The Renewables Infrastructure Group December 2020 Dividend

Today, the FTSE250 company The Renewables Infrastructure Group pay out its Dec 2020 dividend.

It owns:-

45 Wind farms

28 Solar farms

01 Battery Storage

The total number of Ordinary Shares in issue on Admission will be 1,903,402,338 each with one voting right.

Thus:-

1,903,402,338 x £0.0169 = £32,167,499.5122

That is £32million

The Vanguard Total Stock Market Index Fund

The Vanguard Total Stock Market Index Fund

Created in 1992, Vanguard Total Stock Market Index Fund is designed to provide investors with exposure to the entire U.S. equity market, including small-, mid-, and large-cap growth and value stocks

https://investor.vanguard.com/mutual-funds/profile/portfolio/vtsmx

The assets of this fund are now $1 Trillion.

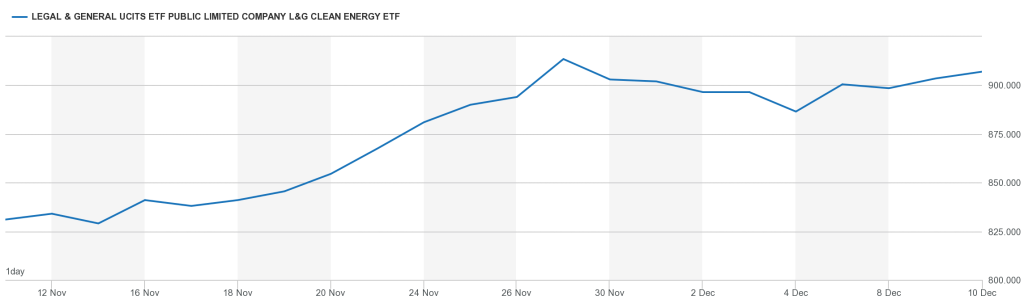

L&G Clean Energy UCITS ETF

The L&G Clean Energy UCITS ETF is a listed Exchange Traded Fund that invests in Clean Energy companies

https://fundcentres.lgim.com/uk/professional/fund-centre/ETF/Clean-Energy?isin_code=IE00BK5BCH80

The L&G Clean Energy UCITS ETF (the “Fund”) is a passively

managed exchange traded fund (“ETF”) that aims to track the

performance of the Solactive Clean Energy Index NTR (the “Index”)

https://www.londonstockexchange.com/stock/RENG/legal-and-general-asset-management/company-page

The graph speaks volumes

Merry Xmas

Blackrock Clean Energy ETF

What is “The Great Reset” & Why are People So Worried About It?

BP December 2020 Dividend.

Yesterday, BP PLC paid out its quarterly dividend.

This is an oil major.

$0.0525 (3.9169p) a share.

https://www.londonstockexchange.com/news-article/BP./total-voting-rights/14774649

The total number of voting rights in BP p.l.c. is 20,273,698,735

Thus:

20,273,698,735 x 0.039169 = £794,100,505.751215

That is £794 Million.

https://www.londonstockexchange.com/stock/BP./bp-plc/company-page

Royal Dutch Shell: December 2020 Dividend.

Yesterday, (Wed 16th Dec 2020), Royal Dutch Shell paid out its quarterly dividend.

Shell PLC is a dual listed company, Shell A and Shell B shares.

RDSA Royal Dutch Shell A, pays out $0.1665 (12.48p) a share.

RDSB Royal Dutch Shell B, pays out $0.1665 (12.48p) a share.

Royal Dutch Shell plc’s capital as at 30 November 2020, consists of 4,101,239,499 A shares and 3,706,183,836 B shares, each with equal voting rights. Royal Dutch Shell plc holds no ordinary shares in Treasury.

https://www.londonstockexchange.com/news-article/RDSA/voting-rights-and-capital/14774381

Thus:

4,101,239,499 x £00.1248 = £511,834,689.4752

3,706,183,836 x £00.1248 = £462,531,742.7328

That is £511,834,689.4752 + £462,531,742.7328 = £974,366,432.208.

That is £974 Million

https://www.londonstockexchange.com/stock/RDSA/royal-dutch-shell-plc/company-page

Investment in Meat (said with a German accent)

HM Government Borrowings Nov 2020

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a Covid 19 world. UK’s HM Government needs to fund many new demands. [www.dmo.gov.uk]

https://www.dmo.gov.uk/dmo_static_reports/Gilt%20Operations.pdf

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In October 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 15 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

24-Nov-2020 1¼% Treasury Gilt 2027 £3,002.7500 Million

24-Nov-2020 1¾% Treasury Gilt 2057 £1,562.4990 Million

18-Nov-2020 0 5/8% Treasury Gilt 2035 £2,500.0000 Million

17-Nov-2020 0 1/8% Treasury Gilt 2024 £4,062.4990 Million

17-Nov-2020 0 5/8% Treasury Gilt 2050 £2,500.0000 Million

12-Nov-2020 0¼% Treasury Gilt 2031 £3,749.9990 Million

12-Nov-2020 1 5/8% Treasury Gilt 2054 £1,562.4990 Million

11-Nov-2020 0 1/8% Index-linked Treasury Gilt 2036 3 months £861.4000 Million

04-Nov-2020 0 1/8% Treasury Gilt 2026 £3,000.0000 Million

03-Nov-2020 0 1/8% Treasury Gilt 2028 £3,405.6250 Million

03-Nov-2020 1¼ % Treasury Gilt 2041 £2,499.9990 Million

[£3,002.7500 Million+£1,562.4990 Million+£2,500.0000 Million+£4,062.4990 Million+£2,500.0000 Million+£3,749.9990 Million+£1,562.4990 Million+£861.4000 Million+£3,000.0000 Million+£3,405.625 Million+£2,499.9990 Million = £28,707.27 Million]

£28,707.27 Million = £28.70727 Billion

On another way of looking at it, is in the 30 days in November 2020, HM Government borrowed:- £956.909 Million each day for the 30 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature from 2024 through to 2045. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

Paul Krugman: A word from the wise

Helium One.

The world is running out of Helium.

Despite its prevalence across the universe, helium is rare on Earth. It is usually found with oil and natural gas. The US is the world’s largest producer, accounting for roughly 40% of supply. However, the US National Helium Reserve in Amarillo, Texas, the world’s single largest source of helium for the past 70 years, is now exhausted.

Apart filling birthday balloons. It plays a critical role in a number of high-tech applications, from barcode readers to semiconductors to liquid-crystal display (LCD) panels. Magnetic resonance imaging (MRI) machines can’t work without it. Google, Netflix and Amazon have been buying massive quantities of it for their data centers

However there are opportunities to invest in Helium explorers.

Helium One is a new London Listed company looking for Helium in Tanzania.

Its shares were listed on Fridy 4th Dec 2020

https://polaris.brighterir.com/public/helium_one/news/rns/story/x2jm9zw

https://www.londonstockexchange.com/stock/HE1/helium-one-global-ltd/company-page

The Ashoka India Equity Investment Trust PLC

The Ashoka India Equity Investment Trust PLC is a London listed investment trust investing in India.

TOP 10 HOLDINGS (as at 30 November, 2020)

ICICI Bank Financials 6.8% of the fund

Infosys Information Technology 6.6% of the fund

Bajaj Finserv Financials 5.6% of the fund

HDFC Bank Financials 5.3% of the fund

Nestle India Consumer Staples 5.0% of the fund

Asian Paints Materials 4.3% of the fund

Coforge Information Technology 3.9% of the fund

Kotak Mahindra Bank Financials 3.0% of the fund

Garware Technical Fibres Consumer Discretionary 3.0% of the fund

Navin Fluorine International Materials 2.9% of the fund

Total Portfolio 46.4% are the top 10 holdings.

https://www.londonstockexchange.com/stock/AIE/ashoka-india-equity-investment-trust-plc/company-page

The graph below makes interesting viewing.

Ray Dalio: Don’t Own Bonds, Don’t Own Cash

The Legal & General Global 100 Index Trust

The Legal & General Global 100 Index Trust is an Index fund, the objective of the Fund is to provide growth by tracking the capital performance of the S&P Global 100 Index

Top 10 holdings (%):-

Apple Inc 13.1% of the fund

Microsoft Corp 11.1% of the fund

Amazon.Com Inc 9.4% of the fund

Alphabet Cl A 3.1% of the fund

Alphabet Cl C 3.0% of the fund

Johnson & Johnson 2.7% of the fund

Nestle 2.4% of the fund

Procter & Gamble Company 2.4% of the fund

JPMorgan Chase & Co 2.1% of the fund

Samsung Electronics Co Ltd 1.8% of the fund

£308.8m fund.

Wise Warren Buffet Quote

Give Back to Society

“If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.”

Warren Buffett and his wisdom

Ray Dalio on Inflation that is on the horizon

The Legal and General Global Technology Index Fund.

The Legal and General Global Technology Index Fund is a Unit Trust. The objective of the Fund is to provide growth by tracking the performance of the FTSE World -Technology Index (the “Index”). This objective is after the deduction of charges and taxation.

£967.2m of Technology assets.

