One of the UK largest insurance companies, is the Direct Line Group.

https://www.directlinegroup.co.uk/

Its origins are the from the ownership of Direct Line by the Royal Bank of Scotland Group, then spun out from the RBS group after the UK Government bailout in 2008.

Today it is a standalone PLC.

Motor Insurance £1,432.7m in premiums received

Home, Commercial, Rescue and other personal lines – ongoing operations £1,537.1m in premiums received

Total premium income £2,969.8m

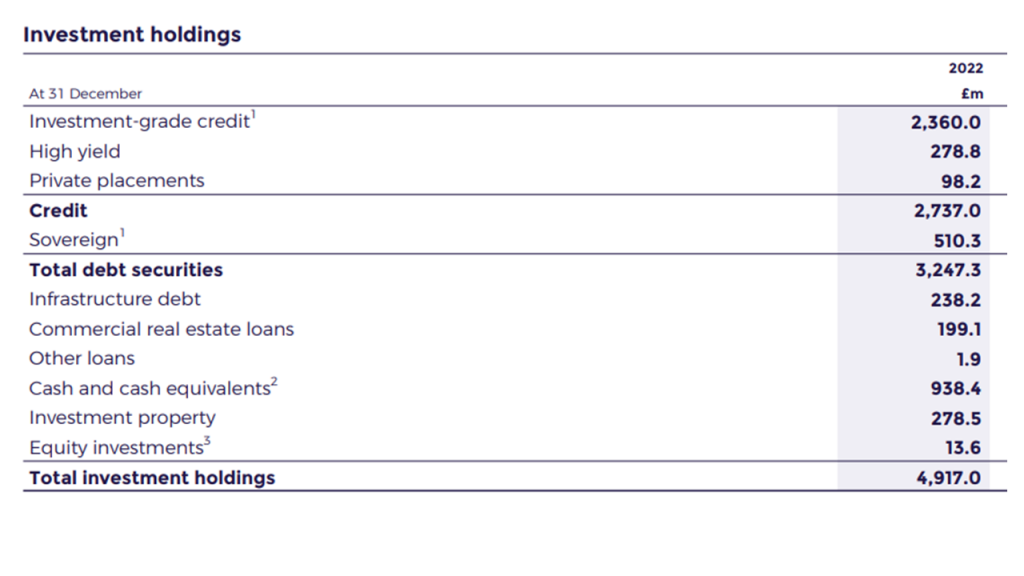

What is interesting to see is what Direct Line does with its insurance premiums that it collects, and what investments it holds:-

Debt (credit) assets in total (such as high quality bonds = debt) = £3,247.3 million

Total assets it holds = 4,917.0 million

thus (£3,247.3 million) / (4,917.0 million) = 66% of its assets are in bonds.

Only £13m of its investments are in shares (equities) = 0.26% of its assets are in shares

Investment income £124.0m on its investment portfolio of 4,917.0 million

That is a yield of 2.52%

DIRECT LINE INSURANCE GROUP PLC DLG Stock | London Stock Exchange