Courtesy of Bloomberg

Legal & General MSCI World Socially Responsible Investment (SRI) Index Fund

The US Stock Market: Thursday 3rd April 2025

Tribute to Val Kilmer

Investment in Ramanujan: Pi

The Alliance Witan Investment Trust plc

Alliance Witan aims to be a core equity holding for investors that delivers a real return over the long term through a combination of capital growth and a rising dividend. The Company invests primarily in global equities across a wide range of industries and sectors to achieve its objective. Formed from the merger of Witan and Alliance

https://www.alliancewitan.com/investor-information

Total Assets: £5,670.0m

Shares in Issue: 400,191,982

The top 20 Holdings

Microsoft £190.1m 3.4% of the fund

Amazon £189.9m 3.3% of the fund

Visa £161.4m 2.8% of the fund

Meta Platforms £109.3m 1.9% of the fund

Alphabet £87.7m 1.5% of the fund

Diageo £87.0m 1.5% of the fund

Aon £85.2m 1.5% of the fund

Netflix £82.5m 1.5% of the fund

Eli Lilly £76.9m 1.4% of the fund

UnitedHealth Group £75.4m 1.3% of the fund

Mastercard £67.0m 1.2% of the fund

Taiwan Semiconductor £63.6m 1.1% of the fund

Safran £62.9m 1.1% of the fund

Philip Morris Intl £61.1m 1.1% of the fund

Petrobras £57.8m 1.0% of the fund

NVIDIA £57.7m 1.0% of the fund

HDFC Bank £57.1m 1.0% of the fund

Unilever £55.4m 1.0% of the fund

Mercadolibre £52.5m 0.9% of the fund

Airbus £50.3m 0.9% of the fund

Top 10 holdings 20.1%

Top 20 holdings 30.4%

It today pays 6.73p a share for its March 2025 dividend

Thus:-

400,191,982 x £0.0673 = £26,932,920.3886

That is £26 million paid to shareholders

https://www.londonstockexchange.com/stock/ALW/alliance-witan-plc/company-page

Unilever March 2025 Dividend

Yesterday, Unilever pays out its March 2025 dividend

37.75p a share

https://www.londonstockexchange.com/news-article/ULVR/total-voting-rights/16923130

there were 2,475,206,898 shares with voting rights.

thus:-

2,475,206,898 x £0.3775 = £934,390,603.995

that is £934 million paid to shareholders in Unilever

https://www.londonstockexchange.com/stock/ULVR/unilever-plc/company-page

Courtesy of The London Stock Exchange

BP March 2025 Dividend

Tomorrow, the UK Energy Oil Major pays out its March 2025 dividend

$0.08 = 6.1761p a share

https://www.londonstockexchange.com/news-article/BP./total-voting-rights/16881802

The total number of voting rights in BP p.l.c. is 16,055,772,413

thus:-

16,055,772,413 x £0.061761 = £991,620,559.999293

that is £991 million paid to shareholders in BP

https://www.londonstockexchange.com/stock/BP./bp-plc/company-page

Courtesy of The London Stock Exchange

The late Paul Volcker Discusses Banking Culture

Shell PLC March 2025 Dividend

Tomorrow, the oil major Shell PLC pays out its quarterly dividend.

$0.358 a share = 27.79p

https://www.londonstockexchange.com/news-article/SHEL/voting-rights-and-capital/16920792

Shell plc’s capital as at February 28, 2025, consists of 6,047,482,616 ordinary shares of €0.07 each.

Thus:-

6,047,482,616 x £0.2779 = £1,680,595,418.9864

£1,680 Million = £1.680 Billion paid to shareholders

https://www.londonstockexchange.com/stock/SHEL/shell-plc/company-page

Premier Miton Global Renewables Trust

Courtesy of The London Stock Exchange

Premier Miton Global Renewables Trust PLC announces that at close of business on 28 February 2025 its investments were as follows:

| Company | % of total net assets |

| Greencoat UK Wind | 7.0% |

| Clearway Energy A Class | 6.5% |

| SSE | 6.0% |

| Northland Power | 5.5% |

| Octopus Renewables Infrastructure Trust | 5.3% |

| Drax Group | 5.1% |

| Bonheur | 5.1% |

| Grenergy Renovables | 5.0% |

| RWE | 4.9% |

| NextEnergy Solar Fund | 4.4% |

| National Grid | 3.9% |

| Gore Street Energy Storage Fund | 3.9% |

| Foresight Solar Fund | 3.7% |

| Cadeler | 3.6% |

| AES | 2.6% |

| SDCL Energy Efficiency Income Trust | 2.4% |

| Enefit Green | 2.3% |

| Aquila European Renewables Income Fund | 2.2% |

| Harmony Energy Income Trust | 2.0% |

| GCP Infrastructure Investments | 1.9% |

| Greencoat Renewable | 1.8% |

| Fastned | 1.7% |

| Corporacion Acciona Energias Renovables | 1.7% |

| Polaris Renewable Energy | 1.4% |

| Orsted | 1.2% |

| MPC Energy Solutions | 0.9% |

| 7C Solarparken | 0.9% |

| VH Global Sustainable Energy Opportunities | 0.8% |

| Serena Energia | 0.8% |

| Scatec Solar | 0.6% |

| Boralex | 0.5% |

| US Solar Fund | 0.4% |

| Westbridge Renewable Energy | 0.3% |

| Cloudberry Clean Energy | 0.2% |

| Cash/Net Current Assets | 3.4% |

At close of business on 28 February 2025 the total net assets of Premier Miton Global Renewables Trust PLC amounted to £35.6 million. The sector breakdown and geographical allocation were as follows:

| Sector Breakdown | % of total net assets |

| Yieldcos & investment companies | 32.2% |

| Renewable energy developers | 31.4% |

| Renewable focused utilities | 8.6% |

| Energy storage | 5.9% |

| Biomass generation and production | 5.1% |

| Electricity networks | 3.9% |

| Renewable technology and service | 3.6% |

| Renewable financing and energy efficiency | 4.2% |

| Renewable Fuels and Charging | 1.7% |

| Cash/Net Current Assets | 3.4% |

| Geographical Allocation | % of total net assets |

| United Kingdom | 30.1% |

| Europe (ex UK) | 29.8% |

| Global | 23.8% |

| North America | 9.8% |

| Latin America | 3.1% |

| Cash/Net Current Assets | 3.4% |

| 100% |

2025 outlook: US exceptionalism, political risk and non-consensus views

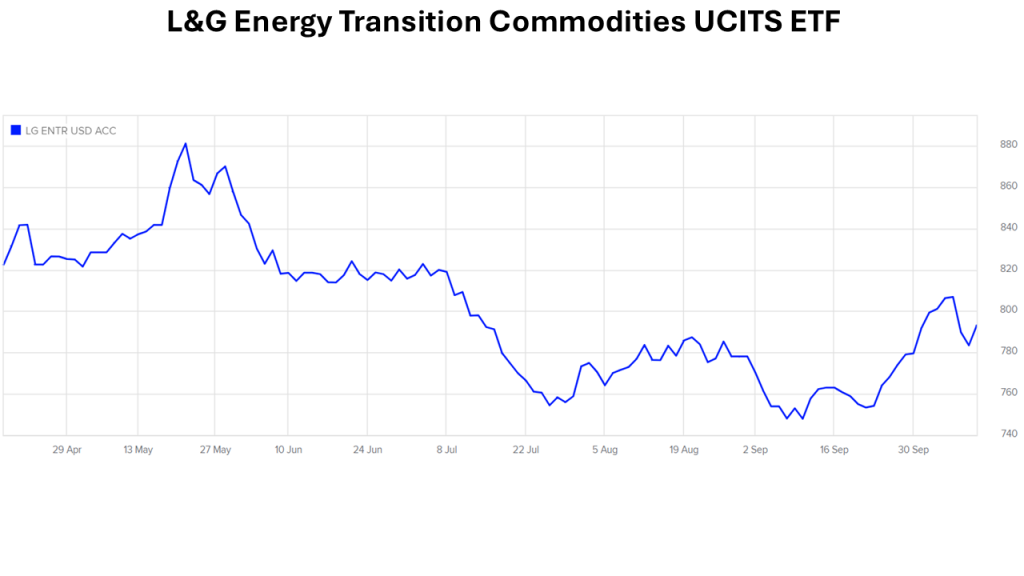

L&G Energy Transition Commodities UCITS ETF

L&G Energy Transition Commodities UCITS ETF

The L&G Energy Transition Commodities UCITS ETF The L&G Energy Transition Commodities UCITS ETF aims to track the performance of the Solactive Energy Transition Commodity TR Index

This ETF is designed for investors: (1) looking to grow their money in an investment

which can form part of their existing savings portfolio; and (2) familiar with commodity

futures contracts and the particular features of the Index, including spot, roll and collateral

return.

https://www.londonstockexchange.com/stock/ETRA/legal-and-general-asset-management/company-page

Courtesy of The London Stock Exchange

Courtesy of Legal and General Investment Management

L&G Global Equity Fixed Weights (50:50) Index Pension Fund

The L&G Global Equity Fixed Weights (50:50) Index Pension Fund is an investment fund with £3,184.0m assets under management.

The investment objective of the fund is to provide diversified exposure to UK and overseas equity markets. The fund will invest 50% in the UK and 50% overseas. The fund’s overseas asset distribution is

fixed with 17.5% in North America, 17.5% in Europe (ex UK), 8.75% in Japan and 6.25% in Asia Pacific (ex Japan).

Top Holdings:-

ASTRAZENECA 3.6% of the fund

SHELL 3.2% of the fund

HSBC HOLDINGS 2.6% of the fund

UNILEVER 2.5% of the fund

RELX GROUP 1.4% of the fund

BP 1.3% of the fund

GSK 1.3% of the f% of the fund

RIO TINTO 1.2% of the fund

DIAGEO 1.2% of the fund

APPLE 1.2% of the fund

Total 19.5% of the fund

BAE Systems PLC

BAE Systems, provide some of the world’s most advanced, technology-led defence, aerospace and security solutions. They employ a skilled workforce of around 107,000 people in more than 40 countries. Working with customers and local partners, they develop, engineer, manufacture, and support products and systems to deliver military capability, protect national security and people, and keep critical information and infrastructure secure

Courtesy of The London Stock Exchange

The Legal & General Cash Trust

The Legal & General Cash Trust is a fund investing in near cash securities.

This fund is designed for investors looking to preserve their money from an investment in deposits and short term instruments.

