In the past few days, Oracle has been making the headlines with its incredible database software, its data centres and its move into AI. The world runs on Oracle.

https://www.bbc.co.uk/news/articles/cx2rp992y88o

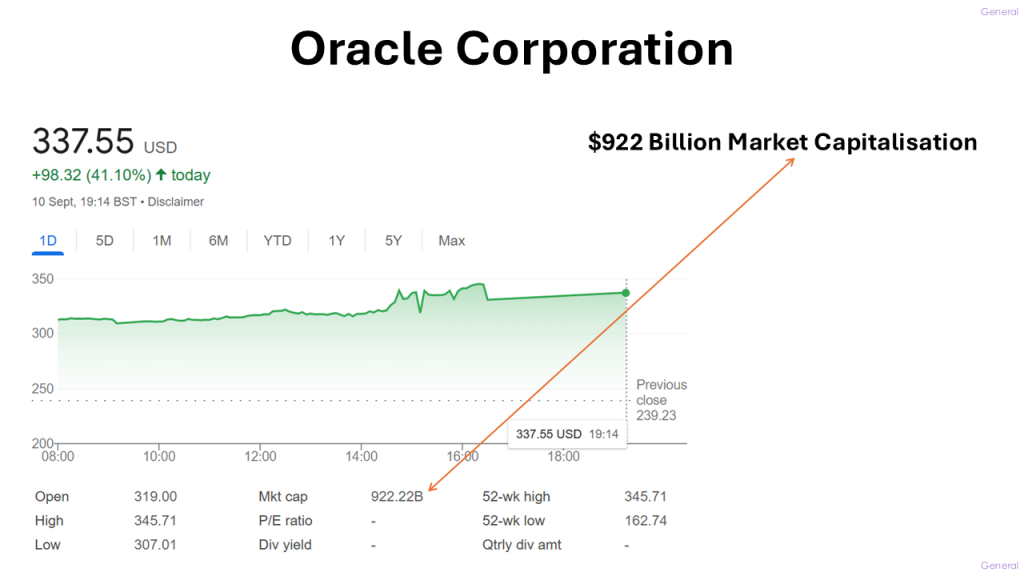

“Shares in Oracle soared more than 40% after the database software company gave investors a surprisingly rosy outlook for its cloud infrastructure business and artificial intelligence (AI) deals.”

Lets look at the numbers:-

The market value is now $922 Billion

The

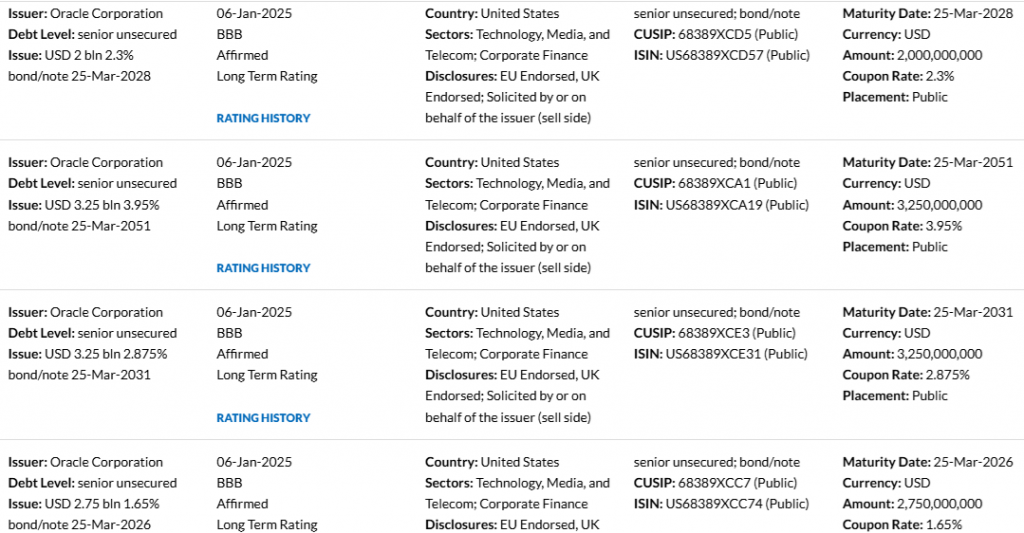

See below, a snapshot of some of the bonds that Oracle has outstanding. Currently money owed to the bondholders of Oracle

We can see above the different interest levels on each “debt bundle”, approximately an average of about 2.8%.

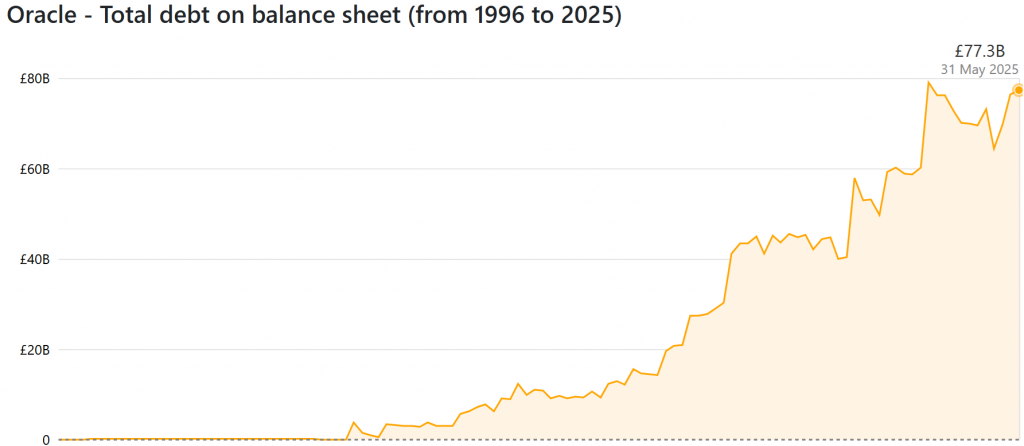

We can see Oracle owes about £77 billion. Total debt of £77bn at an average interest rate of 2.8%, meaning the interest costs for Oracle on £77bn is £2.156 billion.

So, lets keep things in context. Interest payments to bond holders of £2.156 billion…and in 2024 it sees just Cloud revenues of over $18bn which is only one of its revenue streams. It is firing on all cylinders.

Oracle stock posts best day since 1992, tops $900 billion market cap

So the debt interest payments are trivial, based on its huge reveunes.

“Oracle now sees $18 billion in cloud infrastructure revenue in fiscal 2026, with the company calling for the annual sum to reach $32 billion, $73 billion, $114 billion and $144 billion over the subsequent four years.”