Top 10 holdings (%)

Apple Inc 16.5% of the fund

Microsoft Corp 13.4% of the fund

Facebook 4.6% of the fund

Alphabet Cl A 4.1% of the fund

Alphabet Cl C 4.1% of the fund

Taiwan Semiconductor Manufacturing 3.4% of the fund

Nvidia Corp 3.0% of the fund

Adobe Inc 2.2% of the fund

Samsung Electronics Co Ltd 2.2% of the fund

Intel Corp 2.1% of the fund

The graph below shows its growth:-

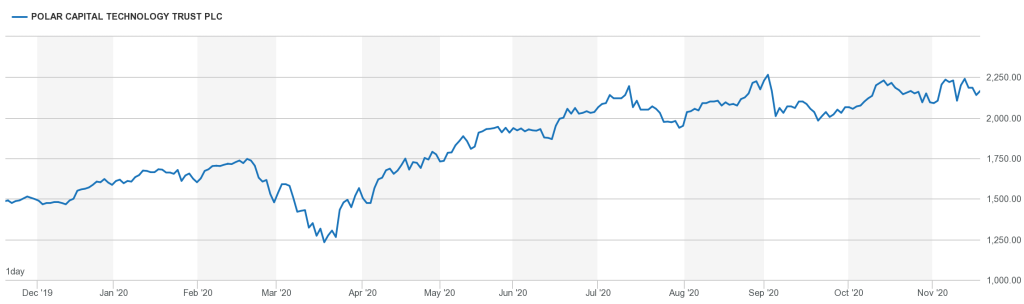

The Polar Capital Technology Investment Trust plc

The Polar Capital Technology Investment Trust plc is a London listed investment trust.

https://www.polarcapitaltechnologytrust.co.uk/

£2,972.87m is it market capitalisation

Its top 15 holdings (%)

Apple 9.3% of the trust

Microsoft 8.2% of the trust

Alphabet 6.3% of the trust

Facebook 5.0% of the trust

Alibaba 4.0% of the trust

Tencent 3.8% of the trust

Samsung 2.8% of the trust

Amazon.com 2.6% of the trust

Taiwan Semiconductors 2.6% of the trust

Adobe Systems 2.2% of the trust

NVIDIA 2.0% of the trust

Advanced Micro Devices 1.8% of the trust

Salesforce.com 1.7% of the trust

Netflix 1.4% of the trust

Qualcomm 1.3% of the trust

https://www.londonstockexchange.com/stock/PCT/polar-capital-technology-trust-plc/company-page

The graph below shows its growth:-

Sainsburys Bank

Their is news in the media, that Sainsbury’s Bank (part of the Sainsbury’s supermaket group) is to be sold to National Westminister Group.

Some figures from the Sainsbury’s annual report

Customer deposits of £6300 million.

Customer lending £7400 million

Ray Dalio on the Economy

Legal & General Japan Index Trust

The Legal & General Japan Index Trust in an Index Fund managed by Legal and General.

A £1,321.9m fund. The objective of the Fund is to provide growth by tracking the capital performance of the FTSE Japan Index

Its top ten holdings are:

Toyota Motor Corp 4.2% of the fund

Sony Corp 2.4% of the fund

Softbank Group Corp 2.3% of the fund

Keyence Corp 2.2% of the fund

Nintendo 1.6% of the fund

Daiichi Sankyo Co Ltd 1.5% of the fund

Takeda Pharmaceutical Co Ltd 1.4% of the fund

Shin-Etsu Chemical Co Ltd 1.3% of the fund

Mitsubishi UFJ Financial Group 1.3% of the fund

Recruit Holdings Co Ltd 1.3% of the fund

It invests across 10 sectors:

Industrials 24.0% of the fund

Consumer Goods 22.7% of the fund

Health Care 11.6% of the fund

Financials 11.2% of the fund

Consumer Services 9.9% of the fund

Technology 6.8% of the fund

Telecommunications 6.2% of the fund

Basic Materials 5.5% of the fund

Utilities 1.5% of the fund

Oil & Gas 0.6% of the fund

Investment in ONE

Or do you feel the same?

Will it make it easier on you now?

You got someone to blame

You say one love, one life (One life)

It’s one need in the night

One love (one love), get to share it

Leaves you darling, if you don’t care for it

Did I disappoint you?

Or leave a bad taste in your mouth?

You act like you never had love

And you want me to go without

Well it’s too late, tonight

To drag the past out into the light

We’re one, but we’re not the same

We get to carry each other

Carry each other

One, one

One, one

One, one

One, one

Have you come here for forgiveness?

Have you come to raise the dead?

Have you come here to play Jesus?

To the lepers in your head

Well, did I ask too much, more than a lot?

You gave me nothing, now it’s all I got

We’re one,…

HM Government Borrowings: October 2020

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a Covid 19 world. UK’s HM Government needs to fund many new demands. [www.dmo.gov.uk]

https://www.dmo.gov.uk/dmo_static_reports/Gilt%20Operations.pdf

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In October 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 15 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

28-Oct-2020 0 3/8% Treasury Gilt £3,084.9990 Million

27-Oct-2020 0 1/8% Treasury Gilt 2024 £3,510.7420 Million

27-Oct-2020 1 5/8% Treasury Gilt 2071 £1,249.9990 Million

22-Oct-2020 0 5/8% Treasury Gilt 2035 £2,632.0000 Million

22-Oct-2020 0 5/8% Treasury Gilt 2050 £1,986.8750 Million

20-Oct-2020 1¼% Index-linked Treasury Gilt 2032 3 months £697.0490 Million

14-Oct-2020 0 7/8% Treasury Gilt 2029 £3,125.0000 Million

13-Oct-2020 0 1/8% Treasury Gilt 2026 £3,000.0000 Million

13-Oct-2020 1¾% Treasury Gilt 2057 £1,562.4990 Million

07-Oct-2020 0 3/8% Treasury Gilt 2030 £2,500.0000 Million

07-Oct-2020 0 1/8% Index-linked Treasury Gilt 2041 3 months £884.1490 Million

06-Oct-2020 0 1/8% Treasury Gilt 2024 £3,518.4520 Million

06-Oct-2020 1¾% Treasury Gilt 2049 £2,000.0000 Million

01-Oct-2020 0 1/8% Treasury Gilt 2023 £3,250.0000 Million

01-Oct-2020 1¼ % Treasury Gilt 2041 £2,000.0000 Million

(£3,084.9990 Million + £3,510.7420 Million + £1,249.9990 Million + £2,632.0000 Million + £1,986.8750 Million + £697.0490 Million + £3,125.0000 Million + £3,000.0000 Million + £1,562.4990 Million + £2,500.0000 Million + £884.1490 Million + £3,518.4520 Million + £2,000.0000 Million + £3,250.0000 Million + £2,000.0000 Million) = £35,001.764 Million

£35,001.764 Million = £35 Billion

On another way of looking at it, is in the 31 days in October 2020, HM Government borrowed:- £1129.089161 Million each day for the 31 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature from 2023 through to 2071. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

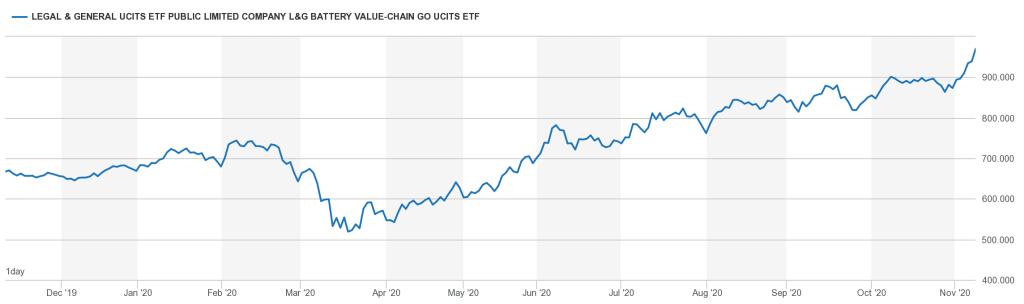

The Ascent of the Lithium Ion Battery Exchange Traded Fund – BATG

BATG is a London Listed Exchange Traded Fund (ETF)

https://www.londonstockexchange.com/stock/BATG/legal-and-general-asset-management/company-page

The graph speaks volumes.

Over 900p a share.

Investment in Good US Comedy

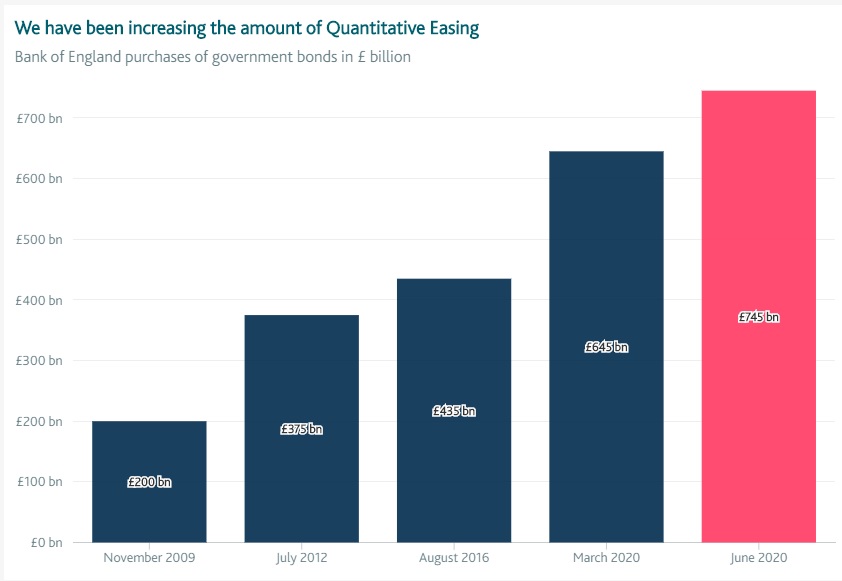

Bank of England November 2020 QE Programme

https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2020/november-2020

On Thursday 5th November, The Bank of England, extended its QE programme by an additional £150bn.

” The Committee voted unanimously for the Bank of England to continue with the existing programme of £100 billion of UK government bond purchases, financed by the issuance of central bank reserves, and also for the Bank of England to increase the target stock of purchased UK government bonds by an additional £150 billion, financed by the issuance of central bank reserves, to take the total stock of government bond purchases to £875 billion. “

Since the start of the financial crisis that began in 2008, the UK Central Bank, has created £875 billion of new money.