Top Ten Holdings:-

KBC Bank 4.7% of the fund

DZ Bank 4.7% of the fund

Nationwide Building Society 4.7% of the fund

Mizuho Bank 4.4% of the fund

Rabobank 4.4% of the fund

Credit Agricole 4.0% of the fund

Goldman Sachs 4.0% of the fund

Sumitomo Mitsui Trust Bank 3.9% of the fund

National Bank of Canada 3.9% of the fund

BNP Paribas 3.7% of the fund

Fund size £3,208.9m

Distribution yield 4.6%

Courtesy of Legal & General Investment Management

Investment: Got A Hold On Me

5 Years of Rolls Royce PLC

HM Government Borrowing: Feb 2025

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties. Now we are in a post Covid 19 world. UK’s HM Government needs to fund many new demands. https://www.dmo.gov.uk

Another deficit month, thus to bridge the gap, needs to borrow on the bond market in February 2025, the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is the PSNCR: The Public Sector Net Cash Requirement. There were “only” 10 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

27-Feb-2025 4 3/8% Treasury Gilt 2040 £3,092.07 Million

25-Feb-2025 1 1/8% Index-linked Treasury Gilt 2035 £1,914.91 Million

19-Feb-2025 4 3/8% Treasury Gilt 2028 4,250.00 £4,259.70 Million

18-Feb-2025 4% Treasury Gilt 2063 £1,726.72 Million

12-Feb-2025 0 5/8% Index-linked Treasury Gilt 2045 £874.09 Million

05-Feb-2025 1½% Green Gilt 2053 £947.37 Million

04-Feb-2025 4 3/8% Treasury Gilt 2030 £5,335.55 Million

£3,092.07 Million + £1,914.91 Million + £4,259.70 Million + £1,726.72 Million + £874.09 Million + £947.37 Million + £5,335.55 Million = £18,150.41 Million

£18,150.41 Million = £18.15041 Billion

On another way of looking at it, is in the 28 days Feb 2025, HM Government borrowed:- £648.2289286 Million each day for the 28 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bonds maturing from 2028 to 2063. All long-term borrowings, we are mortgaging our futures, but at least “We Are In It Together……“

Investors: The NATO defence opportunity

Holdings:-

| RHEINMETALL AG COMMON |

| BAE SYSTEMS PLC |

| SAFRAN SA COMMON STOCK |

| THALES SA COMMON STOCK |

| PALANTIR TECHNOLOGIES INC |

| FORTINET INC COMMON STOCK |

| RTX CORP |

| CISCO SYSTEMS INC COMMON |

| CROWDSTRIKE HOLDINGS INC |

| PALO ALTO NETWORKS INC |

| GENERAL DYNAMICS CORP |

| NORTHROP GRUMMAN CORP |

| L3HARRIS TECHNOLOGIES INC |

| CHECK POINT SOFTWARE |

| CYBERARK SOFTWARE LTD |

| LEONARDO SPA COMMON STOCK |

| HANWHA AEROSPACE CO LTD |

| ZSCALER INC COMMON STOCK |

| SAAB AB COMMON STOCK SEK |

| LEIDOS HOLDINGS INC |

| KONGSBERG GRUPPEN ASA |

| OKTA INC COMMON STOCK USD |

| BOOZ ALLEN HAMILTON |

| CAE INC COMMON STOCK CAD |

| TEXTRON INC COMMON STOCK |

| DASSAULT AVIATION SA |

| ELBIT SYSTEMS LTD COMMON |

| CURTISS-WRIGHT CORP |

| BABCOCK INTERNATIONAL |

| AKAMAI TECHNOLOGIES INC |

| CASH |

| CHEMRING GROUP PLC COMMON |

| QINETIQ GROUP PLC COMMON |

| BWX TECHNOLOGIES INC |

| SOFTCAT PLC COMMON STOCK |

| KYNDRYL HOLDINGS INC |

| CACI INTERNATIONAL INC |

| ROCKET LAB USA INC COMMON |

| HUNTINGTON INGALLS |

| KBR INC COMMON STOCK USD |

| HENSOLDT AG COMMON STOCK |

| PARSONS CORP COMMON STOCK |

| RENK GROUP AG COMMON |

| SENTINELONE INC COMMON |

| SCIENCE APPLICATIONS |

| MOOG INC-CLASS A |

| QUALYS INC COMMON STOCK |

| VARONIS SYSTEMS INC |

| TENABLE HOLDINGS INC |

| AEROVIRONMENT INC COMMON |

| LIG NEX1 CO LTD COMMON |

| KRATOS DEFENSE & SECURITY |

| HANWHA SYSTEMS CO LTD |

| BLACKBERRY LTD COMMON |

| KOREA AEROSPACE |

| AMENTUM HOLDINGS INC |

| ASELSAN ELEKTRONIK SANAYI |

| MERCURY SYSTEMS INC |

| DUCOMMUN INC COMMON STOCK |

| LEONARDO DRS INC COMMON |

| RAPID7 INC COMMON STOCK |

Investment in AI

HSBC: 12month share performance

Fine Art Investment

L&G Cyber Security Innovation UCITS ETF

The L&G Cyber Security Innovation UCITS ETF aims to provide exposure to companies engaged in the cyber security industry.

Fund size $15.8m

Top 10 constituents (%)

IonQ 12.4% of the fund

Fortinet 3.7% of the fund

Broadcom 3.5% of the fund

CrowdStrike 3.4% of the fund

eMemory Technology 3.3% of the fund

Cloudflare 3.2% of the fund

A10 Networks 3.2% of the fund

CyberArk 2.9% of the fund

Arista Networks 2.9% of the fund

F7 2.9% of the fund

Top 10 constituents 41.6% of the fund

Rest of Index 58.4% of the fund

Number of constituents in Index 36

Courtesy of Legal and General Investment Management

A Conversation with the late John C. Bogle

John Bogle, founder of the Vanguard Group

Investment in U2 & One

Courtesy of U2 – One – Live Symphony Orchestra & Choir

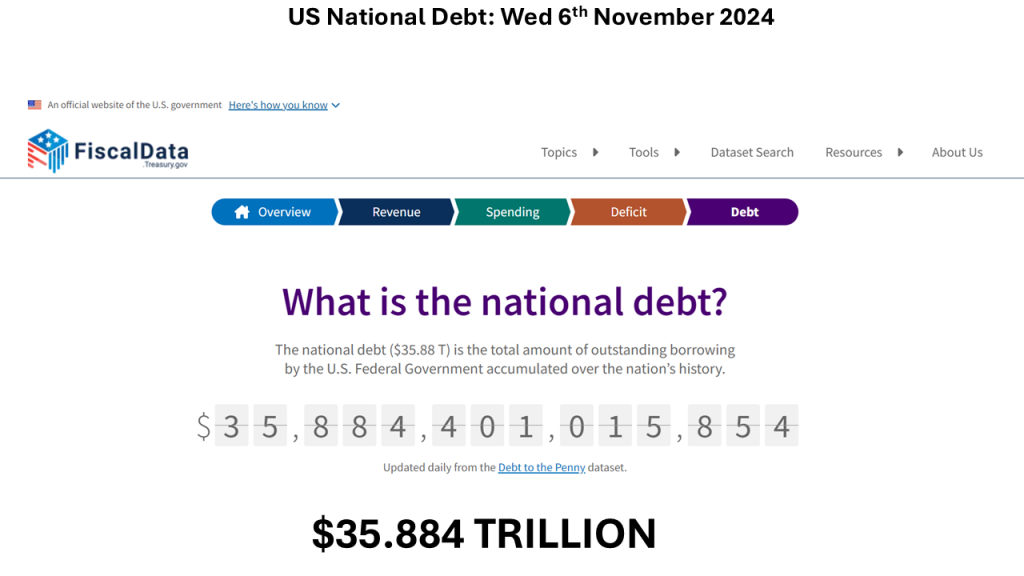

U.S. national debt hits new record, topping $35 trillion

Share Price Pressure at Infrastructure Asset Companies

JPMorgan Global Growth & Income PLC

The JPMorgan Global Growth & Income PLC is a London listed investment trust

The Company aims to provide superior total returns and outperform the MSCI All Country World Index over the long-term by investing in companies

based around the world.

Assets of £3044.2m

Top 10 Sector % of assets

Microsoft Technology Software 6.7% of the fund

Amazon.Com Media 6.7% of the fund

Nvidia Technology – Semi & Hardware 5.1% of the fund

Meta Platforms Media 3.7% of the fund

LVMH Retail 3.5% of the fund

TSMC Technology – Semi & Hardware 3.1% of the fund

Mastercard Financial Services 2.5% of the fund

UnitedHealth Health Services & Systems 2.2% of the fund

Exxon Mobil Energy 2.1% of the fund

Otis Worldwide Industrial Cyclicals 2.1% of the fund

https://www.londonstockexchange.com/stock/JGGI/jpmorgan-global-growth-income-plc/company-page

Investment in the late Ray Bradbury

Henderson International Income Trust.

The Henderson International Income Trust is a London listed investment trust.

Total assets £395.39M

Share price of 168.00p

Estimated Net Asset Vale 189.01p

Discount / Premium of -11.12%

Yield 4.43%

Top 10 holdings (%)

Microsoft 4.7% of the trust

Home Depot 3.0% of the trust

Taiwan Semiconductor Manufacturing 2.9% of the trust

Sony Group 2.9% of the trust

CME Group 2.7% of the trust

nVent Electric 2.7% of the trust

Coca-Cola 2.6% of the trust

Nordea Bank 2.5% of the trust

Honeywell International 2.3% of the trust

American Tower 2.2% of the trust

https://www.londonstockexchange.com/stock/HINT/henderson-international-income-trust-plc/company-page

Vodafone Feb 2025 Dividend

Today, the UK’s 2nd telecoms group pays out its Feb dividend

€0.0225 per share = £0.0188606 per share

https://www.londonstockexchange.com/news-article/VOD/total-voting-rights/16880377

the total number of voting rights in Vodafone is 25,392,110,945

thus:-

25,392,110,945 x £0.0188606 = £478,910,447.689267

That is £478 million, paid to shareholders

https://www.londonstockexchange.com/stock/VOD/vodafone-group-plc/analysis

British Telecommunications PLC: Feb 2025 Dividend

Today, the UK’s premier Telecommunications giant, British Telecommunications PLC, paid out its Feb 2025 dividend.

2.4p a share

https://www.londonstockexchange.com/news-article/BT.A/total-voting-rights/16879823

The total number of voting rights in BT Group plc on that date of 31st Jan 2025 was 9,956,837,263

Thus:-

9,956,837,263 x £0.024 = £238,964,094.312

That is £238.9 Million paid to shareholders.

https://www.londonstockexchange.com/stock/BT.A/bt-group-plc/company-page

Courtesy of The London Stock Exchange

Foreign & Colonial Investment Trust: Feb 2025 Dividend.

Today, the Foreign & Colonial Investment Trust, paid out its Feb 2025 dividend.

3.6p a share.

https://www.londonstockexchange.com/news-article/FCIT/total-voting-rights/16833558

The total number of voting rights that can be exercised in the Company is, 482,532,548

Thus:-

482,532,548 x £0.036 = £17,371,171.728

That is £17.3 Million paid to shareholders.

https://www.londonstockexchange.com/stock/FCIT/f-c-investment-trust-plc/company-page

Courtesy of The London Stock Exchange

What’s going on in government bonds? Market Talk

Courtesy of Legal & General Investment Management

ISHARES S&P 500 EQL WGHT ETF

Courtesy of The London Stock Exchange.

