 0.134070%

CHINA TELECOM CORP H 0.129047%

CIMB GROUP HOLDINGS 0.127993%

TELEF BRASIL PN 0.127238%

VEDANTA 0.126374%

58.COM ADR 0.125978%

BANK OF COMMUNICATIONS H 0.124020%

LG DISPLAY CO 0.121955%

ASUSTEK COMPUTER 0.121323%

VODACOM GROUP 0.120537%

RAIA DROGASIL ON 0.118939%

FALABELLA SACI 0.117955%

AYALA LAND 0.117932%

SM PRIME HOLDINGS 0.117729%

SAMSUNG SDS CO 0.117330%

UNITED MICROELECTRONICS 0.117232%

CCR ON 0.116942%

EICHER MOTORS 0.115786%

EMPRESAS COPEC 0.115638%

CHINA TAIPING INSURANCE 0.113390%

FIRST FINANCIAL HLDG CO 0.113191%

SINO BIOPHARMACEUTICAL 0.112096%

GRASIM INDUSTRIES 0.112093%

ANHUI CONCH CEMENT H 0.111938%

BHARAT PETROLEUM CORP 0.111729%

ROSNEFT (RUB) 0.111152%

BB SEGURIDADE PART ON 0.111104%

TAIWAN MOBILE 0.111087%

NEPI ROCKCASTLE 0.111065%

CHINA CITIC BANK H 0.109693%

BDO UNIBANK 0.109671%

E.SUN FINANCIAL HOLDINGS 0.109162%

ULTRATECH CEMENT 0.108988%

ENEL AMERICAS 0.108879%

BYD CO H 0.108071%

INDIABULLS HOUSING FIN 0.108015%

BANK PEKAO 0.107892%

CHINA MINSHENG BANK H 0.107777%

QUANTA COMPUTER 0.106925%

ADVANCED INFO SERVICE 0.106728%

TURKIYE GARANTI BANKASI 0.106554%

UNILEVER INDONESIA 0.106319%

SAMSUNG BIOLOGICS 0.105799%

PTT GLOBAL CHEMICAL 0.104712%

SINA CORP 0.104621%

WIPRO 0.104382%

PRESIDENT CHAIN STORE 0.103956%

WOORI BANK 0.103366%

CHINA GAS HOLDINGS 0.103196%

ENN ENERGY HOLDINGS 0.103119%

FOSUN INTL(CN) 0.102568%

GUANGZHOU AUTO GROUP H 0.102085%

SILLAJEN 0.101434%

SAMSUNG ELECTRO-MECH. CO 0.101037%

BRF ON 0.100910%

SOQUIMICH PREF B 0.099464%

EMART CO 0.097855%

LOTTE CHEMICAL CORP 0.097160%

ASIAN PAINTS 0.096717%

MOBILE TELESYS ADR 0.095594%

AYALA CORP 0.094881%

TIGER BRANDS 0.094793%

AKBANK 0.094415%

NEW CHINA LIFE INS H 0.094328%

GENTING 0.094300%

S-OIL CORP 0.094295%

CHINA COMMUNIC CONST H 0.094262%

SK TELECOM CO 0.094127%

CITIC SECURITIES CO H 0.093889%

WEIBO CORP ADR 0.093174%

COWAY CO 0.092615%

HAITONG SECURITIES CO H 0.092264%

FORMOSA PETROCHEMICAL CO 0.091720%

SINOPHARM GROUP CO H 0.091363%

BIDVEST GROUP 0.091075%

YUANTA FINANCIAL HOLDING 0.090601%

ANTA SPORTS PRODUCTS 0.089328%

FIBRA UNO ADMINISTRACION 0.089249%

NTPC 0.088634%

SM INVESTMENTS 0.088062%

KASIKORNBANK 0.087582%

VTB BANK(RUB) 0.087346%

ZEE ENTERTAINMENT ENT 0.087195%

CHINA HUARONG AST MGMT H 0.087025%

BCO SANTANDER CHILE (NEW 0.086289%

PEGATRON 0.086213%

BANK NEGARA INDONESIA 0.085389%

COMMERCIAL INTL BANK 0.085160%

CHINA VANKE CO H 0.085145%

CHINA RESOURCES BEER 0.084549%

BAJAJ FINANCE 0.083700%

HYUNDAI STEEL CO 0.083686%

KAKAO CORP 0.083487%

SIAM CEMENT FGN 0.083342%

BANCOLOMBIA PREF 0.083250%

ADANI PORTS AND SEZ 0.083104%

TAIWAN COPR FINL HLDG 0.083088%

PETRONAS CHEMICALS GROUP 0.083014%

YY INC ADR 0.082862%

KGHM POLSKA MIEDZ 0.081943%

TAISHIN FINANCIAL HLDG 0.081829%

WOOLWORTHS HOLDINGS 0.081822%

RUMO ON 0.081613%

CHINA DEV FINANCIAL HLDG 0.081538%

HINDALCO INDUSTRIES 0.081396%

DISCOVERY HOLDINGS 0.081054%

TURKCELL ILETISIM HIZMET 0.080606%

HYUNDAI HEAVY INDUSTRIES 0.080339%

BAJAJ AUTO 0.080028%

UNITED TRACTORS 0.079468%

MOL MAGYAR OLAJ GAZIPARI 0.079455%

ANGLOGOLD ASHANTI 0.079382%

GRUPO FIN INBURSA O 0.078975%

LENOVO GROUP 0.077797%

GUANGDONG INVESTMENT 0.077755%

TAIWAN CEMENT CORP 0.077462%

SMIC 0.077310%

UPL 0.076945%

DP WORLD 0.076314%

ABU DHABI COMM BANK 0.076287%

BIM BIRLESIK MAGAZALAR 0.076159%

KANGWON LAND 0.075986%

HUA NAN FINANCIAL HLDGS 0.075902%

WANT WANT CHINA HLDGS 0.075824%

GROWTHPOINT PROP LTD 0.075794%

DR REDDY’S LABORATORIES 0.075742%

AMOREG 0.075666%

SAPPI 0.075395%

PTT EXPLORATION & PROD 0.075125%

WEG ON 0.075098%

EQUATORIAL ENERGIA ON 0.074734%

FIRST ABU DHABI BANK 0.074463%

