Their is a LOT of talk about the UK impending budget and why taxes will have to rise.

Rachel Reeves says she is looking at tax rises ahead of Budget – BBC News

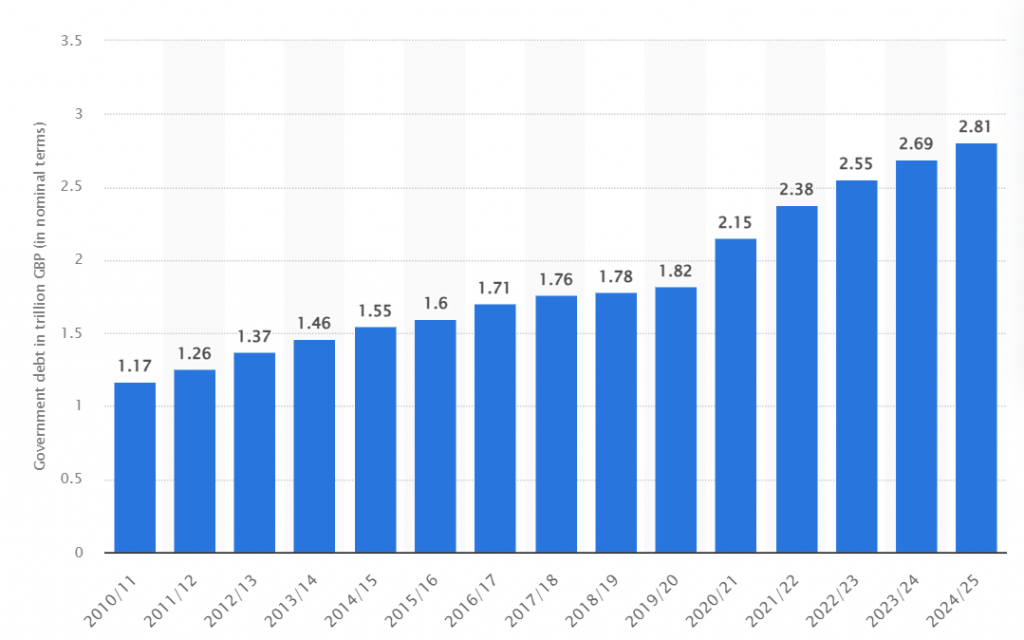

However lets look at the rising national debt in the UK and see how it rose over the past 15 years.

Number are in UK £Pounds: Trillion.

Courtesy of Statista

Government debt in the United Kingdom reached over 2.81 Trillion British pounds in 2024/25, compared with 2.69 trillion pounds in the previous financial year. Although debt has been increasing throughout this period, there is a noticeable jump between 2019/20, and 2020/21, when debt increased from 1.82 trillion pounds, to 2.15 trillion. The UK’s government debt was the equivalent of 95.8 percent of GDP in 2024/25, and is expected to increase slightly in coming years, and not start falling until the end of this decade

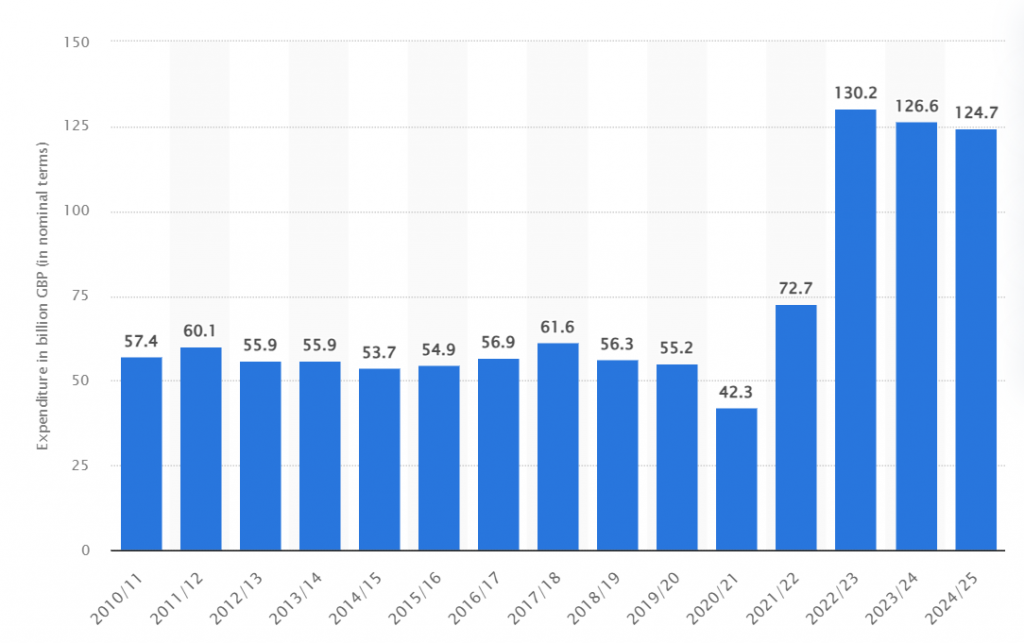

Now, the big issue is looking at the total debt of £2810 Billion = £2.81 Trillion. Thus when carrying this level of debt, there is huge public sector expenditure on public sector debt interest in the United Kingdom from 2010/11 to 2024/25, see below:-

Courtesy of Statista

As you can see above, in 2024/25, total interest payments on HM Government debt was £124.7 Billion, money that is paid to the creditors of the UK (the lenders), which means, money that can NOT be used on the UK, e.g. not able to use £124.7 Billion on new hospitals or new schools or better roads. Servicing the debt is now a large part of HM Government expenditure.