This ETF holds all 500 companies that make up the S&P 500 Index:-

1 AAPL Apple Inc. 3,572.85B 237.59 -0.74% 391.04B

2 MSFT Microsoft Corporation 3,085.03B 414.99 -6.18% 261.80B

3 NVDA NVIDIA Corporation 3,059.05B 124.91 0.98% 113.27B

4 AMZN Amazon.com, Inc. 2,466.82B 234.60 -1.04% 620.13B

5 GOOGL Alphabet Inc. 2,458.85B 200.87 2.79% 339.86B

6 GOOG Alphabet Inc. 2,401.81B 202.63 2.76% 339.86B

7 META Meta Platforms, Inc. 1,734.32B 687.00 1.55% 164.50B

8 TSLA Tesla, Inc. 1,284.92B 400.28 2.87% 97.69B

9 BRK.B Berkshire Hathaway Inc. 1,012.35B 472.44 0.68% 369.89B

10 AVGO Broadcom Inc. 1,010.88B 215.66 4.51% 51.57B

11 WMT Walmart Inc. 792.49B 98.65 1.18% 673.82B

12 JPM JPMorgan Chase & Co. 750.40B 268.23 0.62% 166.88B

13 LLY Eli Lilly and Company 741.26B 823.23 2.38% 40.86B

14 V Visa Inc. 672.58B 342.97 2.11% 35.93B

15 MA Mastercard Incorporated 519.50B 566.01 3.14% 28.17B

16 UNH UnitedHealth Group Incorporated 502.08B 545.57 1.39% 400.28B

17 XOM Exxon Mobil Corporation 481.57B 109.57 0.83% 343.82B

18 ORCL Oracle Corporation 476.55B 170.38 5.16% 54.93B

19 COST Costco Wholesale Corporation 434.49B 978.81 1.53% 258.81B

20 NFLX Netflix, Inc. 416.31B 973.24 -0.50% 39.00B

21 HD The Home Depot, Inc. 411.75B 414.50 0.26% 154.60B

22 PG The Procter & Gamble Company 392.55B 167.41 0.71% 84.35B

23 JNJ Johnson & Johnson 368.05B 152.87 1.14% 88.82B

24 BAC Bank of America Corporation 355.58B 46.72 -0.06% 96.07B

25 CRM Salesforce, Inc. 328.80B 343.57 -2.95% 37.19B

26 ABBV AbbVie Inc. 310.40B 175.65 0.22% 55.53B

27 CVX Chevron Corporation 280.92B 156.32 0.40% 191.69B

28 KO The Coca-Cola Company 275.91B 64.05 1.94% 46.37B

29 TMUS T-Mobile US, Inc. 268.26B 234.37 -0.33% 81.40B

30 WFC Wells Fargo & Company 259.23B 78.82 0.57% 77.96B

31 MRK Merck & Co., Inc. 250.31B 98.95 0.68% 63.17B

32 CSCO Cisco Systems, Inc. 240.84B 60.47 1.54% 52.98B

33 IBM International Business Machines Corporation 238.81B 258.27 12.96% 62.75B

34 ACN Accenture plc 238.15B 380.75 1.69% 66.36B

35 TMO Thermo Fisher Scientific Inc. 232.08B 606.74 6.78% 42.88B

36 MS Morgan Stanley 224.88B 139.94 0.89% 61.50B

37 AXP American Express Company 223.90B 318.95 1.17% 60.76B

38 ABT Abbott Laboratories 223.42B 128.81 0.74% 41.95B

39 GE General Electric Company 220.72B 205.57 3.25% 38.70B

40 GS The Goldman Sachs Group, Inc. 218.38B 645.70 1.31% 52.16B

41 BX Blackstone Inc. 217.17B 177.78 -4.10% 12.79B

42 LIN Linde plc 212.55B 446.38 1.84% 33.03B

43 PEP PepsiCo, Inc. 210.83B 151.90 1.02% 91.92B

44 NOW ServiceNow, Inc. 208.95B 1,012.75 -11.44% 10.98B

45 MCD McDonald’s Corporation 208.05B 290.32 0.07% 25.94B

46 ISRG Intuitive Surgical, Inc. 206.65B 580.18 1.30% 8.35B

47 DIS The Walt Disney Company 205.13B 113.43 0.21% 91.36B

48 PM Philip Morris International Inc. 202.63B 130.32 0.56% 37.22B

49 ADBE Adobe Inc. 194.14B 446.00 0.98% 21.51B

50 AMD Advanced Micro Devices, Inc. 192.89B 118.86 1.29% 24.30B

51 QCOM QUALCOMM Incorporated 190.05B 171.93 0.13% 38.96B

52 PLTR Palantir Technologies Inc. 185.02B 81.22 1.83% 2.65B

53 CAT Caterpillar Inc. 181.04B 374.98 -4.64% 64.81B

54 T AT&T Inc. 172.37B 24.02 -0.87% 122.34B

55 RTX RTX Corporation 171.67B 128.98 3.08% 80.74B

56 INTU Intuit Inc. 169.24B 604.60 1.96% 16.59B

57 TXN Texas Instruments Incorporated 168.78B 185.27 2.77% 15.64B

58 VZ Verizon Communications Inc. 166.15B 39.47 -2.01% 134.79B

59 BLK BlackRock, Inc. 165.96B 1,071.52 1.80% 20.41B

60 SPGI S&P Global Inc. 162.28B 523.54 1.22% 13.77B

61 DHR Danaher Corporation 160.42B 223.08 -0.29% 23.74B

62 BKNG Booking Holdings Inc. 158.01B 4,774.33 1.11% 23.05B

63 C Citigroup Inc. 153.66B 81.86 1.53% 71.36B

64 SCHW The Charles Schwab Corporation 153.03B 83.60 1.88% 19.61B

65 AMGN Amgen Inc. 152.67B 284.02 0.83% 32.53B

66 PFE Pfizer Inc. 152.50B 26.91 1.09% 59.38B

67 BSX Boston Scientific Corporation 151.86B 103.04 0.32% 15.91B

68 UNP Union Pacific Corporation 151.52B 249.92 0.15% 24.25B

69 LOW Lowe’s Companies, Inc. 149.07B 264.00 0.87% 83.72B

70 SYK Stryker Corporation 148.84B 390.43 -0.16% 22.60B

71 KKR KKR & Co. Inc. 148.22B 166.87 0.34% 27.82B

72 AMAT Applied Materials, Inc. 147.68B 181.72 3.67% 27.18B

73 NEE NextEra Energy, Inc. 146.62B 71.30 0.58% 24.75B

74 PGR The Progressive Corporation 146.04B 249.22 1.14% 71.96B

75 HON Honeywell International Inc. 145.69B 224.06 1.36% 37.85B

76 ANET Arista Networks Inc 143.44B 113.86 5.58% 6.61B

77 TJX The TJX Companies, Inc. 141.75B 126.09 1.51% 56.42B

78 UBER Uber Technologies, Inc. 140.22B 66.59 -0.24% 41.96B

79 BA The Boeing Company 134.40B 179.39 3.30% 66.52B

80 COP ConocoPhillips 131.24B 101.46 -0.10% 56.92B

81 DE Deere & Company 130.73B 479.99 0.38% 51.53B

82 ETN Eaton Corporation plc 129.27B 327.10 2.99% 24.61B

83 CMCSA Comcast Corporation 127.23B 33.25 -11.00% 123.73B

84 SBUX Starbucks Corporation 123.82B 109.00 0.39% 36.15B

85 ADP Automatic Data Processing, Inc. 123.40B 303.26 0.90% 19.90B

86 PANW Palo Alto Networks, Inc. 122.99B 187.42 1.08% 8.29B

87 FI Fiserv, Inc. 122.84B 215.91 1.60% 20.12B

88 GILD Gilead Sciences, Inc. 120.83B 96.95 1.42% 28.30B

89 BMY Bristol-Myers Squibb Company 119.95B 59.14 0.15% 47.44B

90 MDT Medtronic plc 117.96B 91.99 0.63% 33.00B

91 NKE NIKE, Inc. 115.86B 78.33 2.29% 48.98B

92 PLD Prologis, Inc. 113.65B 120.65 1.24% 8.56B

93 VRTX Vertex Pharmaceuticals Incorporated 112.90B 438.40 -0.71% 10.63B

94 CB Chubb Limited 110.11B 274.78 -0.38% 56.44B

95 MMC Marsh & McLennan Companies, Inc. 108.45B 220.83 1.07% 24.46B

96 LMT Lockheed Martin Corporation 108.20B 459.65 1.16% 71.04B

97 GEV GE Vernova Inc. 105.56B 382.94 8.40% 34.94B

98 ADI Analog Devices, Inc. 105.41B 212.40 1.19% 9.43B

99 LRCX Lam Research Corporation 103.73B 80.73 7.43% 16.21B

100 MU Micron Technology, Inc. 103.06B 92.50 3.92% 29.09B

101 KLAC KLA Corporation 99.31B 742.43 4.13% 10.26B

102 UPS United Parcel Service, Inc. 98.05B 114.90 -14.11% 91.07B

103 CRWD CrowdStrike Holdings, Inc. 97.75B 396.87 -0.05% 3.74B

104 APO Apollo Global Management, Inc. 97.18B 171.76 0.39% 31.67B

105 CEG Constellation Energy Corporation 96.53B 308.55 5.71% 23.98B

106 SO The Southern Company 93.06B 84.93 2.54% 26.43B

107 ELV Elevance Health, Inc. 92.61B 399.32 -0.24% 176.81B

108 SHW The Sherwin-Williams Company 91.75B 365.55 1.43% 23.10B

109 ICE Intercontinental Exchange, Inc. 91.55B 159.44 1.41% 9.16B

110 PH Parker-Hannifin Corporation 90.61B 703.89 5.72% 19.91B

111 MCO Moody’s Corporation 90.47B 499.20 1.81% 6.90B

112 PYPL PayPal Holdings, Inc. 89.80B 89.57 0.91% 31.46B

113 WM Waste Management, Inc. 89.28B 222.43 6.15% 22.06B

114 EQIX Equinix, Inc. 88.97B 922.13 1.53% 8.15B

115 MO Altria Group, Inc. 87.35B 51.54 -2.13% 20.44B

116 AMT American Tower Corporation 86.83B 185.82 1.19% 11.17B

117 DUK Duke Energy Corporation 86.72B 112.26 1.48% 29.75B

118 APH Amphenol Corporation 86.39B 71.66 3.29% 15.22B

119 INTC Intel Corporation 86.30B 20.01 1.32% 54.25B

120 WELL Welltower Inc. 85.42B 137.18 1.67% 7.56B

121 CME CME Group Inc. 85.02B 235.92 1.47% 6.03B

122 HCA HCA Healthcare, Inc. 84.76B 334.61 2.13% 70.60B

123 MMM 3M Company 83.29B 154.40 1.89% 24.58B

124 TT Trane Technologies plc 82.43B 366.32 0.64% 19.84B

125 ABNB Airbnb, Inc. 82.34B 131.79 -0.60% 10.84B

126 CDNS Cadence Design Systems, Inc. 81.66B 297.76 2.72% 4.35B

127 CTAS Cintas Corporation 81.59B 202.18 1.82% 9.94B

128 SNPS Synopsys, Inc. 81.36B 526.36 2.66% 6.13B

129 MAR Marriott International, Inc. 81.29B 292.54 0.99% 6.57B

130 AON Aon plc 80.48B 372.15 1.48% 14.93B

131 CMG Chipotle Mexican Grill, Inc. 80.44B 58.99 1.24% 10.98B

132 PNC The PNC Financial Services Group, Inc. 80.01B 202.07 -0.05% 20.77B

133 MSI Motorola Solutions, Inc. 78.98B 472.61 1.99% 10.66B

134 CI The Cigna Group 78.71B 282.98 -6.70% 247.12B

135 MDLZ Mondelez International, Inc. 78.11B 58.41 2.24% 36.15B

136 COF Capital One Financial Corporation 78.00B 204.62 0.35% 27.40B

137 ZTS Zoetis Inc. 77.92B 172.71 1.46% 9.15B

138 FTNT Fortinet, Inc. 77.36B 100.93 1.61% 5.71B

139 ITW Illinois Tool Works Inc. 76.82B 260.13 1.46% 15.95B

140 MCK McKesson Corporation 76.75B 604.60 0.24% 330.19B

141 TDG TransDigm Group Incorporated 76.49B 1,364.89 1.94% 7.94B

142 ORLY O’Reilly Automotive, Inc. 75.64B 1,310.16 1.71% 16.44B

143 USB U.S. Bancorp 74.88B 48.00 0.71% 25.10B

144 AJG Arthur J. Gallagher & Co. 74.70B 299.03 1.68% 10.67B