TITAN COMPANY 0.074176%

BHARTI INFRATEL 0.074069%

HINDUSTAN PETROLEUM CORP 0.074004%

INNOLUX CORP 0.073864%

GRUPO AEROPORTUARIO B 0.073564%

GRUPO BIMBO A 0.073109%

CRRC CORP H 0.073063%

JG SUMMIT HOLDINGS 0.072919%

NEDBANK GROUP 0.072918%

FAR EASTONE TELECOM. CO 0.072800%

LATAM AIRLINES GROUP 0.072655%

PRICE GROUP (MR) 0.072200%

TUPRAS TURKIYE PETROL 0.071890%

BEIJING ENTERPRISE WATER 0.071793%

KOREA ZINC 0.071719%

BK SANTANDER BRASIL UNIT 0.071390%

REDEFINE PROPERTIES LTD 0.071376%

GRUPO AEROP PACIFICO B 0.071113%

CEZ CESKE ENER ZAVODY 0.071010%

GENTING MALAYSIA 0.070638%

HYUNDAI MOTOR CO PREF 2 0.070487%

INDUSTRIES QATAR 0.070468%

SOUTHERN COPPER CORP 0.069503%

GREAT WALL MOTOR H 0.069478%

AU OPTRONICS CORP 0.069224%

GODREJ CONSUMER PRDCTS 0.068976%

CHINA RESOURCES POWER 0.068936%

HANKOOK TIRE CO 0.068922%

HYUNDAI ROBOTICS 0.068864%

RICHTER GEDEON 0.068655%

GAIL INDIA 0.068560%

PEOPLE’S INSURANCE CO H 0.068504%

BANK ZACHODNI WBK 0.068418%

CHINA CONCH VENTURE 0.068367%

OIL & NATURAL GAS CORP 0.068347%

CENCOSUD 0.068315%

KINGBOARD CHEM HLDG (CN) 0.067958%

EMPRESAS CMPC 0.067841%

INDUSTRIAL BANK OF KOREA 0.067840%

DIGI.COM 0.067451%

HYPERMARCAS ON 0.067429%

AXIATA GROUP 0.067253%

INDIAN OIL CORP 0.066999%

MOTHERSON SUMI SYSTEMS 0.066998%

GERDAU PN 0.066850%

WIN SEMICONDUCTORS 0.066695%

LONGFOR PROPERTIES CO 0.066428%

MIRAE ASSET DAEWOO 0.066419%

CHAILEASE HOLDING 0.066156%

RMB HOLDINGS 0.066090%

PAO DE ACUCAR PN 0.065942%

GOLD FIELDS 0.065732%

TECH MAHINDRA 0.065658%

AL RAYAN BANK 0.065498%

SURGUTNEFTEGAZ PREF(RUB) 0.065366%

BANCO DE CHILE 0.065365%

FIBRIA CELULOSE ON 0.065355%

VIPSHOP HOLDINGS ADR 0.065274%

ALROSA (RUB) 0.065256%

ALFA 0.065134%

SABESP ON 0.065028%

COCA-COLA FEMSA L 0.064883%

DONGFENG MOTOR GROUP H 0.064862%

LOJAS AMERICANAS PN 0.064702%

SURGUTNEFTEGAZ COMN(RUB) 0.064637%

SILICONWARE PRECISION 0.064497%

CHINA MERCHANTS PORT 0.064118%

CHINA RESOURCES GAS GRP 0.064003%

HAIER ELCTRNCS GRP (CN) 0.063942%

CENTRAL PATTANA PUB CO 0.063721%

HUATAI SECURITIES CO H 0.063702%

JSW STEEL 0.063216%

CHINA EVERBRIGHT INTL 0.063109%

CHENG SHIN RUBBER IND 0.063039%

PIRAMAL ENTERPRISES 0.062908%

CHINA CINDA ASSET MGMT H 0.062801%

HANMI PHARM CO (NEW) 0.062661%

SINOPAC HOLDINGS 0.062437%

SEVERSTAL (RUB) 0.062399%

KLABIN UNIT 0.061725%

THAI OIL 0.061486%

CIPLA 0.061351%

KOC HOLDING 0.061226%

TINGYI HOLDING CORP (CN) 0.060966%

TATA STEEL 0.060774%

KOMERCNI BANKA 0.060663%

HOTAI MOTOR COMPANY 0.060606%

EMBRAER ON 0.060587%

BR MALLS PARTICIPACOE ON 0.060516%

LOCALIZA RENT A CAR ON 0.060282%

ZHUZHOU CRRC TIMES H 0.060205%

MOSCOW EXCHANGE (RUB) 0.059238%

KOREA AEROSPACE IND 0.058890%

DB INSURANCE CO 0.058863%

TIM PARTICIPACOES ON 0.058698%

GP INV SURAMERICANA 0.058411%

RESILIENT REIT 0.058324%

LPP 0.058259%

SHRIRAM TRANSPORT FIN 0.058053%

BAJAJ FINSERV 0.057729%

OTE HELLENIC TELECOM 0.057536%

EREGLI DEMIR CELIK FABRI 0.057221%

ARCA CONTINENTAL 0.056974%

CHINA RAILWAY GROUP H 0.056927%

INDUSTRIAS PENOLES CP 0.056648%

COMPAL ELECTRONICS 0.056310%

INFRA ENERGETICA 0.055968%

SIME DARBY PLANTATION 0.055741%

ECOPETROL 0.055645%

CGN POWER CO H 0.055539%

GRP FINL SANTANDER B 0.055506%

AUTOHOME ADR 0.055424%

UNITED SPIRITS 0.055342%

BEIJING ENTERPRISES HLDG 0.055159%

MINOR INTERNATIONAL 0.055098%

COAL INDIA 0.055069%

CAPITEC BANK HOLDINGS 0.054906%

NETMARBLE GAMES 0.054752%

KUALA LUMPUR KEPONG 0.054743%

SAMSUNG HEAVY INDUSTRIES 0.054642%

CJ CHEILJEDANG CORP 0.054635%

GS HOLDINGS CORP 0.054582%

FULLSHARE HOLDINGS (CN) 0.054580%

HANWHA CHEMICAL CORP 0.054476%

POLISH OIL & GAS 0.054332%

IHH HEALTHCARE 0.054301%