Now the QW programme was at £435bn in June 2016, and since Covid has jumped. It went up by £200bn when Covid19 hit in March.

https://www.bankofengland.co.uk/monetary-policy/quantitative-easing

and now jumped again:-

Robotics and Automation ETF

Milton Friedman Quote.

Inflation is taxation without legislation. Milton Friedman

The Long Term Investors

HM Government Borrowings: September 2020

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a Covid 19 world. UK’s HM Government needs to fund many new demands. [www.dmo.gov.uk]

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In September 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 11 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

29-Sep-2020 0 1/8% Treasury Gilt 2028 £3,437.4990 Million

24-Sep-2020 0 1/8% Treasury Gilt 2026 £3,749.9990 Million

24-Sep-2020 0 1/8% Index-linked Treasury Gilt 2028 3 months £1,310.7490 Million

16-Sep-2020 0 3/8% Treasury Gilt 2030 £3,124.9990 Million

15-Sep-2020 1¼% Treasury Gilt 2027 £2,867.5000 Million

15-Sep-2020 1¾% Treasury Gilt 2037 £2,187.5000 Million

10-Sep-2020 0 1/8% Treasury Gilt 2023 £3,250.0000 Million

10-Sep-2020 0 5/8% Treasury Gilt 2050 £2,421.7490 Million

03-Sep-2020 0 1/8% Treasury Gilt 2028 £3,412.7490 Million

03-Sep-2020 1¼ % Treasury Gilt 2041 £2,500.0000 Million

02-Sep-2020 0 1/8% Index-Linked Treasury Gilt 2056 3 months £459.0500 Million

= £3,437.4990 Million + £3,749.9990 Million + £1,310.7490 Million + £3,124.9990 Million + £2,867.5000 Million + £2,187.5000 Million + £3,250.0000 Million + £2,421.7490 Million + £3,412.7490 Million + £2,500.0000 Million + £459.0500 Million = £28,721.794 Million

£28,721.794 Million = £28.721 Billion

On another way of looking at it, is in the 30 days in September 2020, HM Government borrowed:- £957.3931333333333 Million each day for the 30 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature from 2023 through to 2056. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

BP’s Quarterly Results.

The oil major BP had some interesting results in the Q2 figures.

A huge oil and gas company that is transitioning into Green energy.

Its balance sheet on page 17 has some very interesting figures:

Cash position £34.217 Billion.

It has a pension surplus, in its Defined benefit pension plan of £6.346 Billion

Page 27 has some interesting Deb figures:

Finance debt £76.003 Billion

Gearing of 33.1%.

Investment in Comedy

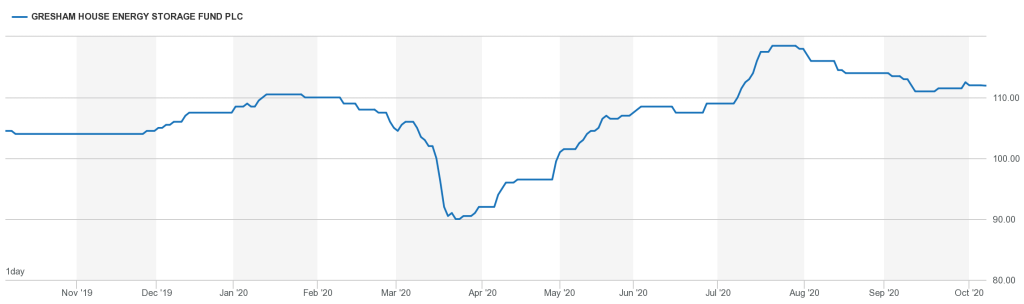

The Gresham House Energy Storage Fund September 2020 Dividend

The Gresham House Energy Storage Fund paid out its September dividend on the 30th Sept.

It was 1.75p a share

https://www.londonstockexchange.com/news-article/GRID/total-voting-rights/14483969

The Company’s issued share capital consisted of 234,270,650 Ordinary Shares.

thus:-

234,270,650 x £0.0175 = £4,099,736.375

https://www.hl.co.uk/shares/shares-search-results/g/gresham-house-energy-storage-ord-gbp0.01

A yield of 4.01%

The Father of Index Funds

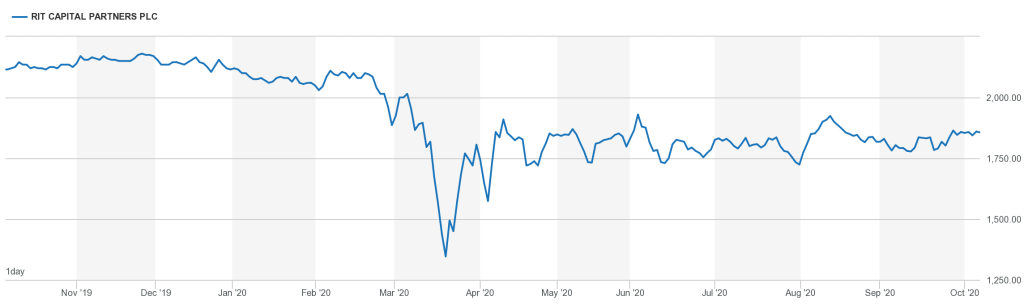

Graphs of the Covid19 Dip in the Stockmarket

The Investment in Bold Bets. Your Calling

Legal and General Cyber Security ETF

Standard Life Aberdeen PLC September dividend

Standard Life Aberdeen paid out its September dividend on the 30th Sept.

https://www.standardlifeaberdeen.com/

It was 7.3p a share

https://www.lse.co.uk/rns/SLA/total-voting-rights-w5s1goqtue7qnsu.html

The total number of voting rights in the Company, as at 30 September 2020, is therefore 2,225,782,374

thus:-

2,225,782,374 x £0.073 = 162,482,113.302

https://www.hl.co.uk/shares/shares-search-results/s/standard-life-aberdeen-plc-ordinary-13-616

A yield of 9%

Legal and General Battery ETF

The US Federal Reserve Balance Sheet

A picture paints a thousand words. The most highly regarded and respected financial institution in the world is arguably is the United States central bank, the US Federal Reserve, affectionately known as The Fed. It’s current chairman is Jerome Powell, the former chair persons, all have vast intellectual capacity, famous name such as Janet Yellan, Ben Bernanke, Alan Greenspan, Paul Volcker people of incredible calibre and wisdom. Since 2008 the world has had huge financial turmoil, from the 2008 global financial crisis to the now terrible impact of Covid19 on the global economy. What is very interesting to observe is shear scale of the financial intervention into the markets that The Fed has undertaken, effectively injecting huge quantities of cash (liquidity) into the market, to buy assets off commercial banks, to keep markets functioning. A good way to see that scale of intervention is to look at the movement in size of The Fed’s balance sheet.https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm From 2008, just before the financial crisis hit, the assets on the US Federal Reserve were $914,632 Million = $914 Billion = $0.914 Trillion dollars. Then the credit crisis hits and then the Fed intervened into the market by buying mortgage securities and also buying US Treasuries (US Government bonds = US Government Debt) what we know as Quantitative Easing (QE). Then the balance sheet jumped to $2,871,301 Million = £2,871 Billion = $2.871 Trillion dollars, and then by March this year that grown to $4,241,507 Million = $4,241 Billion = $4.241 Trillion dollars just before Covid19 hits, and then the acceleration in the size of the balance sheet, rockets to now where it stands at $7,056,129 Million = $7,056 Billion = $7.056 Trillion. Its scale can not be under-estimated, the fire power of the US Federal Reserve is vast. However what we are seeing is a huge scale market intervention from the central bank to ensure market stability by pumping massive quantities of cash into the system by asset purchases, and then question becomes, are asset prices rising because of the level of national debt, globally, as we are seeing soaring equity prices and perhaps inflation is on the horizon that will wipe out the value of our cash savings.

Investment in Multiple Languages

The Renewables Infrastructure Group Sept 2020 dividend

The Renewables Infrastructure Group paid out its September dividend on the 30th Sept.

It was 1.69p a share

https://www.londonstockexchange.com/news-article/TRIG/total-voting-rights/14704386

The total issued share capital with voting rights is 1,741,925,855.

thus:-

1,741,925,855 x £0.0169 = £29,438,546.9495

A yield of 4.86%

Investment in Quantum Mechanics

The beauty of a superfluid. Liquid Helium.

Buffet quote

I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for ten years. Warren Buffett

The total Debt of Astra Zeneca

Astra Zeneca is the UK’s largest company. The pharma giant.