145 APD Air Products and Chemicals, Inc. 74.52B 335.10 2.38% 12.10B

146 EMR Emerson Electric Co. 74.29B 130.44 1.23% 17.49B

147 CL Colgate-Palmolive Company 74.26B 90.89 1.47% 20.11B

148 RCL Royal Caribbean Cruises Ltd. 73.89B 274.79 2.12% 16.48B

149 DELL Dell Technologies Inc. 73.50B 105.35 2.18% 93.95B

150 REGN Regeneron Pharmaceuticals, Inc. 73.49B 683.08 -0.61% 13.85B

151 EOG EOG Resources, Inc. 72.68B 129.78 -0.35% 23.86B

152 BDX Becton, Dickinson and Company 72.06B 248.49 0.64% 20.18B

153 CVS CVS Health Corporation 71.50B 56.82 -0.14% 367.25B

154 ECL Ecolab Inc. 71.50B 252.51 2.26% 15.67B

155 NOC Northrop Grumman Corporation 70.42B 483.37 0.38% 41.03B

156 GD General Dynamics Corporation 69.35B 256.93 2.18% 47.72B

157 WDAY Workday, Inc. 69.18B 260.07 -2.01% 8.16B

158 WMB The Williams Companies, Inc. 68.98B 56.59 2.28% 10.37B

159 RSG Republic Services, Inc. 68.38B 218.36 2.85% 15.82B

160 ADSK Autodesk, Inc. 66.59B 309.95 1.90% 5.96B

161 SPG Simon Property Group, Inc. 66.00B 175.79 1.24% 5.91B

162 FDX FedEx Corporation 64.85B 269.24 -2.12% 87.39B

163 TGT Target Corporation 64.35B 140.44 0.25% 107.57B

164 CSX CSX Corporation 63.37B 32.86 -0.36% 14.54B

165 TFC Truist Financial Corporation 63.19B 48.02 1.22% 11.41B

166 HLT Hilton Worldwide Holdings Inc. 62.60B 256.79 1.13% 4.70B

167 KMI Kinder Morgan, Inc. 62.42B 28.10 2.91% 15.10B

168 BK The Bank of New York Mellon Corporation 62.08B 86.50 0.53% 18.55B

169 ROP Roper Technologies, Inc. 61.18B 570.60 5.08% 7.04B

170 MET MetLife, Inc. 60.24B 87.00 0.42% 71.34B

171 AFL Aflac Incorporated 60.14B 108.25 0.59% 17.30B

172 VST Vistra Corp. 59.98B 176.30 13.59% 16.27B

173 CARR Carrier Global Corporation 59.19B 65.97 1.81% 24.80B

174 PCAR PACCAR Inc 59.00B 112.51 1.46% 33.66B

175 OKE ONEOK, Inc. 58.35B 99.87 -0.51% 19.93B

176 NSC Norfolk Southern Corporation 58.21B 257.20 0.18% 12.12B

177 SLB Schlumberger Limited 57.46B 41.02 0.20% 36.29B

178 TRV The Travelers Companies, Inc. 56.44B 249.09 -0.17% 46.42B

179 CPRT Copart, Inc. 56.42B 58.56 2.16% 4.36B

180 AZO AutoZone, Inc. 56.24B 3,351.01 1.12% 18.58B

181 DLR Digital Realty Trust, Inc. 55.53B 164.23 1.55% 5.37B

182 GWW W.W. Grainger, Inc. 54.84B 1,126.07 1.08% 16.93B

183 NXPI NXP Semiconductors N.V. 53.73B 211.39 -0.76% 12.93B

184 CHTR Charter Communications, Inc. 53.54B 336.62 -6.32% 54.87B

185 PAYX Paychex, Inc. 53.31B 148.05 0.79% 5.37B

186 SRE Sempra 52.73B 83.25 1.55% 12.92B

187 AMP Ameriprise Financial, Inc. 52.70B 547.84 -4.75% 17.45B

188 FCX Freeport-McMoRan Inc. 52.65B 36.64 0.99% 25.46B

189 PSA Public Storage 52.34B 298.05 1.29% 4.70B

190 AEP American Electric Power Company, Inc. 52.21B 98.03 -0.02% 19.60B

191 HWM Howmet Aerospace Inc. 51.75B 127.37 0.80% 7.27B

192 JCI Johnson Controls International plc 51.63B 78.21 2.53% 22.95B

193 ALL The Allstate Corporation 51.33B 193.83 1.58% 62.43B

194 LULU Lululemon Athletica Inc. 51.13B 421.16 2.43% 10.18B

195 DFS Discover Financial Services 50.87B 202.48 0.72% 15.96B

196 URI United Rentals, Inc. 50.55B 774.08 2.07% 15.35B

197 ROST Ross Stores, Inc. 50.45B 152.92 1.84% 21.24B

198 COR Cencora, Inc. 50.10B 258.46 0.98% 293.96B

199 PSX Phillips 66 49.91B 120.84 -1.08% 147.74B

200 AXON Axon Enterprise, Inc. 49.83B 653.43 2.10% 1.94B

201 FANG Diamondback Energy, Inc. 49.76B 170.41 -0.26% 9.16B

202 CMI Cummins Inc. 49.34B 359.68 1.60% 34.20B

203 GM General Motors Company 49.25B 49.50 -0.56% 187.44B

204 NEM Newmont Corporation 48.56B 43.09 3.61% 16.99B

205 MPC Marathon Petroleum Corporation 48.20B 149.96 -0.94% 142.67B

206 MNST Monster Beverage Corporation 48.00B 49.36 0.53% 7.41B

207 O Realty Income Corporation 47.69B 54.32 0.48% 5.01B

208 NDAQ Nasdaq, Inc. 47.29B 82.28 0.67% 7.40B

209 AIG American International Group, Inc. 47.04B 75.42 0.01% 45.30B

210 D Dominion Energy, Inc. 46.88B 55.81 1.29% 14.59B

211 MSCI MSCI Inc. 46.30B 590.73 -0.39% 2.86B

212 DHI D.R. Horton, Inc. 45.99B 145.93 2.82% 36.69B

213 OXY Occidental Petroleum Corporation 45.90B 48.92 0.18% 27.14B

214 PWR Quanta Services, Inc. 45.65B 309.29 3.86% 22.90B

215 CTVA Corteva, Inc. 45.46B 66.15 1.77% 16.64B

216 FICO Fair Isaac Corporation 45.44B 1,866.42 0.33% 1.72B

217 HES Hess Corporation 44.79B 145.85 0.48% 12.66B

218 TRGP Targa Resources Corp. 44.75B 205.21 1.16% 16.22B

219 TEL TE Connectivity plc 44.70B 149.81 1.42% 15.85B

220 FIS Fidelity National Information Services, Inc. 44.19B 82.08 1.79% 10.03B

221 KR The Kroger Co. 44.17B 61.04 -0.03% 149.88B

222 BKR Baker Hughes Company 44.13B 44.60 3.55% 27.30B

223 DAL Delta Air Lines, Inc. 43.96B 68.57 0.20% 61.64B

224 KDP Keurig Dr Pepper Inc. 43.73B 32.24 1.19% 15.15B

225 CBRE CBRE Group, Inc. 43.51B 144.65 2.13% 34.31B

226 KMB Kimberly-Clark Corporation 43.42B 130.85 0.91% 20.06B

227 PRU Prudential Financial, Inc. 43.39B 121.88 -0.37% 72.97B

228 A Agilent Technologies, Inc. 43.23B 151.38 2.92% 6.51B

229 EW Edwards Lifesciences Corporation 43.19B 73.22 2.94% 6.31B

230 AME AMETEK, Inc. 43.02B 186.00 1.91% 6.91B

231 FAST Fastenal Company 42.99B 74.98 1.21% 7.55B

232 VLO Valero Energy Corporation 42.87B 135.42 -2.12% 129.88B

233 GLW Corning Incorporated 42.80B 49.99 0.38% 13.12B

234 IT Gartner, Inc. 42.30B 548.38 1.93% 6.14B

235 PEG Public Service Enterprise Group Incorporated 41.77B 83.83 2.61% 10.43B

236 GRMN Garmin Ltd. 41.68B 217.04 1.26% 5.96B

237 KVUE Kenvue Inc. 41.64B 21.72 1.92% 15.46B

238 CTSH Cognizant Technology Solutions Corporation 41.03B 82.76 1.93% 19.41B

239 GEHC GE HealthCare Technologies Inc. 40.91B 89.55 1.94% 19.56B

240 VRSK Verisk Analytics, Inc. 40.68B 288.08 1.94% 2.82B

241 F Ford Motor Company 40.38B 10.16 -0.49% 182.74B

242 LHX L3Harris Technologies, Inc. 40.22B 212.06 0.05% 21.33B

243 EXC Exelon Corporation 40.21B 40.02 1.14% 22.92B

244 ODFL Old Dominion Freight Line, Inc. 39.88B 186.78 0.51% 5.92B

245 CCI Crown Castle Inc. 38.69B 89.03 1.30% 6.59B

246 XEL Xcel Energy Inc. 38.39B 66.86 1.20% 13.76B

247 OTIS Otis Worldwide Corporation 38.09B 95.36 0.75% 14.26B

248 IR Ingersoll Rand Inc. 37.89B 94.01 3.08% 7.16B

249 RMD ResMed Inc. 37.84B 257.65 1.89% 4.81B

250 CCL Carnival Corporation & plc 37.36B 28.49 2.08% 25.02B

251 IQV IQVIA Holdings Inc. 36.62B 201.78 1.87% 15.32B

252 KHC The Kraft Heinz Company 36.60B 30.27 2.06% 26.13B

253 VMC Vulcan Materials Company 36.50B 276.36 1.53% 7.40B

254 YUM Yum! Brands, Inc. 36.48B 130.73 1.21% 7.22B

255 WAB Westinghouse Air Brake Technologies Corporation 36.07B 209.86 1.47% 10.33B

256 UAL United Airlines Holdings, Inc. 35.98B 109.40 1.05% 57.06B

257 LEN Lennar Corporation 35.91B 135.26 2.29% 35.44B

258 SYY Sysco Corporation 35.88B 73.34 1.97% 80.57B

259 HUM Humana Inc. 35.75B 296.91 0.91% 115.01B

260 ACGL Arch Capital Group Ltd. 35.44B 94.58 0.81% 16.87B

261 LVS Las Vegas Sands Corp. 34.97B 48.24 11.08% 11.30B

262 RJF Raymond James Financial, Inc. 34.91B 170.65 -0.80% 13.32B

263 ETR Entergy Corporation 34.81B 81.18 2.45% 11.86B

264 IDXX IDEXX Laboratories, Inc. 34.72B 423.99 1.25% 3.84B

265 EFX Equifax Inc. 34.50B 278.34 2.64% 5.59B

266 PCG PG&E Corporation 34.30B 15.69 -0.63% 24.83B

267 DXCM DexCom, Inc. 34.22B 87.62 1.38% 3.95B

268 EXR Extra Space Storage Inc. 34.02B 154.71 1.10% 3.31B

269 DECK Deckers Outdoor Corporation 33.90B 223.11 1.92% 4.66B

270 TTWO Take-Two Interactive Software, Inc. 33.59B 191.23 0.60% 5.46B

271 GIS General Mills, Inc. 33.49B 60.65 1.25% 19.90B

272 MTB M&T Bank Corporation 33.43B 201.98 0.81% 8.67B

273 MLM Martin Marietta Materials, Inc. 33.39B 546.33 1.20% 6.51B

274 STZ Constellation Brands, Inc. 33.31B 184.32 1.15% 10.18B

275 WTW Willis Towers Watson Public Limited Company 33.22B 329.83 1.63% 9.81B

276 LYV Live Nation Entertainment, Inc. 33.22B 144.06 1.12% 23.32B

277 HIG The Hartford Financial Services Group, Inc. 33.12B 114.26 0.67% 26.08B

278 CNC Centene Corporation 32.62B 64.62 1.11% 146.20B

279 ED Consolidated Edison, Inc. 32.52B 93.86 1.39% 15.03B

280 EBAY eBay Inc. 32.34B 67.52 2.30% 10.27B

281 DD DuPont de Nemours, Inc. 32.04B 76.66 0.24% 12.19B

282 ROK Rockwell Automation, Inc. 31.54B 279.00 0.04% 8.26B

283 WEC WEC Energy Group, Inc. 31.46B 99.45 1.45% 8.53B

284 VICI VICI Properties Inc. 31.46B 29.84 0.67% 3.81B

285 CSGP CoStar Group, Inc. 31.37B 76.52 1.15% 2.67B

286 AVB AvalonBay Communities, Inc. 31.23B 219.88 2.29% 2.93B