MAXIS BHD 0.054123%

CELLTRION HEALTHCARE 0.053995%

NINE DRAGONS PAPER 0.053966%

POLSKA GRUPA ENER 0.053922%

HM SAMPOERNA 0.053918%

GLOBALWAFERS 0.053739%

KUNLUN ENERGY 0.053731%

SHIN KONG FINL HLDGS 0.053670%

LUPIN 0.053435%

DABUR INDIA 0.053383%

HERO MOTOCORP 0.053341%

MONDI (ZA) 0.053173%

MACRONIX INTERNATIONAL 0.053047%

ALPHA BANK 0.052944%

NESTLE INDIA 0.052796%

SPAR GROUP (THE) 0.052761%

GF SECURITIES CO H 0.052706%

AUROBINDO PHARMA 0.052554%

GRUMA B 0.052267%

HUANENG POWER INTL H 0.052175%

ENEL GENERACION CHILE 0.052062%

FAR EASTERN NEW CENTURY 0.052051%

CHINA MEDICAL SYSTEM 0.052022%

GUDANG GARAM 0.052021%

KIMBERLY-CLARK MEXICO A 0.051726%

TRUWORTHS INTERNATIONAL 0.051603%

CHINA STATE CONSTRUCTION 0.051500%

PETRONAS GAS 0.051406%

ABOITIZ EQUITY VENTURES 0.051119%

OPAP 0.051057%

NOVOLIPETSK STEEL (RUB) 0.050966%

THE FOSCHINI GROUP 0.050900%

MEXICHEM SAB DE CV 0.050884%

BUENAVENTURA MINAS ADR 0.050784%

POU CHEN CORP 0.050737%

EXXARO RESOURCES 0.050478%

LIC HOUSING FINANCE 0.050406%

LITE-ON TECHNOLOGY CORP 0.050390%

CJ CORP 0.050184%

WINBOND ELECTRONICS CORP 0.050105%

HYOSUNG CORP 0.050052%

CHINA GALAXY SEC H 0.049913%

TRAVELSKY TECHNOLOGY H 0.049750%

CHINA NATL BUILDING H 0.049672%

ALUMINUM CORP OF CHINA H 0.049512%

BANCO DE CREDITO E INVER 0.049271%

FOXCONN TECHNOLOGY CO 0.049122%

IMPERIAL HOLDINGS 0.049009%

CHANG HWA COMMERCIAL BK 0.049003%

ZTE CORP H 0.048476%

HOTEL SHILLA CO 0.048398%

BANGKOK DUSIT MED. SVCS 0.048119%

PLDT 0.048024%

INDOCEMENT TUNGGAL 0.047927%

TURKIYE IS BANKASI C 0.047897%

KALBE FARMA 0.047696%

HYUNDAI ENGR. & CONSTR. 0.047594%

LIFE HEALTHCARE GROUP 0.047522%

HYUNDAI GLOVIS CO 0.047344%

FORTRESS INCOME FUND B 0.047240%

HYUNDAI MARINE & FIRE 0.046744%

MOMO A ADR 0.046552%

AMBUJA CEMENTS 0.046542%

CHINA RESOURCES PHARMA 0.046506%

CHINA LIFE INSURANCE CO 0.046156%

KOREA INVESTMENT HLDG 0.046056%

SUZANO PAPEL E CELU ON 0.046026%

HONG LEONG BANK 0.046021%

ORION CORP (NEW) 0.045911%

IOI CORP 0.045850%

BRASKEM PN A 0.045764%

SABANCI HLDG (HACI OMER) 0.045704%

SUN ART RETAIL GROUP 0.045698%

INDOFOOD SUKSES MAKMUR 0.045447%

SHIMAO PROPERTY HLDGS 0.045313%

SIBANYE GOLD 0.045302%

HANON SYSTEMS 0.045202%

PROMOTORA Y OPER DE INFR 0.045013%

VAKRANGEE 0.044747%

SHANGHAI FOSUN PHARMA H 0.044647%

CHINA RAILWAY CONST H 0.044359%

INDORAMA VENTURES 0.044333%

ADVANTECH CO 0.044250%

UNIVERSAL ROBINA CORP 0.044175%

MISC BHD 0.044129%

HIWIN TECHNOLOGIES CORP 0.044088%

HYUNDAI DEVELOPMENT CO 0.043508%

CHINA MOLYBDENUM CO H 0.043436%

BOSCH 0.043404%

AGILE GROUP HOLDINGS 0.043403%

NOVATEK MICROELECTRS 0.043255%

KINGSOFT 0.043104%

SAMSUNG SECURITIES CO 0.042956%

POLYUS (RUB) 0.042913%

BNK FINANCIAL GROUP 0.042899%

WPG HOLDINGS CO 0.042729%

SHREE CEMENT 0.042627%

BHARAT FORGE 0.042512%

CHAROEN POKPHAND FOODS 0.042394%

IJM CORP 0.041918%

BANCOLOMBIA 0.041826%

BUMRUNGRAD HOSPITAL PUB 0.041749%

ASHOK LEYLAND 0.041661%

BEIJING CPTL INTL AIR H 0.041649%

LOTTE SHOPPING CO 0.041566%

MARICO 0.041562%

YAGEO CORP 0.041491%

CHINA LONGYUAN POWER H 0.041231%

QUALICORP ON 0.041168%

BRITANNIA INDUSTRIES 0.041053%

BERLI JUCKER 0.040894%

GUANGZHOU R&F PROP H 0.040832%

HYUNDAI MOTOR CO PREF 0.040715%

WEICHAI POWER CO H 0.040607%

DAELIM INDUSTRIAL CO 0.040561%

CCC 0.040415%

LG INNOTEK CO 0.040353%

JOLLIBEE FOODS CORP 0.040344%

ASIA CEMENT CORP 0.040307%

ENEL CHILE 0.040089%

KRUNG THAI BANK 0.039932%

VANGUARD INTL SC 0.039896%

IDEA CELLULAR 0.039881%

GCL POLY ENERGY 0.039800%

RAND MERCHANT INV HLDGS 0.039754%

AIRTAC INTERNATIONAL 0.039590%

POWERTECH TECHNOLOGY 0.039519%

SEMEN GRESIK 0.039398%

CHINA EVERBRIGHT 0.039286%