It carries debt as a part of its funding strategy.

https://www.astrazeneca.com/investor-relations/debt-investors.html

Currency Notional (m) Issue date Maturity date Coupon Frequency ISIN

USD 1,600 16-Nov-15 16-Nov-20 2.375% Semi-annual US046353AK44

EUR 500 12-May-16 12-May-21 0.25% Annual XS1411403709

EUR 750 24-Nov-14 24-Nov-21 0.875% Annual XS1143486865

USD 250 12-Jun-17 10-Jun-22 3m Libor + 0.62% Quarterly US046353ap31

USD 1,000 12-Jun-17 12-Jun-22 2.375% Semi-annual US046353AQ14

USD 850 17-Aug-18 17-Aug-23 3.50% Semi-annual US046353AR96

USD 400 17-Aug-18 17-Aug-23 3m Libor + 0.665% Quarterly US046353AS79

USD 287 15-Nov-93 15-Nov-23 7.00% Semi-annual US98934KAB61

EUR 900 12-May-16 12-May-24 0.75% Annual XS1411404855

USD 2,000 16-Nov-15 16-Nov-25 3.375% Semi-annual US046353AL27

USD 1,200 06-Aug-20 08-Apr-26 0.70% Semi-annual US046353AV09

USD 750 12-Jun-17 12-Jun-27 3.125% Semi-annual US046353AN82

EUR 800 12-May-16 12-May-28 1.25% Annual XS1411404426

USD 1,000 17-Aug-18 17-Jan-29 4.00% Semi-annual US046353AT52

USD 1,300 06-Aug-20 06-Aug-30 1.375% Semi-annual US046353AW81

GBP 350 13-Nov-07 13-Nov-31 5.75% Annual XS0330497149

USD 2,750 12-Sep-07 15-Sep-37 6.45% Semi-annual US046353AD01

USD 1,000 18-Sep-12 18-Sep-42 4.00% Semi-annual US046353AG32

USD 1,000 16-Nov-15 16-Nov-45 4.375% Semi-annual US046353AM00

USD 750 17-Aug-18 17-Aug-48 4.375% Semi-annual US046353AU26

USD 500 06-Aug-20 06-Aug-50 2.125% Semi-annual US046353AX64

That is:-

£350m

€2950m

$16,637m

That is in UK £ = 16,019m

Ice on Fire: HBO

Robotics and Automation

https://www.londonstockexchange.com/stock/ROBG/legal-and-general-asset-management/company-page

And lets not forget the dangers and risks…..of Robotics and Automation…..

HM Government Borrowings: August 2020

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a Covid 19 world. UK’s HM Government needs to fund many new demands.

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In August 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 14 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

26-Aug-2020 0 3/8% Treasury Gilt 2030 2,750.0000 Million

25-Aug-2020 0 1/8% Treasury Gilt 2026 3,000.0000 Million

25-Aug-2020 1 5/8% Treasury Gilt 2054 1,342.3750 Million

20-Aug-2020 0 1/8% Index-linked Treasury Gilt 2028 3 months 1,374.9990 Million

19-Aug-2020 0 7/8% Treasury Gilt 2029 3,437.5000 Million

18-Aug-2020 0 1/8% Treasury Gilt 2023 4,062.4970 Million

18-Aug-2020 0 5/8% Treasury Gilt 2050 2,477.2500 Million

12-Aug-2020 0 1/8% Treasury Gilt 2028 3,437.4990 Million

11-Aug-2020 0 5/8% Treasury Gilt 2025 3,250.0000 Million

11-Aug-2020 1¾% Treasury Gilt 2057 1,250.0000 Million

05-Aug-2020 0 1/8% Index-linked Treasury Gilt 2048 3 months 562.2500 Million

05-Aug-2020 0 3/8% Treasury Gilt 2030 2,750.0000 Million

04-Aug-2020 0 1/8% Treasury Gilt 2026 4,062.4990 Million

04-Aug-2020 1¼ % Treasury Gilt 2041 2,812.4990 Million

Thus:

2,750.0000 Million+3,000.0000 Million+1,342.3750 Million+1,374.9990 Million+3,437.5000 Million+4,062.4970 Million+2,477.2500 Million+3,437.4990 Million+3,250.0000 Million+1,250.0000 Million+562.2500 Million+2,750.0000 Million+4,062.4990 Million+2,812.4990 Million = £36569.368 Million

That is £36.569368 Billion

On another way of looking at it, is in the 31 days in August 2020, HM Government borrowed:- £1.179657032 Billion each day for the 31 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature from 2023 through to 2057. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

Royal Dutch Shell September Dividend.

Today, Royal Dutch Shell pays out its quarterly dividend.

it is 12.09p a share.

Shell PLC is a dual listed company

https://www.londonstockexchange.com/stock/RDSA/royal-dutch-shell-plc/company-page

and

https://www.londonstockexchange.com/stock/RDSB/royal-dutch-shell-plc/company-page

Royal Dutch Shell plc’s capital as at 31 August 2020, consists of 4,101,239,499 A shares and 3,706,183,836 B shares, each with equal voting rights. Royal Dutch Shell plc holds no ordinary shares in Treasury.

https://www.londonstockexchange.com/news-article/RDSA/voting-rights-and-capital/14671798

Thus:

4,101,239,499 A shares x 12.09p = £495,839,855.4291

+

3,706,183,836 B shares x 12.09p = £448,077,625.7724

Thus

[£495,839,855.4291]+[£448,077,625.7724]= £943,917,481.2015

That is £943million of cash

LGIM (Legal & General Investment Management) Talks

Technics

Investment in “Shadow Play”

Investment in The Law.

A New York Minute

Ray Dalio on Money Printing

Norway’s wealth fund loses £16bn in first half of 2020 after Covid panic

Norway’s sovereign wealth fund – the world’s largest – made a £16bn loss in the first half of the year and warned that financial markets could face further volatility as the Covid pandemic was still out of control.

The £895bn fund said it suffered a 3.4% drop in returns in the first six months of 2020, equivalent to a 188bn kroner (£16bn) decline, when its investments were hit by the early-March market sell-off sparked by panic about the coronavirus outbreak.

While investor confidence had been restored by “massive” state support packages, the fund’s deputy chief executive, Trond Grande, said financial markets were not reflecting the real economic impact of the virus, which he said was not under control “in any shape or form”.

He said: “We have already seen some sort of V-shaped recovery in the financial markets. I think there is a slight disconnect between the real economy and the financial markets.”

He also warned that there could be further market volatility, particularly if there was a surge in coronavirus cases later this year.

“We could be in for some turbulence this fall as things unfold and whether or not the coronavirus pandemic recedes, or gains some force,” Grande said, and the full impact on sectors such as travel and leisure was yet to be seen.

The fund’s deputy also noted that state support for national economies may not be sustainable long-term.

A further drop in share prices would cause further pain for the sovereign wealth fund, which was founded in 1996 and invests the country’s oil revenues abroad to shield its economy from market turmoil. The fund owns nearly 1.5% of all globally listed shares, with stakes in over 9,000 companies.

The Norwegian fund’s shareholdings in oil and gas companies suffered the biggest declines in the first six months of 2020. The stocks lost 33.1% of their value as oil prices plunged amid coronavirus travel restrictions, which dramatically reduced demand.

Its bank investments also performed poorly, with financial stocks declining nearly 21% over in first six months of the year. Lender profits were hit by lower interest rates and provisions for future defaults on loans, as a number of countries plunged into economic recessions due to Covid-19. Norway’s returns were also impacted by a drop in shareholder payouts, after regulators pressure banks to either scrap or reduce dividends at the start of the year.

The worst performers in its portfolio included Royal Dutch Shell, HSBC and JP Morgan.

Amazon was one of the strongest performers, alongside Microsoft and Apple. Overall, the tech sector delivered a 14.2% return for the fund thanks to strong demand for online services around remote working, education, shopping and entertainment during the pandemic.

The UK – which accounts for the fund’s largest equity holdings at 6.9% – was the worst regional performers, after the fund’s share of London-listed stocks losing 24.3% of their value over the period.

It comes after the UK reported a 20.4% drop in gross domestic product in the second quarter, which was the worst of any G7 nation in the three months to June. It also marked the deepest recession since records began.

The Ascent of the Nasdaq

The “Tech Heavy” Nasdaq index started in Feb 1971 at 100 Points. Today it is over 11,000+ points.

6 Months of the the FTSE-100 Index

Wise Quote from Warren Buffet

Do not save what is left after spending, but spend what is left after saving.

Warren Buffet

Read more: https://www.wiseoldsayings.com/investment-quotes/#ixzz6Unv1G0MT

The Knowledge of Paul Krugman

The Legal and General Global Technology Index Trust

The Legal and General Global Technology Index Trust is an index fund managed by Legal and General. It aims to provide growth by tracking the performance of the FTSE World-Technology Index.

Its top ten holdings are:-

Apple Inc 15.5% of the fund

Microsoft Corp 15.5% of the fund

Alphabet Cl A 4.6% of the fund

Alphabet Cl C 4.4% of the fund

Facebook 4.4% of the fund

Taiwan Semiconductor Manufacturing 2.7% of the fund

Intel Corp 2.7% of the fund

Nvidia Corp 2.4% of the fund

Adobe Inc 2.2% of the fund

Samsung Electronics Co Ltd 2.2% of the fund

It is £807.3m fund.

United States is where 80.5% of the assets are held.

Greencoat UK Wind August 2020 Dividend

Tomorrow, Greencoat UK Wind pays out is dividend.

https://www.greencoat-ukwind.com/

1.775p a share

the total voting rights figure will be 1,518,162,889

Thus:

1,518,162,889 x 0.01775 = £26,947,391.27975

That is £26million

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=7013076&action=

4.8% yield.

HM Government Borrowing: July 2020

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a Covid 19 world. UK’s HM Government needs to fund many new demands.