287 EA Electronic Arts Inc. 31.13B 118.68 1.35% 7.41B

288 MPWR Monolithic Power Systems, Inc. 31.06B 636.78 2.91% 2.04B

289 CAH Cardinal Health, Inc. 31.04B 128.26 0.39% 222.28B

290 EQT EQT Corporation 30.82B 51.65 2.03% 4.62B

291 HSY The Hershey Company 30.79B 152.14 1.95% 10.97B

292 HPQ HP Inc. 30.76B 32.80 0.58% 53.56B

293 ANSS ANSYS, Inc. 30.74B 351.57 1.52% 2.47B

294 EL The Estée Lauder Companies Inc. 30.69B 85.48 3.89% 15.45B

295 NUE Nucor Corporation 30.22B 128.68 1.43% 30.73B

296 BRO Brown & Brown, Inc. 30.16B 105.46 2.22% 4.71B

297 GDDY GoDaddy Inc. 29.98B 213.53 -0.18% 4.48B

298 IRM Iron Mountain Incorporated 29.93B 102.00 1.38% 5.99B

299 FITB Fifth Third Bancorp 29.80B 44.49 0.72% 7.95B

300 TPL Texas Pacific Land Corporation 29.74B 1,294.39 1.76% 686.70M

301 MCHP Microchip Technology Incorporated 29.62B 55.16 -1.55% 5.50B

302 XYL Xylem Inc. 29.59B 121.79 0.45% 8.42B

303 KEYS Keysight Technologies, Inc. 29.53B 170.52 1.30% 4.98B

304 STT State Street Corporation 29.52B 102.23 1.37% 12.93B

305 TSCO Tractor Supply Company 29.00B 54.29 -5.02% 14.88B

306 MTD Mettler-Toledo International Inc. 28.79B 1,364.50 2.17% 3.76B

307 GPN Global Payments Inc. 28.74B 112.91 2.35% 10.02B

308 PPG PPG Industries, Inc. 28.44B 122.75 0.30% 18.03B

309 FTV Fortive Corporation 28.32B 81.63 1.22% 6.20B

310 K Kellanova 28.24B 81.94 0.21% 12.80B

311 DOV Dover Corporation 28.18B 205.42 4.08% 7.75B

312 BR Broadridge Financial Solutions, Inc. 27.95B 239.12 1.51% 6.50B

313 HPE Hewlett Packard Enterprise Company 27.87B 21.19 -2.17% 30.13B

314 SW Smurfit Westrock Plc 27.61B 53.26 -0.56% 16.43B

315 EQR Equity Residential 27.26B 69.74 1.84% 2.94B

316 DOW Dow Inc. 27.08B 38.55 -6.09% 42.96B

317 CPAY Corpay, Inc. 27.01B 387.47 1.64% 3.88B

318 SYF Synchrony Financial 26.98B 69.47 1.02% 9.39B

319 CDW CDW Corporation 26.35B 197.76 1.14% 20.83B

320 CHD Church & Dwight Co., Inc. 26.24B 107.12 0.33% 6.05B

321 WBD Warner Bros. Discovery, Inc. 26.05B 10.62 1.82% 39.58B

322 TROW T. Rowe Price Group, Inc. 25.75B 115.89 1.38% 6.91B

323 VLTO Veralto Corporation 25.68B 103.85 0.97% 5.14B

324 TYL Tyler Technologies, Inc. 25.63B 598.89 -1.40% 2.08B

325 VTR Ventas, Inc. 25.44B 60.16 0.94% 4.80B

326 HBAN Huntington Bancshares Incorporated 25.28B 17.39 1.28% 6.97B

327 AEE Ameren Corporation 25.12B 94.11 1.42% 7.06B

328 WST West Pharmaceutical Services, Inc. 24.91B 343.91 1.28% 2.88B

329 NTAP NetApp, Inc. 24.89B 122.44 1.80% 6.47B

330 WAT Waters Corporation 24.78B 417.28 3.24% 2.91B

331 ADM Archer-Daniels-Midland Company 24.73B 51.67 0.02% 87.01B

332 DTE DTE Energy Company 24.71B 119.33 1.47% 12.42B

333 PPL PPL Corporation 24.70B 33.47 2.26% 8.28B

334 LYB LyondellBasell Industries N.V. 24.69B 76.12 -2.23% 40.73B

335 NVR NVR, Inc. 24.52B 8,140.57 2.20% 10.69B

336 PHM PulteGroup, Inc. 24.30B 118.51 4.89% 17.95B

337 TDY Teledyne Technologies Incorporated 24.18B 518.84 1.98% 5.67B

338 AWK American Water Works Company, Inc. 24.10B 123.66 -0.47% 4.52B

339 ROL Rollins, Inc. 24.08B 49.72 1.99% 3.31B

340 HAL Halliburton Company 23.32B 26.54 0.64% 22.94B

341 FOXA Fox Corporation 23.30B 51.02 1.17% 14.34B

342 PTC PTC Inc. 23.11B 192.01 1.55% 2.30B

343 DVN Devon Energy Corporation 23.02B 35.05 -0.06% 14.53B

344 DRI Darden Restaurants, Inc. 22.98B 196.19 1.23% 11.58B

345 HUBB Hubbell Incorporated 22.89B 426.57 2.12% 5.64B

346 FE FirstEnergy Corp. 22.89B 39.72 0.13% 13.26B

347 WDC Western Digital Corporation 22.74B 65.78 4.75% 15.60B

348 ON ON Semiconductor Corporation 22.68B 53.27 -0.93% 7.38B

349 WRB W. R. Berkley Corporation 22.53B 59.29 1.06% 13.64B

350 RF Regions Financial Corporation 22.51B 24.77 0.77% 6.60B

351 WY Weyerhaeuser Company 22.49B 30.96 1.38% 7.19B

352 IFF International Flavors & Fragrances Inc. 22.43B 87.72 2.00% 11.42B

353 FOX Fox Corporation 22.43B 48.37 1.09% 14.34B

354 ATO Atmos Energy Corporation 22.18B 142.71 1.19% 4.17B

355 NTRS Northern Trust Corporation 22.09B 112.74 0.12% 8.29B

356 EXPE Expedia Group, Inc. 22.07B 171.95 0.40% 13.39B

357 ZBH Zimmer Biomet Holdings, Inc. 22.02B 110.62 -0.39% 7.60B

358 STE STERIS plc 21.88B 221.70 0.64% 5.33B

359 CINF Cincinnati Financial Corporation 21.73B 139.04 0.56% 12.16B

360 LII Lennox International Inc. 21.61B 606.54 0.37% 5.34B

361 CBOE Cboe Global Markets, Inc. 21.57B 206.09 1.01% 3.96B

362 CNP CenterPoint Energy, Inc. 21.43B 32.88 1.80% 8.56B

363 SBAC SBA Communications Corporation 21.41B 199.14 0.53% 2.66B

364 BIIB Biogen Inc. 21.31B 146.23 1.26% 9.61B

365 CFG Citizens Financial Group, Inc. 21.30B 48.36 1.55% 7.12B

366 NRG NRG Energy, Inc. 21.27B 105.00 4.40% 28.12B

367 ES Eversource Energy 21.04B 57.42 0.24% 11.62B

368 LH Labcorp Holdings Inc. 21.04B 251.54 2.16% 12.71B

369 EIX Edison International 20.93B 54.06 -3.12% 17.32B

370 CTRA Coterra Energy Inc. 20.91B 28.39 0.53% 5.50B

371 ERIE Erie Indemnity Company 20.87B 399.15 1.33% 3.69B

372 MKC McCormick & Company, Incorporated 20.86B 77.78 1.10% 6.72B

373 STX Seagate Technology Holdings plc 20.81B 98.28 -1.11% 8.04B

374 VRSN VeriSign, Inc. 20.57B 214.01 0.11% 1.54B

375 ZBRA Zebra Technologies Corporation 20.36B 394.70 -1.22% 4.66B

376 TSN Tyson Foods, Inc. 20.22B 56.76 0.28% 53.31B

377 KEY KeyCorp 19.96B 18.03 2.04% 4.24B

378 STLD Steel Dynamics, Inc. 19.90B 130.71 1.19% 17.54B

379 BLDR Builders FirstSource, Inc. 19.88B 172.71 2.43% 16.73B

380 CLX The Clorox Company 19.86B 160.45 1.67% 7.47B

381 IP International Paper Company 19.82B 57.05 -1.60% 18.62B

382 CMS CMS Energy Corporation 19.78B 66.20 0.65% 7.48B

383 PODD Insulet Corporation 19.64B 280.03 1.05% 1.98B

384 COO The Cooper Companies, Inc. 19.58B 98.10 0.10% 3.90B

385 ULTA Ulta Beauty, Inc. 19.41B 418.53 1.92% 11.36B

386 PKG Packaging Corporation of America 19.10B 214.24 -0.41% 8.38B

387 PFG Principal Financial Group, Inc. 19.10B 83.51 0.16% 14.07B

388 INVH Invitation Homes Inc. 19.05B 30.99 1.04% 2.55B

389 LDOS Leidos Holdings, Inc. 18.97B 142.19 1.37% 16.28B

390 SNA Snap-on Incorporated 18.82B 358.62 1.58% 5.10B

391 L Loews Corporation 18.77B 86.18 0.19% 17.22B

392 LUV Southwest Airlines Co. 18.75B 31.26 -1.23% 27.48B

393 TER Teradyne, Inc. 18.74B 115.08 -5.71% 2.82B

394 ESS Essex Property Trust, Inc. 18.73B 281.16 1.64% 1.75B

395 BBY Best Buy Co., Inc. 18.57B 86.86 2.08% 42.23B

396 TRMB Trimble Inc. 18.53B 75.38 0.82% 3.63B

397 DGX Quest Diagnostics Incorporated 18.32B 164.17 5.62% 9.87B

398 MAA Mid-America Apartment Communities, Inc. 18.21B 151.84 2.21% 2.18B

399 FDS FactSet Research Systems Inc. 17.95B 472.12 1.61% 2.23B

400 FSLR First Solar, Inc. 17.92B 167.39 0.83% 3.85B

401 MOH Molina Healthcare, Inc. 17.90B 312.89 2.83% 37.54B

402 JBL Jabil Inc. 17.81B 162.64 1.03% 27.49B

403 NI NiSource Inc. 17.61B 37.72 2.95% 5.29B

404 MAS Masco Corporation 17.50B 81.10 1.77% 7.88B

405 FFIV F5, Inc. 17.49B 301.48 0.34% 2.89B

406 JBHT J.B. Hunt Transport Services, Inc. 17.43B 173.36 0.83% 12.09B

407 TPR Tapestry, Inc. 17.40B 75.91 2.04% 6.67B

408 J Jacobs Solutions Inc. 17.34B 139.82 1.87% 11.50B

409 GEN Gen Digital Inc. 17.19B 27.89 0.94% 3.86B

410 PNR Pentair plc 17.09B 103.46 1.78% 4.09B

411 OMC Omnicom Group Inc. 16.99B 86.52 -0.33% 15.43B

412 IEX IDEX Corporation 16.97B 224.11 2.39% 3.19B

413 BAX Baxter International Inc. 16.90B 33.10 0.98% 15.06B

414 ALGN Align Technology, Inc. 16.82B 225.36 0.41% 3.96B

415 SMCI Super Micro Computer, Inc. 16.77B 28.64 3.02% 14.94B

416 BALL Ball Corporation 16.72B 56.04 1.28% 13.79B

417 HRL Hormel Foods Corporation 16.71B 30.43 0.83% 11.92B

418 NWS News Corporation 16.67B 31.60 -0.28% 10.16B

419 ARE Alexandria Real Estate Equities, Inc. 16.59B 95.85 0.06% 3.12B

420 GPC Genuine Parts Company 16.43B 118.16 1.56% 23.30B

421 HOLX Hologic, Inc. 16.29B 72.17 1.06% 4.03B

422 RL Ralph Lauren Corporation 16.05B 258.50 0.66% 6.74B

423 CF CF Industries Holdings, Inc. 16.04B 92.20 -0.35% 5.98B

424 DLTR Dollar Tree, Inc. 16.02B 74.50 0.40% 31.22B

425 NWSA News Corporation 15.94B 28.08 -0.43% 10.16B

426 EXPD Expeditors International of Washington, Inc. 15.92B 113.74 -0.49% 9.92B

427 DG Dollar General Corporation 15.87B 72.15 0.15% 40.17B

428 MRNA Moderna, Inc. 15.79B 41.04 0.79% 5.08B

429 BF.B Brown-Forman Corporation 15.69B 33.20 1.78% 4.08B

430 DPZ Domino’s Pizza, Inc. 15.57B 450.80 5.38% 4.67B

431 UDR UDR, Inc. 15.44B 41.43 1.57% 1.68B

432 RVTY Revvity, Inc. 15.44B 126.84 2.69% 2.72B