GAMUDA 0.039244%

JBS ON 0.039037%

KCC CORP 0.038975%

DUBAI ISLAMIC BANK 0.038773%

SINOPEC SHANGHAI PETRO H 0.038744%

INTER RAO UES(RUB) 0.038145%

ACER 0.037878%

HAVELLS INDIA 0.037681%

WISTRON CORP 0.037597%

AIR CHINA H 0.037471%

GRUPO ARGOS 0.037460%

FUYAO GLASS IND GRP H 0.037306%

GT CAPITAL HOLDINGS 0.037305%

ZIJIN MINING GROUP H 0.037203%

SINO OCEAN GROUP HOLDING 0.037164%

MATAHARI DEPARTMENT 0.037154%

MBANK 0.037105%

3SBIO 0.037028%

PSG GROUP 0.037014%

SHINSEGAE CO (NEW) 0.036964%

PPB GROUP 0.036927%

INVESTEC LTD (ZA) 0.036570%

M & M FINANCIAL SVCS 0.036439%

IRPC PUBLIC COMPANY 0.036384%

JIANGXI COPPER CO H 0.036364%

HYPROP INVESTMENTS LTD 0.036273%

LEE & MAN PAPER MFG (CN) 0.036170%

ALDAR PROPERTIES 0.036008%

INVENTEC CO 0.035981%

SYNNEX TECHNOLOGY INTL 0.035842%

NEXTEER AUTOMOTIVE GRP 0.035712%

CERVEZAS 0.035633%

HAITIAN INTL HLDGS 0.035541%

OCI COMPANY 0.035397%

ALIOR BANK 0.035330%

MEITU 0.035287%

MEDY-TOX 0.035271%

CD PROJEKT 0.035135%

CEMIG PN 0.035069%

GRUPO CARREFOUR BRASIL 0.035020%

METRO PACIFIC INVESTMENT 0.034984%

DIALOG GROUP 0.034954%

BANGKOK EXPRESSWAY & MET 0.034897%

TECO ELECTRIC & MACH 0.034832%

ADARO ENERGY PT 0.034581%

FAR EAST HORIZON 0.034565%

BGF RETAIL 0.034481%

MULTIPLAN EMPREENDIM ON 0.034475%

YANZHOU COAL MINING H 0.034216%

LG CHEM PREF 0.034161%

COSAN ON 0.034137%

INTERCONEXION ELEC (NEW) 0.034092%

NATIONAL BANK OF GREECE 0.033986%

ENGIE BRASIL ON 0.033816%

NH INVESTMENT & SEC 0.033795%

PICK N PAY STORES 0.033777%

CHONGQING RURAL COMM H 0.033705%

HANSSEM CO 0.033635%

OOREDOO 0.033589%

TURK HAVA YOLLARI 0.033574%

MONETA MONEY BANK 0.033570%

EZDAN HOLDING GROUP 0.033419%

SHANGHAI PHARMA H 0.033399%

TRUE CORP 0.033149%

NANYA TECHNOLOGY 0.033081%

HANWHA LIFE INSURANCE 0.032827%

PHOSAGRO GDR 0.032753%

DAMAC PROPERTIES DUBAI 0.032587%

PETRONET LNG 0.032530%

ZHEJIANG EXPRESSWAY H 0.032492%

NETCARE 0.032485%

CHINA JINMAO HLDGS GROUP 0.032458%

CHINA OILFIELD SVCS H 0.032443%

JIANGSU EXPRESSWAY CO H 0.032416%

MAGNITOGORSK IRON (RUB) 0.032276%

HANWHA CORP 0.032249%

YUHAN CORP 0.032187%

AMMB HOLDINGS 0.032158%

ASELSAN ELEKTRONIK 0.032114%

MALAYSIA AIRPORTS HLDGS 0.031991%

COSCO SHIPPING PORTS 0.031901%

PRESS METAL ALUMINIUM 0.031843%

TELEKOM MALAYSIA 0.031776%

RURAL ELECTRIFICATION CO 0.031465%

CEMENTOS ARGOS (NEW) 0.031436%

BANGKOK BANK FGN 0.031269%

ALIBABA PICTURES GROUP 0.031185%

JUMBO 0.031133%

CHINA STH AIRLINES H 0.031057%

ING LIFE INSURANCE KOREA 0.030993%

REALTEK SEMICONDUCTOR 0.030966%

EUROBANK ERGASIAS 0.030768%

LOTTE HOLDINGS 0.030701%

ALIBABA HEALTH INFO TECH 0.030610%

ECLAT TEXTILE COMPANY 0.030549%

MICRO-STAR INTERNATIONAL 0.030516%

CHAROEN POKPHAND INDO 0.030451%

S1 CORPORATION 0.030088%

BANK OF PHIL ISLANDS 0.029887%

SIAM CEMENT 0.029876%

BYD ELECTRONIC INTL 0.029841%

ENERGY ABSOLUTE 0.029840%

NATURA COSMETICOS ON 0.029776%

COLBUN 0.029749%

CJ E&M CORPORATION 0.029721%

TATA POWER CO 0.029670%

DGB FINANCIAL HOLDINGS 0.029554%

HARTALEGA HOLDINGS 0.029464%

CYFROWY POLSAT SA 0.029379%

HOME PRODUCT CENTER 0.029367%

CHINA COMMU SERVICES H 0.029319%

KUMHO PETRO CHEMICAL CO 0.029239%

HUANENG RENEWABLES H 0.029124%

KUMBA IRON ORE 0.029075%

AGUAS ANDINAS 0.028657%

HTC CORP 0.028627%

GIANT MANUFACTURING CO. 0.028566%

RUSHYDRO (RUB) 0.028534%

PHISON ELECTRONICS CORP 0.028519%

GRUPO CARSO 0.028380%

ELETROBRAS PN B 0.028333%

BTS GROUP HOLDINGS 0.028290%

QATAR ISLAMIC BANK 0.028230%

HAP SENG CONSOLIDATED 0.028133%

PETRONAS DAGANGAN 0.028094%

M DIAS BRANCO ON 0.028036%

COMMERCIAL BANK OF QATAR 0.028005%

GRUPO AVAL ACCIONES PREF 0.027960%

TSINGTAO BREWERY H 0.027905%