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In March 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 19 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

29-Jul-2020 0 1/8% Treasury Gilt 2023 £3,500.0000 Million

29-Jul-2020 1 5/8% Treasury Gilt 2028 £3,008.8750 Million

28-Jul-2020 1 5/8% Treasury Gilt 2054 £1,874.9990 Million

28-Jul-2020 1¼% Treasury Gilt 2027 £3,437.4990 Million

22-Jul-2020 0 1/8% Treasury Gilt 2028 £3,000.0000 Million

22-Jul-2020 1¼% Index-linked Treasury Gilt 2032 £500.0000 Million

21-Jul-2020 0 5/8% Treasury Gilt 2050 £2,711.0000 Million

21-Jul-2020 1½% Treasury Gilt 2026 £3,749.9990 Million

15-Jul-2020 1¾% Treasury Gilt 2057 £1,500.0000 Million

15-Jul-2020 2¼% Treasury Gilt 2023 £3,250.0000 Million

14-Jul-2020 0 1/8% Treasury Gilt 2026 £3,834.0950 Million

14-Jul-2020 0 3/8% Treasury Gilt 2030 £3,750.0000 Million

09-Jul-2020 0 1/8% Index-linked Treasury Gilt 2041 £1,062.8500 Million

07-Jul-2020 0 1/8% Treasury Gilt 2023 £3,750.0000 Million

07-Jul-2020 1¼ % Treasury Gilt 2041 £2,812.500 Million

02-Jul-2020 0 5/8% Treasury Gilt 2025 £4,261.1950 Million

02-Jul-2020 4½% Treasury Gilt 2034 £2,329.2500 Million

01-Jul-2020 0 1/8% Treasury Gilt 2028 £3,000.0000 Million

01-Jul-2020 0 5/8% Treasury Gilt 2050 £2,785.9990 Million

Add:- (£3,500.0000 + £3,008.8750 + £1,874.9990 + £3,437.4990 + £3,000.0000 + £500.0000 +£2,711.0000 +£3,749.9990 + £1,500.0000 + £3,250.0000 + £3,834.0950 + £3,750.0000 + £1,062.8500 + £3,750.0000 + £2,812.500 + £4,261.1950 + £2,329.2500 + £3,000.0000 + £2,785.9990) Million = £54,118.261 Million

£54,118.261 Million = £54.11261 Billion

On another way of looking at it, is in the 31 days in July 2020, HM Government borrowed:- £1,745.75 Billion each day for the 31 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature from 2023 through to 2057. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

Warren Buffett Bets on…Berkshire Hathaway

The Octopus Renewables Infrastructure Trust

Today, The Octopus Renewables Infrastructure Trust pays out its August dividend.

https://octopusrenewablesinfrastructure.com/

1.06p a share.

Total number of voting rights of The Octopus Renewables Infrastructure Trust is 350,000,000

Thus:

350,000,000 x £0.0106 = £3,710,000

£3.7million

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=55025967

Ray Dalio: Inflation Is Coming

The Recovery Trajectory: Allianz’s El-Erian

Wealth Destruction at Aston Martin

The Depreciation of the $ US Dollar to the € Euro

Vodafone August 2020 Dividend

On Friday 7th August 2020, Vodafone PLC paid out its August 2020 dividend.

www.vodafone.com

€0.045 a share = 4.079745p a share.

https://otp.tools.investis.com/clients/uk/vodafone4/rns/regulatory-story.aspx?cid=221&newsid=1405715

Therefore, the total number of voting rights in Vodafone is 26,824,338,960

Thus:-

26,824,338,960 x £0.04079745 = £1,094,364,627.503652

That is £1.094 Billion.

7% yield

The Foreign and Colonial Investment Trust PLC: August Dividend

On the 3rd of August 2020, The Foreign and Colonial Investment Trust PLC paid out its August dividend.

One of the world’s oldest investment trusts, F&C Investment Trust (FCIT) is a behemoth,with almost £4bn in AUM. The company, over 150 years old.

It paid out 2.9p a share.

Therefore, the total number of voting rights in the Company is now 541,189,043

Thus:

541,189,043 x £0.029 = 15,694,482.247

That is £15m

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10192&action=

The Legal and General Future World Multi-Index 4 Fund

The Legal and General Future World Multi-Index 4 Fund, is a fund that invests in a risk-profile targeted range of index tracker funds and individual investments including property. Typically has higher exposure to bonds than to shares in companies.

| North America Equity | 13.3% | |

| UK Equity | 9.2% | |

| Europe ex UK Equity | 6.9% | |

| Japan Equity | 4.8% | |

| Emerging Market Equity | 2.4% | |

| Asia Pacific ex Japan Equity | 2.1% |

TOP 10 HOLDINGS (%)

L&G Future World ESG Developed Fund 20.0% of the fund

L&G Future World Global Credit Fund 16.7% of the fund

L&G Short Dated Sterling Corporate Bond Index Fund 11.0% of the fund

L&G Global Inflation Linked Bond Index Fund 7.8% of the fund

L&G Future World ESG UK Fund 7.1% of the fund

L&G ESG EM Gov Bond USD Fund 4.9% of the fund

LGIM GBP Liquidity Fund Plus 4.9% of the fund

Europe ex UK Equity 3.5% of the fund

L&G High Income Trust 3.4% of the fund

L&G Japan Equity UCITS ETF 3.0% of the fund

https://literature-lgim.huguenots.co.uk/srp/documents/?type=FS&ISIN=GB00BJ0M3438

From “The Way Forward” Conference: Ray Dalio Founder, Co-Chairman and Co-CIO, Bridgewater Associates

United Utilities August 2020 Dividend.

Today, 3rd August, United Utilities pays out its August 2020 dividend.

28.4p a share.

the total voting rights in United Utilities is 681,888,418 shares.

Thus:

681,888,418 x £0.284 = £193,656,310.712

That is £193 Million.

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10096

4.9% yield

Charles Dickens Money Quote

“Annual income twenty pounds, annual expenditure nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pound ought and six, result misery.” – Charles Dickens

Bill Gates: Covid 19 on TED

Legal & General UCITS ETF Public Limited Company Robo Global Rob&Auto Go UCITS ETF

Negative Interest Rates: Mechanisms

FTSE100: The Covid 19 Effect

Britain’s Most Valuable Company: Astra Zeneca

Today, Astra Zeneca PLC is the most valuable company listed on the LondonStockExchange.

A world-leading pharmaceutical group, AstraZeneca was created in 1999 via the merger of Sweden’s Astra and the UK’s Zeneca, which had been demerged from chemicals group ICI in 1993.

Its low this year was £62.21 a share and is now at nearly £90 a share.

The Ascent of The Allianz Technology Trust PLC

Government Funding: National Savings and Investments.

HM Government has asked National Savings & Investments to “get more cash” into The Treasury.

HM Treasury has today confirmed that NS&I’s Net Financing target for 2020-21 has been revised from £6 billion (+/- £3 billion) to £35 billion (+/- £5 billion) to reflect government finance requirements arising from Covid-19.

NS&I’s Annual Report & Accounts 2019-20, published on 23 June 2020, stated that NS&I’s £6 billion Net Financing target announced in the March 2020 Budget would be subject to in-year revision. Today’s new target may be subject to further revision during the year, depending on the government finance requirement.

the jump is the £6bn to £35bn. HM Treasury looking at all avenues to raise revenue / income into the government to fund the massive budget deficit.

Dr Doom: Nouriel Roubini

HM Government Borrowing: June 2020

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In June 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure and deal with the economic damage from Covid19. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 16 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

25-Jun-2020 0 1/8% Index-linked Treasury Gilt 2029 3 months £1,229.5760

24-Jun-2020 1 5/8% Treasury Gilt 2054 £1,768.2500 Million

24-Jun-2020 2¾% Treasury Gilt 2024 £3,250.0000 Million

23-Jun-2020 0 1/8% Treasury Gilt 2026 £3,250.0000 Million

23-Jun-2020 0 3/8% Treasury Gilt 2030 £3,628.7500 Million

17-Jun-2020 0 1/8% Treasury Gilt 2023 £4,260.7490 Million

17-Jun-2020 1¼ % Treasury Gilt 2041 £2,812.5000 Million

16-Jun-2020 1½% Treasury Gilt 2026 £3,716.2500 Million

16-Jun-2020 4¾% Treasury Gilt 2030 £2,000.0000 Million

11-Jun-2020 0 1/8% Treasury Gilt 2028 £4,036.6240 Million

11-Jun-2020 1% Treasury Gilt 2024 £3,250.0000 Million

10-Jun-2020 0 1/8% Index-linked Treasury Gilt 2036 £900.0000 Million

03-Jun-2020 1 5/8% Treasury Gilt 2054 £1,500.0000 Million

03-Jun-2020 2¼% Treasury Gilt 2023 £3,941.2490 Million

02-Jun-2020 0 1/8% Treasury Gilt 2026 £3,328.7500 Million

02-Jun-2020 0 3/8% Treasury Gilt 2030 £3,749.9990 Million

When you add the cash raised:-

1,229.58 Million + 1,768.25 Million + 3,250.00 Million + 3,250.00 Million + 3,628.75 Million + 4,260.75 Million + 2,812.50 Million + 3,716.25 Million + 2,000.00 Million + 4,036.62 Million + 3,250.00 Million + 900.00 Million + 1,500.00 Million + 3,941.25 Million + 3,328.75 Million + 3,750.00 = £46,622.697 Million

£46,622.697 Million = £46.622 Billion

On another way of looking at it, is in the 30 days in June 2020, HM Government borrowed:- £1,554.0899 Million each day for the 30 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature from 2024 through to 2057. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

Ray Dalio on the Economy, Pandemic, China’s Rise

The Investment in Ramanujan: The Meaning of Ramanujan and His Lost Notebook

The Renewables Infrastructure Group.

On Tuesday 30th June, The Renewables Infrastructure Group paid its shareholders its June 2020 dividend.

1.69p a share

The total issued share capital with voting rights is 1,637,453,267.

https://www.londonstockexchange.com/news-article/TRIG/total-voting-rights/14485497

Thus:

1,637,453,267 x £0.0169 = 27,672,960.2123

That is £27.672million

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=11834937&action=

5.3% yield

HICL Infrastructure

On Tuesday 30th June, HICL Infrastructure paid to its shareholders its June 2020 dividend

£0.0207 a share.

he total issued share capital with voting rights is 1,863,642,769

https://otp.tools.investis.com/clients/uk/hicl/rns/regulatory-story.aspx?cid=1239&newsid=1362209

Thus:

1,863,642,769 x £0.0207 = 38,577,405.3183

That is £38.577 Million

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=185903&action=

4.7% yield

The Investment in 0.577

$7 Trillion Dollar Balance Sheet : The US Federal Reserve.