433 KIM Kimco Realty Corporation 15.31B 22.68 1.14% 1.96B

434 AKAM Akamai Technologies, Inc. 15.25B 101.48 1.07% 3.97B

435 LNT Alliant Energy Corporation 15.23B 59.34 1.28% 3.97B

436 EG Everest Group, Ltd. 15.13B 352.09 0.17% 16.44B

437 APTV Aptiv PLC 14.79B 62.91 0.37% 19.73B

438 EVRG Evergy, Inc. 14.78B 64.25 1.95% 5.78B

439 AVY Avery Dennison Corporation 14.66B 182.49 -5.40% 8.76B

440 DOC Healthpeak Properties, Inc. 14.63B 20.51 1.48% 2.56B

441 DVA DaVita Inc. 14.47B 176.50 1.57% 12.67B

442 SWKS Skyworks Solutions, Inc. 14.30B 89.40 -0.84% 4.18B

443 TXT Textron Inc. 14.23B 76.69 0.62% 13.70B

444 EPAM EPAM Systems, Inc. 14.22B 250.63 -0.48% 4.64B

445 INCY Incyte Corporation 14.21B 73.77 0.07% 4.08B

446 AMCR Amcor plc 14.08B 9.75 – 13.55B

447 SWK Stanley Black & Decker, Inc. 13.86B 89.92 1.73% 15.38B

448 VTRS Viatris Inc. 13.63B 11.42 0.79% 15.05B

449 KMX CarMax, Inc. 13.47B 87.59 2.21% 27.80B

450 POOL Pool Corporation 13.27B 348.62 1.14% 5.33B

451 REG Regency Centers Corporation 13.11B 71.96 0.88% 1.49B

452 SOLV Solventum Corporation 13.01B 75.30 1.07% 8.22B

453 NCLH Norwegian Cruise Line Holdings Ltd. 12.78B 29.07 2.14% 9.36B

454 BXP BXP, Inc. 12.76B 72.40 5.17% 3.05B

455 JKHY Jack Henry & Associates, Inc. 12.72B 174.34 0.83% 2.25B

456 NDSN Nordson Corporation 12.60B 220.63 1.22% 2.69B

457 CAG Conagra Brands, Inc. 12.55B 26.29 1.51% 11.93B

458 UHS Universal Health Services, Inc. 12.49B 189.29 1.13% 15.42B

459 CPT Camden Property Trust 12.26B 113.20 2.37% 1.56B

460 CHRW C.H. Robinson Worldwide, Inc. 11.87B 100.44 -6.94% 17.72B

461 CPB The Campbell’s Company 11.81B 39.62 2.46% 9.89B

462 HST Host Hotels & Resorts, Inc. 11.63B 16.64 0.30% 5.59B

463 ALLE Allegion plc 11.61B 133.52 1.92% 3.72B

464 TECH Bio-Techne Corporation 11.56B 72.76 1.29% 1.17B

465 PAYC Paycom Software, Inc. 11.47B 205.26 -0.59% 1.82B

466 SJM The J. M. Smucker Company 11.47B 107.78 1.78% 8.83B

467 JNPR Juniper Networks, Inc. 11.38B 34.38 -2.19% 5.03B

468 TAP Molson Coors Beverage Company 11.38B 55.23 0.51% 11.68B

469 AIZ Assurant, Inc. 11.22B 218.67 0.81% 11.76B

470 DAY Dayforce Inc. 11.13B 70.57 -1.16% 1.69B

471 BG Bunge Global SA 10.84B 77.65 -0.73% 54.50B

472 EMN Eastman Chemical Company 10.74B 92.67 -0.03% 9.34B

473 IPG The Interpublic Group of Companies, Inc. 10.69B 28.71 -0.24% 9.34B

474 BEN Franklin Resources, Inc. 10.55B 20.15 0.50% 8.48B

475 MGM MGM Resorts International 10.29B 34.55 1.59% 17.22B

476 GL Globe Life Inc. 10.27B 122.30 0.29% 5.73B

477 ALB Albemarle Corporation 10.07B 85.65 -0.73% 6.50B

478 HSIC Henry Schein, Inc. 9.98B 80.03 0.20% 12.50B

479 LKQ LKQ Corporation 9.94B 38.24 1.06% 14.50B

480 PNW Pinnacle West Capital Corporation 9.91B 87.13 1.43% 5.02B

481 WBA Walgreens Boots Alliance, Inc. 9.90B 11.46 1.87% 150.41B

482 AOS A. O. Smith Corporation 9.76B 67.31 -2.76% 3.82B

483 WYNN Wynn Resorts, Limited 9.75B 89.60 6.53% 7.13B

484 FRT Federal Realty Investment Trust 9.27B 108.29 1.04% 1.19B

485 MOS The Mosaic Company 9.08B 28.58 -0.35% 11.46B

486 GNRC Generac Holdings Inc. 9.06B 152.25 2.79% 4.12B

487 MTCH Match Group, Inc. 8.84B 35.21 0.09% 3.49B

488 LW Lamb Weston Holdings, Inc. 8.79B 61.63 0.20% 6.33B

489 IVZ Invesco Ltd. 8.61B 19.22 1.16% 6.07B

490 APA APA Corporation 8.51B 22.99 -0.82% 8.96B

491 TFX Teleflex Incorporated 8.49B 182.84 1.25% 3.03B

492 CRL Charles River Laboratories International, Inc. 8.47B 165.57 2.43% 4.06B

493 ENPH Enphase Energy, Inc. 8.38B 62.05 1.94% 1.25B

494 HAS Hasbro, Inc. 8.31B 59.56 1.73% 4.32B

495 MKTX MarketAxess Holdings Inc. 8.21B 217.77 -0.56% 811.94M

496 AES The AES Corporation 8.01B 11.27 1.08% 12.28B

497 MHK Mohawk Industries, Inc. 7.98B 126.49 0.44% 10.81B

498 CE Celanese Corporation 7.89B 72.17 1.73% 10.48B

499 CZR Caesars Entertainment, Inc. 7.70B 36.23 1.83% 11.27B

500 HII Huntington Ingalls Industries, Inc. 7.65B 195.50 1.35% 11.71B

501 PARA Paramount Global 7.32B 10.98 -0.99% 28.87B

502 BWA BorgWarner Inc. 7.18B 32.85 1.17% 14.17B

503 FMC FMC Corporation 7.04B 56.38 0.09% 4.17B

USDV SPDR S&P US DIVIDEND ARISTOCRATS ETF

USDV is an ETF that holds high quality US stocks that pay healthy dividends

Top Ten holdings:-

1 CHEVRON CORP ORD 2.24% of the fund

2 REALTY INCOME CORP ORD 2.21% of the fund

3 XCEL ENERGY INC ORD 1.83% of the fund

4 EDISON INTERNATIONAL ORD 1.75% of the fund

5 WEC ENERGY GROUP INC ORD 1.73% of the fund

6 KENVUE INC ORD 1.73% of the fund

7 KIMBERLY-CLARK CORP ORD 1.72% of the fund

8 INTERNATIONAL BUSINESS MACHINES CORP ORD 1.60% of the fund

9 ABBVIE INC ORD 1.54% of the fund

10 ARCHER-DANIELS-MIDLAND CO ORD 1.54% of the fund

https://www.londonstockexchange.com/stock/USDV/street-global-advisors/company-page

Courtesy of The London Stock Exchange

LG ARTIFICIAL INTELLIGENCE ETF

Courtesy of the London Stock Exchange

LEGAL AND GENERAL ASSET MANAGEMENT AIAG Stock | London Stock Exchange

The David Rubenstein Show: Eli Lilly CEO Dave Ricks

Eli Lilly: $757 Billion Dollar Company

Investment in Euler

The FTSE All-World High Dividend Yield UCITS ETF (VHYG)

The FTSE All-World High Dividend Yield UCITS ETF (VHYG) is a Vanguard ETF owning shares in high dividend companies.

Number of stocks 2,135

Total assets $815.1 Million

This ETF tracks the FTSE All-World High Dividend Yield Index

Top ten holdings:-

JPMorgan Chase & Co 2.28% of the fund

Exxon Mobil Corp 1.68% of the fund

Home Depot Inc/The 1.35% of the fund

Procter & Gamble Co/The 1.35% of the fund

Johnson & Johnson 1.19% of the fund

AbbVie Inc 1.03% of the fund

Bank of America Corp 1.02% of the fund

Chevron Corp 0.89% of the fund

Wells Fargo & Co 0.85% of the fund

Merck & Co Inc 0.82% of the fund

https://www.londonstockexchange.com/stock/VHYL/vanguard/company-page

Courtesy of Vanguard / The London Stock Exchange

The ascent of ISPY: L&G ISE CYBER SECURITY GO UCITS ETF

https://www.londonstockexchange.com/stock/ISPY/legal-and-general-asset-management/company-page

Courtesy of The London Stock Exchange

Investment in “Rain”

Investment in Elegance

The M&G Managed Growth Fund

The M&G Managed Growth Fund is a fund of funds, that invests in other M&G Funds.

At least 70% of the fund is invested in other funds to give exposure to a range of assets from anywhere in the world. The fund may also invest directly in these assets and use derivatives. In aggregate, at least 70% of the fund’s assets will be invested in company shares, either directly or via other funds.

Courtesy of M&G

Marks and Spencer Group: January 2025 Dividend

Tomorrow, the mighty high street retailer, Marks and Spencer pays out its January 2025 dividend.

https://www.marksandspencer.com

1p per share.

https://www.londonstockexchange.com/news-article/MKS/total-voting-rights/16790521

The Company’s capital consists of 2,051,278,567 ordinary shares with voting rights

Thus:-

2,051,278,567 x £0.01 = £20,512,785.67

£20million paid to shareholders

https://www.londonstockexchange.com/stock/MKS/marks-and-spencer-group-plc/company-page

The M&G Global AI Themes Fund

The M&G Global AI Themes Fund is a relatively new fund that seeks to identify opportunities where artificial intelligence (AI) is emerging as a potential driver to long-term revenue growth or profit margin expansion. They look for innovations through provision or adoption of Al, which they expect will cause changes in the way existing markets or businesses operate. At least 80% of the fund is invested in the shares of companies in the following three categories: AI Enablers (providing key underlying AI technology), AI Providers (supplying AI services to end users) and AI Beneficiaries (companies that meaningfully benefit from using AI).

Fund size (millions) £29.29

Courtesy of M&G

Surge in Broadcom

2025

Happy New Year 2025

The Renewables Infrastructure Group December Dividend.

Today, 31st December, the UK’s premier renewables energy company, The Renewables Infrastructure Group paid out its December 2024 Dividend.

1.8675p a share.

https://www.londonstockexchange.com/news-article/TRIG/total-voting-rights/16691238

The total issued share capital with voting rights is 2,478,868,326

Thus:-

2,478,868,326 x £0.018675 = £46,292,865.98805

That is £46.292 Million paid to shareholders of TRIG plc.

BP December Dividend, 2024

On Friday 20th Dec, BP plc paid out its December 2024 Dividend.