STANDARD FOODS CORP 0.027878%

INDOFOOD CBP SUKSES 0.027853%

ENTEL 0.027575%

GP INV SURAMERICANA PREF 0.027441%

FENG TAY ENTERPRISE CO 0.027435%

BANK MILLENNIUM 0.027322%

ANGLO AMERICAN PLATINUM 0.027220%

TRANSNEFT PREF (RUB) 0.027218%

CSN SIDERURGICA NATL ON 0.027211%

NIEN MADE ENTERPRISE CO 0.027103%

LOTOS GROUP 0.027027%

MMI HOLDINGS 0.026784%

TURKIYE HALK BANKASI 0.026762%

NESTLE (MALAYSIA) 0.026663%

AMOREPAC CORP PREF (NEW) 0.026607%

QATAR INSURANCE CO 0.026465%

SHANGHAI INDL HOLDINGS 0.026339%

CHICONY ELECTRONICS CO 0.026328%

PERUSAHAAN GAS NEGARA 0.026208%

LG HOUSEHOLD & HEAL PREF 0.026158%

SIME DARBY 0.026146%

MANILA ELECTRIC CO B 0.026131%

SHANGHAI LUJIAZUI B(USD) 0.025985%

TATA MOTORS A 0.025874%

CADILA HEALTHCARE 0.025845%

JASTRZEBSKA SPOLKA WEGL 0.025777%

GLOW ENERGY 0.025732%

KOREAN AIR CO 0.025659%

FORTRESS REIT 0.025478%

TAIWAN HIGH SPEED RAIL 0.025429%

HANMI SCIENCE CO 0.025424%

HYUNDAI DEPT STORE 0.025078%

GENERAL INTERFACE SOLN 0.025020%

BRITISH AMER TOBACCO MY 0.024944%

CHEIL WORLDWIDE 0.024898%

EDP ENERGIAS DO BRASI ON 0.024863%

DELTA ELECTRONICS THAI 0.024857%

SIHUAN PHARMA HLDGS 0.024846%

SHANDONG WEIGAO GROUP H 0.024800%

SIEMENS INDIA 0.024769%

ALLIANCE GLOBAL GROUP 0.024543%

CHINA EVERBRIGHT BANK H 0.024406%

PORTO SEGURO ON 0.024265%

ODONTOPREV ON 0.024182%

GOME RETAIL HOLDINGS 0.024115%

BRAIT SA 0.023930%

GS ENGINEERING & CONSTR 0.023925%

ELETROBRAS ON 0.023910%

YTL CORP 0.023867%

PUERTO DE LIVERPOOL C1 0.023825%

BANK DANAMON INDONESIA 0.023823%

BHARAT HEAVY ELECTRICALS 0.023797%

ANADOLU EFES BIRACILIK 0.023596%

QATAR ELECT & WATER CO 0.023389%

ARCELIK 0.023338%

PIONEER FOODS 0.023335%

ITAU CORPBANCA 0.023059%

SOHO CHINA 0.022954%

SAPURA ENERGY 0.022757%

TRANSMISSORA ALIANC UNIT 0.022754%

GLENMARK PHARMACEUTICALS 0.022742%

CORONATION FUND MANAGERS 0.022732%

GLOBE TELECOM 0.022652%

EMLAK KONUT GAYRIMENKUL 0.022465%

METROPOLITAN BANK &TRUST 0.022428%

ACC 0.022401%

POWER FINANCE CORP 0.022372%

TMB BANK 0.022354%

MEGAWORLD CORP 0.022229%

PLAY COMMUNICATIONS 0.022166%

AIRASIA BHD 0.022073%

HANWHA TECHWIN CO 0.022060%

IDFC BANK 0.022025%

DMCI HOLDINGS 0.021923%

EMBOTELLADORA PREF B 0.021862%

EMAAR MALLS 0.021842%

SUL AMERICA UNITS 0.021787%

ROBINSON PCL 0.021530%

PETKIM PETROKIMYA HLDG 0.021513%

ABOITIZ POWER 0.021507%

TITAN CEMENT CO 0.021501%

PANOCEAN 0.021443%

CJ KOREA EXPRESS CORP 0.021425%

DOOSAN BOBCAT 0.021331%

AVICHINA IND & TECH H 0.021278%

SHANGHAI ELECTRIC GRP H 0.021218%

SECURITY BANK CORP 0.021194%

KOREA GAS CORPORATION 0.021124%

EVERGREEN MARINE CORP 0.021052%

LIBERTY HOLDINGS 0.020833%

ASTRO MALAYSIA HOLDINGS 0.020747%

BANPU 0.020693%

HIGHWEALTH CONSTRUCTION 0.020620%

DOHA BANK 0.020505%

THAI UNION GROUP 0.020472%

ICTSI INTL CONTAINER 0.020456%

EVA AIRWAYS CORP 0.020398%

TURKIYE VAKIFLAR BANKASI 0.020363%

TAIMED BIOLOGICS 0.020242%

CHINA AIRLINES 0.020067%

ZHEN DING TECHNOLOGY 0.019871%

QATAR GAS TRAN (NAKILAT) 0.019738%

JASA MARGA (PERSERO) 0.019616%

TAIWAN BUSINESS BANK 0.019520%

SP SETIA 0.019325%

SAMSUNG CARD CO 0.019316%

GS RETAIL 0.019300%

BANK TABUNGAN NEGARA 0.019157%

DINO POLSKA 0.019132%

DUBAI INVESTMENT 0.019052%

HYUNDAI WIA CORP 0.019036%

FORD OTOMOTIV SANAYI 0.019021%

PAKUWON JATI 0.018989%

TOFAS TURK OTOMOBIL FAB. 0.018830%

ORANGE POLSKA 0.018796%

RHB BANK 0.018369%

OIL & GAS DEVELOPMENT 0.018197%

SURYA CITRA MEDIA 0.018184%

DONGSUH COMPANIES 0.017990%

RUENTEX DEVELOPMENT CO 0.017979%

BUMI SERPONG DAMAI 0.017952%

TELKOM SA SOC 0.017836%

TAURON POLSKA ENERGIA 0.017812%

GRUPO LALA B 0.017728%

RUENTEX INDUSTRIES 0.017662%

ALLIANCE BANK MALAYSIA 0.017356%