The US Central Bank is the US Federal Reserve https://www.federalreserve.gov/

Its balance sheet is huge:

https://www.federalreserve.gov/releases/h41/current/h41.htm

Total assets: $7,168,936 MILLION

That is $7.1 TRILLION Dollar$

There’s a great disconnect between fundamentals and finance

Investment in Innovation

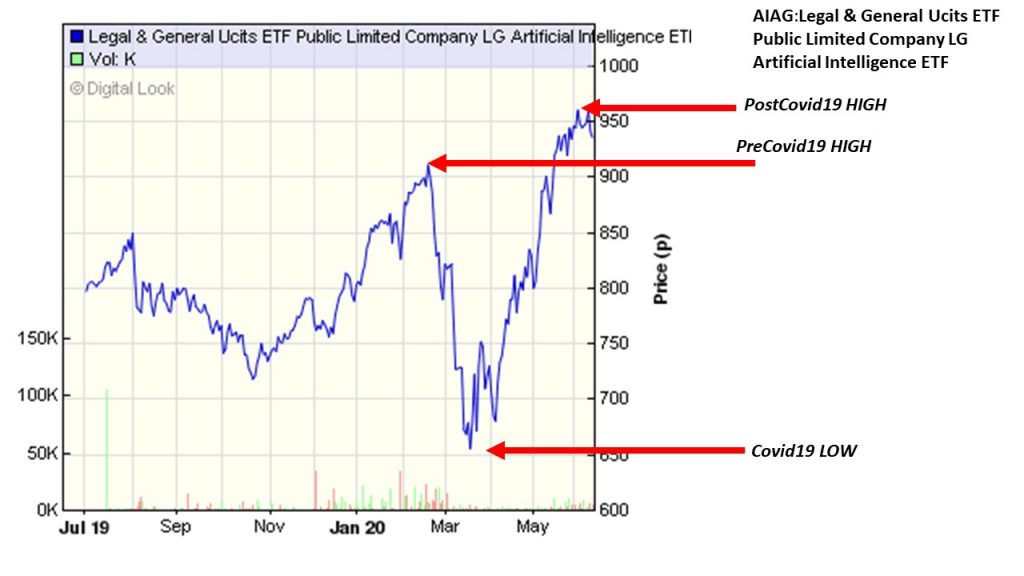

AIAG:Legal & General Ucits ETF Public Limited Company LG Artificial Intelligence ETF

The Legal & General Ucits ETF Public Limited Company LG Artificial Intelligence ETF invests in companies that are pioneering Artificial Intelligence.

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=54852988&action=

Its performance is remarkable.

The Shell June 2020 Dividend.

Royal Dutch Shell, paid out Mon 22nd June its reduced June quarterly dividend.

www.shell.com

RDSA Royal Dutch Shell A FTSE 100 $0.16 (12.68p) 22-Jun

RDSB Royal Dutch Shell B FTSE 100 $0.16 (12.68p) 22-Jun

https://www.londonstockexchange.com/news-article/RDSA/voting-rights-and-capital/14558429

Royal Dutch Shell plc’s capital as at 29 May 2020, consists of 4,101,239,499 A shares and 3,706,183,836 B shares, each with equal voting rights. Royal Dutch Shell plc holds no ordinary shares in Treasury. The total number of A shares and B shares in issue as at 29 May 2020 is 7,807,423,335

Thus

4,101,239,499 A shares x 12.68p = £520,037,168.4732

3,706,183,836 B shares x 12.68p = £469,944,110.4048

(£520,037,168.4732)+(£469,944,110.4048) = £989,981,278.878

That is £989million of cash

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=133655

Shell A 11% yield

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=133755

Shell B 11% yield.

L&G Battery Value-Chain Go Ucits ETF

The performance of the L&G ETF that invests in Lithium Ion technology is very dramatic.

HM Government May 2020 Borrowings

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In May 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure and deal with the economic damage from Covid19. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 14 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

28-May-2020 1¼% Treasury Gilt 2027 2,927.5000 Million

28-May-2020 1¾% Treasury Gilt 2049 2,357.7500 Million

27-May-2020 0 1/8% Treasury Gilt 2023 3,750.0000 Million

27-May-2020 1¾% Treasury Gilt 2057 1,785.4990 Million

21-May-2020 0 1/8% Index-linked Treasury Gilt 2028 3 months 1,562.4990 Million

21-May-2020 4¼% Treasury Stock 2032 2,500.0000 Million

20-May-2020 0¾% Treasury Gilt 2023 3,869.6240 Million

14-May-2020 0 5/8% Treasury Gilt 2025 3,250.0000 Million

14-May-2020 1¼ % Treasury Gilt 2041 2,250.0000 Million

13-May-2020 0 1/8% Index-linked Treasury Gilt 2048 3 months 745.8500 Million

06-May-2020 0 1/8% Treasury Gilt 2023 3,897.9580 Million

06-May-2020 1 5/8% Treasury Gilt 2054 1,750.0000 Million

05-May-2020 1 5/8% Treasury Gilt 2028 3,000.0000 Million

05-May-2020 2% Treasury Gilt 2025 4,062.4990 Million

When you add the cash raised:-

£2,927.5000 Million + £2,357.7500 Million + £3,750.0000 Million + £1,785.4990 Million + £1,562.4990 Million + £2,500.0000 Million + £3,869.6240 Million + £3,250.0000 Million + £2,250.0000 Million + £745.8500 Million + £3,897.9580 Million + £1,750.0000 Million + £3,000.0000 Million + £4,062.4990 Million

= £37709.18 Million = £37.70918 Billion

On another way of looking at it, is in the 31 days in May 2020, HM Government borrowed:- £1,216.425129 Million each day for the 31 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature from 2023 through to 2054. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

BP’s June 2020 Dividend.

Today, BP one of the world’s largest oil company, pays out its quarterly dividend.

$0.105 (8.3421p) a share

The total number of voting rights in BP p.l.c. is 20,265,294,069

https://www.londonstockexchange.com/news-article/BP./total-voting-rights/14559000

Thus:

20,265,294,069 x £0.083421 = £1,690,551,096.530049

That is £1.690 Billion

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10022&action=

9.4% yield.

The Investment in Spring 1 (Vivaldi)

The Gresham House Energy Storage Fund

On Friday 12th June, GRID [Gresham House Energy Storage Fund] paid out its June dividend.

1.75p a share

The total number of voting rights of the Company is 234,270,650

https://www.londonstockexchange.com/news-article/GRID/total-voting-rights/14483969

Thus:

234,270,650 x £0.0175 = 4,099,736.375

That is £4m of cash

4.1% yield

Why Buy An Index Fund ?……….

The Investment of RAT

The Art of Investment

Covid19

Unilever PLC June Dividend.

On Thursday 4th June, Unilever PLC paid out its June dividend.

36.14p a share.

https://otp.tools.investis.com/clients/uk/unilever/rns1/regulatory-story.aspx?cid=129&newsid=1259667

Unilever PLC’s issued share capital as at 30 April 2019 consisted of 1,168,530,650 ordinary shares of 3 1/9p each. Unilever PLC does not hold any ordinary shares of 3 1/9p each as treasury shares. Accordingly, there are 1,168,530,650 shares with voting rights.

Thus:

1,168,530,650 x £0.3614 = £422,306,976.91

That is £422 million

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10094&action=

4.8% yield.

Legal and General June 2020 Dividend

Tomorrow, the UK’s largest money manager pays out is full year dividend.

12.64p a share

https://www.londonstockexchange.com/exchange/news/market-news/market-news-detail/LGEN/14526159.html

The total number of voting rights in the Company is 5,965,563,767:-

Thus:-

5,965,563,767 x 12.64p = £754,047,260.1488

That is £754 million

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10055&action=

That is a 9.1% yield.

Sir John Templeton: Great Quote

The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” – Sir John Templeton

Investment in Deception: Dominic Cummings

Greencoat UK Wind: May 2020 Dividend

Today, Greencoat UK Wind pays out its May 2020 Dividend.

https://www.greencoat-ukwind.com/

The dividend is 1.775p a share:

https://www.londonstockexchange.com/exchange/news/market-news/market-news-detail/UKW/14525219.html

The total voting rights figure will be 1,518,162,889

Thus:-

1,518,162,889 x 1.775p = £26,947,391.27975

That is £26m.

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=7013076&action=

5.1% yield.

The Investment of Stevie Nicks

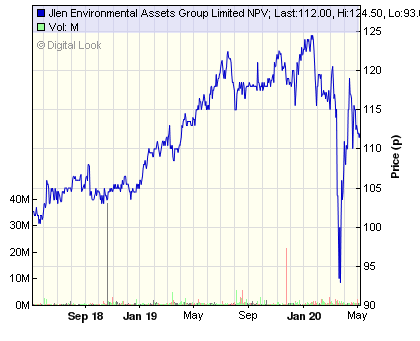

Jlen Environmental Assets Group Limited

You can see the 2 year trajectory of JLEN

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=28067217&action=

UK Gilt Auction: Negative Rates.

The UK Government, HM Treasury is borrowing money to fund its day to day operations as tax revenues (income) are lower than government expenditure. Now with the Covid19 pandemic, HM Government is tapping the bond market to borrow money by issuing Gilts.

The British Government sold a government bond with a negative yield for the first time.

On Wed 20th May 2020, the British Government borrowed £3,869.6240 Million (£3.869624 Billion).

The Yield at Auction Price was -0.003%

That means at the end of the 12 months, the Gilt owner would have had their oringial capital reduced by 0.003%.