$0.08 a share which is 6.2959p a share.

https://www.londonstockexchange.com/news-article/BP./total-voting-rights-and-share-capital/16821041

The total number of voting rights in BP p.l.c. is 16,188,970,873

Thus:-

16,188,970,873 x £0.062959 = £1,019,241,417.193207

That is £1,019241417193207 Million paid to shareholders of BP, £1.019 Billion

https://www.londonstockexchange.com/stock/BP./bp-plc/company-page

Shell PLC, December Dividend 2024

On Thursday 19th Dec, Shell plc paid out its December 2024 Dividend.

$0.344 which is 27.03p a share.

https://www.londonstockexchange.com/news-article/SHEL/voting-rights-and-capital/16789162

Shell plc’s capital as at November 29, 2024, consists of 6,154,483,817 ordinary shares of €0.07 each. Shell plc holds no shares in Treasury.

Thus:-

6,154,483,817 x £0.2703 = £1,663,556,975.7351

That is £1.663556 Million paid to shareholders of Hello, £1.663 Billion

https://www.londonstockexchange.com/stock/SHEL/shell-plc/company-page

Happy Christmas

HSBC December Dividend 2024

On Thursday 19th Dec, HSBC Holdings plc paid out its December 2024 Dividend.

$0.1 a share which is 7.8285p a share.

https://www.londonstockexchange.com/news-article/HSBA/total-voting-rights/16789140

The total number of voting rights in HSBC Holdings plc is 18,014,625,163

Thus:-

18,014,625,163 x £0.078285 = £1,410,274,930.885455

That is £1410.274 Million paid to shareholders of HSBC, £1.41 Billion

https://www.londonstockexchange.com/stock/HSBA/hsbc-holdings-plc/company-page

The US needs more mines for crucial transition metals | FT Energy Source

Unilever PLC December 2024 Dividend.

On the 6th December, Unilever PLC paid out its December 2024 dividend.

36.63p a share

https://www.londonstockexchange.com/news-article/ULVR/total-voting-rights/16791512

The voting rights attaching to the Unilever Group Shares are not exercisable. Accordingly, as at 29 November 2024, there were 2,475,572,871 shares with voting rights.

Thus:-

2,475,572,871 x £0.3663 = £906,802,342.6473

That is £906 million paid to shareholders in Unilever PLC.

https://www.londonstockexchange.com/stock/ULVR/unilever-plc/company-page

Broadcom

8 Churchward Close Chester

Investment in “The Animal Instinct”

Suddenly, something has happened to me

As I was having my cup of tea

Suddenly, I was feeling depressed

I was utterly and totally stressed

Do you know you made me cry? (Woah-oh)

Do you know you made me die?

And the thing that gets to me (thing that gets to me)

Is you’ll never really see (never really see)

And the thing that freaks me out (thing that freaks me out)

Is I’ll always be in doubt (always be in)

It is the lovely thing that we have

It is the lovely thing that we

It is the lovely thing

The animal, the animal instinct

So take my hands and come with me

We will change reality

So take my hands and we will pray

They won’t take you away

They will never make me cry, no-oh

They will never make me die

And the thing that gets to me (thing that gets to me)

Is you’ll never really see (never really see)

And the thing that freaks me out (thing that freaks me out)

Is I’ll always be in doubt (always be in)

The animal, the animal

The animal instinct in me

It’s the animal, the animal

The animal instinct in me

It’s the animal, it’s the animal

It’s the animal instinct in me

It’s the animal, it’s the animal

It’s the animal instinct in me

5 year performance of the Foreign & Colonial Investment Trust

Warren Buffett Charlie Rose Full Interview [2024]

Courtesy of YouTube

Investment in AI

“That Terminator is out there. It can’t be bargained with. It can’t be reasoned with. It doesn’t feel pity, or remorse, or fear. And it absolutely will not stop, EVER, until you are DEAD.” ~ Sergeant Kyle Reese, 1984

UK Greencoat Wind: Investment Opportunity

BAE Systems December 2024 Dividend.

Yesterday, Monday 2nd Dec the UK defence contractor giant, paid out its December dividend.

12.4p a share

https://www.londonstockexchange.com/news-article/BA./total-voting-rights/16788820

BAE Systems has total voting rights of 3,018,852,441

Thus:-

3,018,852,441 x £0.124 = £374,337,702.684

That is £374 million paid to shareholders

https://www.londonstockexchange.com/stock/BA./bae-systems-plc/company-page

In Conversation: Ray Dalio

UK Greencoat Wind, November 2024 Dividend.

Today, Friday 29th November, the FTSE-250 green energy producer, UK Greencoat Wind pays out its November 2024 dividend

https://www.greencoat-ukwind.com

2.5p a share.

https://www.londonstockexchange.com/news-article/UKW/total-voting-rights/16743491

the total voting rights figure in Greencoat UK wind is 2,264,106,755

Thus:-

2,264,106,755 x £0.025 = £56,602,668.875

That is £56.6 Million paid to shareholders

https://www.londonstockexchange.com/stock/UKW/greencoat-uk-wind-plc/company-page

Uranium Investment and Growth

Sprott Uranium Miners UCITS ETF

The Sprott Uranium Miners UCITS ETF is an ETF investing in uranium miners.

The Uranium Miners ETF (URNM) seeks to provide investors with a way to invest in the growth of nuclear power through exposure to uranium miners. This comprises companies involved in the uranium industry, spanning the mining, exploration, development and production of uranium. The uranium miners ETF is also permitted to invest in entities that hold physical uranium, uranium royalties or other non-mining assets.

Top Ten holdings:-

CAMECO CORP COMMON STOCK 17.57% of the fund

NAC KAZATOMPROM JSC GDR 15.15% of the fund

SPROTT PHYSICAL URANIUM 11.82% of the fund

URANIUM ENERGY CORP 6.05% of the fund

DENISON MINES CORP COMMON 5.62% of the fund

NEXGEN ENERGY LTD COMMON 5.35% of the fund

CGN MINING CO LTD COMMON 5.33% of the fund

ENERGY FUELS INC/CANADA 4.33% of the fund

YELLOW CAKE PLC COMMON 3.88% of the fund

PALADIN ENERGY LTD COMMON 3.36% of the fund

https://www.londonstockexchange.com/stock/URNP/hanetf/company-page

Courtesy of The London Stock Exchange

Pacific Horizon Investment Trust plc

The Pacific Horizon Investment Trust is a London listed investment trust managed by Baille Gifford of Scotland.

https://www.bailliegifford.com/en/uk/individual-investors/funds/pacific-horizon-investment-trust

Share Price = 567.00p

NAV at Fair = 660.60p

Premium / Discount (+/-) at Fair -14.2%

Thus buying 660p for 567p

Top Ten assets:-

1 TSMC 9.6% of the fund

2 Samsung Electronics 6.5% of the fund

3 Tencent 4.8% of the fund

4 Bytedance Ltd. 3.2% of the fund

5 Zijin Mining 3.1% of the fund

6 Daily Hunt 3.0% of the fund

7 PDD Holdings 2.6% of the fund

8 Sea Limited 2.6% of the fund

9 Delhivery 2.6% of the fund

10 Equinox India Developments Ltd 2.6% of the fund

Top 10 assets make up 40.5% of the fund

Courtesy of The London Stock Exchange

Tesco November 2024 Dividend.

Tomorrow, Tesco PLC, the UK’s largest supermarket group pays out its November dividend.

4.25p a share

https://www.londonstockexchange.com/news-article/TSCO/total-voting-rights/16745211

The Company’s share capital as at 31 October 2024 consisted of 6,800,930,757 ordinary shares

Thus:-

6,800,930,757 x £0.045 = £289,039,557.1725

That is £289 Million paid to shareholders of Tesco PLC.

https://www.londonstockexchange.com/stock/TSCO/tesco-plc/company-page

Investment in Office Reality

17% of US Federal Government Spending is used on Debt Interest Payments

Why UK Taxation has to rise: (1) to fund public services, (2) to pay interest on the national debt.

Total UK Government Debt is over £2.7 Trillion

Courtesy of Statistica

UK Government Debt Interest on the cumulative national debt for 2024-25 will be £89 Billion, money that can NOT be used for public services such as the NHS, our brave armed forces, our brave police, fire services, ambulance crews, teachers, courts, etc etc

Courtesy of The Treasury and The Office of Budget Responsibility

In 2024-25, HM Government faces a short fall of £127 billion so will borrow it.

Courtesy of The Treasury and The Office of Budget Responsibility

HM Government Borrowings: October 2024

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties. Now we are in a post Covid 19 world. UK’s HM Government needs to fund many new demands. https://www.dmo.gov.uk

Another deficit month, thus to bridge the gap, needs to borrow on the bond market in October 2024, the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is the PSNCR: The Public Sector Net Cash Requirement. There were “only” 10 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

31-Oct-2024 1½% Green Gilt 2053 £2,250.0000 Million

29-Oct-2024 4 1/8% Treasury Gilt 2029 £4,000.0000 Million

23-Oct-2024 3¾% Treasury Gilt 2027 £4,787.2730 Million

22-Oct-2024 0 5/8% Index-linked Treasury Gilt 2045 £1,084.8490 Million

16-Oct-2024 4% Treasury Gilt 2031 £4,374.9990 Million

15-Oct-2024 4 3/8% Treasury Gilt 2054 £2,812.4990 Million

09-Oct-2024 4¼% Treasury Gilt 2034 £3,768.7500 Million

08-Oct-2024 0 1/8% Index-linked Treasury Gilt 2039 £1,151.6210 Million

02-Oct-2024 4 1/8% Treasury Gilt 2029 £4,020.0000 Million

01-Oct-2024 4¾% Treasury Gilt 2043 £2,812.4980 Million

£2,250.0000 Million + £4,000.0000 Million + £4,787.2730 Million + £1,084.8490 Million + £4,374.9990 Million + £2,812.4990 Million + £3,768.7500 Million + £1,151.6210 Million + £4,020.0000 Million + £2,812.4980 Million = £31,062.49 Million

£31,062.49 Million = £31.062 Billion

On another way of looking at it, is in the 31 days October 2024, HM Government borrowed:- £1002.015774 Million (£1.002 Billion) each day for the 31 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bonds maturing from 2027 to 2054. All long-term borrowings, we are mortgaging our futures, but at least “We Are In It Together……“

The F&C Investment Trust: November Dividend

Earlier in the month, The Foreign & Colonial Investment Trust paid out its November 2024 dividend.

3.6p a share

https://www.londonstockexchange.com/news-article/FCIT/total-voting-rights/16743097

The total number of voting rights in the Company is 484,863,066

Thus:-

484,863,066 x £0.036 = £17,455,070.376

That is £17 million paid to shareholders.

https://www.londonstockexchange.com/stock/FCIT/f-c-investment-trust-plc/company-page

Shell PLC: How the shares have performed since Covid-19

US National Debt

The numbers are vast:-

Courtesy of the US Federal Government

U.S. debt could drive the next financial crisis, says former FDIC Chair Sheila Bair

Courtesy of CNBC

Capital Group

Michael Gitlin is President and CEO of Capital Group, the investment behemoth that manages $2.7 trillion and is one of the oldest and largest money managers in the USA.

‘climate action investing’ actually mean?