HABIB BANK 0.017349%

GRUPA AZOTY 0.017338%

GLOBAL TELECOM HOLDING 0.017248%

HONG LEONG FINANCIAL GRP 0.017228%

YAPI VE KREDI BANKASI 0.017175%

GENTERA 0.017045%

OTTOGI CORPORATION 0.016758%

KT CORP 0.016733%

AES GENER 0.016669%

ELECTRICITY GENERATING 0.016585%

WESTPORTS HOLDINGS 0.016449%

TOWER BERSAMA INFRA 0.016426%

PIRAEUS BANK 0.016288%

AKR CORPORINDO 0.016154%

TURKIYE SISE VE CAM FABR 0.015902%

TAV HAVALIMANLARI HLDG 0.015869%

CONTAINER CORP OF INDIA 0.015694%

UNITED BANK 0.015592%

MCB BANK 0.015372%

SK NETWORKS 0.015180%

DOOSAN HEAVY INDUSTRIES 0.014986%

KEPCO PLANT SVCS & ENGR 0.014847%

O2 CZECH REPUBLIC 0.014785%

TURK TELEKOMUNIKASYON 0.014714%

IOI PROPERTIES GROUP 0.014644%

FORMOSA TAFFETA CO 0.014555%

BARWA REAL ESTATE CO 0.014299%

WASKITA KARYA PERSERO 0.014167%

XL AXIATA TBK 0.013957%

ULKER BISKUVI SANAYI 0.013719%

ROBINSONS LAND CORP 0.013643%

SYNTHOS 0.013591%

SIME DARBY PROPERTY 0.013351%

ASIA PACIFIC TELECOM CO 0.013084%

BK HANDLOWY W WARSZAWIE 0.013075%

COCA-COLA ICECEK 0.013070%

EFG-HERMES HOLDING 0.012922%

KCE ELECTRONICS 0.012759%

FF GROUP 0.012642%

FELDA GLOBAL VENTURES 0.012414%

DAEWOO ENGR & CONSTR 0.012111%

GENTING PLANTATIONS 0.011828%

POSCO DAEWOO 0.011821%

LUCKY CEMENT 0.011607%

UMW HOLDINGS 0.011512%

DXB ENTERTAINMENTS 0.010991%

YTL POWER INTL 0.010943%

Martin Currie Global Portfolio Trust plc

The Martin Currie Global Portfolio Trust is a London listed investment trust.

https://www.martincurrie.com/uk/global-portfolio-trust

It’s top 10 holdings which make up 36.6% of total portfolio are:-

Visa 4.5%

Apple 4.3%

JP Morgan Chase 4.1%

AIA 4.1%

Lockheed Martin 3.2%

Prudential 3.2%

Airbus 3.0%

Check Point 2.9%

Cognizant 2.8%

CSL 2.8%

Number of holdings 48, Number of countries 16.

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=12840

Assets of The City of London Investment Trust

The City of London Investment Trust is a highly regarded investment trust, listed on the London Stock Exchange

https://www.janushenderson.com/ukpi/fund/169/the-city-of-london-investment-trust-plc

Managed by Janus Henderson

It actually trades at a Premium, so the assets are worth about £4.00 and the shares trade at £4.22.

It’s top 10 holdings are:-

Royal Dutch Shell 5.9% of the fund

HSBC 4.4% of the fund

British American Tobacco 4.2% of the fund

BP 3.3% of the fund

Diageo 3.1% of the fund

Lloyds Banking Group 2.8% of the fund

Prudential 2.7% of the fund

Unilever 2.7% of the fund

RELX 2.6% of the fund

Vodafone 2.5% of the fund

The Blackrock view on Investing and Tariffs

BlackRock North American Income Trust

The BlackRock North American Income Trust aims to provide an attractive and growing level of income return with capital appreciation over the long term, predominantly through investment in a diversified portfolio of primarily large-cap US equities

Its top ten holdings are:-

JPMorgan Chase USA 4.3% of the fund

Bank of America USA 4.3% of the fund

Pfizer USA 3.7% of the fund

Citigroup USA 3.5% of the fund

Wells Fargo USA 2.9% of the fund

Oracle USA 2.9% of the fund

Microsoft USA 2.5% of the fund

Anthem USA 2.4% of the fund

Verizon Communications USA 2.4% of the fund

Royal Dutch Shell Netherlands 2.3% of the fund

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=2895465&action=

a yield of 3%

Legal & General Future World Equity Factors Index Fund

The Legal & General Future World Equity Factors Index Fund is a new index fund from Legal and General, the investment objective of the Fund is to seek to provide both capital growth and income by tracking the performance of the FTSE All-World ex CW Climate Balanced Factor Index