It is a 3 year gilt.

Thus:-

£3,869.6240 Million on the 20th May 2020:

Capital reduced by 0.003% after year 1 = £3869.507911 Million

Capital reduced by 0.003% after year 2 = £3869.391826 Million

Capital reduced by 0.003% after year 3 = £3869.275744 Million

So after 3 years years the initial capital of £3,869.6240 Million becomes £3869.275744 Million.

A capital reduction of 0.348256 Million = £348,256.

In effect, negative yield effectively means investors have to pay to lend money to fund the government’s response to the Covid-19 pandemic. In searching for a safe haven for their money they bought gilts knowing they would get back less than they paid for them when the bonds mature in three years’ time, because it Trusts the UK Government

HSBC Shareprice: Covid19

http://www.shareshop.hsbc.co.uk/shareshop/security.cgi?csi=10048&action=

HSBC is one of the world’s largest banks. It has had a rollercoaster sharerprice:-

Berkshire Hathaway Annual General Meeting 2020

Ray Dalio goes into detail on debt

Bernie Madoff: CNBC American Greet

2008 Financial Crisis

Ten reasons why a ‘Greater Depression’ for the 2020s is inevitable:- Nouriel Roubini

Ominous and risky trends were around long before Covid-19, making an L-shaped depression very likely.

After the 2007-09 financial crisis, the imbalances and risks pervading the global economy were exacerbated by policy mistakes. So, rather than address the structural problems that the financial collapse and ensuing recession revealed, governments mostly kicked the can down the road, creating major downside risks that made another crisis inevitable. And now that it has arrived, the risks are growing even more acute. Unfortunately, even if the Greater Recession leads to a lacklustre U-shaped recovery this year, an L-shaped “Greater Depression” will follow later in this decade, owing to 10 ominous and risky trends.

The first trend concerns deficits and their corollary risks: debts and defaults. The policy response to the Covid-19 crisis entails a massive increase in fiscal deficits – on the order of 10% of GDP or more – at a time when public debt levels in many countries were already high, if not unsustainable.

Worse, the loss of income for many households and firms means that private-sector debt levels will become unsustainable, too, potentially leading to mass defaults and bankruptcies. Together with soaring levels of public debt, this all but ensures a more anaemic recovery than the one that followed the Great Recession a decade ago.

A second factor is the demographic timebomb in advanced economies. The Covid-19 crisis shows that much more public spending must be allocated to health systems, and that universal healthcare and other relevant public goods are necessities, not luxuries. Yet, because most developed countries have ageing societies, funding such outlays in the future will make the implicit debts from today’s unfunded healthcare and social security systems even larger.

A third issue is the growing risk of deflation. In addition to causing a deep recession, the crisis is also creating a massive slack in goods (unused machines and capacity) and labour markets (mass unemployment), as well as driving a price collapse in commodities such as oil and industrial metals. That makes debt deflation likely, increasing the risk of insolvency.

A fourth (related) factor will be currency debasement. As central banks try to fight deflation and head off the risk of surging interest rates (following from the massive debt build-up), monetary policies will become even more unconventional and far-reaching. In the short run, governments will need to run monetised fiscal deficits to avoid depression and deflation. Yet, over time, the permanent negative supply shocks from accelerated de-globalisation and renewed protectionism will make stagflation all but inevitable.

A fifth issue is the broader digital disruption of the economy. With millions of people losing their jobs or working and earning less, the income and wealth gaps of the 21st-century economy will widen further. To guard against future supply-chain shocks, companies in advanced economies will re-shore production from low-cost regions to higher-cost domestic markets. But rather than helping workers at home, this trend will accelerate the pace of automation, putting downward pressure on wages and further fanning the flames of populism, nationalism, and xenophobia.

This points to the sixth major factor: deglobalisation. The pandemic is accelerating trends toward balkanisation and fragmentation that were already well underway. The US and China will decouple faster, and most countries will respond by adopting still more protectionist policies to shield domestic firms and workers from global disruptions. The post-pandemic world will be marked by tighter restrictions on the movement of goods, services, capital, labour, technology, data, and information. This is already happening in the pharmaceutical, medical-equipment, and food sectors, where governments are imposing export restrictions and other protectionist measures in response to the crisis.

The backlash against democracy will reinforce this trend. Populist leaders often benefit from economic weakness, mass unemployment, and rising inequality. Under conditions of heightened economic insecurity, there will be a strong impulse to scapegoat foreigners for the crisis. Blue-collar workers and broad cohorts of the middle class will become more susceptible to populist rhetoric, particularly proposals to restrict migration and trade.

This points to an eighth factor: the geostrategic standoff between the US and China. With the Trump administration making every effort to blame China for the pandemic, Chinese President Xi Jinping’s regime will double down on its claim that the US is conspiring to prevent China’s peaceful rise. The Sino-American decoupling in trade, technology, investment, data, and monetary arrangements will intensify.

Worse, this diplomatic breakup will set the stage for a new cold war between the US and its rivals – not just China, but also Russia, Iran, and North Korea. With a US presidential election approaching, there is every reason to expect an upsurge in clandestine cyber warfare, potentially leading even to conventional military clashes. And because technology is the key weapon in the fight for control of the industries of the future and in combating pandemics, the US private tech sector will become increasingly integrated into the national-security-industrial complex.

Internet Investment: Vint Cerf-Our Internet is working. Thank these Cold War-era pioneers who designed it to handle almost anything.

Coronavirus may have forced people to stay at home, but the Internet these scientists envisioned long ago is keeping the world connected

Coronavirus knocked down — at least for a time — Internet pioneer Vinton Cerf, who offers this reflection on the experience: “I don’t recommend it … It’s very debilitating.”

Cerf, 76 and now recovering in his Northern Virginia home, has better news to report about the computer network he and others spent much of their lives creating. Despite some problems, the Internet overall is handling unprecedented surges of demand as it keeps a fractured world connected at a time of global catastrophe.

“This basic architecture is 50 years old, and everyone is online,” Cerf noted in a video interview over Google Hangouts, with a mix of triumph and wonder in his voice. “And the thing is not collapsing.”

The Internet, born as a Pentagon project during the chillier years of the Cold War, has taken such a central role in 21st Century civilian society, culture and business that few pause any longer to appreciate its wonders — except perhaps, as in the past few weeks, when it becomes even more central to our lives.

Many facets of human life — work, school, banking, shopping, flirting, live music, government services, chats with friends, calls to aging parents — have moved online in this era of social distancing, all without breaking the network. It has groaned here and there, as anyone who has struggled through a glitchy video conference knows, but it has not failed.

“Resiliency and redundancy are very much a part of the Internet design,” explained Cerf, whose passion for touting the wonders of computer networking prompted Google in 2005 to name him its “Chief Internet Evangelist,” a title he still holds.

Sign up for our Coronavirus Updates newsletter to track the outbreak. All stories linked in the newsletter are free to access.

Comcast, the nation’s largest source of residential Internet, serving more than 26 million homes, reports peak traffic was up by nearly one third in March, with some areas reaching as high as 60 percent above normal. Demand for online voice, video and VPN connections — all staples of remote work — have surged, and peak usage hours have shifted from evenings, when people typically stream video for entertainment, to daytime work hours.

Concerns about shifting demands prompted European officials to request downgrades in video streaming quality from major services such as Netflix and YouTube, and there have been localized Internet outages and other problems, including the breakage of a key transmission cable running down the West coast of Africa — an incident with no connection to the coronavirus pandemic. Heavier use of home WiFi also has revealed frustrating limits to those networks.

But so far Internet industry officials report they’ve managed the shifting loads and surges. To a substantial extent, the network has managed them automatically because its underlying protocols adapt to shifting conditions, working around trouble spots to find more efficient routes for data transmissions and managing glitches in a way that doesn’t break connections entirely.

Net of Insecurity Part 2: The long life of a quick fix

Some credit goes to Comcast, Google and the other giant, well-resourced corporations essential to the Internet’s operation today. But perhaps even more goes to the seminal engineers and scientists like Cerf, who for decades worked to create a particular kind of global network — open, efficient, resilient and highly interoperable so anyone could join and nobody needed to be in charge.

“They’re deservedly taking a bit of a moment for a high five right now,” said Jason Livingood, a Comcast vice president who has briefed some members of the Internet’s founding generation about how the company has been handling increased demands.

Cerf, along with fellow computer scientist Robert E. Kahn, was a driving force in developing key Internet protocols in the 1970s for the Pentagon’s Defense Advanced Research Projects Agency, which provided early research funding but ultimately relinquished control of the network it spawned. Cerf also was among a gang of self-described “Netheads” who led an insurgency against the dominant forces in telecommunications at the time, dubbed the “Bellheads” for their loyalty to the Bell Telephone Company and its legacy technologies.

Bell, which dominated U.S. telephone service until it was broken up in the 1980s, and similar monopolies in other countries wanted to connect computers through a system much like their lucrative telephone systems, with fixed networks of connections run by central entities that could make all of the major technological decisions, control access and charge whatever the market — or government regulators — would allow.

The vision of the Netheads was comparatively anarchic, relying on technological insights and a lot of faith in collaboration. The result was a network — or really, a network of networks — with no chief executive, no police, no taxman and no laws.

In their place were technical protocols, arrived at through a process for developing expert consensus, that offered anyone access to the digital world from any properly configured device. Their numbers, once measured in the dozens, now rank in the tens of billions, including phones, televisions, cars, dams, drones, satellites, thermometers, garbage cans, refrigerators, watches and so much more.

This Netheads’ idea of a globe-spanning network that no single company or government controlled goes a long way toward explaining why an Indonesian shopkeeper with a phone made in China can log on to an American social network to chat — face to face and almost instantaneously — with her friend in Nigeria. That capability still exists, even as much of the world has banned or restricted international travel.