HSBC: 5 Year Share Price Performance

Timing The Market….Jack Bogle Quote

“The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.“

Investment in Bob Dylan

‘Twas in another lifetime, one of toil and blood

When blackness was a virtue the road was full of mud

I came in from the wilderness, a creature void of form

Come in, she said

I’ll give ya shelter from the storm

And if I pass this way again, you can rest assured

I’ll always do my best for her, on that I give my word

In a world of steel-eyed death, and men who are fighting to be warm

Come in, she said

I’ll give ya shelter from the storm

Not a word was spoke between us, there was little risk involved

Everything up to that point had been left unresolved

Try imagining a place where it’s always safe and warm

Come in, she said

I’ll give ya shelter from the storm

I was burned out from exhaustion, buried in the hail

Poisoned in the bushes an’ blown out on the trail

Hunted like a crocodile, ravaged in the corn

Come in, she said

I’ll give ya shelter from the storm

Suddenly I turned around and she was standin’ there

With silver bracelets on her wrists and flowers in her hair

She walked up to me so gracefully and took my crown of thorns

Come in, she said

I’ll give ya shelter from the storm

Now there’s a wall between us, somethin’ there’s been lost

I took too much for granted, I got my signals crossed

Just to think that it all began on an uneventful morn

Come in, she said

I’ll give ya shelter from the storm

Well, the deputy walks on hard nails and the preacher rides a mount

But nothing really matters much, it’s doom alone that counts

And the one-eyed undertaker, he blows a futile horn

Come in, she said

I’ll give ya shelter from the storm

I’ve heard newborn babies wailin’ like a mournin’ dove

And old men with broken teeth stranded without love

Do I understand your question, man, is it hopeless and forlorn

Come in, she said

I’ll give ya shelter from the storm

In a little hilltop village, they gambled for my clothes

I bargained for salvation and she gave me a lethal dose

I offered up my innocence I got repaid with scorn

Come in, she said

I’ll give ya shelter from the storm

Well, I’m livin’ in a foreign country but I’m bound to cross the line

Beauty walks a razor’s edge, someday I’ll make it mine

If I could only turn back the clock to when God and her were born

Come in, she said

I’ll give ya shelter from the storm

iShares S&P 500 Equal Weight UCITS ETF GBP Hedged (Acc)

iShares S&P 500 Equal Weight UCITS ETF GBP Hedged (Acc) is a fund that invests equally in the S&P500 Index.

The fund aims to achieve a return on investment, through capital and income returns on its assets, which reflects the return of the S&P 500 Equal Weight Index

It gives investors:-

Provides exposure to 500 stocks from top US companies in leading industries of the US economy

The Index measures the performance of securities within the S&P 500 Index (Parent Index) with each security being equally weighted within the Index at the rebalance date

Exposure to companies in the S&P 500 with a greater weighting in the smaller market capitalization companies

Courtesy of Investors Chronicle

Courtesy of The London Stock Exchange

Risks of the S&P500 Index

The “Magnificent Seven” is a term coined by Bank of America analyst Michael Hartnett to describe seven industry-leading tech-focused companies: Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), Amazon (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), and Tesla (NASDAQ: TSLA).

What this actually means is that these seven companies are now so valuable that they make up a combined 35.5% of the S&P 500.

Thus the index of 500 companies is 35.5% dominated by the 7 technology titans.

Thus, the risk is that The Magnificent Seven are so valuable that they can single-handedly spark a so-called correction in the S&P 500. A correction is a fall of 10% to 20% in a major market index, so an average decline of 28% in the Magnificent Seven could put the S&P 500 in correction territory

HM Government Borrowings: September 2024

Another month, guess what, take a lucky guess, it is the same old story, HM Government, spends more money than it receives via taxes and duties. Now we are in a post Covid 19 world. UK’s HM Government needs to fund many new demands. https://www.dmo.gov.uk

Another deficit month, thus to bridge the gap, needs to borrow on the bond market in August 2024, the HM Government had to borrow money to meet the difference between tax revenues and public sector expenditure. The term for this is the PSNCR: The Public Sector Net Cash Requirement. There were “only” 7 auctions of Gilts (UK Government Bonds) by the UK Debt Management Office to raise cash for HM Treasury:-

25-Sep-2024 4% Treasury Gilt 2031 3,750.00 £3,750.0000 Million

24-Sep-2024 0¾% Index-linked Treasury Gilt 2033 £1,500.00 Million

18-Sep-2024 0 7/8% Green Gilt 2033 £2,750.00 Million

17-Sep-2024 4 3/8% Treasury Gilt 2054 £2,250.00 Million

11-Sep-2024 4¼% Treasury Gilt 2034 £3,750.00 Million

10-Sep-2024 0 5/8% Index-linked Treasury Gilt 2045 £900.00 Million

05-Sep-2024 4 1/8% Treasury Gilt 2029 £4,000.00 Million

3,750.0000 Million + 1,500.00 Million + 2,750.0000 Million + 3,750.00 Million + 900.00 Million + 4,000 Million = £18,900 Million

£18,900 Million = £18.9 Billion

On another way of looking at it, is in the 30 days Sept 2024, HM Government borrowed:- £630 Million each day for the 30 days.

We are fortunate, while the global banking and financial markets still has the confidence in HM Government to buy the Gilts (Lend money to the UK), the budget deficit keeps rising. What is also alarming, is the dates these bonds maturing from 2029 to 2054. All long-term borrowings, we are mortgaging our futures, but at least “We Are In It Together……“

Investment in CyberDyne Systems

Sundar Pichai

Courtesy of Bloomberg

Cash of $277Bn reserves….Berkshire Hathaway

Aviva October 2024 Dividend.

Today, Thursday 17th Oct 2024, Aviva PLC one of the UK largest casualty and life insurers and money managers (Aviva Investors) pays out its October 2024 dividend.

11.9p a share.

https://www.londonstockexchange.com/news-article/AV./total-voting-rights/16693420

The total number of voting rights in Aviva plc was 2,677,089,316.

Thus:-

2,677,089,316 x £0.119 = £318,573,628.604

That is £318.573 Million paid to shareholders in Aviva plc

https://www.londonstockexchange.com/stock/AV./aviva-plc/company-page

Funny Advice from the America’s Greatest Investor

L&G Energy Transition Commodities UCITS ETF

The L&G Energy Transition Commodities UCITS ETF aims to track the performance of the Solactive Energy Transition Commodity TR Index

Its objective is to give investors:-

Transition metals exposure

Futures on transition metals, which are used in clean energy generation, storage and distribution equipment.

Transition energy exposure

Futures on transition energy, which emits less carbon than most other fossil fuels and can help overcome peak energy demand and the challenge of ‘hard to abate’ sectors.

Carbon exposure

Allocation to an exchange listed certificate (the “Certificate”) which provides exposure to an index of global carbon futures. Carbon pricing makes polluting less profitable and incentivises the switch to low- and no-carbon activities.

Courtesy of Legal and General Investment Management

Courtesy of The London Stock Exchange

China rally, US jobs and Japan’s new PM

The Future with Professor Hannah Fry

The abrdn Sustainable Index World Equity Pension Fund

The aim of the abrdn Sustainable Index World Equity Fund is to generate growth over the long term (5 years or more) by tracking the return of the MSCI World Select ESG Climate Solutions Target Index.

Underlying Fund Launch Date 12/11/2020

Underlying Fund Size (28/06/2024) £2,667.6m

Top 10 Holdings

MICROSOFT CORP 5.5% of the fund

NVIDIA CORP 5.3% of the fund

APPLE INC 4.2% of the fund

ALPHABET INC 2.8% of the fund

AMAZON.COM INC 2.5% of the fund

ELI LILLY & CO 1.3% of the fund

COCA-COLA CO/THE 1.2% of the fund

META PLATFORMS INC 1.0% of the fund

TRANE TECHNOLOGIES PLC 1.0% of the fund

NOVO NORDISK A/S 0.9% of the fund

Total 25.7% of the fund

Courtesy of Standard Life

AIAG: The Legal & General ARTIFICIAL INTELLIGENCE ETF

https://www.londonstockexchange.com/stock/AIAG/legal-and-general-asset-management/company-page

Top ETF holdings, as of 31 July 2024

1 SAMSARA INC ORD 2.57% of the fund

2 PALO ALTO NETWORKS INC ORD 2.41% of the fund

3 CLOUDFLARE INC ORD 2.35% of the fund

4 SERVICENOW INC ORD 2.34% of the fund

5 AUTODESK INC ORD 2.33% of the fund

6 MICROSOFT CORP ORD 2.25% of the fund

7 ARISTA NETWORKS INC ORD 2.24% of the fund

8 NVIDIA CORP ORD 2.21% of the fund

9 RAPID7 INC ORD 2.15% of the fund

10 COGNEX CORP ORD 2.14% of the fund

Courtesy of The London Stock Exchange

Target Retirement 2035 Fund

The Vanguard Target Retirement 2035 Fund The Fund’s investment objective is to achieve an increase in value and, consistent with a gradually changing asset allocation, hold investments that will pay out money for investors planning to retire in or within approximately five years after 2035. The Fund’s asset allocation will become more conservative as 2035 is approached and passed, moving from higher risk (such as shares) to mainly lower risk (such as bonds) investments. The Fund seeks to achieve its investment objective by investing more than 90% of its assets in passive funds that track an index

It is a fund of funds:-

Vanguard Global Bond Index Fund GBP Hedged Acc 19.3% of the fund

Vanguard FTSE Developed World ex-U.K. Equity Index Fund GBP Acc 19.0% of the fund

Vanguard U.S. Equity Index Fund GBP Acc 14.9% of the fund

Vanguard FTSE U.K. All Share Index Unit Trust GBP Acc 12.8% of the fund

Vanguard U.K. Government Bond Index Fund GBP Acc 6.6% of the fund

Vanguard Emerging Markets Stock Index Fund GBP Acc 4.9% of the fund

Vanguard FTSE North America UCITS ETF (USD) Accumulating 4.4% of the fund

Vanguard Global Aggregate Bond UCITS ETF GBP Hedged Accumulating 4.4% of the fund

Vanguard FTSE 100 UCITS ETF (GBP) Accumulating 3.8% of the fund

Vanguard U.K. Investment Grade Bond Index Fund GBP Acc 3.6% of the fund

Vanguard FTSE Developed Europe ex-U.K. Equity Index Fund GBP Acc 3.5% of the fund

Vanguard Japan Stock Index Fund GBP Acc 1.8% of the fund

Vanguard Pacific ex-Japan Stock Index Fund GBP Acc 0.8% of the fund

Total 100%

Courtesy of Vanguard

Verizon Debt Levels:- 157.515bn

One of the USA’s largest telecommunications group is Verizon.

Created from the merger of Bell Atlantic and NYNEX.

It carries a large level of debt:-

https://www.verizon.com/about/sites/default/files/Debt-Schedule-063024.pdf

COUPON MATURITY COMPANY: RATE DATE TOTAL TOTALS ($billion)

DEBT MATURING WITHIN ONE YEAR:-

Commercial Paper $605 $605

Verizon Communications Inc. $1,161 3.500% 1-Nov-2024

Verizon Communications Inc. $1,340 3.376% 15-Feb-2025

Verizon Communications Inc. $889 LIBOR+1.10% 15-May-2025

Verizon Communications Inc. € 747 0.875% 2-Apr-2025 $4,207

Private Placements $17,697 $17,697

TOTAL DEBT MATURING WITHIN ONE YEAR: $ 22,509bn

LONG TERM DEBT:

Verizon Pennsylvania LLC $44 6.000% 1-Dec-2028

Verizon Pennsylvania LLC $31 8.350% 15-Dec-2030

Verizon Pennsylvania LLC $35 8.750% 15-Aug-2031 $110

Verizon Maryland LLC $20 8.000% 15-Oct-2029

Verizon Maryland LLC $21 8.300% 1-Aug-2031

Verizon Maryland LLC $139 5.125% 15-Jun-2033 $180

Verizon Virginia LLC $9 8.375% 1-Oct-2029 $9

Verizon Delaware LLC $2 8.625% 15-Oct-2031 $2

Verizon New Jersey Inc. $45 7.850% 15-Nov-2029 $45

Verizon New England Inc. $133 7.875% 15-Nov-2029 $133

Verizon New York Inc. $35 6.500% 15-Apr-2028

Verizon New York Inc. $99 7.375% 1-Apr-2032 $134

Alltel Corporation $38 6.800% 1-May-2029

Alltel Corporation $56 7.875% 1-Jul-2032 $94

Verizon Communications Inc. $1,404 0.850% 20-Nov-2025

Verizon Communications Inc. € 843 3.250% 17-Feb-2026

Verizon Communications Inc. $1,916 1.450% 20-Mar-2026

Verizon Communications Inc. $526 SOFR + 0.79% 20-Mar-2026

Verizon Communications Inc. $4 1.100% 15-Jun-2026