It spreads its risks across these sectors:-

Industrials 18.3% of the fund

Consumer Services 16.2% of the fund

Consumer Goods 14.1% of the fund

Financials 14.1% of the fund

Health Care 9.5% of the fund

Technology 9.4% of the fund

Utilities 6.6% of the fund

Basic Materials 5.0% of the fund

Telecommunications 4.1% of the fund

Oil & Gas 2.8% of the fund

The Foreign & Colonial Property Trust: Monthly Dividend

The Foreign & Colonial Property Trust PLC pays out its dividend on a monthly basis.

It is 0.5p a share, a month.

The company had 799,366,108 Ordinary Shares in issue. The number of shares with voting rights was 799,366,108, each carrying one voting right.

Thus we can calculate the cost of the monthly dividend:

799,366,108 x £0.005 = £3,996,830.54 a month

Which equate to £47,961,966.48 a year.

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=112535

4% yield.

Benjamin Graham Quote:

“If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume.”

The Laughing Investor

Bitcoin

Glaxo Smithkline April dividend.

On Thur 12th April, the UK’s premier health and pharma company, Glaxo Smithkline paid its half yearly dividend.

12p per share.

the total number of voting rights in the Company is 4,958,962,323

Thus:

23p x 4,958,962,323 = £1,140,561,334.29

That is £1.14 Billion

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10042

5.5% yield.

The Multi Index 3 Fund from Legal and General

The Multi Index 3 Fund from Legal and General.

It holds:-

Legal & General All Stocks Gilt Index Trust ‘I’ Inc 11.04%

Legal & General Sterling Corporate Bond Index Fund ‘L’ Inc 10.80%

Legal & General Global Inflation Linked Bond Index Fund ‘L’ Inc 10.53%

Legal & General Short Dated Sterling Corporate Bond Index Fund ‘L’ Inc 8.23%

LGIM Global Corporate Bond Fund ‘B’ Acc 8.02%

Legal & General Emerging Markets Government Bond (US$) Index Fund ‘L’ Inc 5.85%

Legal & General UK Property Fund ‘L’ Inc 4.84%

Legal & General US Index Trust ‘I’ Inc 4.68%

Legal & General High Income Trust ‘I’ Inc 4.40%

Legal & General UK Index Trust ‘L’ Inc 3.70%

Middle Eastern Oil Production

The middle east accounts for 34.5% (over one third) of global oil production according to BP’s Energy Statistical review.

That does this mean ?

Iran 5.0%

Iraq 4.8%

Kuwait 3.4%

Oman 1.1%

Qatar 2.1%

Saudi Arabia 13.4%

Syria no figure

United 4.4%

Yemen no figure

Other Middle East 0.2%

Total = 34.5%

This 34.5% is 31,789,000 barrels of oil a day.

the value is that oil is worth about $70 a barrel, thus:-

31,789,000 barrels of oil a day x $70 = $2,225,230,000.00

That is $2.225 Billion a day.

£2,000 Tax Free Dividends = What it means

The rules on dividends from HMRC are clear to UK tax payers.

You are allowed “only” the first £2,000 of dividends to be tax free, and then anything above is taxed. Dividend income in excess of the allowance is taxable at the following rates: 7.5% within the basic rate band; 32.5% within the higher rate band; and 38.1% on dividend income taxable at the additional rate

So what is £2,000 tax free dividends worth if you held some high quality UK stocks.

e.g the world’s leading Telecommunications corporation is BT plc. www.bt.com

https://www.btplc.com/Sharesandperformance/Dividends/Dividends.htm

In the tax year 2017-18 BT paid 2 dividends:

4.85p in 5th Feb 2018

10.55p in 4th Sept 2017

4.85p + 10.55p = 15.4p

So to have £2,000 dividend income in 2017-18 from BT you would need: £2,000 / £0.154 = 12987.01298701299 Shares in BT plc.

at today’s market price of £2.35

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10025&action=

That would mean an investment of £2.35 * 12987.01298701299 = £30519.48051948052

Thus £30,519 buying BT shares today would give an approximate income of £2,000 if all things being equal (share price steady, dividend payment steady). BT Be There.

If you wanted £2,000 income in an oil company like Royal Dutch Shell plc, what would that be ?

Shell pays out 4 dividends a year

https://www.shell.com/investors/dividend-information/historical-dividend-payments.html

It is has remained steady at US$0.47 a share which is about 33p a share.

Thus 4 dividends:-

33p+33p+33p+33p = £1.32

So to have £2,000 dividend income in 2017-18 from Royal Dutch Shell B shares you would need: £2,000 / £1.32 = 1515.151515151515 Shares in Royal Dutch Shell B plc.

at today’s market price of £23.71

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=133755

That would mean an investment of £23.71 * 1515.151515151515 = £35924.24242424242

Thus £35,924 buying shares in Royal Dutch Shell B would give today would give an approximate income of £2,000 if all things being equal (share price steady, dividend payment steady)

HM Government Borrowings: March 2018

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties. Another deficit month, thus to bridge the gap, needs to borrow on the bond market.

In March 2018 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement.

