The US, the world’s largest economy home to giants, like Exxon Mobile, Google, Intel, IBM, Cisco, Juniper, S-One Communications Corporation.

The US Central Bank, is the US Federal Reserve.

https://www.federalreserve.gov/

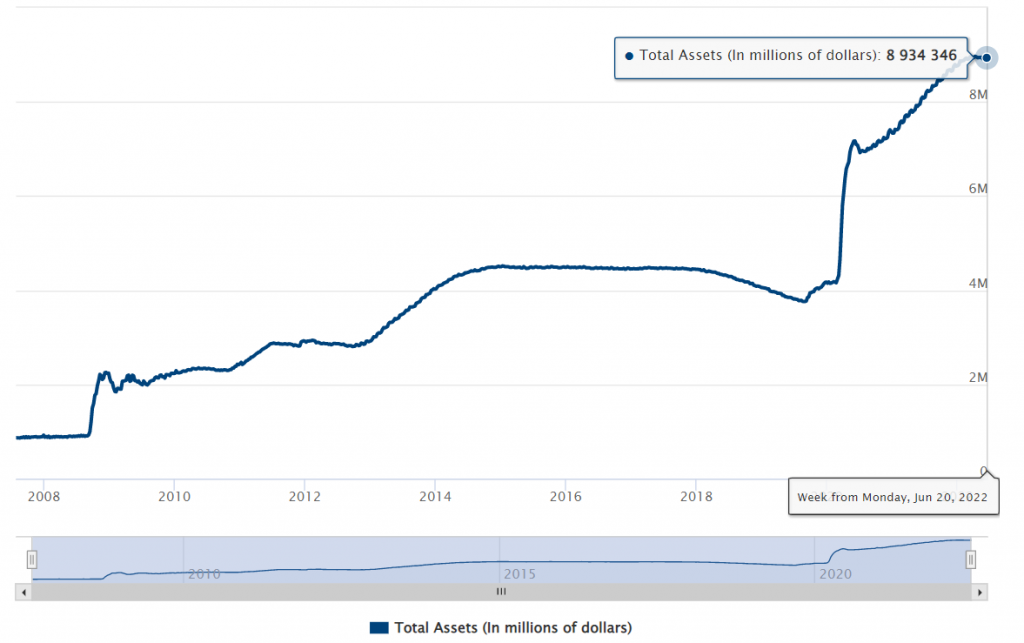

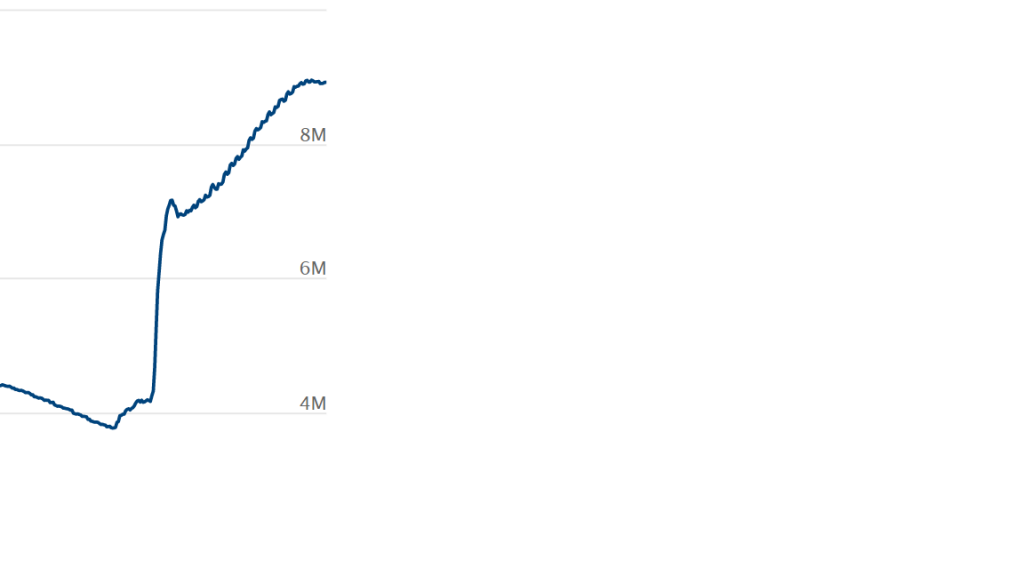

They are in a process of reducing the size of the balance sheet, that since 2008 has grown to deal with the Global Financial Crisis and then the 2020 Covid 19 Pandemic.

The 2 diagrams below show the size, now sitting at $8,934,346 Billion. (That is $8.9 Trillion)

The press release below shows the plan to reduce the size of the balance sheet with a reduction in the bond buying programme of QE.

https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20220615.pdf

“In their consideration of the appropriate stance of monetary policy, participants concurred that the labor market was very tight, inflation was well above the Committee’s 2 percent inflation objective, and the near-term inflation outlook had deteriorated since the time of the May meeting. Against this backdrop, almost all participants agreed that it was appropriate to raise the target range for the federal funds rate 75 basis points at this meeting. One participant favored a 50 basis point increase in the target range at this meeting instead of 75 basis points. All participants judged that it was appropriate to continue the process of reducing the size of the federal Reserve’s balance sheet, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that the Committee issued in May. In light of elevated inflation pressures and signs of deterioration in some measures of inflation expectations, all participants reaffirmed their strong commitment to returning inflation to the Committee’s 2 percent objective. Participants observed that a return of inflation to the 2 percent objective was necessary for creating conditions conducive to a sustainably strong labor market over time. “