“You’re seeing a success story right now,” said David D. Clark, a Massachusetts Institute of Technology computer scientist who worked on early Internet protocols, speaking by the videoconferencing service Zoom. “If we didn’t have the Internet, we’d be in an incredibly different place right now. What if this had happened in the 1980s?”

Such a system carries a notable cost in terms of security and privacy, a fact the world rediscovers every time there’s a major data breach, ransomware attack or controversy over the amount of information governments and private companies collect about anyone who’s online — a category that includes more than half of the world’s almost 8 billion people.

Thousands of Zoom video calls left exposed on open Web

But the lack of a central authority is key to why the Internet works as well as it does, especially at times of unforeseen demands.

Some of the early Internet architects — Cerf among them, from his position at the Pentagon — were determined to design a system that could continue operating through almost anything, including a nuclear attack from the Soviets.

That’s one reason the system doesn’t have any preferred path from Point A to Point B. It continuously calculates and recalculates the best route, and if something in the middle fails, the computers that calculate transmission paths find new routes — without having to ask anyone’s permission to do so.

Steve Crocker, a networking pioneer like Cerf, compared this quality to that of a sponge, an organism whose functions are so widely distributed that breaking one part does not typically cause the entire organism to die.

“You can do damage to a portion of it, and the rest of it just lumbers forward,” Crocker said, also speaking by Zoom.

Even more elementally, the Netheads believed in an innovation called “packet-switching,” which broke from the telephone company’s traditional model, called “circuit switching,” that dedicated a line to a single conversation and left it open until the participants hung up.

The Netheads considered that terribly wasteful given that any conversation includes pauses or gaps that could be used to transmit data. Instead, they embraced a model in which all communications were broken into chunks, called packets, that continuously shuttled back and forth over shared lines, without pauses.

The computers at either end of these connections reassembled the packets into whatever they started as — emails, photos, articles or video — but the network itself didn’t know or care what it was carrying. It just moved the packets around and let the recipient devices figure out what to do.

That simplicity, almost an intentional brainlessness at the Internet’s most fundamental level, is a key to its adaptability. As many others have said, it’s a web of highways everyone can use for almost any purpose they desire.

Many of the Internet’s founding generation have memories of trying to convince various Bellheads packet-switching was the inevitable future of telecommunications — cheaper, faster, easier to scale and vastly more efficient and adaptable.

Those anecdotes all end the same way, with the telephone company titans of the day essentially treating the Netheads as precocious but fundamentally misguided children who, some day, might understand how telecommunications technology really worked. Several acknowledged they celebrated just a bit when the telephone companies gradually abandoned old-fashioned circuit-switching for what was called “Voice Over IP” or VoIP. It was essentially transmitting voice calls over the Internet — using the same technical protocols that Cerf and others had developed decades earlier.

Leonard Kleinrock, one of three scientists credited with inventing the concept of packet switching in the 1960s, also was present for the first transmission on the rudimentary network that would, years later, become the Internet.

That was Oct. 29, 1969, and Kleinrock was a computer scientist at the University of California at Los Angeles. A student programmer tried to send the message “login” to a computer more than 300 miles away, at the Stanford Research Institute, but got only as far as the first two letters — “L” and “O” — before the connection crashed.

Retelling the story by phone, over a line using the Internet’s packet-switching technology instead of the one long preferred by the “Bellheads,” he recalled his own experience in trying to convince some phone company executives that he had discovered a technology that would change the world.

“They said, ‘Little boy, go away,’” Kleinrock said. “So we went away.”

And now Kleinrock, 85 and staying home to minimize the risk of catching the coronavirus, is enjoying that his home Internet connection is 2,000 times faster than the phone-booth sized communications device that Internet pioneers used in 1969.

“The network,” he said, “has been able to adapt in a beautiful way.”

The Flu Pandemic @1918

HM Government Borrowing, April 2020

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Now we are in a Covid 19 world. UK’s HM Government needs to fund many new demands.

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In March 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 17 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

29-Apr-2020 1¾% Treasury Gilt 2049 £2,152.5000 Million

29-Apr-2020 2¾% Treasury Gilt 2024 £3,616.3750 Million

28-Apr-2020 0 1/8% Index-linked Treasury Gilt 2028 3 months £1,499.9990 Million

28-Apr-2020 0 7/8% Treasury Gilt 2029 £3,749.9990 Million

22-Apr-2020 1% Treasury Gilt 2024 £3,671.4760 Million

22-Apr-2020 1¼% Treasury Gilt 2027 £3,141.0000 Million

21-Apr-2020 0 5/8% Treasury Gilt 2025 £4,062.4990 Million

21-Apr-2020 1 5/8% Treasury Gilt 2054 £1,874.9990 Million

16-Apr-2020 1½% Treasury Gilt 2026 £3,648.7500 Million

16-Apr-2020 1¾% Treasury Gilt 2049 £2,499.9980 Million

15-Apr-2020 0 7/8% Treasury Gilt 2029 £3,676.2490 Million

15-Apr-2020 1¾% Treasury Gilt 2037 £2,313.7490 Million

08-Apr-2020 2% Treasury Gilt 2025 £2,750.0000 Million

08-Apr-2020 4¾% Treasury Gilt 2030 £2,092.5000 Million

07-Apr-2020 0 1/8% Treasury Gilt 2023 £4,062.5000 Million

07-Apr-2020 1¾% Treasury Gilt 2057 £1,562.4990 Million

02-Apr-2020 1¼ % Treasury Gilt 2041 £2,299.9970 Million

When you add the cash raised:-

£2,152.50 Million

£3,616.38 Million

£1,500.00 Million

£3,750.00 Million

£3,671.48 Million

£3,141.00 Million

£4,062.50 Million

£1,875.00 Million

£3,648.75 Million

£2,500.00 Million

£3,676.25 Million

£2,313.75 Million

£2,750.00 Million

£2,092.50 Million

£4,062.50 Million

£1,562.50 Million

£2,300.00 Million

Total: £48,675.09 Million = £48.67509 Billion

On another way of looking at it, is in the 30 days in April 2020, HM Government borrowed:- £1622.502967 Million each day for the 30 days.

That is £1.622 Billion A DAY.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature 2024-2057. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

The Words of Ray Dalio: Clarity

Words of Investment on Covid 19

Do not obsess about the loss in value of your investments. Do not pontificate that you saw it coming. There is the important difference between wealth and income; stock and flow. The wealth you accumulated over a lifetime in investments has eroded in value as the markets have crashed. But what matters currently is the income, the flow. Do you have a job that offers salary even during the shutdown? Are you confident you will keep the job through and after this period? You are fortunate. Evaluate the reality of the situation………

Bill Gates: Pandemic

CNBC’s full interview with Berkshire Hathaway CEO Warren Buffett [Feb 2020]

HM Government Borrowing, March 2020

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties.

Another deficit month, thus to bridge the gap, needs to borrow on the bond market In March 2020 , the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is The PSNCR: The Public Sector Net Cash Requirement. There were “only” 4 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

19-Mar-2020 0 5/8% Treasury Gilt 2025 £3,250.0000 Million

17-Mar-2020 1¾% Treasury Gilt 2049 £2,299.9990 Million

10-Mar-2020 4¾% Treasury Gilt 2030 £2,587.4880 Million

05-Mar-2020 0 1/8% Index-linked Treasury Gilt 2028 3 months £1,244.2380 Million

04-Mar-2020 0 5/8% Treasury Gilt 2025 £3,500.0000 Million

When you add the cash raised:-

£3,250.0000 Million + £2,299.9990 Million+ £2,587.4880 Million + £1,244.2380 Million + £3,500.0000 Million = £12,764.406 Million

£12,881.725 Million = £12.881725 Billion

On another way of looking at it, is in the 31 days in March 2020, HM Government borrowed:- £415.5395161290323 Million each day for the 31 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bond mature 2025, 2028, 2030 and 2049. All long term borrowings, we are mortgaging our futures, but at least “We Are In It Together….”

What coronavirus means for the global economy | Ray Dalio

Newsnight: Emily is superb

“The disease is not a great leveller, the consequences of which everyone – rich or poor – suffers the same,” the 49-year-old said.

“This is a myth which needs debunking. Those on the front line right now – bus drivers and shelf stackers, nurses, care home workers, hospital staff and shop keepers – are disproportionately the lowest paid members of our workforce. They are more likely to catch the disease because they are more exposed.”

And she added: “Those who live in tower blocks and small flats will find the lockdown a lot tougher. Those who work in manual jobs will be unable to work from home.

Covid 19: The University of Liverpool: Funding for Research

Hello.

The University of Liverpool has a world famous School of Tropical Medicine.

https://www.liverpool.ac.uk/coronavirus/support-us/

They are asking for money to help research into Covid 19 (see the link at the bottom)

It was my first University, and I have made a donation to Liverpool’s world leading research.

If you can help, it would be wonderful.

Thanks

Asad

We are all the same

The WorldCON Fraud.

https://www.youtube.com/watch?v=juebYwvU91o

https://www.youtube.com/watch?v=juebYwvU91o

The episode from American Greed on CNBC.

Copper Destroys Viruses and Bacteria. Why Isn’t It Everywhere?

It could destroy norovirus, MRSA, virulent strains of E. coli, and coronaviruses—including the novel strain currently causing the COVID-19 pandemic.

In 1852, physician Victor Burq visited a copper smelter in Paris’s 3rd arrondissement, where they used heat and chemicals to extract the reddish-brown metal. It was a dirty and dangerous job. Burq found the facility to be “in poor condition,” along with the housing and the hygiene of the smelters. Normally, their mortality rates were “pitiful,” he observed.