There were “only” 4 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office (http://www.dmo.gov.uk/) to raise cash for HM Treasury:-

27-Mar-2018 0 1/8% Index-Linked Treasury Gilt 2056 3 months 675.2400 Million

15-Mar-2018 1 5/8% Treasury Gilt 2028 2,864.7310 Million

06-Mar-2018 1½% Treasury Gilt 2047 2,250.0000 Million

01-Mar-2018 0¾% Treasury Gilt 2023 2,815.6600 Million

When you add the cash raised:-

∑(675.2400 Million + 2,864.7310 Million + 2,250.0000 Million + 2,815.6600 Million) = £8605.631 Million

£8605.631 Million = £8.605631 Billion

On another way of looking at it, is in the 31 days in March, HM Government borrowed:-

£277 million each day for the 31 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature 2023, 2028, 2047 and 2056. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

Assets of The Alliance Trust PLC

The Alliance Trust is a famous old UK Investment trust.

https://www.alliancetrust.co.uk/

£2.3 Billion London Listed Investment Fund

Top 20 holdings are:-

Alphabet

Microsoft

Amazon

Comcast

Charter

Communications

Baidu – ADR

United Health

Group

Oracle

Western Union

Page Group

Ryanair

Tencent

AIA

Airbus

Anthem

Novo-Nordisk

HDFC Bank

Visa

Liberty

Interactive

HCA Healthcare

Top 20 holdings make up 24.6% of the trust.

Rio Tinto plc April Dividend.

Yesterday, the world’s second largest mininig company, Rio Tinto paid out its dividend.

The dividend was 129.43p a share.

The total number of voting rights in Rio Tinto plc is 1,329,626,900

http://otp.investis.com/clients/uk/rio_tinto1/rns/regulatory-story.aspx?cid=507&newsid=995555

Thus:-

1,329,626,900 x 129.43p a share = £1,720,936,096.67

That is £1.720 Billion paid out by Rio Tinto to its shareholders.

A 5% yield. Delicious.

BP breaking the £100bn valuation.

Yesterday BP plc, one of the oil majors broke the £100bn market value.

BP is a major UK company, in the same premier league as BT, the world’s leading telecommunications corporation, (www.bt.com)

The share price yesterday of BP was £5.011 a share.

The share capital of BP is 19,958,001,728 shares

https://otp.investis.com/clients/uk/bp_plc/rns/regulatory-story.aspx?cid=233&newsid=995631

Thus:

19,958,001,728 shares x £5.011 a share = £100,009,546,659.01

That is £100bn.

Investment Quote from Michelle Obama

You have to stay in school. You have to. You have to go to college. You have to get your degree. Because that’s the one thing people can’t take away from you is your education. And it is worth the investment.

HSBC April 2018 Dividend.

Yesterday, HSBC Holdings PLC paid out is quarterly dividend, of $0.21 (14.762p) a share.

The total number of voting rights in HSBC Holdings plc is 20,053,152,822

Thus:-

20,053,152,822 x 14.762p = £2,960,246,419.58

That is £2,960 Million = £2.960 Billion

A 5.4% yield.

Investment: Has to be RELEVANT to the REAL NEEDS

The Dunedin Income Growth Investment Trust plc

The Dunedin Income Growth Investment Trust plc is 145 years old.

A £370m London Listed investment trust.

http://www.dunedinincomegrowth.co.uk/

Twenty largest equity holdings %

Royal Dutch Shell ‘B’ 4.8% of the fund

British American Tobacco 4.6% of the fund

Prudential 4.4% of the fund

Unilever 4.1% of the fund

HSBC 4.0% of the fund

GlaxoSmithKline 3.9% of the fund

AstraZeneca 3.8% of the fund

BHP Billiton 3.3% of the fund

Vodafone 3.1% of the fund

Total 3.0% of the fund

Assura 3.0% of the fund

Chesnara 2.4% of the fund

Compass 2.3% of the fund

Sage 2.3% of the fund

Standard Chartered 2.2% of the fund

Croda 2.2% of the fund

BP 2.0% of the fund

Novo-Nordisk 1.9% of the fund

Unibail-Rodamco 1.9% of the fund

Close Brothers 1.9% of the fund

Total 61.1% are the 20 top equity holdings above.

Ten largest fixed income holdings %

HBOS Cap Funding 6.461% 9.2% of the fund

SSE 3.875% 7.7% of the fund

BHP Billiton Finance 6.5% 22/10/77 6.2% of the fund

Citigroup 5.125% 12/12/18 5.9% of the fund

Rabobank Cap Funding Trust 5.556% 5.7% of the fund

Firstgroup 6.125% 18/01/19 5.6% of the fund

Barclays Bank 8.25% 29/12/49 4.4% of the fund

Daimler Intl Finance 3.5% 06/06/19 4.4% of the fund

Heathrow Funding 6% 20/03/20 4.3% of the fund

ASIF III Jersey 5% 18/12/18 4.0% of the fund

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?username=&ac=&csi=10166&record_search=1&search_phrase=dunedin

BP: Quarterly March 2018 Dividend

On Thursday last week (Thur 29th March 2018) BP plc paid out its quarterly dividend.

One of the largest oil companies in the world.

The dividend was 7.1691p per share.

The total number of voting rights in BP p.l.c. is 19,926,859,767

https://otp.investis.com/clients/uk/bp_plc/rns/regulatory-story.aspx?cid=233&newsid=983623

Thus:

19,926,859,767 x £0.071691 = £1,428,576,503.56

That is £1.428 billion.

That is a 6% yield. Delicious

Statoil to Equinor

Statoil, Norway’s state oil company has become Equinor.

The move from fossil fuels to an energy company

Royal Dutch Shell: March 2018 Dividend

On Monday 26th March, Royal Dutch Shell paid its quarterly dividend to its shareholders:

www.shell.com

it was:- 33.91p a share:-

| RDSA | Royal Dutch Shell A | FTSE 100 | $0.47 (33.91p) | 26-Mar |

| RDSB | Royal Dutch Shell B | FTSE 100 | $0.47 (33.91p) | 26-Mar |

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=133655

Shell A

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=133755

Shell B

Now, 33.91p to shareholders has cost Shell:-

Royal Dutch Shell plc’s capital consists of 4,597,136,050 A shares and 3,745,486,731 B shares, each with equal voting rights. Royal Dutch Shell plc holds no ordinary shares in Treasury.